Europe Market Open: APAC stocks continued tech-inspired US gains; hot Aussie CPI

26 Jun 2024, 06:40 by Newsquawk Desk

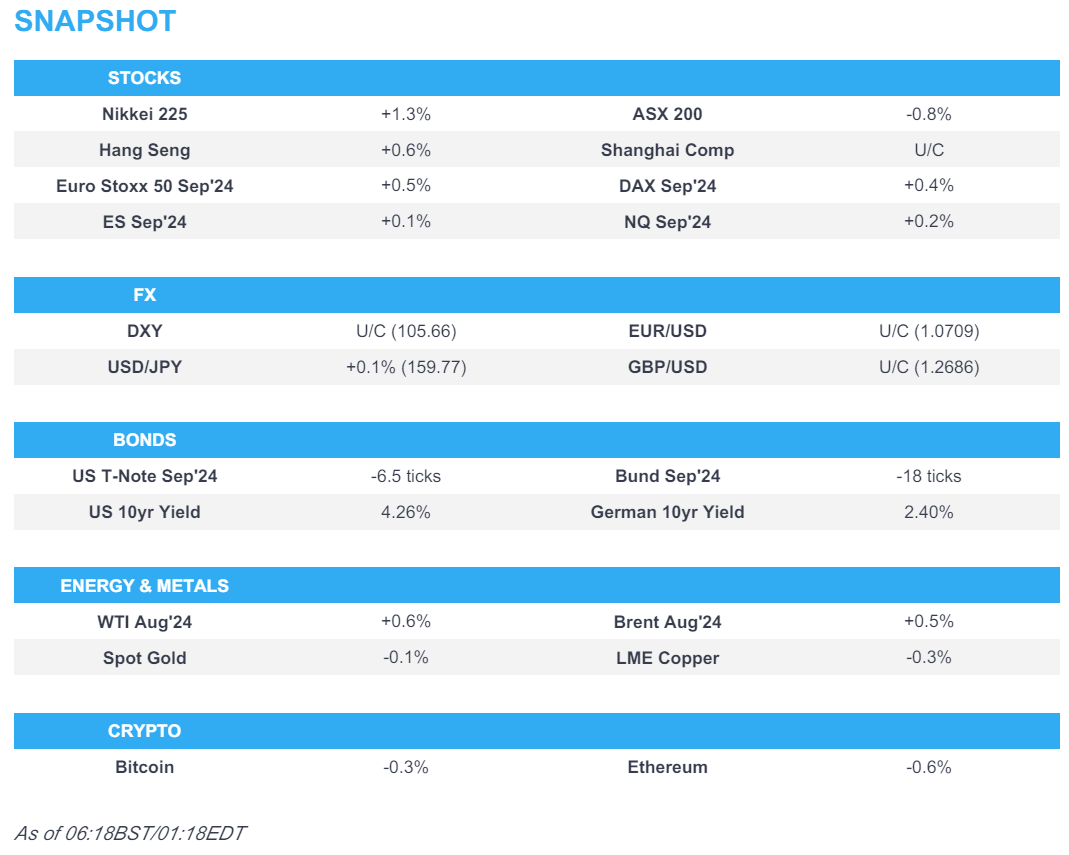

- APAC stocks followed suit to the mixed performance stateside where tech rebounded as Nvidia snapped its losing streak.

- European equity futures indicate a firmer open with Euro Stoxx 50 future +0.5% after the cash market closed lower by 0.2% on Tuesday.

- DXY is caged in a tight range on a 105 handle, AUD boosted post-CPI, EUR/USD sits just above the 1.07 level.

- Australian monthly CPI data saw markets price around a 33% probability for an RBA hike at the August meeting vs around 12% pre-release.

- Looking ahead, highlights include German Gfk Consumer Sentiment, Fed Bank Stress Test, Comments from ECB’s Rehn, Panetta & Lane, Supply from UK & US

US TRADE

EQUITIES

- US stocks saw another mixed trading session in a reversal of fortunes for the major indices as the S&P 500 and Nasdaq clawed back Monday's losses with the latter helped as Nvidia (NVDA)(+6.8%) snapped its three-day losing streak, while the Dow and small-cap Russell 2000 reversed the previous day's gains. It was a fairly quiet day as participants awaited the next risk events including Micron (MU) earnings on Wednesday and the eagerly anticipated core PCE numbers on Friday, while mixed data releases and comments from Fed Governors Bowman and Cook did little to alter the dial.

- SPX +0.39% at 5,469, NDX +1.16% at 19,701, DJI -0.76% at 39,112, RUT -0.42% at 2,022.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Cook (voter) said the current policy is 'well positioned' to respond to the economic outlook and at some point, it will be appropriate to cut rates. Cook said monetary policy is restrictive, while she added the timing of any policy adjustment will depend on economic data and its implications for the outlook and balance of risks.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the mixed performance stateside where the major indices reversed Monday's price action and tech rebounded as Nvidia snapped its losing streak, while markets continue to await fresh catalysts.

