US Market Open: Subdued risk tone following downbeat EZ PMIs with equities softer & bonds bid

21 Jun 2024, 11:12 by Newsquawk Desk

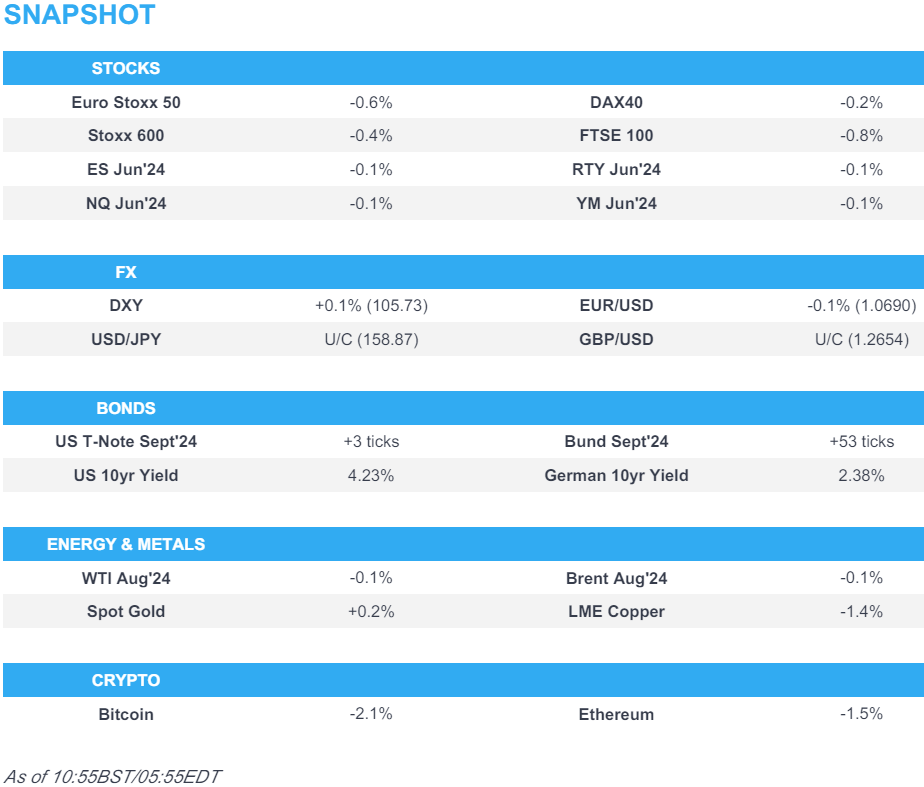

- Equities are subdued amid a broader risk aversion following the downbeat EZ PMI data

- France, Germany and the EZ-wide figure all reported lower-than-expected PMI data, which has led to outperformance in Bunds and slight pressure in the EUR

- Dollar is incrementally firmer, USD/JPY went as high as 159.12 before paring back towards 158.80 following the European data

- Crude is rangebound, base metals suffer from the subdued risk tone

- Looking ahead, US Manufacturing & Services PMI, Canadian Retail Sales, ECB’s Schnabel, and quad-witching

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.4%) are lower across the board, though with price action fairly rangebound, and generally unreactive to the downbeat EZ PMI data.

- European sectors are mostly lower, and hold a slight defensive bias, with Utilities and Healthcare towards the top of the pile, whilst Banks are towards the bottom of the pile, alongside Tech.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY -0.1%) are very modestly lower, continuing some of the losses seen in the prior session, and in fitting with the broader sentiment in Europe.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly firmer amid the risk aversion which emanated from yesterday's US session, with the index also benefiting from the weaker EUR following the downbeat EZ PMIs.

- EUR is softer after France, Germany and the EZ all reported soft PMI figures, though with the accompanying release suggesting "the HCOB PMI do not provide ammunition for another rate cut in July by the ECB." EUR/USD sits in a 1.0672-0720 range after testing levels near the 14th June low.

- GBP is also losing vs the Dollar, with the hotter-than-expected UK Retail Sales providing fleeting upside for Cable, before edging lower ahead of the region's own PMI data, which was mixed. Cable fell from 1.2649 to 1.2630 before paring the entirety of the move and lifting incrementally to 1.2653.

