Europe Market Open: Underwhelming earnings dented the risk tone

24 Jul 2024, 06:40 by Newsquawk Desk

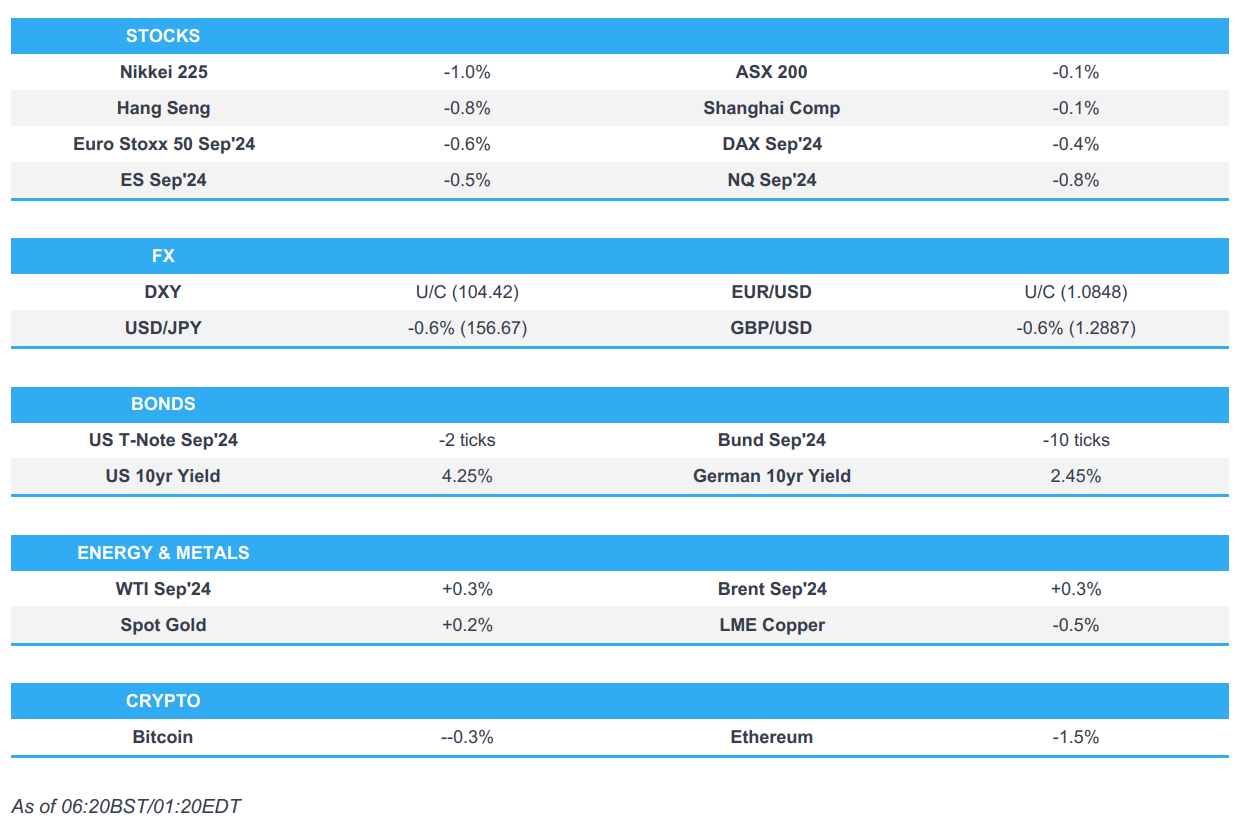

- APAC stocks were mostly rangebound with a negative bias seen following the lacklustre handover from Wall Street after risk appetite was dampened by underwhelming earnings results.

- Alphabet (GOOG), Tesla (TSLA), and Visa (V) fell 2.2%, 7.8%, and 3.3% respectively post-earnings, whilst CAC futures slipped following LVMH (MC FP) numbers yesterday.

- Reuters/Ipsos poll showed US Vice President Kamala Harris leads Republican candidate Donald Trump 44% to 42% among registered voters, within a 3-point margin of error.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.6% after the cash market finished with gains of 0.4% on Tuesday.

- Looking ahead, highlights include EZ, UK, US Flash PMIs, German GfK Consumer Sentiment, US Advance Goods Trade Balance, BoC Policy Announcement & MPR, Comments from ECB’s de Guindos & Lane, Fed’s Bowman, BoC's Macklem & Rogers Supply from UK, Germany & US, Earnings from AT&T, CME, Thermo Fisher, Ford, IBM, Newmont, ServiceNow & General Dynamics.

US TRADE

EQUITIES

- US stocks were ultimately mixed and the major indices finished with mild losses as attention centred around earnings releases with slight pressure in the NDX as semis declined after NXPI earnings disappointed, although the small-cap Russell 2000 index outperformed, while there was also some weakness observed heading into the closing bell as participants braced for key earnings from the likes of Alphabet and Tesla, who ultimately fell 2.2% and 7.8% after-market respectively.

- SPX -0.2% at 5,556, NDX -0.4% at 19,754, DJIA -0.1% at 40,358, RUT +1.0% at 2,243

- Click here for a detailed summary.

NOTABLE HEADLINES

- Reuters/Ipsos poll showed US Vice President Kamala Harris leads Republican candidate Donald Trump 44% to 42% among registered voters, within a 3-point margin of error.

