US Market Open: European bourses advance, DXY slightly lower & USTs flat ahead of key US CPI; Fed's Bostic & Musalem due

11 Jul 2024, 11:14 by Newsquawk Desk

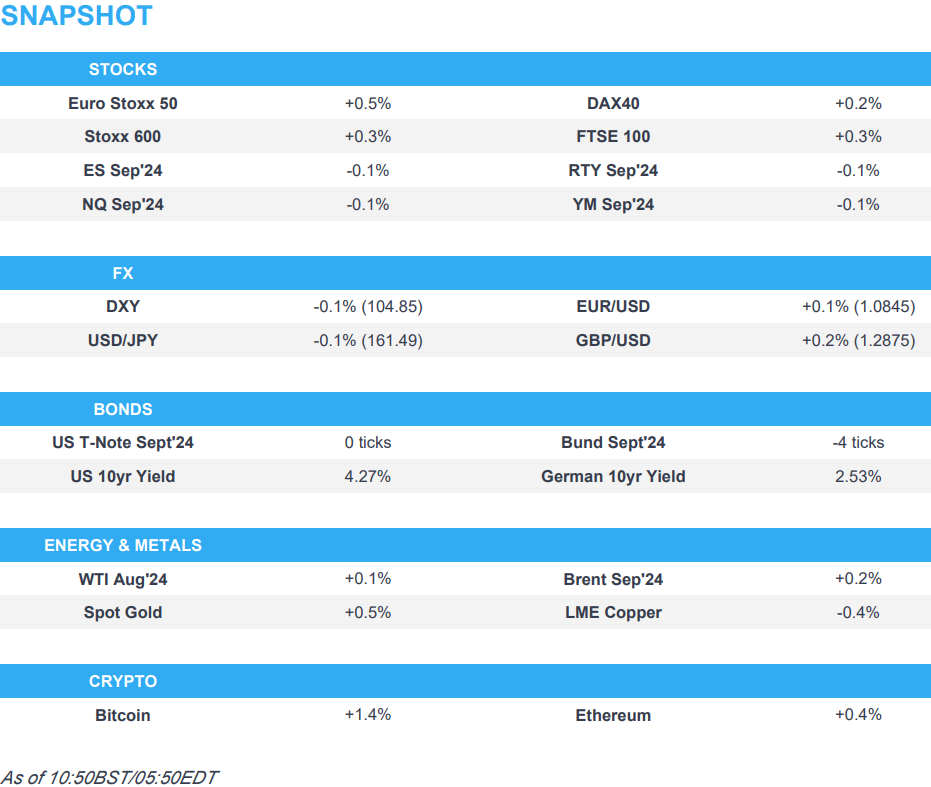

- European bourses are entirely in the green whilst US futures take a breather from the prior day’s advances

- Dollar is incrementally softer, GBP benefits from the region’s strong GDP metrics

- Bonds are flat/lower, with Treasuries standing pat as focus remains on US CPI, Gilts marginally underperform

- Crude is incrementally higher, having pared overnight gains; XAU at session highs and base metals are mixed

- Looking ahead, US CPI, IJC, Comments from Fed’s Bostic & Musalem, Supply from the US, Earnings from PepsiCo & Delta Airlines

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) are entirely in the green, in a continuation of the strength seen on Wall St. in the prior session, which also helped to prop up sentiment in APAC trade.

- European sectors hold a strong positive bias; Consumer Products takes the spot, propped up by gains in the Luxury sector. Energy is found at the foot of the pile, though with marginal losses.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY U/C) are flat/lower, taking a breather from the significant gains seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is back onto a 104 handle with all eyes on US CPI which takes place in the context of last week's "dovish NFP" and "dovish" comments from Fed Chair Powell.

- EUR/USD has marginally built on yesterday's gains and incrementally surpassed Monday's 1.0845 peak. For today, fate for the EUR/USD pair will likely be dictated by events stateside.

- GBP is extending its run as the best performing G10 currency YTD. Strong GDP metrics have followed up recent hawkish rhetoric from Haskel, Pill and Mann. Cable as high as 1.2876 with the next target coming via the March 8th YTD peak at 1.2893.

- JPY clawed back some ground vs. the USD after climbing as high as 161.75 overnight and backing away from the multi-decade 161.95 high seen on the 3rd July.

- Antipodeans are both near the top of the G10 leaderboard, benefiting from the constructive risk tone. NZD/USD is attempting to atone for Wednesday's RBNZ induced losses which saw the pair relinquish the 0.61 handle.

