Europe Market Open: China trade frictions and tariff threats clouded APAC trade, UK CPI due

17 Jul 2024, 06:35 by Newsquawk Desk

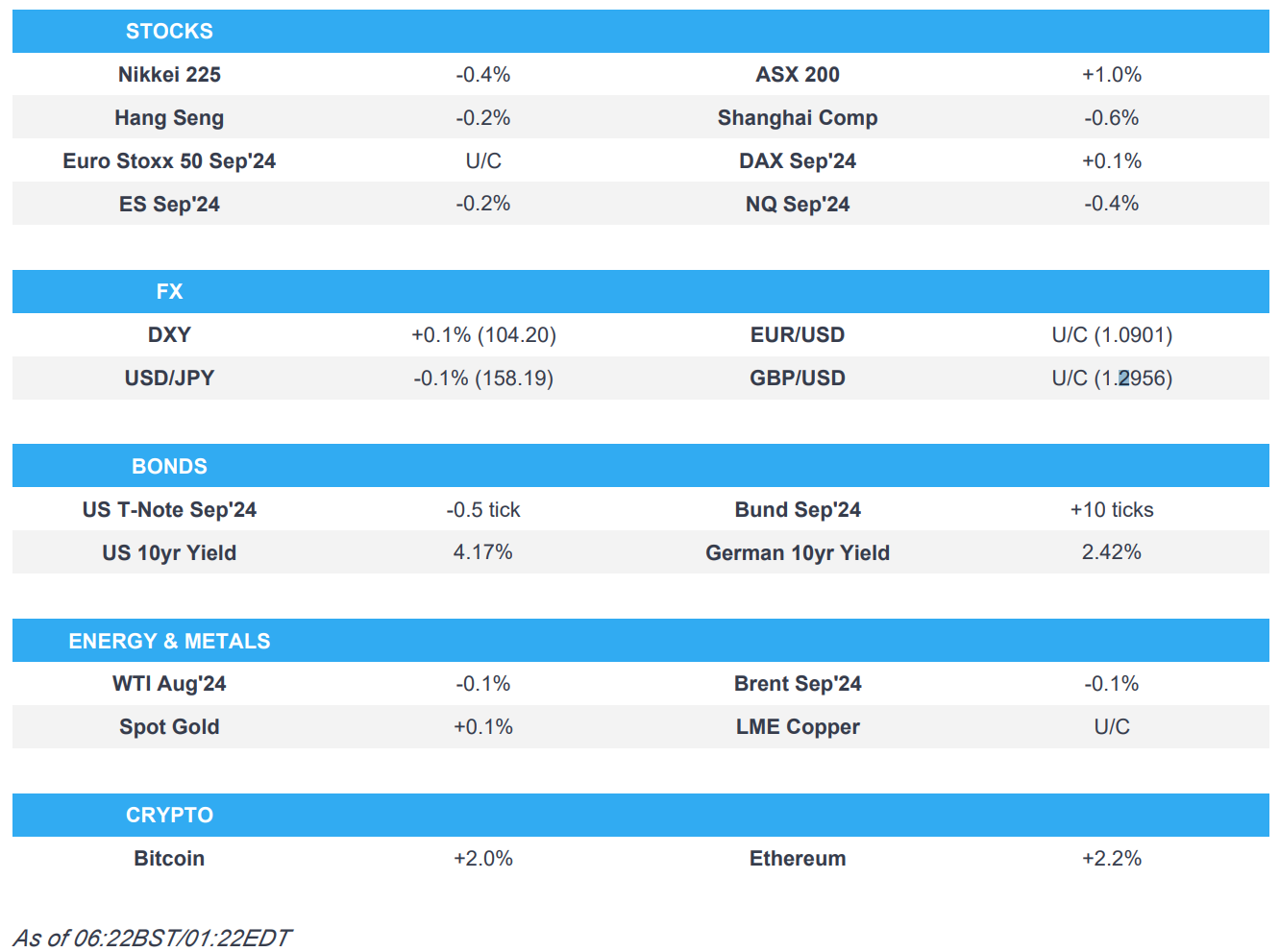

- APAC stocks were mixed despite the positive handover from Wall St, while China trade frictions and tariff threats clouded over Asia-Pac sentiment.

