US Market Open: Major worldwide IT outages sparked by updates at CrowdStrike -14% weighs on sentiment

19 Jul 2024, 11:19 by Newsquawk Desk

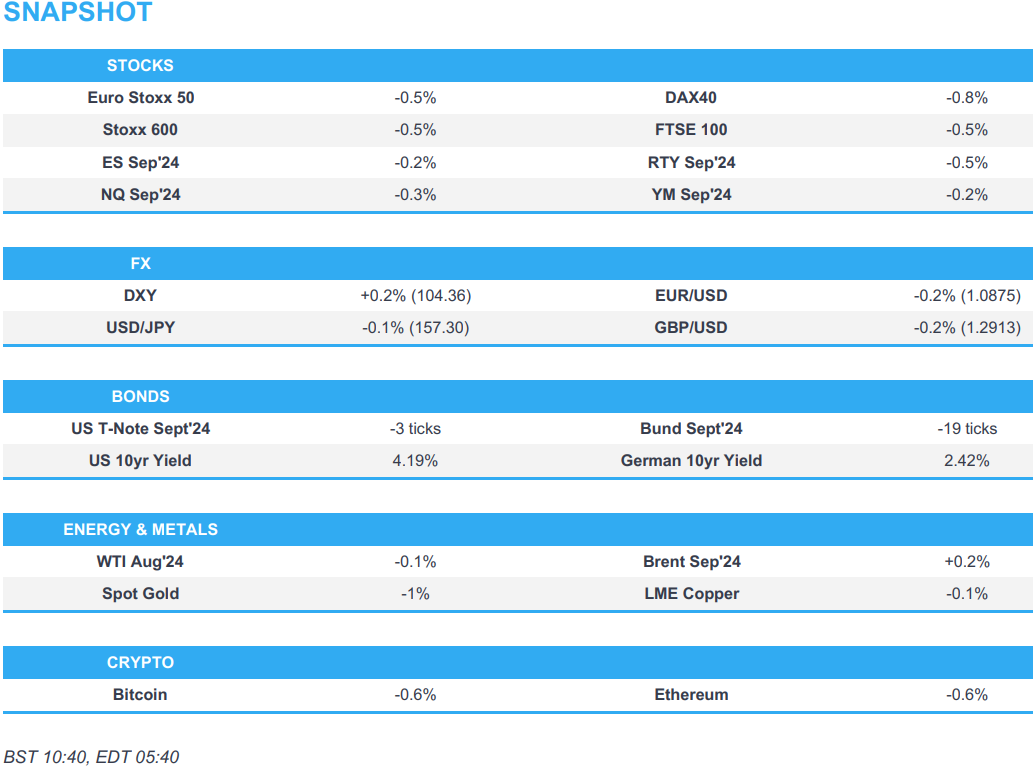

- Equities are entirely in the red, with sentiment hit amid ongoing worldwide IT outages, sparked by CrowdStrike (-14%) updates, which have impacted Microsoft (-2.2%) and Nvidia (-1%) services.

- Dollar is firmer, G10s are mostly lower, with slight underperformance in the Antipodeans given the risk tone, GBP slips post-Retail Sales.

- Bonds are pressured and trading within a tight range, having initially been boosted by the broader risk aversion

- Crude has clambered off worst levels and now trades flat, XAU continues to dip off recent highs and base metals are lower

- Looking ahead, Canadian Producer Prices & Retail Sales, Comments from Fed’s Williams & Bostic, Earnings from American Express, SLB & Travelers

EUROPEAN TRADE

IT OUTAGES

- Major global IT outages have grounded planes and led to major service disruptions, for the likes of Microsoft (-2.2%) and Nvidia (-1%). A full list of headlines below.

- "Issue at cybersecurity firm CrowdStrike (CRWD) causing major IT problems around the world", according to BNO News.

- London Stock Exchange Group (LSEG LN) is investigating technical issue with RNS announcements; said other services across the group, including London Stock Exchange, continue as normal.

- Microsoft (MSFT) some 365 apps remain in "degraded state", via Bloomberg.

- AWS (AMZN) is investigating reports of connectivity issues related to update to CrowdStrike (CRWD) agent.

- American Airlines (AAL), Delta (DAL) and United Airlines (UAL) grounding all flights due to IT problem, according to ABC.

- Several major oil/gas trading desks in London and Singapore struggle to execute trades amid cyber outage, according to six sources cited by Reuters.

- CrowdStrike (CRWD) said outage resulted from an issue with the latest update, according to CNBC.

- NVIDIA (NVDA) said GeForce is currently experiencing a global outage for linking Xbox accounts with GFN.

- Microsoft (MSFT) said multiple services are "continuing to see improvements"

EQUITIES

- European equities, Stoxx 600 (-0.5%) are entirely in the red, with sentiment hit amid ongoing worldwide IT outages, which have affected banking transactions and flights.

