US Market Open: RTY continues to outperform, Dollar is flat & Bonds slightly pare recent gains; US PPI due

12 Jul 2024, 11:08 by Newsquawk Desk

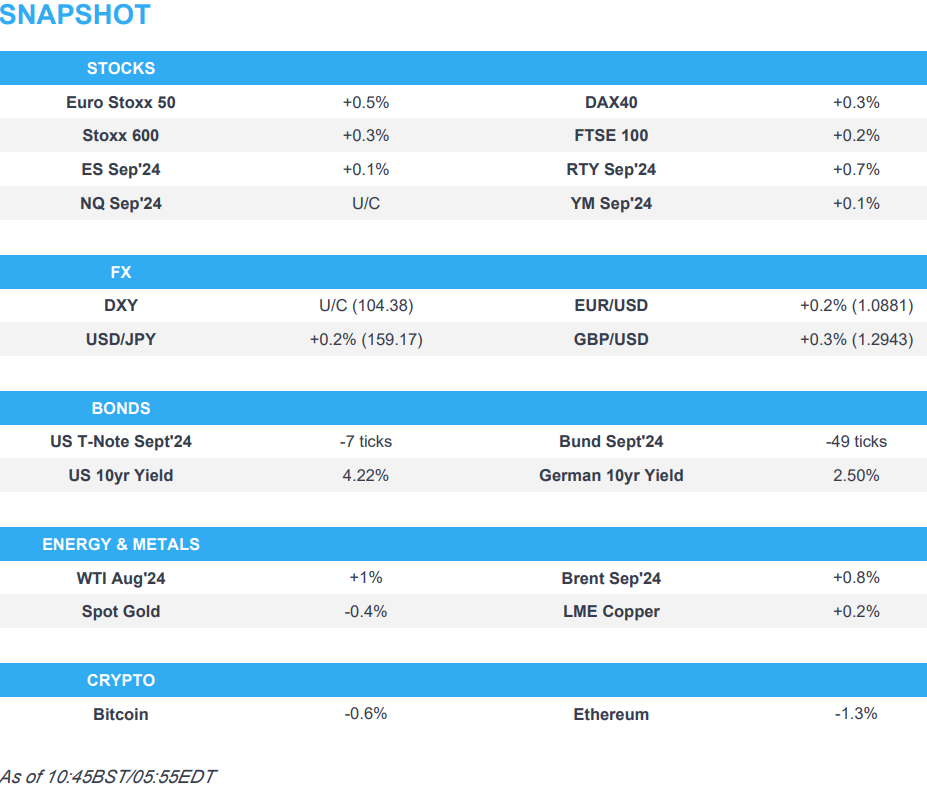

- European bourses are entirely in the green, US futures are mixed with the ES and NQ flat whilst the RTY continues to outperform

- Dollar is flat having erased earlier gains, USD/JPY back below 160 after choppy trade overnight

- Bonds are pressured giving back some of the post-CPI strength

- Crude is firmer and resides near session highs, XAU lower and base metals are mixed

- Looking ahead, US PPI, Uni. of Michigan Prelim., Earnings from BNY Melon, JPMorgan, Wells Fargo, Citi

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.3%) are entirely in the green, continuing the price action seen in the prior session. Indices initially opened tentatively higher and continued higher as the morning progressed, though has edged off best levels in recent trade.

- European sectors hold a strong positive bias; Energy takes the top spot, benefiting from underlying strength in the crude complex. The Telecoms sector has been lifted by post-earnings strength in Ericsson (+7.2%).

- US equity futures (ES +0.1%, NQ U/C, RTY +0.7%) are mixed with the ES and NQ taking a breather from yesterday’s hefty selling pressure; the RTY continues to advance and holds at highs, with the rotation narrative remaining firm. Bank earnings today: BNY Melon, JPMorgan, Wells Fargo, Citi.

- Intel (INTC) exec. says they are on track for cumulative software sales of USD 1bln by end-2027

- UBS has downgraded Tesla (TSLA) to Neutral from Sell with a price target of USD 197

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Despite initial upside earlier in the session, USD strength has begun to wane with the DXY now flat. Should the downside continue, a test of Thursday's low at 104.07 could be seen.

- EUR/USD firmer on the session as the attempted recovery in the USD has begun to wane. Upside focus for EUR/USD remains on a potential breach of 1.09 after topping out bang on that level yesterday.

- GBP firmer vs. the USD with Cable on a 1.29 handle but below yesterday's 1.2949 high. It has been a solid week of gains for the GBP amid hawkish interjections from MPC's Haskel, Mann and Pill as well as a solid M/M June GDP print.

