US Market Open: DXY slips as GBP & EUR lift, NFP looms

05 Jul 2024, 11:20 by Newsquawk Desk

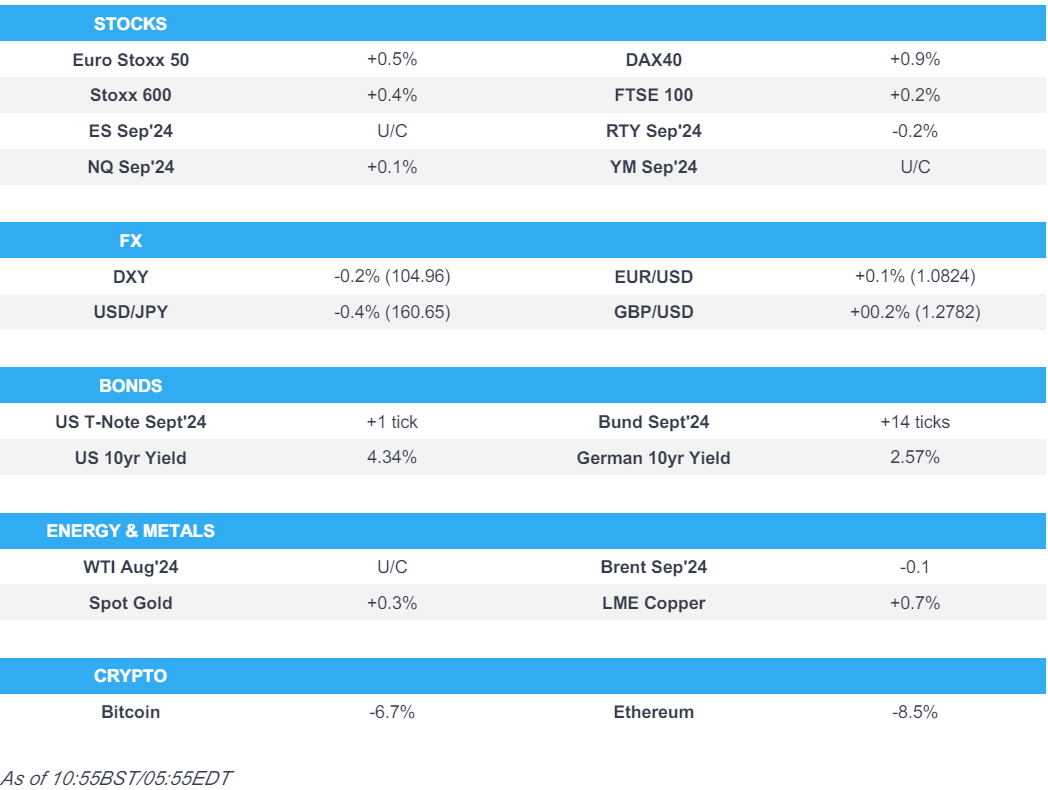

- European bourses have been tilting higher with the region benefitting from the removal of some political risk in the UK, Germany & France

- Stateside, futures pivoting the unchanged mark into Payrolls

- FX has seen a slightly softer start for the USD, weighed on by EUR & GBP; USD/JPY slips to near 160.50

- Fixed benchmarks generally firmer but only modestly so, EGBs unreactive to data and German fiscal updates

- Crude benchmarks near the unchanged mark, metals generally firmer

- Looking ahead, highlights include US & Canadian Jobs Reports. Comments from ECB's Lagarde & Elderson.

UK Election

- UK election exit polls showed the Labour Party is set to win 410 seats for a 170-seat majority, Conservatives 131, Lib Dems 61, SNP 10, Reform 13, Greens 2. This suggested the Labour Party will win the most seats by any party since 2001 and the Conservatives are to win the fewest seats since the party was founded in 1834. The latest results show Labour has won for majority.

- UK Labour Party leader Starmer won his seat and said the people have spoken, while he added that people are ready for change and it is now time for them to deliver. Starmer said in his victory speech "country first, party second" and vowed a transformed Labour Party, while he added that he doesn't promise it will be easy and they will have to move immediately

- UK PM Sunak won his parliament seat in Richmond and Northallerton, while he conceded defeat in the general election and stated that the Labour Party has won and the British people have delivered a sobering verdict. Furthermore, Sunak said he will continue to serve as a Member of Parliament and he takes responsibility for the loss. It was separately reported that Sunak is expected to resign as Conservative party leader on Friday morning, according to Times' Shipman

- UK Reform Leader Farage won his parliament seat and said there is no enthusiasm for Labour, while he added they are coming for Labour votes and this is just the first step that will stun everyone.

- Goldman Sachs raises UK's GDP growth forecast by 0.1ppts in 2025 and 2026 after the UK election; says Labour Party's fiscal policy agenda to provide a modest boost to demand growth in the near-term.

- Click here for the Newsquawk analysis.

