Europe Market Open: APAC stocks continued to slip, ECB sources suggests hawks are open to Sept cut

19 Jul 2024, 06:45 by Newsquawk Desk

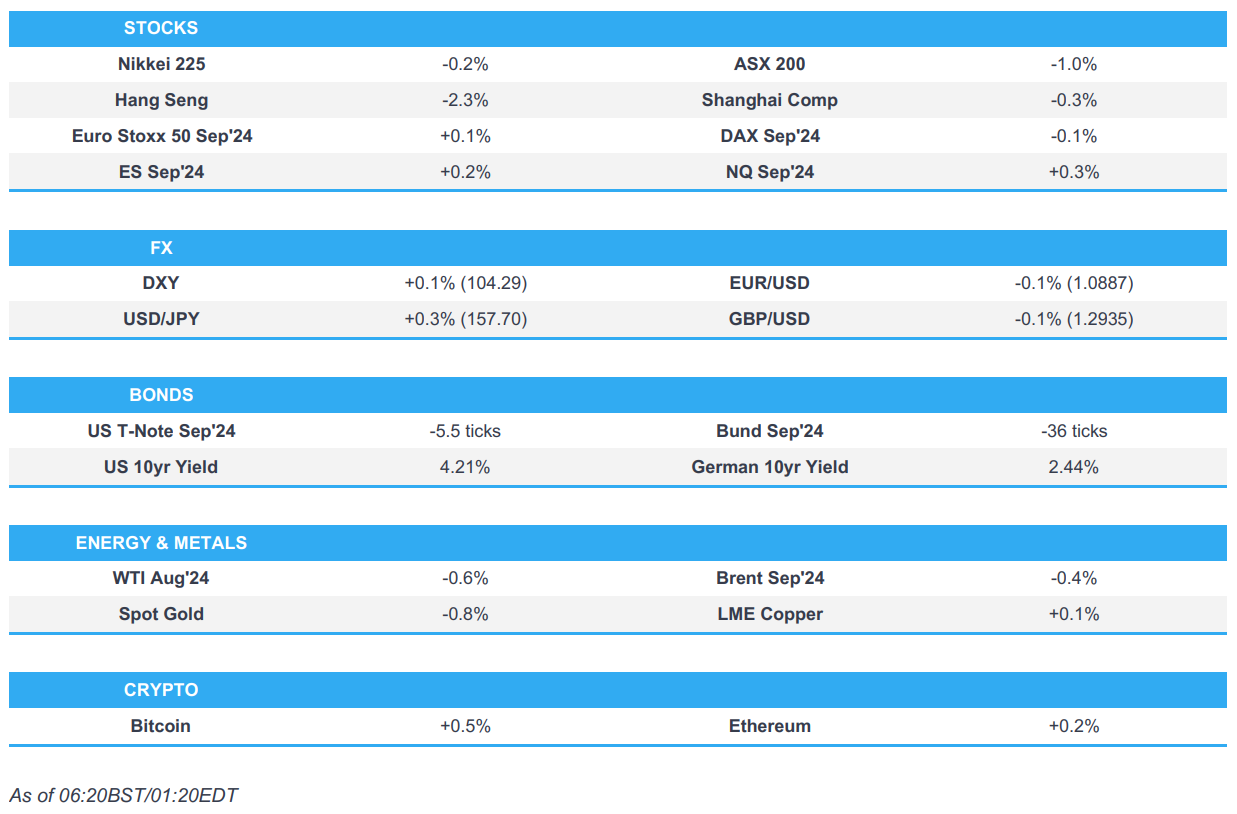

- APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden's re-election chances dwindled further.

- Chinese senior party official for economic affairs said China's economic recovery is not strong enough and needs to implement macro policies more effectively.

- Several people close to US President Biden reportedly said they believe he has begun to accept the idea that he may have to drop out of the presidential race, although this was later refuted by the campaign co-chair; Biden reportedly asked for polling on how VP Harris would do.

- ECB officials reportedly consider if only one more cut is feasible in 2024, according to Bloomberg citing people familiar with the matter. The report noted that as inflation pressures still linger.

- Looking ahead, highlights include German Producer Prices, UK Retail Sales, Canadian Producer Prices & Retail Sales, Comments from Fed’s Williams & Bostic, and Earnings from American Express, SLB & Travelers.