- European sectors hold a strong negative bias, with the typical defensive sectors performing better, given the glum risk tone. Basic Resources underperforms, amid broader weakness in the metals complex, with Travel & Leisure also hampered by the ongoing IT outages; Lufthansa (-1.9%).

- US equity futures (ES -0.2%, NQ -0.3%, RTY -0.4%) are entirely in the red, with sentiment hit amid global IT outages following updates at Crowdstrike (-14%), which has impacted the likes of Microsoft (-2.2%) and Nvidia (-1%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is firmer vs. most peers in a continuation of the price action yesterday which has seen DXY bounce from a 103.65 low to a current peak today at 104.34. Risk aversion is partly behind the price action as well as a general correction from recent losses.

- EUR is softer vs. the broadly firmer USD after the pair slipped onto a 1.08 handle despite the fallout from yesterday's ECB meeting being suggestive of a more cautious approach from policymakers. EUR/USD is now eyeing its weekly low set on Tuesday at 1.0871.

- GBP is a touch softer vs. USD with the pair's 1.3044 print on Wednesday very much in the rear-view mirror. UK retail sales came in softer-than-expected but didn't cause too much of a stir for the GBP.

- JPY relatively stable vs. the USD. For now, the base for the pair sits at 155.36 (printed yesterday) with the pair unable to launch a test of 155; around the European cash open, the JPY caught a slight bid, benefiting from the subdued risk tone, but has since stabilised.

- Antipodeans are both suffering at the hands of the current risk-aversion. AUD/USD has slipped onto a 0.66 handle, with the current session low at 0.6691.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are very slightly lower, but faring better than their Transatlantic counterprarts as the Fed heads into its blackout period ahead of next week's meeting (no change expected). The US curve is currently a touch higher with no real flattening or steepening bias.

- Bunds are on the backfoot amid the fallout from yesterday's ECB meeting which was followed up by source reporting from Bloomberg which suggested that the Governing Council may only opt to lower rates one more time this year vs. the two broadly expected by the market.

- Gilts are lagging peers potentially in a bit of a catch-up play from yesterday's action in other global markets. From a fundamental perspective, today's UK Retail Sales came in soft but has had little follow-through into market pricing. Despite the recent downtrend, the UK 10yr yield is still managing to hold above the 4.0% mark

- Click for a detailed summary

COMMODITIES

- Crude is incrementally softer, but has clambered off lows in recent trade, and currently resides near session highs. Newsflow this morning has been dominated by the system outages caused by cybersecurity firm CrowdStrike, in which major oil/gas trading desks were also affected. In geopolitics, tensions mount as Israeli capital Tel Aviv saw an overnight attack.

- Precious metals are softer across the board amid the rising Dollar, with the deepest losses seen in spot silver, while spot gold pulls back further from record highs. Spot gold sits closer to the bottom of a current USD 2,413-2.445.34/oz parameter.

- Base metals are mostly lower amid the recent rebound of the Dollar coupled with ongoing woes over China's economic health, whilst China's Third Plenum presser only offered vague stimulus language.

- Click for a detailed summary

NOTABLE DATA RECAPa

- UK PSNB, GBP (Jun) 13.589B GB (Prev. 14.1B GB, Rev. 15.573B GB); GBP (Jun) 6.622B GB (Prev. 18.135B GB, Rev. 18.796B GB)

- UK Retail Sales Ex-Fuel YY (Jun) -0.8% vs. Exp. 0.2% (Prev. 1.2%, Rev. 1.6%); Retail Sales YY (Jun) -0.2% vs. Exp. 0.2% (Prev. 1.3%, Rev. 1.7%); Retail Sales MM (Jun) -1.2% vs. Exp. -0.4% (Prev. 2.9%)

- German Producer Prices MM (Jun) 0.2% vs. Exp. 0.1% (Prev. 0.0%); Producer Prices YY (Jun) -1.6% vs. Exp. -1.6% (Prev. -2.2%)

NOTABLE EUROPEAN HEADLINES

- ECB's Muller said rates are sufficiently high to curtail borrowing demand; to cut again need more confidence inflation is going to 2%; we know there is still fluctuation on inflation. Realistic that disinflation continues over next 12 months. "Hard for me to comment how many rate cuts this year." Important to not pre-commit on Sept.

- ECB's Villeroy said disinflation is happening as predicted; inflation will continue to decline a bit slower; there is more uncertainty on growth than a few months ago. Rate decisions will be data-dependent. Watching services inflation carefully. Market expectations on rates seem rather reasonable.

- ECB’s Vasle said decisions will continue to be data dependent, via Econostream.

- ECB's Simkus said no reason for cuts to exceed 25bps each; barring shocks, more easing is "undoubtedly" on the table; no doubt the topic of cut will be discussed in September; agrees with market view of two more cuts in 2024.