- JPY is a touch softer vs. the USD after some wild price action yesterday spurred by US CPI and suspected Japanese intervention. Since then, more volatile price action was observed overnight with the Nikkei suggesting the BoJ likely conducted rate checks in EUR/JPY.

- Antipodeans are both firmer vs the Dollar; AUD/USD is currently extending its winning streak vs. the USD to a 9th consecutive session, albeit is currently below yesterday's CPI-induced 0.6798 peak.

- Soft Swedish inflation data saw EUR/SEK spike higher from 11.4240 to 11.4600. The significantly cooler than expected print serves to reinforce market expectations for an August cut.

- PBoC set USD/CNY mid-point at 7.1315 vs exp. 7.2514 (prev. 7.1339).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are very slightly softer, in a paring of US CPI-induced strength and following a subdued 30yr auction on Thursday. Docket today includes US PPI and UoM Prelim. Currently trading around 110'30.

- Bunds hold a bearish bias, but still remains at elevated levels sparked by the dovish US CPI report. Bunds are down to a 131.56 base where they appear to have made a bit of a floor thus far having pulled back from an overnight 131.81 peak.

- Gilt price action is in-fitting with peers given the lack of UK-specific newsflow. Gapped lower by 26 ticks to 98.25 before slipping further to lows of 97.87; complex awaiting next week's key wage and inflation metrics.

- Click for a detailed summary

COMMODITIES

- Crude is extending on yesterday's modest gains which were supported by a softer Dollar following the US CPI metrics, with the strength continuing in APAC hours. Brent September topped USD 86/bbl to trade in a current USD 85.45-86.35/bbl parameter.

- Downbeat trade across all precious metals following yesterday's US CPI-induced surge, with underperformance this morning seen in spot silver and palladium whilst spot gold posts shallower losses ahead of US PPI. Spot gold is subdued in a current USD 2,400.14-2,416.26/oz band.

- Mixed trade across base metals with copper bucking the trend this morning following yesterday's slide despite the constructive US data for the metal.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish CPIF YY (Jun) 1.3% vs. Exp. 1.6% (Prev. 2.3%); Ex Energy 2.3% vs. Exp. 2.5% (Prev. 3.0%)

- German Wholesale Price Index YY (Jun) -0.6% (Prev. -0.7%); MM -0.3% (Prev. 0.1%)

- French CPI (EU Norm) Final YY (Jun) 2.5% vs. Exp. 2.5% (Prev. 2.5%); CPI (EU Norm) Final MM (Jun) 0.2% vs. Exp. 0.1% (Prev. 0.1%)

- Spanish CPI MM Final NSA (Jun) 0.4% vs. Exp. 0.3% (Prev. 0.3%); CPI YY Final NSA (Jun) 3.4% vs. Exp. 3.4% (Prev. 3.4%); HICP Final YY (Jun) 3.6% vs. Exp. 3.5% (Prev. 3.5%); HICP Final MM (Jun) 0.4% vs. Exp. 0.3% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- Rio Tinto (RIO LN) studies mining megadeals after collapse of the BHP (BHP AT)-Anglo American (AAL LN) swoop; Rio is said to have held talks with bankers to 'wargame' a potential USD 32bln offer for Teck Resources (TECK), via Sky News. The article notes that Teck is among a "refreshed list" of potential takeover targets. One source stated that Rio is "not about to launch an imminent bid for Teck Resources, but acknowledged that it was on a list of possible targets."

NOTABLE US HEADLINES

- Fed's Goolsbee (non-voter) said the June CPI report is excellent and the improvement on shelter inflation is profoundly encouraging, while he added this is what a path to 2% inflation looks like and as inflation falls, leaving Fed policy rate steady means Fed is tightening policy. Goolsbee said the reason to tighten policy would be if the economy is overheating but added they are not overheating, as well as noted that he doesn't like tying their hands on policy decisions and they need to decide when to cut rates, not trying to figure out a rate path for next seven months.

- US President Biden mistakenly referred to Ukrainian President Zelensky as President Putin before correcting himself during comments at the NATO summit, while he also mistakenly referred to Vice President Harris as Trump during his press conference. Furthermore, Biden said he has to finish the job because there is so much at stake and has taken three significant and intense neurological exams which say he is in good shape.

- US President Biden’s campaign said there was increased anxiety after the debate but it is not seeing a drastic shift in where the race stands, while internal data and public polling show the race remains within the margin of error in key battleground states. Furthermore, it noted that polling shows Biden's post-debate net favourability is 20% pts higher than Trump's among undecided voters.

- The Biden campaign is quietly assessing the viability of Vice President Harris' candidacy against Donald Trump in a new head-to-head poll, according to MSNBC.

- Three Biden officials directly involved in his re-election told NBC News that his chances of winning are zero and one said he needs to drop out, while it was also reported that some Biden advisers were discussing how to convince him to step aside, according to NYT.