19th July 2024

SNAPSHOT

US TRADE

EQUITIES

- US stocks were lower with selling pressure seen early in the session alongside reports that several top Democrats said the rising pressure from party congressional leaders and close friends will persuade US President Biden to drop out of the race, potentially as soon as this weekend, while there were also reports that the Houthi leader threatened an expanded escalation in the Indian Ocean and Mediterranean, as well as issued new threats against Saudi Arabia. As such, the major indices were on the back foot although pared some of the losses into the close, while the dollar was underpinned and Treasuries were pressured which are typical characteristics of the 'Trump trade'.

- SPX -0.78% at 5,544, NDX -0.48% at 19,705, DJI -1.29% at 40,665, RUT -1.82% at 2,198.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) said recent data has been really good but the economy is not there yet on inflation, while she added the labour market is coming back into balance and there are risks on both sides for monetary policy choices. Daly said the Fed remains data dependent on monetary policy and warned pre-emptive or urgent policy actions risk making mistakes. Furthermore, she said they are not at price stability yet and she is not predicting an economic decline nor declaring mission accomplished.

- Fed's Logan (non-voter) said the Fed is making progress in getting banks ready to use the discount window and Fed emergency lending programmes have been effective, while she added all eligible banks should be prepared for the discount window.

- US President Biden is 'soul searching' amid calls to exit the 2024 race and some Democratic officials said they see a Biden exit from the race as a matter of time, according to Reuters sources.

- US President Biden reportedly asked for polling on how VP Harris would do, according to ABC News. It was later reported that ABC News cited a US administration official stating that Biden is exhausted and the period of his isolation after being infected with coronavirus gives him an opportunity to consult and think, according to Al Jazeera.

- Several people close to President Biden said they believe he has begun to accept the idea that he may not be able to win in November and may have to drop out of the race, according to The New York Times. However, the Biden-Harris campaign co-chair later said that the New York Times report on President Biden is wrong and that Biden can win.

- US President Biden's campaign reportedly called an all-staff meeting on Friday, according to AP. It was separately reported that top Democrats are preparing for a campaign without Biden, according to WSJ.

- Former President Obama told allies that President Biden needs to seriously consider his viability, according to the Washington Post.

- Former House Speaker Pelosi told some House Democrats she believes President Biden can be convinced fairly soon to exit the race and told California Democrats Biden is getting close to deciding to abandon his presidential bid, according to Washington Post.

- Fox was told that Democratic House and Senate members sense that there is a shift in President Biden’s thinking that he will definitely remain at the top of the ticket. Fox was told that the President contracting COVID is forcing a period of slowing down and reflection although the President’s bout with COVID could arrest the decision-making process, while one senior House Democratic source said “This will be an important weekend in Rehoboth”, while a House Democrat replied “When everyone returns to Washington Monday“ regarding when there might be more clarity.

- Donald Trump said at the RNC that he is running to be president for all of America, not half of America, because there is no victory in winning for half of America, while he said they will achieve a great victory and a new phase towards prosperity will be launched. Trump also stated they will end the devastating inflation crisis immediately and bring down interest rates, as well as noted that they will not allow auto manufacturing plants to be built in Mexico and China. Furthermore, Trump referred to coronavirus as the 'China virus' and said they will not allow other countries to plunder the US.

APAC TRADE

EQUITIES

- APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden's re-election chances dwindled further after top Democrats suggested he could be persuaded to drop out as soon as this weekend.

- ASX 200 fell below the 8,000 level with mining stocks leading the broad downturn seen across sectors.

- Nikkei 225 briefly retreated beneath 40,000 but then pared most of the initial losses to reclaim the key psychological level.

- Hang Seng and Shanghai Comp. conformed to the downbeat mood with the former pressured by weakness in the real estate industry, while losses in the mainland were stemmed after the PBoC liquidity efforts amounted to a net CNY 1.17tln for its largest weekly cash injection since January, while a CPC official noted the economic recovery is not strong enough and they need to implement macro policies more effectively.

- US equity futures traded sideways following recent losses and with Netflix shares indecisive and little changed post-earnings.

- European equity futures indicate a rangebound open with Euro Stoxx 50 futures up 0.1% after the cash market finished lower by 0.4% on Thursday.

FX

- DXY held on to recent gains above the 104.00 level amid the risk-off mood which was triggered by a further diminishing of President Biden's re-election chances.