- ECB's Rehn said the bank is not pre-committing to any specific rate path

- ECB Survey of Professional Forecasters: inflation to average 2.4% in 2024, 2.0% in 2025; both unchanged from the prior survey

NOTABLE US HEADLINES

- Fed's Daly (voter) said recent data has been really good but the economy is not there yet on inflation, while she added the labour market is coming back into balance and there are risks on both sides for monetary policy choices. Daly said the Fed remains data dependent on monetary policy and warned pre-emptive or urgent policy actions risk making mistakes. Furthermore, she said they are not at price stability yet and she is not predicting an economic decline nor declaring mission accomplished.

- US President Biden is 'soul searching' amid calls to exit the 2024 race and some Democratic officials said they see a Biden exit from the race as a matter of time, according to Reuters sources.

- Several people close to President Biden said they believe he has begun to accept the idea that he may not be able to win in November and may have to drop out of the race, according to The New York Times. However, the Biden-Harris campaign co-chair later said that the New York Times report on President Biden is wrong and that Biden can win.

- US President Biden's campaign reportedly called an all-staff meeting on Friday, according to AP. It was separately reported that top Democrats are preparing for a campaign without Biden, according to WSJ.

- Former House Speaker Pelosi told some House Democrats she believes President Biden can be convinced fairly soon to exit the race and told California Democrats Biden is getting close to deciding to abandon his presidential bid, according to Washington Post.

- Donald Trump said at the RNC that he is running to be president for all of America, not half of America, because there is no victory in winning for half of America, while he said they will achieve a great victory and a new phase towards prosperity will be launched. Trump also stated they will end the devastating inflation crisis immediately and bring down interest rates, as well as noted that they will not allow auto manufacturing plants to be built in Mexico and China. Furthermore, Trump referred to coronavirus as the 'China virus' and said they will not allow other countries to plunder the US.

- Netflix Inc (NFLX) Q2 2024 (USD): EPS 4.88 (exp. 4.74), Revenue 9.56bln (exp. 9.53bln).

GEOPOLITICS

- Israeli officials mull EU and Palestinians running Rafah crossing and if enacted, it would foreshadow an end to the conflict between Israel and Hamas and enable more aid to get into Palestinian territory, according to Bloomberg.

- Israeli media reported smoke rising as a result of an explosion in Tel Aviv caused by an explosive device which was said to be a drone, while Yemen's Houthis said they will reveal details about a military operation that targeted Tel Aviv.

- Houthi's spokesperson said they targeted Tel Aviv "with a new drone bearing the name "Jaffa" capable of bypassing interceptor".

- Israeli military believes Iranian-made drone that hit Tel Aviv was launched from Yemen, according to a spokesperson.

- "IDF: In the coming days, we will discuss options for offensive responses to those who threaten Israel's security", according to Sky News Arabia

OTHER

- North Korean leader Kim discussed the importance of military cooperation with Russia in a meeting with a Russian delegation and stressed the need for North Korean and Russian armies to unite more to firmly defend the peace, according to KCNA.

CRYPTO

- Bitcoin is incrementally softer, but remains firmly above USD 63k.

APAC TRADE

- APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden's re-election chances dwindled further after top Democrats suggested he could be persuaded to drop out as soon as this weekend.

- ASX 200 fell below the 8,000 level with mining stocks leading the broad downturn seen across sectors.

- Nikkei 225 briefly retreated beneath 40,000 but then pared most of the initial losses to reclaim the key psychological level.

- Hang Seng and Shanghai Comp. conformed to the downbeat mood with the former pressured by weakness in the real estate industry, while losses in the mainland were stemmed after the PBoC liquidity efforts amounted to a net CNY 1.17tln for its largest weekly cash injection since January, while a CPC official noted the economic recovery is not strong enough and they need to implement macro policies more effectively.

NOTABLE ASIA-PAC HEADLINES

- Chinese senior party official for policy research said promoting Chinese-style modernisation faces many complex contradictions and problems, but it is necessary and they will improve the modern market system and promote market-oriented reform of factors of production. China will also deepen the reform of state-owned enterprises and will encourage the development and expansion of the private economy.

- Chinese senior party official for economic affairs said China's economic recovery is not strong enough and needs to implement macro policies more effectively, while they should speed up the issuance and use of special bonds and noted that monetary policy should be flexible, moderate, accurate, and effective. Furthermore, China will maintain reasonable and abundant liquidity, while they should increase policy support so that enterprises and consumers tangibly benefit.

- Japanese PM Kishida said need to be cautious about the effects of rising prices due to a weak yen, while he noted the government must be vigilant about the impact of rising prices, driven in part by a weak yen, and on the economy to achieve a domestic demand-driven recovery.

- BoJ Minutes of the 20th Round of the "Bond Market Group" Meetings. Click for more details

DATA RECAP

- Japanese National CPI YY (Jun) 2.8% vs. Exp. 2.9% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Jun) 2.6% vs. Exp. 2.7% (Prev. 2.5%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jun) 2.2% vs. Exp. 2.2% (Prev. 2.1%)