- PBoC set USD/CNY mid-point at 7.1339 vs exp. 7.2730 (prev. 7.1342).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat in a very narrow 3+ tick range ahead of US CPI. A data point that will be scrutinised to see if it favours a September cut; within Wednesday's 110-10 to 110-20 parameters, a hawkish CPI print could bring into play the WTD 110-07 base.

- Bunds are incrementally softer with specifics light and attention entirely on US CPI. Recent very modest bout of downside came in tandem with a slight pick-up in the crude complex.

- Gilts are the incremental underperformer after strong growth data for May which caused Gilts to open lower by a handful of ticks before dipping further to a 97.81 base. Gilts remain comfortably within existing 97.64-98.38 WTD parameters. Gilts caught a slight bid following a well received 7yr auction.

- UK sells GBP 3.75bln 4.00% 2031 Gilt: b/c 3.29x (prev. 2.97x), average yield 4.074% (prev. 4.218%), tail 1.9bps (prev. 1.4bps).

- Italy sells EUR 8.5bln vs exp. EUR 7.25-8.5bln 3.45% 2027, 1.10% 2027, 3.45% 2031, 0.90% 2031, 4.45% 2043 BTP. A well received auction which sparked modest upside in BTPs, lifting them to incremental session peaks of 117.26; though not all to surprising given the reduced auction amount.

- Click for a detailed summary

COMMODITIES

- Crude futures hold a modest upward bias but trade off best levels after WTI Aug hit an overnight peak of USD 82.87/bbl. Elsewhere, the IEA monthly oil market report had no bearing on prices. Brent September currently sits around USD 85.30/bbl.

- Mixed price action in the precious metals complex with spot palladium underperforming after yesterday's rebound, whilst spot gold and silver hold a mild upward bias heading into the US CPI metrics. Spot gold currently sits in a USD 2,371.34-2,384.14/oz range.

- Base metals are mixed with the breadth of the market also narrow. Copper prices remain subdued following a large build (+11.3k tons) in LME inventories after jumping to the highest level since 2021 yesterday.

- Azerbaijan oil production at 65.597k tons per day in June (vs 62.118k in May), according to the energy ministry.

- IEA OMR: Sees 2024 and 2025 oil demand growth forecasts little changed from the prior month at just below 1mln BPD; Global oil demand growth slows further at China cools; China’s oil demand growth eased to 710k BPD in Q2, IEA say. IEA sees oil demand growth at 970k BPD in 2024 (prev. 960k BPD), 980k BPD in 2025 (prev. 1mln BPD). Iran’s crude oil production rises to six-year high. Global oil stockpiles fell 18.1mln bbl in June in prelim data. Subpar economic growth, efficiencies, EVs are oil headwinds

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Estimate YY (May) 1.4% vs. Exp. 1.2% (Prev. 0.6%, Rev. 0.7%); GDP Estimate MM (May) 0.4% vs. Exp. 0.2% (Prev. 0.0%); all three main sectors contributed positively to GDP growth in May 2024; Est 3M/3M (May) 0.9% vs. Exp. 0.7% (Prev. 0.7%)

- UK Services MM (May) 0.3% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); Services YY (May) 1.6% vs. Exp. 1.5% (Prev. 1.1%, Rev. 1.2%)

- UK Industrial Output YY (May) 0.4% vs. Exp. 0.6% (Prev. -0.4%, Rev. -0.7%); Industrial Output MM (May) 0.2% vs. Exp. 0.2% (Prev. -0.9%)

- UK Goods Trade Balance GBP (May) -17.917B GB vs. Exp. -16.8B GB (Prev. -19.607B GB, Rev. -19.442B GB); Goods Trade Bal. Non-EU (May) -6.856B GB (Prev. -7.29B GB, Rev. -6.965B GB)

- UK Construction O/P Vol YY (May) 0.8% vs. Exp. -1.9% (Prev. -3.3%, Rev. -2.1%); Construction O/P Vol MM (May) 1.9% vs. Exp. 1.0% (Prev. -1.4%, Rev. -1.1%)

- UK Manufacturing Output MM (May) 0.4% vs. Exp. 0.4% (Prev. -1.4%, Rev. -1.6%); Manufacturing Output YY (May) 0.6% vs. Exp. 1.2% (Prev. 0.4%, Rev. -0.4%)

- UK RICS Housing Survey (Jun) -17.0 vs. Exp. -15.0 (Prev. -17.0)

- German HICP Final YY (Jun) 2.5% vs. Exp. 2.5% (Prev. 2.5%); HICP Final MM (Jun) 0.2% vs. Exp. 0.2% (Prev. 0.2%); CPI Final YY (Jun) 2.2% vs. Exp. 2.2% (Prev. 2.2%); CPI Final MM (Jun) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- Swedish Money Mkt CPIF Infl 1 Yr (Jul) 2.0% (Prev. 1.9%); Money Mkt CPIF Infl 5 Yrs (Jul) 2.1% (Prev. 2.0%)

NOTABLE EUROPEAN HEADLINES

- Goldman Sachs raises UK's 2024 GDP growth forecast to 1.2% (prev. 1.1%)

- UK PM Starmer said the special relationship with the US is so important and stronger than ever.

