US Market Open: Equities on a firmer footing alongside strength in Bonds, USD flat & NZD sinks post-RBNZ

10 Jul 2024, 11:15 by Newsquawk Desk

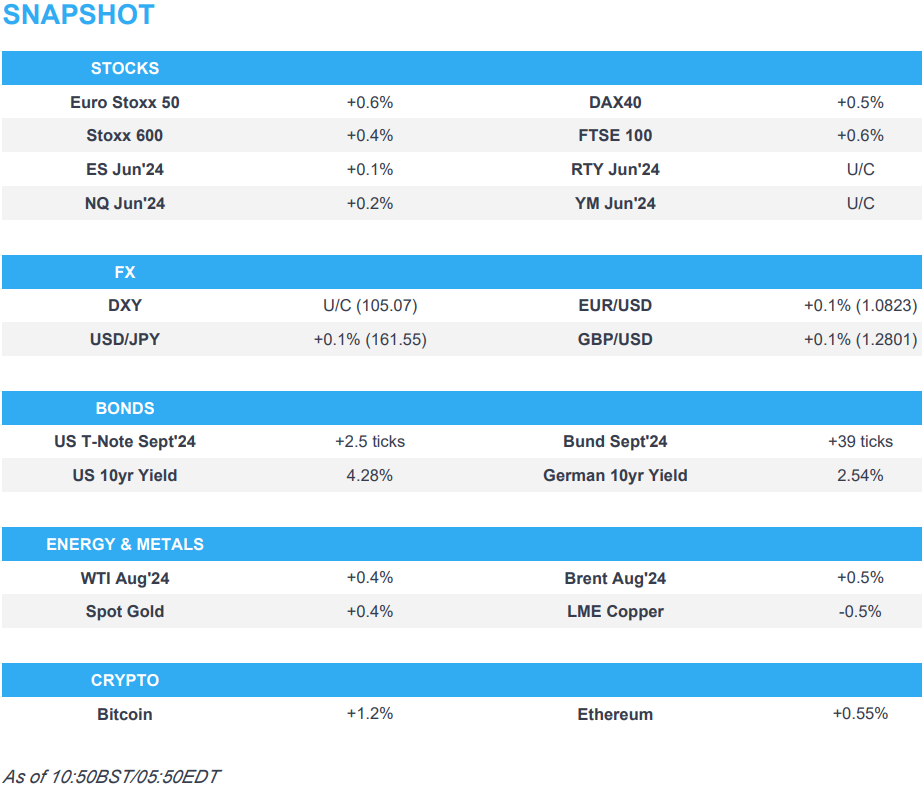

- Equities are entirely in the green and hold near session highs

- Dollar is flat and just above 105, NZD underperforms after the RBNZ kept rates unchanged but language struck a less hawkish tone

- Bonds are firmer ahead of US 10yr supply and another appearance from Chair Powell

- Crude was initially subdued following Chinese inflation data, but caught a bid on geopolitical headlines; XAU is incrementally firmer

- Looking ahead, Comments from Fed’s Powell & Goolsbee and BoE’s Pill & Mann, Supply from the US

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.3%) are modestly in the green, paring back some of the hefty losses seen in the prior session.

- European sectors hold a slight positive bias, though with the breadth of the market fairly narrow. Real Estate tops the pile, whilst Basic Resources is subdued by broader weakness in the metals complex, following the softer than expected Chinese inflation data.

- US Equity Futures (ES +0.1%, NQ +0.3%, RTY +0.3%) are modestly firmer, with the ES & NQ sitting at session highs, whilst the RTY remains within recent ranges.

- TSMC (2330 TW) June (TWD): Sales 207.87bln (May's 229.6bln). Q2: 673.5bln (exp. 654.27bln)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is holding above the 105 mark within yesterday's 104.95-105.20 range. Powell's comments on Tuesday had little follow-through to the USD and this will likely remain the case when he appears before the House today, ahead of CPI on Thursday.

- Steady trade for the EUR with EUR/USD stuck within yesterday's 1.0805-33 range with markets not currently looking to test support at the 1.08 mark which also coincides with the 200DMA.

- Cable is currently holding around the 1.28 mark and respecting yesterday's 1.2777-1.2825 range. GBP remains elevated in the context of greater political certainty and hawkish comments from Haskel on Monday.

- USD/JPY is back onto a 161 handle, having chopped and changed around the 161 mark in recent trading sessions.

- NZD the laggard across the majors amid less hawkish language from the RBNZ alongside its widely-expected decision to stand pat on rates.

- USD/CNH is moving ever closer to the 7.30 mark in the wake of soft inflation metrics overnight and as the PBoC fixing edges gradually higher.

- PBoC set USD/CNY mid-point at 7.1342 vs exp. 7.2711 (prev. 7.1310).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are very modestly firmer, up to a 110-17 peak with Tuesday's 110-18 and Monday's 110-20+ highs in close proximity. Fed Chair Powell will appear before the House, though is unlikely to deviate much from commentary provided yesterday.

- Bunds hold a bullish bias, emerging early in the European morning, having traded relatively contained overnight. Thus far, Bunds have been as high as 131.38, eclipsing Tuesday's 131.31 best.

- Gilt price action is in-fitting with Bunds; boosted to above the 98.00 mark to a 98.23 peak, similarly to Bunds, this eclipses Tuesday's best but stalls before Monday's 98.27 high.

- Germany sells EUR 1.75bln vs exp. EUR 2bln 1.00% 2038 and 0.00% 2036 Bund.

