Europe Market Open: APAC stocks were mixed and only partially sustained the momentum from the tech-led rebound on Wall St.

23 Jul 2024, 06:35 by Newsquawk Desk

- APAC stocks were mixed and only partially sustained the momentum from the tech-led rebound on Wall St.

- US VP Harris's campaign secured enough delegates to attain the Democratic Presidential nomination.

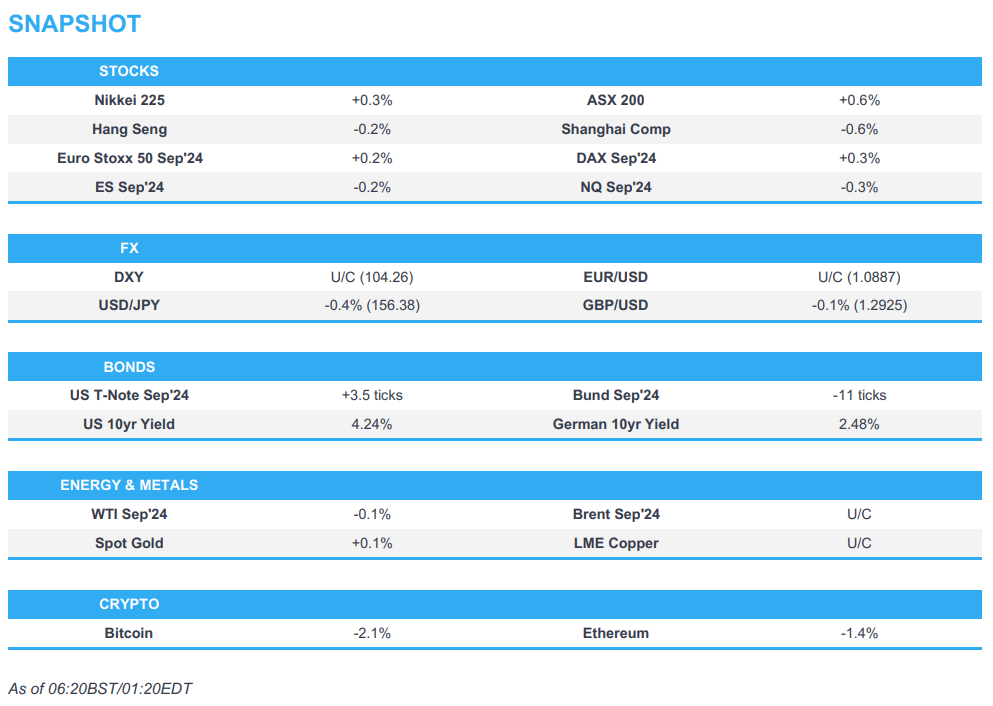

- European equity futures indicate a mildly higher open with Euro Stoxx 50 futures up 0.2% after the cash market finished with gains of 1.5% on Monday.

- USD is mixed vs. peers, JPY is the best performer across the majors, EUR/USD is sub-1.09.

- Looking ahead, highlights include EU Consumer Confidence, US Richmond Fed Index, CBRT & NBH Policy Announcement, ECB’s Lane, Supply from UK, Germany, US, Earnings from Alphabet, Tesla, Visa, Coca-Cola, General Motors, Philip Morris & Spotify.

US TRADE

EQUITIES

- US stocks pared some of the prior week's losses ahead of key earnings and data with advances led by outperformance in the Tech sector which rose nearly 2% leading into the big tech earnings and amid a surge in Nvidia shares after reports the chip behemoth is working on a version of its new flagship AI chips for the Chinese market that would be compatible with US export controls. All major indices finished in the green and outperformance was seen in the Nasdaq and Russell 2000, while there was plenty of focus on the US election after President Biden dropped out of the Presidential race over the weekend with VP Harris the front runner for the Democratic nomination although participants are still mulling whether it is too late or not to boost the Dems chance vs Trump.

- SPX +1.08% at 5,664, NDX +1.54% at 19,822, DJI +0.32% at 40,415, RUT +1.69% at 2,221.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US VP Harris's campaign secured enough delegates to attain the Democratic Presidential nomination.

- Michigan Governor Whitmer endorsed Harris and said she will serve as co-chair of Harris's campaign, while former House Speaker Pelosi also endorsed Harris for President.

- DNC Chair Jaime Harrison said the Democratic Party will deliver a presidential nominee by August 7th which will allow a Vice Presidential nominee in the same time frame, while he added that if only one candidate reaches the 300-delegate threshold to be placed in nomination, virtual voting could occur as soon as August 1st.

