Europe Market Open: APAC stocks pressured after a choppy handover, MU beat but fell afterhours

27 Jun 2024, 06:35 by Newsquawk Desk

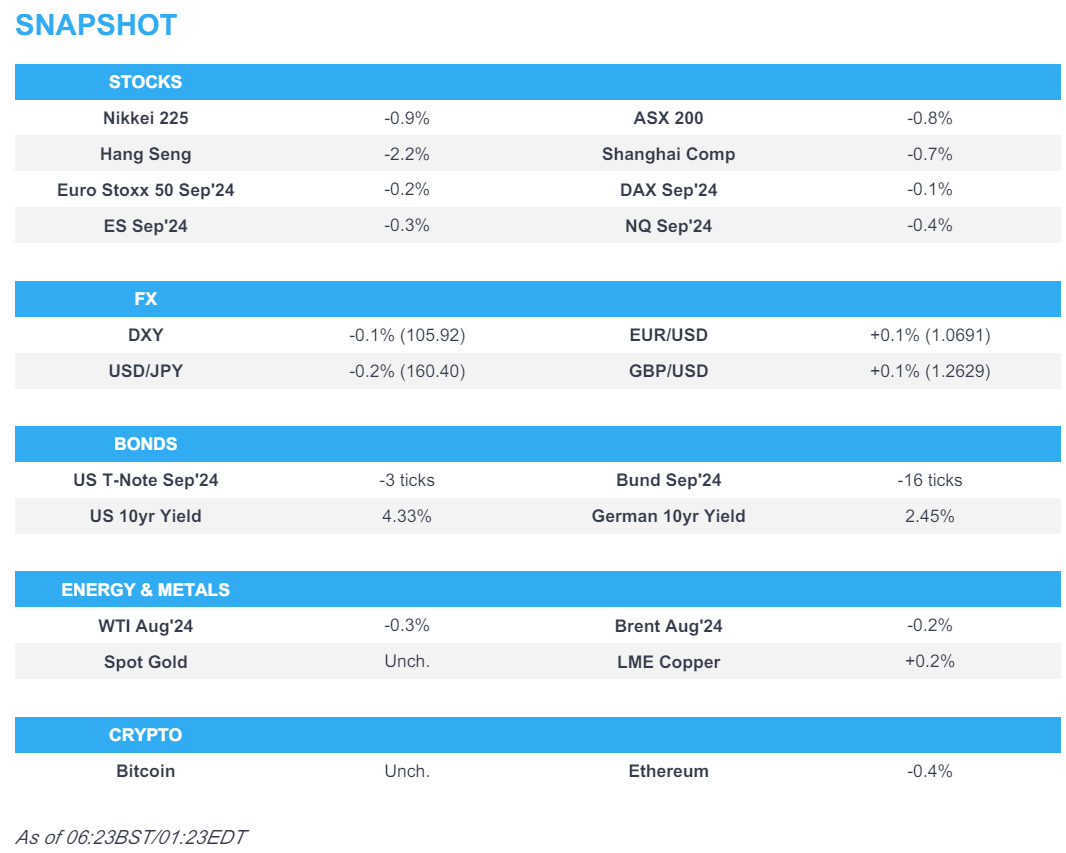

- APAC stocks were negative amid this week's choppy tech performance with headwinds from higher yields.

- Fed Bank Stress Tests showed all banks passed, which paves the way for higher payouts.

- European equity futures indicate a lower open with Euro Stoxx 50 future -0.2% after the cash market closed lower by 0.4% on Wednesday.

- DXY pulled back below the 106 mark, USD/JPY remains above 160 and EUR/USD is stuck on a 1.06 handle.

- Looking ahead, highlights include EZ Consumer Confidence (Final), US IJC, Durable Goods, GDP & PCE Q1 (Final), Riksbank & Banxico Policy Announcements, Biden-Trump debate, Comments from RBA's Hauser & ECB's Elderson, Supply from Italy & US.

