US Market Open: RTY continues to outperform, DXY flat & Crude at lows ahead of US Retail Sales

16 Jul 2024, 11:05 by Newsquawk Desk

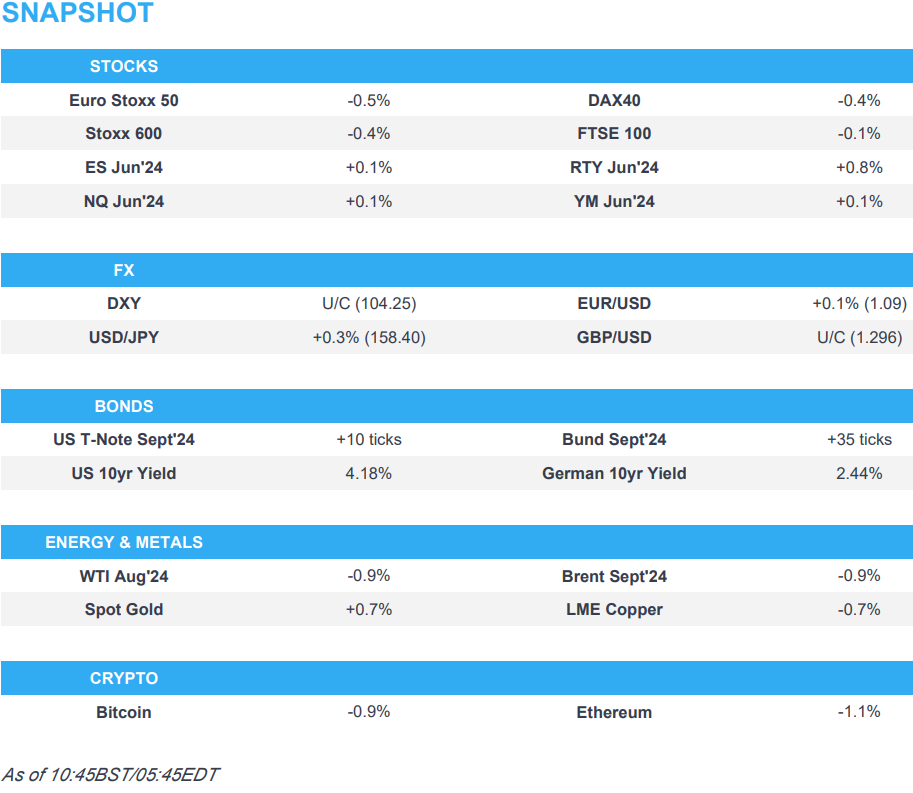

- European equities are entirely in the red; US futures gain, and with clear outperformance in the RTY

- USD gains vs NZD, AUD & JPY, EUR/USD reclaims 1.09 and USD/JPY holds around 158.40

- Bonds are higher following Fed Chair Powell's comments and with yields unwinding some of their Trump-induced steepening

- Crude resides at session lows, XAU gains and eyes its ATH and base metals are mostly lower

- Looking ahead, US Import Prices, Retail Sales, Canadian CPI, Retail Sales, New Zealand CPI, US Republican Convention, Comments from Fed’s Kugler, Earnings from Bank of America, Morgan Stanley, UnitedHealth & Charles Schwab

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.4%) are entirely in the red, having opened on the backfoot and continued to extend on losses as the morning progressed. Since then, indices have found support and traverse across worst levels.

- European sectors hold a strong negative bias; Basic Resources is the clear underperformer, dragged down by losses in the underlying metals complex as well as a poor production update from Rio Tinto (-2.2%).

- US Equity Futures (ES +0.1%, NQ U/C, RTY U/C) are flat/mixed, with the ES and NQ trading on either side of the unchanged mark, whilst the RTY outperforms.

- BlackRock Investment raises UK equities to Overweight from Neutral

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Mixed performance for the USD vs. peers, performing best vs. JPY, AUD, NZD. Today's focus will be on US retail sales, whereby a dovish release could prompt DXY to move onto a 103 handle vs current 104.28.