- NZD/USD was ultimately boosted despite the softer-than-expected New Zealand CPI data for Q2 as the attention turned to the 5.4% surge in non-tradeable consumer inflation; DXY struggled for direction.

- Former President Trump said the Fed should abstain from cutting rates before the November election and wants to bring the corporate tax rate to as low as 15%, while he suggested 60%-100% tariffs on China.

- European equity futures indicate a flat open with Euro Stoxx 50 future unchanged, although fleeting upticks were seen after ASML topped Revenue, Net Income, and Bookings forecasts.

- Looking ahead, highlights include UK CPI, PPI, EZ HICP (F), US Industrial Production & Building Permits, Comments from Fed's Barkin & Waller, Supply from UK, Germany & US, Earnings from ASML, Johnson & Johnson, Elevance Health, US Bancorp & United Airlines

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mostly higher with sentiment underpinned following better-than-expected US Retail Sales data as the headline beat expectations to print flat and the Retail Control number surged which will likely have a positive impact on Q2 GDP. The data initially boosted the dollar and pressured treasuries although the moves were then faded throughout the session, while stocks continued their upward trend which saw the S&P 500 and DJIA extend on their record levels and the Russell 2000 once again outperformed its major counterparts.

- SPX +0.64% at 5,667, NDX +0.06 at 20,399, DJI +1.85% at 40,954, RUT +3.5% at 2,264.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kugler (voter) said it would be appropriate to begin easing monetary policy later this year if economic conditions continue to evolve favourably, while she added that upside risks to inflation and downside risks to employment have become more balanced. Kugler also said disinflation is back on track and she is cautiously optimistic that inflation is returning to 2%.

- US President Biden is set to announce support for major Supreme Court changes, while proposals could include term limits and enforceable ethics code, according to The Washington Post.

- Former US President Trump said "Trumponomics" equates to low interest rates and tariffs, while he said he would not seek to remove Fed Chair Powell before his term ends and would consider JPMorgan CEO Dimon to serve as Treasury Secretary. Furthermore, he said the Fed should abstain from cutting rates before the November election and wants to bring the corporate tax rate to as low as 15%, according to a Bloomberg Businessweek interview.

APAC TRADE

EQUITIES

- APAC stocks were mixed despite the positive handover from Wall St where the S&P 500 and DJIA extended to fresh record highs following better-than-expected Retail Sales data, as China trade frictions and tariff threats clouded over Asia-Pac sentiment.

- ASX 200 gained with notable strength in gold-related stocks after the precious metal rose to a fresh record level, while the mining sector is positive but with upside capped amid indecision in BHP despite posting better-than-expected quarterly iron ore output.

- Nikkei 225 gradually reversed its initial advances with trade restrained by a lack of drivers and a quiet calendar aside from the monthly Reuters Tankan survey which showed an improvement in large manufacturers’ sentiment.

- Hang Seng and Shanghai Comp. were lacklustre amid tariff fears and trade frictions after Trump suggested 60%-100% tariffs on China, while the Biden administration is to issue a proposed rule on Chinese connected vehicles in about a month and warned allies of stricter trade rules in the China chip crackdown.

- US equity futures took a breather after the prior day’s advances and fresh record highs on Wall St.

- European equity futures indicate a marginally positive open with Euro Stoxx 50 future +0.1% after the cash market closed down by 0.7% on Tuesday.

FX

- DXY struggled for direction after paring gains that were spurred by Retail Sales, while attention turns to more data and Fed speakers.

- EUR/USD traded little changed after it just about reclaimed the 1.0900 status.

- GBP/USD price action was uneventful ahead of UK CPI and the King’s Speech.

- USD/JPY conformed to the non-committal mood seen across most of the FX space.

- Antipodeans were firmer with NZD/USD ultimately boosted despite the softer-than-expected New Zealand CPI data for Q2 as the attention turned to the 5.4% surge in non-tradeable consumer inflation.

