Europe Market Open: RBNZ unchanged with language less hawkish, DXY rangebound & APAC trade mixed

10 Jul 2024, 06:25 by Newsquawk Desk

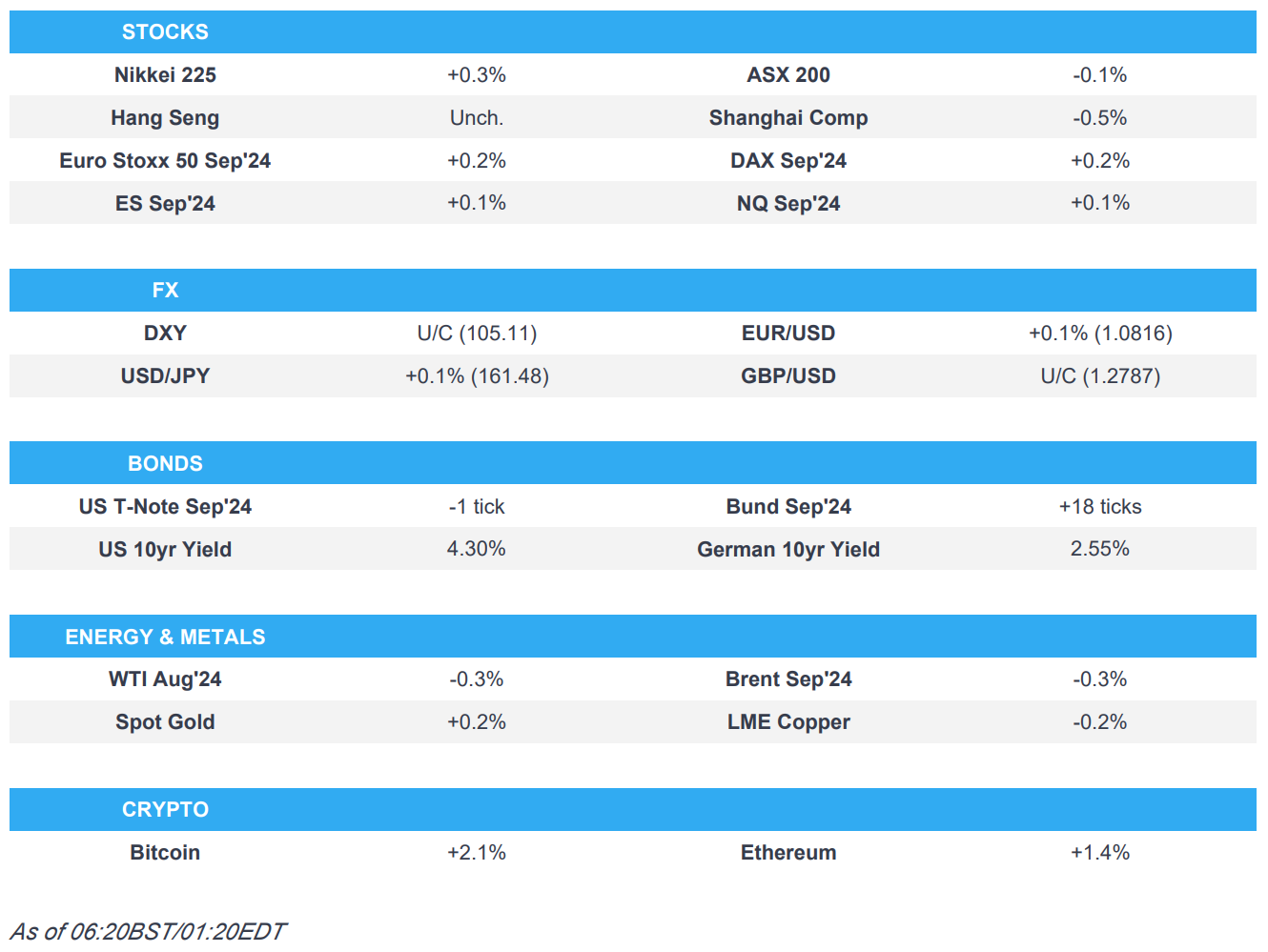

- APAC stocks were mixed following the indecisive performance stateside where the major indices finished rangebound after Fed Chair Powell largely stuck to the script.

- DXY traded rangebound, USD/JPY continued its gradual upward trend, NZD was pressured after RBNZ, and CNY did not react to softer-than-expected Chinese CPI.