- EUR/USD languished beneath the 1.0900 handle after ECB President Lagarde's recent rhetoric that September is "wide open", while there were mixed source reports regarding prospects of a September cut although it was also acknowledged that decisions have yet to be made.

- GBP/USD loitered around this week’s worst levels beneath the 1.3000 territory after recent weakness in cyclical currencies.

- USD/JPY traded steadily following a resurgence from a brief dip beneath 157.00 after the latest BoJ data did not immediately show evidence of intervention on July 17th, while participants also digested somewhat varied Japanese CPI data.

- Antipodeans were restricted owing to risk aversion, a light calendar and softer commodity prices.

FIXED INCOME

- 10-year UST futures tested 111.00 to the downside amid the ongoing Trump trade after Biden’s re-election prospects further diminished.

- Bund futures retreated after failing to sustain post-ECB advances, while participants look ahead to German PPI data.

- 10-year JGB futures lacked conviction as participants digested the latest Japanese CPI data and amid the absence of additional BoJ purchases from the market today.

COMMODITIES

- Crude futures were subdued after yesterday’s indecision and with headwinds from the recent dollar strength.

- Spot gold continued its retreat from record levels although remains above the USD 2,400/oz level.

- Copper futures languished at multi-month lows after retreating alongside the risk aversion and China-related concerns.

CRYPTO

- Bitcoin was rangebound with two-way price action on both sides of the USD 64,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese senior party official for policy research said promoting Chinese-style modernisation faces many complex contradictions and problems, but it is necessary and they will improve the modern market system and promote market-oriented reform of factors of production. China will also deepen the reform of state-owned enterprises and will encourage the development and expansion of the private economy.

- Chinese senior party official for economic affairs said China's economic recovery is not strong enough and needs to implement macro policies more effectively, while they should speed up the issuance and use of special bonds and noted that monetary policy should be flexible, moderate, accurate, and effective. Furthermore, China will maintain reasonable and abundant liquidity, while they should increase policy support so that enterprises and consumers tangibly benefit.

- Japanese PM Kishida said need to be cautious about the effects of rising prices due to a weak yen, while he noted the government must be vigilant about the impact of rising prices, driven in part by a weak yen, and on the economy to achieve a domestic demand-driven recovery.

DATA RECAP

- Japanese National CPI YY (Jun) 2.8% vs. Exp. 2.9% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Jun) 2.6% vs. Exp. 2.7% (Prev. 2.5%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jun) 2.2% vs. Exp. 2.2% (Prev. 2.1%)

GEOPOLITICAL

MIDDLE EAST

- Israeli officials mull EU and Palestinians running Rafah crossing and if enacted, it would foreshadow an end to the conflict between Israel and Hamas and enable more aid to get into Palestinian territory, according to Bloomberg.

- Field commander in Hezbollah's elite Radwan forces was reportedly killed in an Israeli strike on south Lebanon, according to Reuters citing two security sources.

- Israeli media reported smoke rising as a result of an explosion in Tel Aviv caused by an explosive device which was said to be a drone, while Yemen's Houthis said they will reveal details about a military operation that targeted Tel Aviv.

- Houthi's spokesperson said they targeted Tel Aviv "with a new drone bearing the name "Jaffa" capable of bypassing interceptor".

- White House said it has been monitoring threats from Iran when it comes to the former administration.

OTHER

- North Korean leader Kim discussed the importance of military cooperation with Russia in a meeting with a Russian delegation and stressed the need for North Korean and Russian armies to unite more to firmly defend the peace, according to KCNA.

EU/UK

NOTABLE HEADLINES

- ECB officials reportedly consider if only one more cut is feasible in 2024, according to Bloomberg citing people familiar with the matter. The report noted that as inflation pressures still linger, officials are becoming less confident that a path for two further reductions is realistic, and don’t want investors to assume that a move in September is a done deal, while policymakers’ experience of having made too strong a commitment in June are also motivating them to keep all options available for the September meeting. Furthermore, an argument in favour of a cut in September is the weak performance of the economy in Q2 which may struggle to pick up although sticky services inflation could weigh against such a move, while none of the people excluded the possibility that two rate cuts could still occur and all emphasised that decisions have yet to be made.

- ECB hawks are open to September rate cut provided upcoming data confirm disinflation is underway, according to Reuters sources.

DATA RECAP

- UK GfK Consumer Confidence (Jul) -13.0 vs. Exp. -12.0 (Prev. -14.0)