- US President Biden is expected to face a deluge of calls from House Democrats urging him to drop out of the presidential race regardless of his performance at the NATO press conference, according to Axios. It was also reported that dozens of Democratic lawmakers are to call for US President Biden to quit the race in the coming 48 hours, according to CBS.

GEOPOLITICS

- "Israeli warplanes breach the sound barrier over areas north of Beirut (capital of Lebanon)", according to Sky News Arabia

- US President Biden said NATO confirms support for Ukraine and will not allow Russia to achieve victory.

- NATO Secretary General Stoltenberg said Ukraine can count on NATO now and for the long haul, while he added that Chinese exercises with Belarusian forces are part of a pattern and confirms authoritarian regimes are aligning more.

- German Chancellor Scholz said more needs to be done to ramp up air defences for Ukraine, while he added their defence industry needs to be capable of expanding production capacities swiftly.

- South Korea and the US signed a guideline on nuclear deterrence and operation in the Korean Peninsula, according to the South Korean Presidential Office.

- "Israel says it was bombed in southern Syria in response to a projectile fired from the Golan", via Al Arabiya..

CRYPTO

- Bitcoin is incrementally softer and holds just above USD 57k, after briefly dipping below the level earlier. Ethereum posts losses to a slightly higher magnitude but remains firmly above USD 3k.

APAC TRADE

- APAC stocks took their cues from the mixed performance stateside where softer-than-expected CPI data boosted Fed rate cut bets and spurred a stock rotation out of large-cap tech into small-cap cyclicals.

- ASX 200 gained amid lower yields with gold miners, real estate, and consumer stocks leading the advances.

- Nikkei 225 underperformed after recently sliding back from record highs and amid speculated FX intervention.

- Hang Seng and Shanghai Comp. diverged as the former rallied back above the 18,000 level with strength seen in property and tech, while the mainland was lacklustre after mixed Chinese trade data in which Exports topped forecasts but Imports surprisingly contracted.

NOTABLE ASIA-PAC HEADLINES

- China's Foreign Minister said in a phone call with his Dutch counterpart that China is willing to establish close ties with the new Dutch government and carry out all-around dialogue, as well as enhance mutual understanding. Furthermore, China believes the Dutch side will encourage the European side to look at China objectively and rationally and play a constructive role in maintaining a healthy and stable development of China-EU relations.

- Japanese government official said Japan conducted currency intervention to prop up the yen on Thursday, according to Mainichi citing an unidentified official. It was separately reported that the BoJ likely conducted rate checks in EUR/JPY on Friday, according to Nikkei.

- Japanese Finance Minister Suzuki said currency rates should be set by the market and rapid FX moves are undesirable, while he wouldn't comment on FX levels, FX intervention and media reports that Japan conducted FX rate checks.

- Japanese Chief Cabinet Secretary Hayashi said no comment on FX intervention and wouldn't comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals and they are ready to take all possible means on forex.

- Japanese top currency diplomat Kanda said no comment on FX intervention and noted recent yen moves are somewhat rapid, while he added they will take appropriate action on forex if needed. Furthermore, he is puzzled about the media report on intervention, while he did not comment on whether they intervened in the FX market and cannot think if government officials commented on forex intervention.

- BoJ Survey says wage growth spreading among small and medium firms this year. Growth being driven by rising prices, hiring competition and a recovery in earnings performance.

- Japan's business lobby Doyukai Chief Niinami has asked the BoJ to raise rates in July, according to Nikkei.

- Japanese gov't is reportedly expected to slightly cut its economy growth forecast for FY24 from the current view of 1.3%, via Reuters citing sources.

- BoJ data suggest Japan intervened in the FX market on July 11th, may have spent between JPY 3.37-3.57tln, according to Reuters; Accounts point to intervention of some JPY 3.5tln, according to Bloomberg.

DATA RECAP

- Chinese Trade Balance (USD)(Jun) 99.05B vs. Exp. 85.0B (Prev. 82.62B)

- Chinese Exports YY (USD)(Jun) 8.6% vs. Exp. 8.0% (Prev. 7.6%); Imports YY -2.3% vs. Exp. 2.8% (Prev. 1.8%)

- Chinese Trade Balance (CNY)(Jun) 703.7B (Prev. 586.4B)

- Chinese Exports YY (CNY)(Jun) 10.7% (Prev. 11.2%); Imports -0.6% (Prev. 5.2%)

- Singapore GDP QQ (Q2 P) 0.4% vs Exp. 0.4% (prev. 0.1%)

- Singapore GDP YY (Q2 P) 2.9% vs Exp. 2.7% (prev. 2.7%)