- ASX 200 was pressured with sentiment not helped by a hot monthly CPI print which saw both Deutsche Bank and Morgan Stanley call for a 25bps hike at the next RBA meeting in August,

- Nikkei 225 outperforms following recent currency weakness and with tech names boosted after Nvidia's rebound.

- Hang Seng and Shanghai Comp. were mixed with the former kept afloat above the 18,000 level, while the mainland was subdued despite another firm liquidity injection by the PBoC with sentiment clouded by tech and trade-related frictions as OpenAI was reportedly taking steps to block China access to its AI tools.

- US equity futures were rangebound in which E-mini S&P (+0.1%) and Nasdaq 100 (+0.1%) futures marginally extended on yesterday's best levels.

- European equity futures indicate a firmer open with Euro Stoxx 50 future +0.5% after the cash market closed lower by 0.2% on Tuesday.

FX

- DXY kept to within a tight range of 105.60-105.70 after the muted reaction seen to mixed US data, while the latest Fed commentary also provided very little incrementally to influence price action as Fed's Cook noted that current policy is well-positioned and it will be appropriate to cut rates at some point with the timing of any policy adjustment to depend on economic data.

- EUR/USD was contained albeit off the prior day's lows after rebounding from a brief dip beneath 1.0700.

- GBP/USD lacked direction and loitered beneath the 1.2700 handle where it recently hit resistance.

- USD/JPY marginally edged higher and moved closer towards testing the 160.00 level.

- Antipodeans were somewhat mixed with AUD/USD underpinned following firmer-than-expected monthly CPI data from Australia which resulted in money markets pricing around a 33% probability for the RBA to hike the Cash Rate at the August meeting vs around a 12% chance before the data.

FIXED INCOME

- 10-year UST futures were lower after yesterday's choppy mood with headwinds from this week's supply.

- Bund futures lacked demand after recent indecision and global inflationary pressures.

- 10-year JGB futures followed suit to the uninspired mood in global peers in the absence of additional BoJ purchases and with 10-year yield lingering above 1.00%

COMMODITIES

- Crude futures nursed some of the prior day's losses but with upside limited after bearish private inventory data.

- US Private Inventory Data (bbls): Crude +0.9mln (exp. -2.9mln), Distillate -1.2mln (exp. -0.3mln), Gasoline +3.8mln (exp. -1.0mln), Cushing -0.4mln.

- Spot gold was lacklustre amid the absence of pertinent catalysts but remained above the psychological USD 2,300/oz level.

- Copper futures were subdued amid the mixed risk tone and with this month's downward channel intact.

CRYPTO

- Bitcoin was ultimately flat on the session with price action choppy on both sides of the USD 62,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA Assistant Governor Kent said a range of measures shows that monetary policy is restrictive and policy is contributing to slower growth of demand and lower inflation, while he added that recent data reinforced the need to be vigilant to upside inflation risks and hence, they are not ruling anything in or out for interest rates.

DATA RECAP

- Australian Weighted CPI YY (May) 4.00% vs. Exp. 3.80% (Prev. 3.60%)

GEOPOLITICAL

MIDDLE EAST

- US Defense Secretary Austin said Hezbollah's 'provocations' threaten to drag Israeli and Lebanese people into war.

- Pentagon said US Secretary of Defense Austin discussed with his Israeli counterpart efforts to de-escalate tensions on the Israeli-Lebanese border, while he warned that a war between Israel and Hezbollah would be catastrophic for Lebanon, according to Asharq News.

- US and Israel agreed to reschedule the meeting of the US-Israel strategic consultative group on Iran which was supposed to take place last Thursday but was cancelled by the White House in protest of Netanyahu's accusations video, while officials said they expect the meeting to take place in Washington in mid-July, according to Axios's Barak Ravid.

OTHER

- Ukrainian President Zelensky will attend Thursday's European Union summit in Brussels where he is expected to sign an agreement on EU security commitments for Ukraine, according to the French President's office cited by AFP.

- Russian Defence Minister Belousov warned US Defense Secretary Austin regarding the dangers of an escalation of continued US arms supplies to Ukraine, according to the Russian Ministry.

- Russia's Deputy Foreign Minister said their Western opponents underestimate Russia's readiness to stand up for itself and this could become tragic and fatal. Furthermore, the official said they can answer the West with both rhetoric and with practical steps, as well as noted there is a significant danger that the West could make a mistake, while Russia will try to avoid making a mistake.

- North Korea launched a suspected ballistic missile which was believed to have fallen outside of Japan's EEZ shortly after with no damage reported, while Yonhap later reported that North Korea's missile launch was believed to have failed and South Korean military said the missile used by North Korea in its failed launch was potentially a hypersonic missile.

- South Korean marines are to conduct live fire drills, according to Dong-A.

EU/UK

NOTABLE HEADLINES

- ECB's Rehn said he sees bets for two more rate cuts this year as reasonable and the market's terminal rate view of 2.25%-2.50% is also appropriate, while he sees the possibility for rate moves at any policy meeting and noted that rate cuts are contingent on additional disinflation. Rehn said he sees no disorderly market moves in France, as well as noted there is no debt crisis ahead and no need for TPI.