US TRADE

EQUITIES

- US stocks ultimately finished with mild gains as European weakness was offset once US trade got underway and with a last-minute boost seen heading into the market close with upside led by gains in the Consumer Discretionary Sector thanks to outperformance in both Tesla (TSLA) and Amazon (AMZN). However, the gains in the major indices were limited and the majority of sectors closed in the red, while Fed bank stress test results and Micron earnings failed to inspire futures after hours despite the latter beating on top and bottom lines.

- SPX +0.16% at 5,478, NDX +0.25% at 19,751, DJI +0.04% at 39,128, RUT -0.21% at 2,018.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Bank Stress Tests showed large US banks are well positioned to weather a recession and stay above minimum capital requirements, while all banks passed the stress tests which paves the way for higher payouts although they reported greater losses than in 2023 stress tests as bank balance sheets are riskier and expenses are higher.

APAC TRADE

EQUITIES

- APAC stocks were negative amid this week's choppy tech performance with headwinds from higher yields.

- ASX 200 was pressured with real estate leading the declines amid higher yields and firmer inflation expectations.

- Nikkei 225 failed to benefit from stronger-than-expected retail sales with the mood dampened amid rate hike bets for the BoJ's July meeting.

- Hang Seng and Shanghai Comp. traded lower with underperformance in Hong Kong amid pressure in tech and consumer stocks, while the mainland was also pressured as China’s financial industry elites face USD 400k pay caps and bonus clawbacks under President Xi’s “common prosperity” campaign.

- US equity futures (ES -0.3%, NQ -0.4%) were subdued amid the risk aversion in Asia and after failing to benefit from Micron's earnings with the Co.'s shares lower by 8% in after-hours trade.

- European equity futures indicate a lower open with Euro Stoxx 50 future -0.2% after the cash market closed lower by 0.4% on Wednesday.

FX

- DXY marginally softened below the 106.00 level but held on to most of the prior day's spoils as catalysts remained light.

- EUR/USD nurses some of its recent losses but remained sub-1.0700 after ECB officials continued to point to further cuts this year.

- GBP/USD languished near yesterday's trough after sliding from resistance around the 1.2700 level.

- USD/JPY mildly pulled back after yesterday's ascent north of 160.00 to its highest since 1986 which spurred some familiar jawboning.

- Antipodeans lacked firm direction amid the subdued risk appetite and mixed New Zealand Business Survey data.

- PBoC set USD/CNY mid-point at 7.1270 vs exp. 7.2765 (prev. 7.1248).

FIXED INCOME

- 10-year UST futures extended on losses to a sub-110.00 level amid higher global yields and with a 7-year auction due later.

- Bund futures remained subdued following recent selling and after prices gapped beneath the 132.00 level.

- 10-year JGB futures underperformed amid weakness in global peers and after securities flow data showed notable net selling of Japanese and Foreign bonds in the past week, while improved results from a 2-year JGB auction did little to spur a rebound.

COMMODITIES

- Crude futures were lacklustre after yesterday's whipsawing and bearish inventory data.

- Spot gold traded flat and languished near this week's lows around the USD 2,300/oz level.

- Copper futures struggled for direction with demand sapped amid the risk-averse conditions.

- Codelco May copper production was at 103.1k ton which was 8.6% below the target of 112.8k tons, while Jan-May copper production was at 484.5k which was 6.1% below the target of 516.1k tons.

CRYPTO

- Bitcoin eked mild gains in choppy trade as prices oscillated around the USD 61,000 level.

- US SEC could approve ETFs tied to the spot price of Ether as soon as 4th July, according to Reuters citing industry executives and others.

NOTABLE ASIA-PAC HEADLINES

- China’s financial elite reportedly face USD 400k pay caps and bonus clawbacks as some of the industry’s biggest companies impose strict new limits to comply with President Xi’s “common prosperity” campaign, according to Bloomberg.

- Japan reportedly plans support for the Philippines 5G network to counter China tech and the US is expected to provide money for the project, according to Nikkei.