- India warned the UK not to impose a deadline on trade talks, while India's Commerce Minister said India and the UK are 'on board' on the major details, according to FT.

NOTABLE US HEADLINES

- Fed's Cook (voter) said the baseline outlook is for a continued fall in inflation without a significant increase in unemployment and US data is consistent with a soft landing. Cook added they are very attentive to what is happening with the unemployment rate and would be responsive if the situation changes quickly.

- US Senate Majority Leader Schumer is privately signalling to donors he is open to a democratic presidential ticket that isn't led by President Biden, according to Axios.

- US House Oversight Panel subpoenaed top Biden aides over his mental fitness, according to Axios.

- Apple (AAPL) settles EU antitrust probe over Tap-and-Pay tech; avoids EU fine

GEOPOLITICS

MIDDLE EAST

- The Gaza cease-fire agreement framework is reportedly agreed, and the parties are now “negotiating details of how it will be implemented”, according to a senior US official cited by Washington Post's Ignatius. "US officials say the framework of a three-stage deal is down to implementation details." "Officials caution that although the framework is in place, a final pact probably isn’t imminent, and the details are complex and will take time to work through." "A final possible bonus of a Gaza cease-fire is that Saudi Arabia has signaled it is prepared to 'move forward on normalization' of relations with Israel", according to a US official.

- White House's Kirby says he is cautiously optimistic things are moving in the right direction on Gaza ceasefire talks, according to CNN.

OTHER

- China's mission to the EU said the declaration of the NATO summit in Washington is full of 'Cold War mentality and belligerent rhetoric,' and the China-related content is full of provocations, 'lies, incitement, and smears'

- Taiwan is to strengthen its civil defence to prepare against China's threat with the government working to prepare public services and infrastructure to function in wartime as China’s aggressive stance fuels concerns about the risk of open conflict, according to FT.

- Russian Deputy Foreign Minister says US and Germany's decision to deploy long-range missiles in Germany is aimed at harming Russia's security; says Russia will respond "in a military manner", according to RIA

CRYPTO

- Bitcoin continues to climb and sits comfortably above USD 58k, with Ethereum also on the front foot and back above USD 3.1k.

APAC TRADE

- APAC stocks took impetus from Wall St where the major indices rallied as outperformance in tech spear-headed the S&P 500 and Nasdaq to fresh record highs once again following TSMC's record quarterly sales and as Apple aims to boost iPhone shipments.

- ASX 200 gained with all sectors in the green and notable strength in tech, real estate, and heavy industries.

- Nikkei 225 continued its record-setting streak and advanced above the 42,000 level for the first time.

- Hang Seng and Shanghai Comp. conformed to the broad constructive mood amid the rising tide across equities despite NATO's firm rhetoric on China which it called a decisive enabler of Russia’s war effort in Ukraine, while sentiment was also unfazed by reports that Germany is to cut Huawei from its mobile networks.

NOTABLE ASIA-PAC HEADLINES

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously. BoK said it will maintain a restrictive policy stance for a sufficient period of time and will examine the timing of a rate cut, while it dropped the phrase that 'upside risks to inflation forecasts have increased' in its policy statement and said inflation could be slower than forecast. BoK Governor Rhee said they need to assess how a rate cut would affect financial stability and that a cut could adversely affect financial stability. Furthermore, he commented "time to prepare pivot rate cuts" and that two board members said they could consider a rate cut within the next three months, although he added that market expectations for policy rate cuts are a little excessive.

- Fast Retailing (9983 JT) - 9M (JPY): Net Profit 312.84bln (+31.2% Y/Y), operating profit 410.8bln (+21.5%); Sees FY operating income at 475bln (prev. 450bln)

DATA RECAP

- Japanese Machinery Orders MM (May) -3.2% vs. Exp. 0.8% (Prev. -2.9%); YY 10.8% vs. Exp. 7.2% (Prev. 0.7%)