- Alphabet Inc (GOOG) Q2 2024 (USD): EPS 1.89 (exp. 1.84), Revenue 84.742bln (exp. 84.18bln). Revenue breakdown. Google Advertising rev 64.6bln (exp. 64.4bln).Google Cloud Revenue 10.35bln (exp. 10.158bln). Google Search & Other Revenue 48.51bln (exp. 47.65bln). Shares fell 2.2% after hours

- Tesla Inc (TSLA) Q2 2024 (USD): Adj. EPS 0.52 (exp. 0.62), Revenue 25.5bln (exp. 24.77bln). Co. said the focus remains on company-wide cost reduction. Shares fell 7.8% after hours.

- Visa Inc (V) Q3 2024 (USD): Adj. EPS 2.51 (exp. 2.43), Revenue 8.9bln (exp. 8.89bln). Shares fell 3.3% after hours.

APAC TRADE

EQUITIES

- APAC stocks were mostly rangebound with a negative bias seen following the lacklustre handover from Wall Street after risk appetite was dampened by underwhelming earnings results.

- ASX 200 was indecisive and briefly clawed back early losses with sentiment clouded by mixed Flash PMI data.

- Nikkei 225 retreated at the open amid headwinds from a firmer currency, while PMI data was also varied.

- Hang Seng and Shanghai Comp. were subdued with early pressure from demand concerns after China's slowdown weighed on luxury spending which was evident in the 14% decline in LVMH sales in the region, while Chow Tai Fook Jewellery was among the worst hit in Hong Kong after its quarterly group retail sales fell 20% Y/Y. However, the mainland bourse managed to recover losses to return to relatively flat territory after rebounding from a brief dip beneath the 2,900 level.

- US equity futures declined overnight with underperformance in Nasdaq 100 futures after quarterly results from Alphabet and Tesla underwhelmed.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.6% after the cash market finished with gains of 0.4% on Tuesday.

FX

- DXY was little changed as losses against the Yen were offset by gains against other major peers and with price action limited as newsflow remained light ahead of the key risk events later in the week in the form of US GDP and PCE data.

- EUR/USD sat around a weekly low after its recent slide with several DMAs below on approach to the 1.0800 level.

- GBP/USD trickled lower to the sub-1.2900 territory amid light catalysts and recent weakness in cyclical peers.

- USD/JPY continued its descent and eventually breached the 155.00 level to the downside.

- Antipodeans remained subdued owing to the uninspired risk appetite and China's economic concerns.

- PBoC set USD/CNY mid-point at 7.1358 exp. 7.2795 (prev. 7.1334).

FIXED INCOME

- 10-year UST futures lacked conviction after yesterday's two-way price action and curve steepening with VP Harris off to a strong start in her Presidential campaign, while prior moves were also facilitated by soft existing home sales and a strong 2yr auction.

- Bund futures mildly pulled back following recent advances and a return to above the 132.00 level as participants now look towards German PMI data and a 10-year Bund auction scheduled later.

- 10-year JGB futures were subdued after mixed PMI data and weaker results from the latest 40-year JGB auction.

COMMODITIES

- Crude futures found some slight reprieve from the recent selling with the help of bullish private inventory data.

- US Private Inventory Data (bbls): Crude -3.9mln (exp. -1.6mln), Distillate -1.5mln (exp. +0.2mln), Gasoline -2.8mln (exp. -0.4mln), Cushing -1.6mln.

- Spot gold eked slight gains after having reclaimed the USD 2400/oz status but with trade restricted by a flat dollar.

- Copper futures languished around 3-month lows after the recent downtrend and amid the glum mood.

CRYPTO

- Bitcoin was choppy and returned to flat territory with prices contained by resistance around the USD 66,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese JibunBK Manufacturing PMI Flash SA (Jul) 49.2 (Prev. 50.0)

- Japanese JibunBK Services PMI Flash SA (Jul) 53.9 (Prev. 49.4)

- Japanese JibunBK Composite Op Flash SA (Jul) 52.6 (Prev. 49.7)

- Australian Judo Bank Manufacturing PMI Flash (Jul) 47.4 (Prev. 47.2)

- Australian Judo Bank Services PMI Flash (Jul) 50.8 (Prev. 51.2)

- Australian Judo Bank Composite PMI Flash (Jul) 50.2 (Prev. 50.7)

GEOPOLITICAL

MIDDLE EAST

- IDF launched a new incursion into West Bank’s Tulkarem, according to a source cited by Times of Israel.

- Artillery shelling and Israeli tank fire was reported on east of Khan Younis, according to Al Jazeera.

- Islamic Resistance in Iraq said it conducted a drone attack on a vital target in the north of Eilat, according to Al Jazeera.

OTHER

- US Presidential Candidate Trump's advisers floated higher target for NATO defence spending, according to Bloomberg.

- French prosecutors said a Russian was arrested over 'destabilisation' plot during Paris Olympics, according to AFP.

- Japanese Chief Cabinet Secretary Hayashi said Russia's decision to restrict 13 Japanese individuals' entry including Toyota Motor's Chairman is "totally unacceptable" and they filed a complaint against Russia over their decision to restrict entry.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer and European Commission President von der Leyen plan a meeting to reset UK-EU ties, according to FT.

- ECB reportedly weighs halving leveraged finance probe provision demand to about EUR 7bln, according to Bloomberg.

- French President Macron, when asked about left-wing alliance PM candidate, said the current issue is not about names and noted that neither the left-wing alliance nor outgoing majority can apply their programme. Furthermore, Macron urged political parties in parliament to work together to reach compromises during the coming weeks, while he added that France will be focused on Olympic Games until mid-August with a caretaker government and then look to form a new government.