- EUR is steady vs. the USD after a brief incursion above the 1.09 mark to a 1.0902 high. German ZEW was mixed and failed to move the dial for the Single-currency.

- GBP is steady vs. the USD with 1.30 seemingly currently too tough a nut to crack for Cable. The pair got as high as 1.2995 yesterday before running out of steam.

- USD attempting to claw back some lost ground vs. the JPY after last week's US CPI, dovish Powell and Japanese intervention sent the pair markedly lower. 158.78 is the high watermark for today's session but is still a far cry from the July multi-decade high at 161.95

- Antipodeans are both suffering at the hands of the USD with commodity currencies seeing a soft start to the week post-Chinese data over the weekend.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer and holding near highs of 111-10+, as Powell's inflation language serves to weigh on short-term yields, alongside an ongoing pullback in crude; action which is also being seen at the long end of the curve which is currently underperforming and the curve as a whole is flattening.

- Bunds are firmer in-fitting with USTs, eclipsing last week's 132.08 best to a 132.31 peak which now looks to a cluster between 132.56-80 from the 20th-26th June. The latest ECB Bank Lending Survey passed without reaction while the mixed ZEW pushed Bunds away from best levels.

- Gilts remains focussed on upcoming events which commence with CPI and the King's Speech on Wednesday. DMO outing was robust and spurred an incremental fresh high of 98.62.

- OAT-Bund 10yr yield spread remains steady at 64bps ahead of today's political risk event whereby President Macron should accept and allow PM Attal to resign, but it remains to be seen exactly who will be appointed as a caretaker.

- UK sells GBP 2.25bln 4.75% 2043 Gilt: b/c 3.29x (prev. 3.67x), average yield 4.519% (prev. 4.580%) & 0.1bps (prev. 0.4bps)

- Germany sells EUR 3.261bln vs exp. EUR 4bln 2.50% 2029 Bobl: b/c 2.0x, average yield 2.39%, retention 18.48%

- Click for a detailed summary

COMMODITIES

- A subdued session for the crude complex thus far despite the lack of fresh fundamentals, but as the Dollar remains firm and amid the ongoing woes surrounding Chinese demand following several downbeat data releases. Brent September resides near the trough of a USD 84.15-84.86/bbl parameter.

- Mixed trade across the precious metals despite quiet newsflow in the European morning, with spot gold the outperformer amid increased momentum as the yellow metal approaches ATHs. Spot gold probes yesterday's peak (USD 2,439.59/oz) as it eyes its current ATH at USD 2,449.89/oz.

- Base metals are mostly lower with the complex dampened by the prognosis of the Chinese economy following the recent string of disappointing data, whilst some also flag rising inventory as warehouses.

- Freeport LNG expects to restart the first LNG train this week after damage from Hurricane Beryl and plans to restart the remaining two LNG trains shortly after the first one.

- Bolivia’s President announced the discovery of a 1.7tln cubic feet natural gas reserve in the north of the department of La Paz.

- Some Japaense aluminium purchasers have agreed on a July-September premium of USD 172/T, +16-19% Q/Q, via Reuters citing sources

- Click for a detailed summary

NOTABLE DATA RECAP

- Italian Consumer Prices Final MM (Jun) 0.1% vs. Exp. 0.1% (Prev. 0.1%); CPI (EU Norm) Final YY (Jun) 0.9% vs. Exp. 0.9% (Prev. 0.9%); Consumer Prices Final YY (Jun) 0.8% vs. Exp. 0.8% (Prev. 0.8%); CPI (EU Norm) Final MM (Jun) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

- German ZEW Economic Sentiment (Jul) 41.8 vs. Exp. 42.3 (Prev. 47.5); ZEW Current Conditions (Jul) -68.9 vs. Exp. -74.5 (Prev. -73.8)

