Europe Market Open: Fed Chair Powell acknowledged more inflation progress

16 Jul 2024, 06:33 by Newsquawk Desk

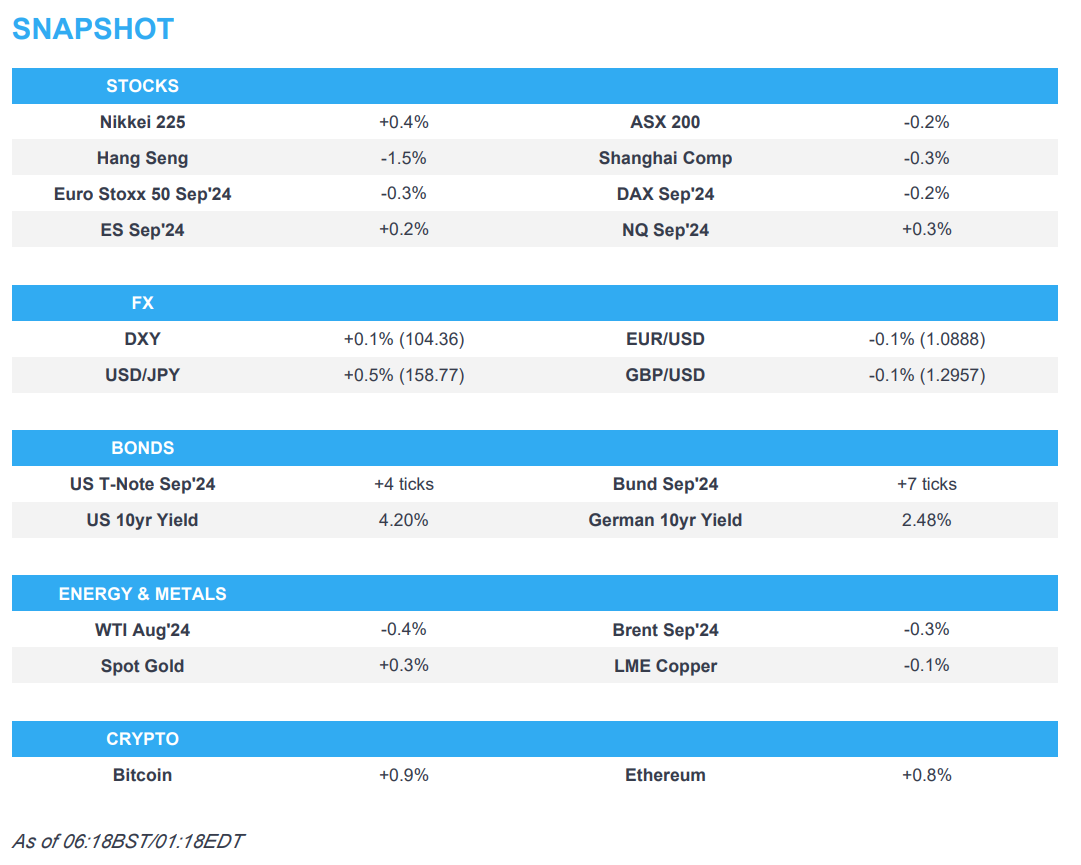

- APAC stocks were mixed amid a quiet calendar and after the choppy but positive performance stateside.

- Fed Chair Powell acknowledged more inflation progress and that recent inflation readings added confidence in inflation falling.

- European equity futures indicate a softer open with Euro Stoxx 50 future -0.3% after the cash market closed down by 1.2% on Monday.

- DXY is marginally higher with the USD mainly firmer vs. JPY, AUD and NZD, EUR/USD hovers just below 1.09.

- Looking ahead, highlights include German ZEW, ECB Bank Lending Survey, US Import Prices, Retail Sales, Canadian CPI, Retail Sales, New Zealand CPI, US Republican Convention, Comments from Fed’s Kugler, Supply from UK & Germany, Earnings from Richemont, Bank of America, Morgan Stanley, UnitedHealth & Charles Schwab.

US TRADE

EQUITIES

- US stocks finished positive although price action was choppy during the session as markets reflected on the failed Trump assassination attempt which ultimately boosted his election chances and with attention also on comments from Fed Chair Powell who acknowledged more inflation progress and that recent inflation readings added confidence in inflation falling. Nonetheless, he refrained from providing any signals on any particular meeting and said decisions would be made meeting by meeting.

- SPX +0.28% at 5,631, NDX +0.27% at 20,386, DJI +0.53% at 40,211, RUT +1.71% at 2,184.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Chair Powell said the economy has performed remarkably well over the last couple of years and he expected the economy to slow and inflation to continue to make progress this year, while he noted that something like that is happening. Powell said Q2 inflation does represent progress with three better readings which add confidence in inflation falling and now that inflation has come down, they will look at both mandates. Powell stated if the US were to see an unexpected weakening in the labour market, that would merit a reaction from them but added he is not going to send any signal on any particular meeting and will make decisions meeting by meeting. Furthermore, he said if the Fed waits for inflation to get to 2% to cut, it has waited too long and the test is that officials want to be confident it is moving down, while more good data will add to confidence and the Fed has been getting that lately. Powell also stated that policy is restrictive, though not severely so, and the neutral rate has probably risen.

- Fed's Daly (voter) said confidence is growing that they are getting nearer to a sustainable pace of getting inflation to 2%, while she sees a policy adjustment over the coming term and said some normalisation of policy is a likely outcome. Furthermore, she said the US economy is slowing and inflation is lower but they are not there yet although they are nearer to the time of achieving their goals.

- WSJ's Timiraos noted that "Fed Chair Powell passed on an opportunity to change expectations that the central bank will hold rates steady at its next meeting".