- RBNZ unsurprisingly maintained the OCR at 5.50% although its language was less hawkish as it added that the extent of restraint will be tempered over time.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 future +0.2% after the cash market closed down by 1.3% on Tuesday.

- Looking ahead, highlights include Chinese Loans, Financing & M2 Money Supply, Norwegian CPI, BoJ Meeting with Bond Market Participants, Comments from Fed’s Powell, Goolsbee & BoE’s Pill, and Supply from Germany & US.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mixed and the major indices were ultimately little changed following a choppy session and after Fed Chair Powell largely stuck to the script on the first day of his testimony to Congress. Nonetheless, the S&P 500 and Nasdaq continued their trend of setting record highs but with the gains only marginal, while the Dow finished in shallow negative territory and Russell 2000 underperformed.

- SPX +0.07% at 5,577, NDX +0.07% at 20,453, DJI -0.13% at 39,292, RUT -0.45% at 2,029.

- Click here for a detailed summary.

NOTABLE HEADLINES

- WSJ's Timiraos posted on X that "Powell inches the Fed closer to cutting rate" and suggested that Powell made a subtle but important shift in his assessment of the risks that moved the Fed closer to lowering interest rates when he said that the trade-offs between bringing inflation down and maintaining a solid labour market are changing.

- US Democrats' full caucus meeting saw lawmakers both defend US President Biden and air concerns about his ability to take on former President Trump, according to Axios citing attendees of the meeting. Furthermore, one House Democrat who was in both meetings said most of the caucus is still with him which means he'll stay in, while the lawmaker who told Axios on Monday night that the revolt is "over" said the gathering only confirmed that view.

APAC TRADE

EQUITIES

- APAC stocks were mixed following the indecisive performance stateside where the major indices finished rangebound after Fed Chair Powell largely stuck to the script and refrained from providing any signals on the timing of future policy action.

- ASX 200 was mildly pressured amid underperformance in the heavy industry sectors.

- Nikkei 225 swung between gains and losses despite initially printing fresh intraday record highs.

- Hang Seng and Shanghai Comp. diverged with the former kept afloat by outperformance among tech names such as Baidu, JD, Meituan & Alibaba, while the mainland conformed to the mostly downbeat mood after softer-than-expected Chinese CPI data and several companies also flagged losses for H1.

- US equity futures traded sideways following the lack of conviction on Wall Street.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 future +0.2% after the cash market closed down by 1.3% on Tuesday.

FX

- DXY traded rangebound after Fed Chair Powell largely stuck to the script during his testimony at the Senate where he gave no signals about the timing of future Fed policy action and noted that elevated inflation is not the only risk the Fed faces.

- EUR/USD lacked firm direction after trickling towards the 1.0800 level where it then bounced off its lows.

- GBP/USD eventually moved off yesterday's worst levels although continues to languish beneath the 1.2800 handle.

- USD/JPY continued its gradual upward trend and briefly returned to north of 161.50 after inline/soft PPI data.

- Antipodeans were mixed with AUD/USD uneventful, while NZD was pressured following the RBNZ announcement in which the central bank unsurprisingly maintained the OCR at 5.50% although its language was less hawkish as the Committee agreed the OCR will need to remain restrictive but added the extent of restraint will be tempered over time consistent with the expected decline in inflation pressures.

- PBoC set USD/CNY mid-point at 7.1342 vs exp. 7.2711 (prev. 7.1310).

FIXED INCOME

- 10-year UST futures lacked direction following post-Powell indecision and as a US 10-year auction looms.

- Bund futures nursed some of the recent losses ahead of incoming German supply and Bundesbank speakers.

- 10-year JGB futures pared some of their opening losses with the BoJ present in the market although the rebound is limited as the central bank meets with bond market participants for a second day after some had called for the BoJ to halve bond purchases.

COMMODITIES

- Crude futures remained lacklustre amid some recent optimism regarding progress in Israel-Hamas hostage deal talks, while a larger-than-expected draw in headline private sector crude inventories had little lasting effect.

- US Private Inventory Data (bbls): Crude -1.9mln (exp. -1.3mln), Distillate +2.3mln (exp. +0.8mln), Gasoline -3.0mln (exp. -0.6mln), Cushing -1.2mln.

- US EIA STEO raised the forecast for 2024 world oil demand and now sees a 1.1mln BPD Y/Y increase, while it also raised the 2025 forecast for world oil demand growth by 300k BPD and now sees a 1.8mln BPD Y/Y increase.

- Port and City of Galveston were impacted by power outages after Hurricane Beryl, while port vessel operations remain suspended with a case-by-case consideration, according to the Galveston Maritime Commercial Centre.