- EU ZEW Survey Expectations (Jul) 43.7 (Prev. 51.3)

NOTABLE EUROPEAN HEADLINES

- ECB Bank Lending Survey Credit standards were broadly unchanged at tight levels in the second quarter of 2024. Banks reported a small net tightening of corporate credit standards and a moderate easing for mortgages. Loan demand continued to decline for firms, while recording the first increase for households since 2022. Credit standards for firms displayed some heterogeneity across economic sectors, tightening strongly in commercial real estate

NOTABLE EARNINGS

- Richemont (CFR SW) Q1 (EUR): Sales 5.27bln (exp. 5.28bln). APAC Revenue -18% (exp. -15.1%); China/Hong Kong/Macau sales -27%, Europe Revenue +5% (exp. +4.83%)

- Hugo Boss (BOSS GY) Co. downgrades its FY24 outlook and now expects Group sales to increase by +1% to +4% (prev. +3% to 6%) to EUR 4.20-4.35bln (prev. EUR 4.30-4.45bln). FY EBIT is now seen between EUR 350-430mln (prev. 430-475mln).

NOTABLE US HEADLINES

- Fed's Daly (voter) said confidence is growing that they are getting nearer to a sustainable pace of getting inflation to 2%, while she sees a policy adjustment over the coming term and said some normalisation of policy is a likely outcome. Furthermore, she said the US economy is slowing and inflation is lower but they are not there yet although they are nearer to the time of achieving their goals.

- US President Biden is reportedly on the brink of failing to win a key labour endorsement as leaders of the 1.3mln member Teamsters union consider backing no candidate at all in the presidential race, according to Reuters citing sources. It was later reported that Teamsters union president O'Brien said they are not beholden to any party.

- US Special Counsel spokesperson said the dismissal of the Trump documents case deviates from the uniform conclusion of all previous courts to have considered the issue that the Attorney General is statutorily authorised to appoint a Special Counsel, while the Justice Department authorised the Special Counsel to appeal the court’s order.

- BofA Fund Manager Survey: investors remain bullish, driven by expectations of Fed cuts and a soft landing. Global growth expectations: -27% (prev. -6%), largest drop since March 2022. Soft landing expected by 68%, 18% see no landing. 67% see no recession in the next 12-months. Long 'Magnificent 7' the most crowded trade by a 'country mile'. 39% believe that monetary policy is too restrictive. Geopols has replaced higher inflation as the main tail risk.

- Former President Trump is reportedly ready to hold talks with Russian President Putin on resolving the Russia-Ukraine conflict without any intermediary, according to Tass

GEOPOLITICS

- North Korea warned that South Korea will face devastating consequences over anti-North Korea leaflets, according to KCNA.

CRYPTO

- Bitcoin gives back some of its recent advances, and slips back below USD 65k.

- Bitcoin (BTC) faced renewed selling pressure on Tuesday after blockchain data showed defunct exchange Mt. Gox started moving coins internally for potential repayments to creditors, according to CoinDesk.

- Mt. Gox reportedly continues large moments to unknown wallets, transferred some USD 3bln, according to The Block.

APAC TRADE

- APAC stocks were mixed amid a quiet calendar and after the choppy but positive performance stateside following the latest comments from Fed Chair Powell.

- ASX 200 traded marginally lower with weakness in mining stocks following Rio Tinto's production update.

- Nikkei 225 gained on return from the holiday weekend with the upside helped by a weaker currency.

- Hang Seng and Shanghai Comp. were subdued with underperformance in the Hong Kong benchmark after it gapped beneath the psychologically key 18,000 level, while sentiment in the mainland was clouded amid the lingering risks of higher tariffs but with downside stemmed after the PBoC upped its liquidity efforts with a CNY 676bln injection through 7-day reverse repos.

NOTABLE APAC HEADLINES

- BoJ accounts point to intervention of about JPY 2.1tln on July 12th, via Bloomberg.