- Japanese Finance Minister Suzuki said won't comment on FX levels and that FX stability is desirable, while he is watching FX moves with a high sense of urgency and is deeply concerned about the FX impact on the economy. Furthermore, Suzuki said they will take necessary actions on FX, as well as noted that rapid and one-sided moves are undesirable.

- Japanese Chief Cabinet Secretary Hayashi won't comment on forex levels and potential FX intervention but said they will take appropriate steps on excessive FX moves and it is important for currencies to move in a stable manner reflecting fundamentals, while he added that rapid FX moves are undesirable.

DATA RECAP

- Chinese Industrial Profit YY (May) 0.7% Y/Y (Prev. 4.0%)

- Chinese Industrial Profit YTD (May) 3.4% (Prev. 4.3%)

- Japanese Retail Sales YY (May) 3.0% vs. Exp. 2.0% (Prev. 2.4%, Rev. 2.0%)

- Australian Melbourne Institute Inflation Expectations (Aug) 4.4% (Prev. 4.1%)

- New Zealand ANZ Business Outlook (Jun) 6.1% (Prev. 11.2%)

- New Zealand ANZ Own Activity (Jun) 12.2% (Prev. 11.8%)

GLOBAL NEWS

- Bolivia TV showed a vehicle destroying the door of the Presidential Palace in a coup attempt as troops gathered in the capital. However, Bolivian President Arce demanded that General Zuniga demobilise military troops, while armoured vehicles and soldiers later withdrew from the square outside the Presidential Palace and General Zuniga was arrested for a coup attempt.

- Brazilian Finance Minister Haddad said a continuous inflation target decree was negotiated with economic teams including the BCB, while it was also reported that Brazil's monetary council expanded a subsidy program to allow export pre-shipment financing.

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu reportedly ordered the resumption of working teams on the Iranian nuclear issue, while officials said the move followed new information about Iranian actions related to the production of nuclear weapons, and concerns that former senior defence officials had expressed to the PM's office that the issue had been neglected since the formation of the government, according to Walla News.

- Israeli Defence Minister Gallant said after meeting with US National Security Adviser Sullivan that significant progress has been made on the issue of the equipping and armaments that Israel needs.

- Israeli Defence Minister Gallant said Israel does not want a war in Lebanon and prefers a diplomatic solution, but cannot accept Hezbollah ‘military formations’ on its border, while he warned that Israel’s military is capable of taking Lebanon ‘back to the Stone Age’ but added that they don’t want to do that. Furthermore, Gallant reaffirmed Israel’s commitment to a ceasefire-hostages deal laid out by US President Biden and discussed with US officials ‘Day After’ proposals for post-war Gaza.

- Senior US official said the US reaffirmed commitment to weapons supplies to Israel, except for one shipment of heavy munitions that remains under review, while the official said the onus remains on Hamas to embrace the ceasefire proposal.

- Israel and the US are concerned that Iran will try to develop its nuclear technology including weapons efforts in the weeks leading up to the US presidential election, according to officials cited by Axios.

- Israel is ready for an additional attempt to reach a settlement on the northern front, according to Al Jazeera. However, it was separately reported that Israel may have to take a very strong escalatory step at Lebanon, according to an army source cited by Israeli Channel 12.

- Israeli warplane fired 2 air-to-surface missiles at a two-story building which caused the building to collapse and damaged surrounding structures, while at least 5 civilians were injured by the Israeli airstrikes on the building in Lebanon's Nabatieh, according to Xinhua.

- Syrian state TV reported explosions from an Israeli airstrike on the capital of Damascus.

OTHER

- North Korea said it successfully conducted an important test in advancing missile technology with the test aimed at developing a multiple warhead missile, according to KCNA. However, it was later reported that the South Korean military said North Korea's claim of a successful missile test on Wednesday is a deception and exaggeration.

EU/UK

NOTABLE HEADLINES

- UK Labour Party secured a fresh letter of support from business leaders backing plans to overhaul the “apprenticeship levy” if the party wins next week's UK general election, according to FT.