- Spot gold eked slight gains with upside contained after yesterday's choppy mood and somewhat balanced Powell comments.

- Copper futures were dampened amid the mixed sentiment in Asia and after softer-than-expected Chinese CPI data.

CRYPTO

- Bitcoin saw two-way price action and gradually clawed back initial losses to extend above the USD 58,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBNZ kept the OCR unchanged at 5.50% as expected, while it noted that the Committee agreed that the OCR will need to remain restrictive and the extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures. RBNZ said some domestically generated price pressures remain strong but there are signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions. Furthermore, it noted that the appropriate stance of monetary policy was discussed and the Committee is confident that inflation will return to within its 1%-3% target range over the second half of 2024.

DATA RECAP

- Chinese CPI MM (Jun) -0.2% vs. Exp. -0.1% (Prev. -0.1%)

- Chinese CPI YY (Jun) 0.2% vs. Exp. 0.4% (Prev. 0.3%)

- Chinese PPI YY (Jun) -0.8% vs. Exp. -0.8% (Prev. -1.4%)

- Japanese Corp Goods Price MM (Jun) 0.2% vs. Exp. 0.4% (Prev. 0.7%)

- Japanese Corp Goods Price YY (Jun) 2.9% vs. Exp. 2.9% (Prev. 2.4%, Rev. 2.6%)

GEOPOLITICAL

MIDDLE EAST

- Israeli military said its air force struck a Hezbollah target in the Janta area of central Lebanon, according to Reuters.

- Israel’s Channel 12 cited the Minister of Culture who stated they are ready to make concessions to conclude the hostage deal and there is a strong desire among the majority of the members of the government and the PM to pass the deal. However, the minister added that they tell Hamas they will not retreat until they achieve their goals and will strengthen military power in Gaza, according to Al Jazeera.

- Israeli strike that hit tents housing displaced families outside a school in Gaza's Khan Younis killed 29 Palestinians, according to Hamas-run media office. It was also reported that Israeli artillery shelling targeted a northern Nuseirat refugee camp and Al-Mughraqa area in the Gaza Strip, according to Al Jazeera.

- Delegations from Egypt, Qatar, US and Israel are to meet in Doha on Wednesday for Gaza ceasefire talks, according to Al Qahera News citing a senior source. It was also reported that negotiations in Doha will discuss bridging the gaps, especially the ceasefire and the identity of the Palestinian prisoners, according to Al Jazeera citing the Israeli Broadcasting Corporation.

- Yemen's Houthis said they targeted the Maersk Sentosa ship in the Arabian Sea with several ballistic missiles, while they attacked the Marathopolis ship in the Arabian Sea and the MSC Patnaree ship in the Gulf of Aden.

OTHER

- Ukrainian President Zelensky said America's leaders must be strong and uncompromising in defending Ukraine's democracy against Russian President Putin, while he urged international leaders to aid Ukraine and not to wait for the US election in November.

- US President Biden said at the NATO Summit that Ukraine will be able to stop Russian President Putin and stand up to him, while they are committed to supporting Ukraine. Furthermore, Biden said the US and its allies will provide Ukraine with five additional strategic air defence systems and they intend to provide Ukraine with dozens of tactical air defence systems in the coming months.

- US National Security Advisor Sullivan said the US is to strengthen Ukraine’s air defences with F-16s.

- NATO Secretary General Stoltenberg said their support for Ukraine comes with costs and risks and there are no risk-free options in war. Stoltenberg said a Russian victory would embolden Iran, North Korea, and China which all want NATO to fail, while he added that the outcome of the Ukraine war will shape global security for decades to come.

- NATO official said Russia still lacks munitions and troops to launch a major offensive in Ukraine, while Ukraine is expected to intensify operations as supplies and conditions permit. NATO official said Russia needs to secure significant ammunition supplies from other countries and that President Putin still thinks time is on his side and is willing to endure truly staggering numbers of military casualties. The official also warned to expect large Russian attacks like the one on the Kyiv children's hospital during the NATO summit.

- Saudi Arabia's Ministry of Finance denied the threat of selling European bonds and maintained that the relationship with G7 and others is mutually respected, according to source via social media platform X.

GLOBAL

NOTABLE HEADLINES

- Global shipping firm Hapag-Lloyd (HLAG GY) raised its outlook amid strong shipping demand and increased freight rates. Co. now sees EBITDA of between EUR 3.2-4.2bln (prev. EUR 2-3bln), according to Reuters.

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.