- JPY is flat in the European morning following APAC weakness which saw softer-than-expected Japanese CPI and weaker PMI. USD/JPY briefly topped 159.00 to a 159.12 peak (vs low 158.68), with European strength possibly emanating from the risk aversion and a pullback in bond yields.

- Mild divergence between the Antipodeans but largely flat trade with upside capped by the risk aversion (and decline in base metals).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly firmer and at the top-end of 110-12+ to 110-23 parameters into US PMI data and Fed's Barkin.

- Bunds are firmer, with price action dominated by EZ PMIs; French numbers missed and remained in contraction with the election perhaps factoring, with Germany and the EZ-wide figure also lower than expected. The metrics have lifted Bunds from c. 132.50 to a peak of 133.00, before stabilising around 132.80.

- Gilts opened modestly firmer with impetus from benchmarks more broadly somewhat capped by a hawkish UK retail sales number. Tracking EGBs into the UK's own PMIs which came in mixed and saw a knee-jerk spike to 99.14, before swiftly paring to below 99.00.

- Click for a detailed summary

COMMODITIES

- Crude is lower amid the stronger Dollar and the broadly downbeat risk tone across the market which reverberated from a lacklustre US performance. WTI August found some support at USD 81/bbl while Brent dipped under USD 85.50/bbl.

- Mixed trade across precious metals with spot gold holding onto gains despite the stronger Dollar, with newsflow also relatively quiet this morning. Spot silver lags following yesterday's outperformance. Spot gold resides near yesterday's peak (USD 2,365.59/oz).

- Copper futures pulled back from yesterday's advances with demand sapped by the subdued risk tone.

- Goldman Sachs sees minimal impact from new EU restrictions on Russian LNG. GS says the latest EU package of sanctions impacting Russia bans the transshipment of Russian LNG by member countries, but the measures do not block EU member states from importing Russian LNG.

- Citi says crude markets are showing tightness, sees Brent picking up in Q3, but notes opportunities to sell into the strength

- Global crude steel output rises 1.5% to 165.1mln tonnes in May 2024 vs May 2023; China crude steel output rises 2.7% Y/Y to 92.9mln tonnes in May 2024

- Click for a detailed summary

NOTABLE DATA RECAP

PMI

- French HCOB Composite Flash PMI (Jun) 48.2 vs. Exp. 49.5 (Prev. 48.9); HCOB Services Flash PMI (Jun) 48.8 vs. Exp. 50.0 (Prev. 49.3); HCOB Manufacturing Flash PMI (Jun) 45.3 vs. Exp. 46.8 (Prev. 46.4)

- German HCOB Composite Flash PMI (Jun) 50.6 vs. Exp. 52.7 (Prev. 52.4); HCOB Services Flash PMI (Jun) 53.5 vs. Exp. 54.4 (Prev. 54.2); HCOB Manufacturing Flash PMI (Jun) 43.4 vs. Exp. 46.4 (Prev. 45.4). "This should be a further reason for the ECB to proceed cautiously with interest rate cuts."

- EU HCOB Composite Flash PMI (Jun) 50.8 vs. Exp. 52.5 (Prev. 52.2); HCOB Manufacturing Flash PMI (Jun) 45.6 vs. Exp. 47.9 (Prev. 47.3); HCOB Services Flash PMI (Jun) 52.6 vs. Exp. 53.5 (Prev. 53.2)

- UK Flash Manufacturing PMI (Jun) 51.4 vs. Exp. 51.3 (Prev. 51.2); Flash Services PMI (Jun) 51.2 vs. Exp. 53.0 (Prev. 52.9); Flash Composite PMI (Jun) 51.7 vs. Exp. 53.1 (Prev. 53.0). "Meanwhile, from an inflation perspective, stubbornly persistent service sector inflation – a major barrier to lower interest rates – remains evident in the survey, but should at least cool further from the current 5.7% pace in coming months. However, companies' costs are rising, most notably in manufacturing, where shipping costs in particular are spiking again and adding to a renewed rise in inflationary pressures from goods."