EUROPEAN TRADE

EQUITIES

- European bourses have been tilting higher throughout the morning with the region benefitting from a continuation of recent broad gains and as political risk is removed in the UK (election), Germany (2025 budget) & France (polls erode chance of a RN majority), Stoxx 600 +0.5%.

- DAX 40, +1.0%, outperforms despite dismal industrial output metrics for May with tech names bolstered after Samsung's update and the index generally benefitting from the German coalition government coming to a draft deal on the 2025 budget framework.

- UK's FTSE 250 (+1.2%) outperforms the FTSE 100 (+0.3%) as the domestic economy welcomes the return of a Labour government, with housebuilders in particular benefitting.

- Stateside, futures have been pivoting the unchanged mark with specifics light on the return from Independence Day into a docket which is dominated by the monthly jobs report, ES +0.1%, NQ +0.1%.

- Foxconn (2317 TT) June revenue +16.1% Y/Y, Q2 +19.1% (-9.6% in Q1). Samsung Electronics (005939 KS) - The world's largest memory chip, smartphone and TV maker sees a better than expected increase in Q2 profits, as the AI boom lifts chip prices. Sees Q2 profit rising to KRW 10.4tln (exp. 8.8tln; prev. 670bln in Q2 2023), and sees Q2 sales of KRW 74tln (exp. 74.5tln).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- A slightly softer start for the USD with the index weighed on by the EUR and GBP as election risk fades and passes respectively. DXY down to a 104.93 base with the 100- & 200-DMAs below and potentially in focus into Payrolls.

- GBP deriving some modest benefit from the passing of any election risk, though the outcome has been nailed on for weeks and Cable itself was unreactive to the exit poll and updates since; at the top-end of a 1.2755-1.2783 bound.

- EUR edging higher into Sunday's second round of the French legislative elections and benefitting from the main market risk of a RN absolute majority being removed in the latest polls, single currency finds itself in a slim range and holding above a cluster of DMAs.

- JPY outperforms with USD/JPY below 161.00 and testing 160.50. No real move to comments from the Finance Minister or thereafter from a Reuters sources piece regarding a report next week which is set to reveal a broadening wage trend

- PBoC set USD/CNY mid-point at 7.1289 vs exp. 7.2704 (prev. 7.1305).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks generally modestly firmer but very much in a holding pattern into payrolls.

- No move from Fed's Williams who noted of progress in bringing inflation back to target, with the line echoing Powell earlier in the week who said they have made quite a bit of progress on inflation.

- USTs a touch firmer with the US yield curve mixed but slightly steeper into Payrolls.

- OATs steady into Sunday's second round; Bunds unreactive to dismal German data this morning with no real or sustained move on the fiscal related updates before or since, with Bunds in a relatively narrow 130.53-130.78 band.

- Gilts gapped higher on the open but initially stalled shy of Thursday's best before extending modestly but stopping within reach of Wednesday's 97.78 WTD peak.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks near the unchanged mark. Initially lifted alongside an uptick in stock performance in the early European morning before benefitting further on a steady flow of hurricane and geopolitical developments.

- WTI and Brent around USD 84.00/bbl and USD 87.40/bbl respectively, towards the mid-point of parameters.

- Metals generally firmer; spot gold picking up as the USD slips and as yields having a very slight negative bias into NFP. XAU at a fresh WTD peak of USD 2367/oz, stalling just shy of the 21st June high at USD 2368/oz.

- Base metals similarly supported with 3M LME Copper inching towards USD 10k/T, though iron ore was pressured in APAC trade with profit taking from recent gains seemingly the driver.

- Qatar set August Marine crude OSP at Oman/Dubai plus USD 0.15/bbl and land crude OSP at Oman/Dubai minus USD 0.40/bbl.

- Chevron (CVX) announced it was removing non-essential personnel from its Gulf of Mexico facilities due to approaching Hurricane Beryl but noted that production from its Gulf of Mexico assets remains at normal levels. It was also reported that Shell (SHEL LN) said is evacuating all personnel at its Perdido asset due to Hurricane Beryl, according to Reuters.

- Russian Energy Ministry says gasoline export supplies to "friendly countries" now 70% lower than average daily level in July 2023; Russia has ample fuel reserves for stable supply of domestic market.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Industrial Output MM (May) -2.5% vs. Exp. 0.2% (Prev. -0.1%)

- EU Retail Sales MM (May) 0.1% vs. Exp. 0.2% (Prev. -0.5%, Rev. -0.2%); YY 0.3% vs. Exp. 0.1% (Rev. 0.6%)

- UK Halifax House Prices MM* (Jun) -0.2% (Prev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- ECB's Lagarde said officials are in no hurry to cut rates again after June’s move and the central bank requires additional reassurance that inflation is headed back towards 2% before it cuts rates further, according to an interview with RTP.

- German coalition government agreed on a 2025 draft budget after months of negotiations, according to a government source.