APAC TRADE

EQUITIES

- APAC stocks were mixed and only partially sustained the momentum from the tech-led rebound on Wall St ahead of key data releases and big-tech earnings as sentiment clouded by ongoing China woes.

- ASX 200 was underpinned with tech stocks inspired by the outperformance of the sector stateside, while energy suffered due to recent declines in oil prices and with pressure in Woodside Energy after a mixed quarterly update.

- Nikkei 225 boosted at the open although has since pared the majority of the gains amid a firmer currency and after a recent source report suggested indecision regarding rates at next week’s BoJ meeting.

- Hang Seng and Shanghai Comp. were subdued in which the latter remained the laggard as the PBoC’s recent short-term funding rate cuts and liquidity boost via 7-day reverse repos, left the market wanting more.

- US equity futures were uneventful overnight as participants braced for incoming earnings including from Alphabet and Tesla.

- European equity futures indicate a mildly higher open with Euro Stoxx 50 futures up 0.2% after the cash market finished with gains of 1.5% on Monday.

FX

- DXY was contained in a very tight range between 104.20-104.31 ahead of the key data releases later in the week and with newsflow from the US very quiet outside of politics.

- EUR/USD lacked direction following its recent failure to sustain the 1.0900 status, while the data release schedule for Europe remains light on Tuesday.

- GBP/USD traded sideways after its recent choppy performance and amid the absence of pertinent catalysts.

- USD/JPY gradually declined throughout the session after slipping back beneath the 157.00 handle.

- Antipodeans remained subdued amid headwinds from lingering China concerns and lacklustre commodity prices.

- PBoC set USD/CNY mid-point at 7.1334 vs exp. 7.2746 (prev. 7.1335).

FIXED INCOME

- 10-year UST futures recouped yesterday’s losses but with upside limited ahead of supply and upcoming key data releases.

- Bund futures languished at a sub-132.00 level as participants await a Schatz auction later and tomorrow's Bund offering.

- 10-year JGB futures clawed back some of Monday's losses with the BoJ’s in the market for over JPY 1.2tln of JGBs with 1yr-10yr maturities, while a recent source report noted that weak consumption is complicating the BoJ’s rate decision next week.

COMMODITIES

- Crude futures traded rangebound amid a lack of energy-specific catalysts and with prices restricted following recent declines and China-related economic concerns.

- Spot gold attempted to nurse some of the prior day’s losses and briefly reclaimed the USD 2,400/oz status.

- Copper futures were little changed as risk momentum somewhat stalled in Asia and amid weakness in its largest buyer.

- World refined copper market was in a 65k metric tonne surplus in May 2024, according to ICSG.

CRYPTO

- Bitcoin was ultimately flat on the session after oscillating around the USD 67,500 level.

- US SEC told issuers US spot ETF products can start trading on Tuesday, according to two firms cited by Reuters

NOTABLE ASIA-PAC HEADLINES

- China Human Resources Ministry said China added 6.98mln urban new jobs in H1 and the employment situation is generally stable, while it will intensify the employment and entrepreneurship of young people such as college graduates.

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu and US President Biden’s meeting was postponed and a US official later stated that President Biden is expected to meet Israeli PM Netanyahu on Thursday at the White House. It was also reported that Vice President Harris will meet with Israeli PM Netanyahu this week at the White House and that Netanyahu requested a meeting with GOP presidential candidate Trump while in the US this week.

- US President Biden said they will keep working to end the war in Gaza and believes a ceasefire is imminent in the Gaza conflict.

- Israeli operation in Khan Yunis killed 70 people and wounded more than 200, according to the health ministry in Gaza cited by AFP News Agency. Furthermore, Israel conducted raids on the town of Aita al-Shaab in southern Lebanon, while Hezbollah said it shelled the Tzuriel colony for the first time with dozens of Katyusha rockets in response to the attack on civilians, according to Al Arabiya and Al Jazeera.

- Japan is to impose its first sanctions on Israeli settlers in the West Bank in which it is arranging an asset freeze on Israeli settlers following similar moves by the US and UK, according to NHK.

- Leaders of Palestinian rival factions Fatah and Hamas will meet with the press in Beijing following reconciliation talks, while Chinese Foreign Minister Wang Yi will attend the meeting, according to CGTN.

- Iraq eyes a drawdown of US-led forces starting September and to formally end the coalition's work by September 2025 with some US forces likely to remain in a newly negotiated advisory capacity, according to four Iraqi sources cited by Reuters.

OTHER

- US official Kritenbrink said the meeting of US-Japan defence and foreign ministers will demonstrate how the two countries will ensure not just the defence of Japan, but also the contribution to regional security.