- PBoC set USD/CNY mid-point at 7.1318 vs exp. 7.2630 (prev. 7.1328).

FIXED INCOME

- 10-year UST futures took a breather after yesterday’s post-Retail Sales fluctuations with a non-committal tone ahead of upcoming supply, data and Fed speakers.

- Bund futures lingered around this month’s best levels but with gains capped as a 30-year auction looms.

- 10-year JGB futures were kept afloat in quiet trade amid a light calendar and relatively reserved BoJ Rinban amount.

COMMODITIES

- Crude futures lacked direction following yesterday’s choppy mood and mixed private sector inventory data.

- US Private Inventory Data (bbls): Crude -4.4mln (exp. +1mln), Distillate +4.9mln (exp. -0.5mln), Gasoline +0.4mln (exp. -1.7mln), Cushing -0.7mln.

- Spot gold remained underpinned and further extended on record highs.

- Copper futures were indecisive after yesterday’s decline and amid the mixed risk tone.

- Russia plans to make extra crude production cuts to compensate for pumping above its OPEC+ quota in the warm seasons of this year and next, according to Bloomberg sources.

CRYPTO

- Bitcoin gained and briefly broke above the USD 66,000 level in continuation of the Trump-related momentum.

NOTABLE ASIA-PAC HEADLINES

- PBoC reportedly questions banks on bond holdings in a push to cool the rally, according to Bloomberg.

- US reportedly warned allies of stricter trade rules in the China chip crackdown with the US mulling whether to impose the Foreign Direct Product Rule, while US restriction would hit technology from Tokyo Electron (8035 JT) and ASML (ASML NA), according to Bloomberg.

- Former US President Trump said he no longer plans to ban TikTok, while he wants new tariffs for China of between 60%-100% and would impose a 10% tariff on imports from other countries, according to a Bloomberg interview.

DATA RECAP

- New Zealand CPI QQ (Q2) 0.4% vs. Exp. 0.5% (Prev. 0.6%)

- New Zealand CPI YY (Q2) 3.3% vs. Exp. 3.4% (Prev. 4.0%)

- New Zealand Q2 CPI Non-Tradeables rose 5.4% Y/Y.

- RBNZ Sectoral Factor Model Inflation Index (Q2) 3.6% (Prev. 4.2%)

GEOPOLITICAL

MIDDLE EAST

- Israel's cabinet was reported to meet on Tuesday night to discuss a swap deal amid Israeli PM Netanyahu's position of calling for more military pressure, according to Sky News Arabia.

- Israeli media reported more than 80 rockets were fired from Lebanon on Tuesday night, according to Sky News Arabia.

- Drones targeted Iraq's Al-Asad Airbase which houses US personnel although there were no casualties, according to Reuters.

- US reportedly received intel of an Iranian plot to assassinate presidential candidate Trump, according to CNN. However, Iran's UN mission said the accusation of a plot against Trump is 'substantiated and malicious', while it added that Trump is a 'criminal who must be prosecuted and punished in a court of law' for the killing of an Iranian general and Iran has chosen the legal path to bring him to justice.

OTHER

- Russian Deputy PM Novak says the latest EU sanctions targeting Russia's LNG industry are illegal, according to TASS.

- Hungarian Foreign Minister said efforts are being made to hold a second peace conference on Ukraine this year, according to RIA.

- Japan is making the final arrangement to contribute USD 3.3bln to Ukraine aid using frozen Russian assets which is about 6% of the total G7 package, according to Kyodo.

- Former US President Trump said Taiwan should pay the US for protection from China and that he is at best lukewarm about standing up to Chinese aggression, according to a Bloomberg interview. It was later reported that Taiwan's Premier said regarding the Trump interview that the relationship between Taiwan and the US is very firm, while he added that peace and stability of the Taiwan Strait and the Indo-Pacific region are our common responsibility and that Taiwan is willing to take on more responsibility.

EU/UK

NOTABLE HEADLINES

- French President Macron accepted the French government's resignation although the current government is to stay on in a caretaker capacity until a new cabinet is formed and Attal was renamed as caretaker PM.