- Thereafter, German Finance Minister Lindner says the 2025 budget deal is EUR 481bln in size, incl. EUR 57bln in investments. Chancellor Scholz says they will fully meet the 2% NATO spending goal every year; high billion-EUR sum is planned for housing construction. Growth package to be presented on 17th July

NOTABLE US HEADLINES

- Fed's Williams (Voter) says there is still a way to go to reach the 2% inflation target on a sustained basis. Have seen significant progress in bringing inflation back to the 2% target. Fed is committed to getting the job done.

- US President Biden said he 'screwed up' in the election debate but would press ahead with his re-election bid, according to FT.

- Chinese state-owned firms have recently purchased a "batch" of Tesla (TSLA) Model Y vehicles, via the Shanghai Local Gov't

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu told US President Biden he has decided to send a delegation to continue negotiations on hostages but reiterated that Israel will only end the war after achieving all of its objectives.

- US senior administration official said President Biden and Israeli PM Netanyahu walked through the draft Israel-Hamas agreement in a 30-minute call and the US believes there is a significant opening for a hostage deal, while the official stated that the Hamas response moves the process forward and could provide basis for closing a deal on hostages and ceasefire. Furthermore, the US official said outstanding issues relate to the implementation of an agreement in which there is significant work to be done and a deal is not likely to be closed in a period of days but they have had a breakthrough on the critical impasse in Israel-Hamas talks.

- Israel’s Mossad chief Barnea is travelling to Doha to resume Gaza ceasefire and hostage talks which will likely take place on Friday and will meet with Qatar’s PM in an effort to bring Israel and Hamas closer to a Gaza peace deal, according to a source cited by Reuters.

- Israeli official confirmed that the Mossad chief will lead a hostage negotiations delegation and another official said there is a real chance for a deal, while it was also stated that the proposal put forward by Hamas includes a very significant breakthrough and the official stated that they can proceed with a deal but it depends on PM Netanyahu.

- Hamas said it did not drop the condition of a ceasefire in Gaza, while it added that Israeli PM Netanyahu did not want a permanent ceasefire in Gaza and requires the movement to lay down arms, according to Al Arabiya.

- Hamas leader said they are waiting for a positive response from the Israeli side to start negotiations on the details of the deal, according to CNN.

- "There are some obstacles before reaching an agreement, including demanding that Hamas not have the right to object to the Palestinian "security" prisoners who will be released", according to Sky News Arabia citing Israeli press Yedioth Ahronoth.

- "The army is making progress in Rafah But the fighting is expected to last at least another month.", according to Israeli press Yedioth Ahronoth cited by Al Jazeera.

OTHER

- Russia's Defence Ministry said it is carrying out drills involving mobile nuclear missile launchers, according to Interfax.

CRYPTO

- Crypto exchange Mt. Gox has begun repaying Bitcoin (BTC) and Bitcoin Cash (BCH) to creditors, according to Cointelegraph. Furthermore, Crypto exchange Mt Gox creditors "may need to wait up to three months to receive their bitcoin or bitcoin cash repayments depending on which crypto exchanges they made the claims with", according to a trustee document cited by The Block.

- Crypto has been pressured across the session given the above reports. BTC falling over USD 5k on the session to a USD 53.56k base.

APAC TRADE

- APAC stocks traded somewhat mixed in the absence of a lead from the US owing to the Independence Day holiday, while there was also a lack of fireworks from the UK election exit polls which showed the Labour Party are on course for a landslide victory.

- ASX 200 was contained amid weakness in miners and the top-weighted financial sector.

- Nikkei 225 traded indecisively and initially climbed to fresh record highs but then failed to sustain the momentum as the yen began to strengthen and as participants also digested weak Household Spending data which showed a surprise contraction.

- KOSPI was boosted amid gains in index heavyweight Samsung Electronics following its preliminary Q2 earnings.

- Hang Seng and Shanghai Comp. were pressured with weakness seen in automakers after the EU confirmed it is to move ahead with planned tariffs on Chinese EVs with provisional duties effective today, while China is to continue the anti-dumping probe into EU port imports and will hold an EU brandy probe hearing on July 18th.

NOTABLE ASIA-PAC HEADLINES

- PBoC has hundreds of billions of yuan of medium- and long-term bonds at its disposal to borrow and signed agreements with several major financial institutions regarding bond borrowing, according to Bloomberg.

- China officially sets up a special fund for revitalisation of state firms' land assets worth CNY 30bln, according to state media.

- China's MOFCOM confirmed it is to hold an EU brandy probe hearing on July 18th.

- Japanese Finance Minister Suzuki warned of inflation concerns despite recent wage rises and noted that a weak yen is pushing up costs for imports and impacting prices, while he said they are to monitor stocks and FX trends urgently.

- BoJ report is to reportedly reveal broadening wage rise trend, according to Reuters sources; report likely to show increasing number of small and mid-sized firms raising wages.

DATA RECAP

- Japanese All Household Spending MM (May) -0.3% vs. Exp. 0.5% (Prev. -1.2%); YY -1.8% vs. Exp. 0.1% (Prev. 0.5%)