- Click for a detailed summary

COMMODITIES

- Crude was initially subdued, with prices heading lower following the softer than expected Chinese inflation metrics. However, prices then began to climb around the time a security source suggested 3 additional teams of the Israeli ground forces are ready in the Northern Command, according to Al Arabiya. Brent September futures fell to a USD 84/bbl vs current levels at USD 84.90/bbl.

- Precious metals are modestly firmer across the board but with the ranges relatively narrow, with mild outperformance seen in silver prices which attempt another move towards USD 31/oz.

- Base metals are lower across the board amid the ongoing weakness in Chinese markets coupled with sub-forecast Chinese CPI and continued deflationary PPI.

- US Private Inventory Data (bbls): Crude -1.9mln (exp. -1.3mln), Distillate +2.3mln (exp. +0.8mln), Gasoline -3.0mln (exp. -0.6mln), Cushing -1.2mln.

- Magnitude 6.7 earthquake occurred south of Africa, around 2.1km away from Western Cape, South Africa, via USGS

- Click for a detailed summary

NOTABLE DATA RECAP

- Norwegian Core Inflation YY (Jun) 3.4% vs. Exp. 3.6% (Prev. 4.1%); Consumer Price Index YY (Jun) 2.6% vs. Exp. 2.9% (Prev. 3.0%)

- Italian Industrial Output YY WDA (May) -3.3% (Prev. -2.9%); Industrial Output MM SA (May) 0.5% vs. Exp. 0.1% (Prev. -1.0%)

- Czech CPI YY (Jun) 2.0% vs. Exp. 2.5% (Prev. 2.6%); CPI MM (Jun) -0.3% vs. Exp. 0.2%

GEOPOLITICS

MIDDLE EAST

- "Security source for Al-Arabiya: 3 additional teams of the Israeli ground forces are ready in the Northern Command", according to Al Arabiya; "The Israeli General Staff is ready with the air and naval arms".

- "IRGC commander: If necessary, we will take practical and direct steps and support the resistance forces in the region", according to Al Jazeera.

- Israeli military said its air force struck a Hezbollah target in the Janta area of central Lebanon, according to Reuters.

- Israel’s Channel 12 cited the Minister of Culture who stated they are ready to make concessions to conclude the hostage deal and there is a strong desire among the majority of the members of the government and the PM to pass the deal. However, the minister added that they tell Hamas they will not retreat until they achieve their goals and will strengthen military power in Gaza, according to Al Jazeera.

OTHER

- Ukrainian President Zelensky said America's leaders must be strong and uncompromising in defending Ukraine's democracy against Russian President Putin, while he urged international leaders to aid Ukraine and not to wait for the US election in November.

- US President Biden said at the NATO Summit that Ukraine will be able to stop Russian President Putin and stand up to him, while they are committed to supporting Ukraine. Furthermore, Biden said the US and its allies will provide Ukraine with five additional strategic air defence systems and they intend to provide Ukraine with dozens of tactical air defence systems in the coming months.

- NATO Secretary General Stoltenberg said their support for Ukraine comes with costs and risks and there are no risk-free options in war. Stoltenberg said a Russian victory would embolden Iran, North Korea, and China which all want NATO to fail, while he added that the outcome of the Ukraine war will shape global security for decades to come.

- Saudi Arabia's Ministry of Finance denied the threat of selling European bonds and maintained that the relationship with G7 and others is mutually respected, according to source via social media platform X.

- US' new envoy to Taiwan, Raymond Greene, said “First of all, and the most important thing, the U.S. will strongly support Taiwan’s self-defense capabilities,”, via AP.

CRYPTO

- Bitcoin is firmer and climbs above USD 58k, whilst Ethereum remains steady and holding above USD 3k.

APAC TRADE

- APAC stocks were mixed following the indecisive performance stateside where the major indices finished rangebound after Fed Chair Powell largely stuck to the script and refrained from providing any signals on the timing of future policy action.

- ASX 200 was mildly pressured amid underperformance in the heavy industry sectors.

- Nikkei 225 swung between gains and losses despite initially printing fresh intraday record highs.

- Hang Seng and Shanghai Comp. diverged with the former kept afloat by outperformance among tech names such as Baidu, JD, Meituan & Alibaba, while the mainland conformed to the mostly downbeat mood after softer-than-expected Chinese CPI data and several companies also flagged losses for H1.

NOTABLE ASIA-PAC HEADLINES

- RBNZ kept the OCR unchanged at 5.50% as expected, while it noted that the Committee agreed that the OCR will need to remain restrictive and the extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures. RBNZ said some domestically generated price pressures remain strong but there are signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions. Furthermore, it noted that the appropriate stance of monetary policy was discussed and the Committee is confident that inflation will return to within its 1%-3% target range over the second half of 2024.

- China's MOFCOM is to investigate EU trade barriers following the probe on Chinese firms, investigation to occur between 10th July to 10th January 2025, can be extended to April

DATA RECAP

- Chinese CPI MM (Jun) -0.2% vs. Exp. -0.1% (Prev. -0.1%); YY (Jun) 0.2% vs. Exp. 0.4% (Prev. 0.3%)

- Chinese PPI YY (Jun) -0.8% vs. Exp. -0.8% (Prev. -1.4%)

- Japanese Corp Goods Price MM (Jun) 0.2% vs. Exp. 0.4% (Prev. 0.7%)

- Japanese Corp Goods Price YY (Jun) 2.9% vs. Exp. 2.9% (Prev. 2.4%, Rev. 2.6%)