- US President Biden will reportedly unveil a new proposal in Nevada on Tuesday to cap rental costs nationwide, according to WaPo citing sources. Biden’s plan, which would need to be approved by Congress, calls for stripping a tax benefit from landlords who increase their tenants’ rent by more than 5% per year, while the measure would only apply to landlords who own more than 50 units which represent roughly half of all rental properties and wouldn’t cover units that have not yet been built, in an attempt to ensure that the policy does not discourage construction of new rental housing.

- US President Biden said he doesn't know if the Trump shooting changed the trajectory of the election and that polling does not show a wide gap with Trump, while he added it is a toss-up and he will debate Trump in September.

- US President Biden is reportedly on the brink of failing to win a key labour endorsement as leaders of the 1.3mln member Teamsters union consider backing no candidate at all in the presidential race, according to Reuters citing sources. It was later reported that Teamsters union president O'Brien said they are not beholden to any party.

- US presidential candidate Trump picked JD Vance as his running mate, while President Biden later commented that J.D. Vance is a clone of Trump on the issues.

- US Special Counsel spokesperson said the dismissal of the Trump documents case deviates from the uniform conclusion of all previous courts to have considered the issue that the Attorney General is statutorily authorised to appoint a Special Counsel, while the Justice Department authorised the Special Counsel to appeal the court’s order.

APAC TRADE

EQUITIES

- APAC stocks were mixed amid a quiet calendar and after the choppy but positive performance stateside following the latest comments from Fed Chair Powell.

- ASX 200 traded marginally lower with weakness in mining stocks following Rio Tinto's production update.

- Nikkei 225 gained on return from the holiday weekend with the upside helped by a weaker currency.

- Hang Seng and Shanghai Comp. were subdued with underperformance in the Hong Kong benchmark after it gapped beneath the psychologically key 18,000 level, while sentiment in the mainland was clouded amid the lingering risks of higher tariffs but with downside stemmed after the PBoC upped its liquidity efforts with a CNY 676bln injection through 7-day reverse repos.

- US equity futures held onto recent gains after both the S&P 500 and Dow printed fresh record highs on Monday.

- European equity futures indicate a softer open with Euro Stoxx 50 future -0.3% after the cash market closed down by 1.2% on Monday.

FX

- DXY was marginally positive but with gains limited after the two-way price action seen during the US session where it briefly slipped to the 104.00 level after comments from Fed Chair Powell who noted progress on inflation before bouncing back as he refrained from providing a signal on any meeting and stated that more good data will add to the confidence.

- EUR/USD lacked direction after having recently failed to sustain a brief incursion above the 1.0900 level.

- GBP/USD traded sideways following yesterday's pullback from resistance around the 1.3000 status.

- USD/JPY edged higher after reversing a brief dip towards 157.00 which coincided with Powell's comments.

- Antipodeans were mildly pressured amid the lacklustre risk appetite in Asia and a slightly softer yuan.

- PBoC set USD/CNY mid-point at 7.1328 vs exp. 7.2671 (prev. 7.1313).

FIXED INCOME

- 10-year UST futures traded rangebound around the 111.00 level after recent curve steepening amid boosted prospects of a Trump re-election and after Fed Chair Powell noted recent data added to Fed confidence that inflation is returning to the target.

- Bund futures were contained by resistance at the 132.00 level ahead of ZEW data and a Bobl auction.

- 10-year JGB futures were boosted on return from the extended weekend to resume this month's upward momentum, while the b/c at the enhanced liquidity auction for long-end JGBs was relatively in line with the previous.

COMMODITIES

- Crude futures remained lacklustre after yesterday's choppy mood owing to recent weak Chinese data and with Gaza talks halted.

- Freeport LNG expects to restart the first LNG train this week after damage from Hurricane Beryl and plans to restart the remaining two LNG trains shortly after the first one.

- Bolivia’s President announced the discovery of a 1.7tln cubic feet natural gas reserve in the north of the department of La Paz.

- Spot gold kept afloat but with upside capped amid mild gains in the dollar and light overnight catalysts.

- Copper futures languished at the prior day's lows with prices not helped by the cautious mood in Asia.

CRYPTO

- Bitcoin traded indecisively throughout the session and is ultimately flat beneath the USD 65,000 level.

- SEC asked Spot ETH ETF issuers to return final S-1s on Wednesday for a Tuesday 23rd July launch, according to Bloomberg.

NOTABLE ASIA-PAC HEADLINES

- US chipmaking equipment manufacturers have become more dependent on the Chinese market despite Washington's export restrictions on advanced products as they boost shipments of machinery used to make legacy chips, according to Nikkei.

- Presidential candidate Trump's running mate J.D. Vance said China is a bigger issue for the US than the Russia-Ukraine war.

GEOPOLITICAL

MIDDLE EAST

- Three civilians were reportedly killed and three were wounded in an Israeli strike on a building in Lebanon's Bint Jbeil, according to Reuters citing sources.

- Israeli security cabinet will convene on Tuesday and discuss the Gaza hostage and ceasefire deal, according to Axios/Walla's Ravid.

- US State Department said they believe the remaining issues between Israel and Hamas on a ceasefire deal are issues that can be solved.

- Yemen's Houthis said they carried out three military operations in which they targeted the "Bentley I" ship in the Red Sea with ballistic missiles and drones, while it targeted the oil tanker "Chios Lion" in the Red Sea with a booby-trapped boat and along with the Islamic Resistance in Iraq, targeted the Olivia vessel in the Mediterranean Sea.

OTHER

- North Korea warned that South Korea will face devastating consequences over anti-North Korea leaflets, according to KCNA.

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.