Other Data

- UK Retail Sales MM (May) 2.9% vs. Exp. 1.5% (Prev. -2.3%, Rev. -1.8%); UK Retail Sales YY (May) 1.3% vs. Exp. -0.9% (Prev. -2.7%, Rev. -2.3%); Retail Sales Ex-Fuel YY (May) 1.2% vs. Exp. -0.8% (Prev. -3.0%, Rev. -2.5%); Retail Sales Ex-Fuel MM (May) 2.9% vs. Exp. 1.3% (Prev. -2.0%, Rev. -1.4%)

- UK PSNB Ex Banks GBP (May) 15.024B GB vs. Exp. 15.7B GB (Prev. 20.514B GB, Rev. 18.444B GB); PSNB, GBP (May) 14.1B GB (Prev. 19.59B GB, Rev. 17.520B GB); PSNCR, GBP (May) 18.135B GB (Prev. -5.217B GB, Rev. -5.249B GB)

- French Business Climate Mfg (Jun) 99.0 vs. Exp. 100.0 (Prev. 99.0)

- UK GfK Consumer Confidence (Jun) -14.0 vs. Exp. -16.0 (Prev. -17.0)

NOTABLE EUROPEAN HEADLINES

- UK Conservative MPs have accused the BoE of making a "political decision" after deciding to hold rates, according to The Telegraph.

NOTABLE US HEADLINES

- Fed's Barkin (voter) urged for clearer inflation signals before cutting rates and said data is to determine further moves after the initial rate cut, while he added the Fed is well-positioned and has the necessary firepower for the job.

- Fed's Goolsbee (non-voter) repeated that they can cut if they see more good inflation reports.

- US Treasury Secretary Yellen said it is necessary that the US contain deficits and President Biden's budget is full of proposals to do exactly that, while she added that President Biden would protect tax benefits received by families making USD 400k or less.

GEOPOLITICS

MIDDLE EAST

- "The IDF wants to declare the end of the war after the Rafah operation", according to Sky News Arabia citing Israeli press Haaretz

- Israel will reportedly step up attempts to assassinate Hamas leaders in a bid to force Hamas to accept the ceasefire deal, according to a senior Israeli official cited by The Times.

- US Secretary of State Blinken underscored the importance of avoiding further escalation in Lebanon and reaching a diplomatic resolution in the meeting with Israeli officials, while he emphasised the need to take additional steps to surge humanitarian aid into Gaza and plan for post-conflict governance, security, and reconstruction, according to the State Department.

OTHER

- UK is reportedly at loggerheads with the US and Germany over Ukraine joining NATO as the US and Germany have derailed a European plan to grant Ukraine an “irreversible” path to NATO membership and instead support offering Ukraine a lighter commitment to membership of the military alliance, according to The Telegraph.

- Russian President Putin said Russia is ready to start talks on a settlement of the Ukrainian conflict even as early as tomorrow but all parties should study its peace proposals and it is up to them when they bother to do it, while he added Russia never rejected the idea of negotiations and that the Ukrainian side has forbidden itself to negotiate, according to TASS.

- Japan imposed sanctions against China-based companies in connection to the Ukraine war with sanctions placed on China-based Yilufa Electronics and Shenzhen 5G High-Tech Innovation Co.

- South Korean military fired warning shots after North Korean soldiers crossed the border on Thursday, according to Yonhap.

CRYPTO

- Bitcoin continues to slip and now sits beneath USD 64k, with Ethereum also slipping below USD 3.5k.

APAC TRADE

- APAC stocks were mostly rangebound with sentiment subdued after the lacklustre handover from Wall St where tech underperformed and risk appetite was sapped as participants reflected on higher yields and soft data releases ahead of quad-witching.

- ASX 200 was rangebound with upside restricted after weak Australian flash PMI data including a steeper contraction in manufacturing.

- Nikkei 225 traded indecisively after softer-than-expected National CPI data and weakening PMIs.

- Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong as the local benchmark dipped beneath 18,000 amid losses in property and tech, while the mainland conformed to the glum mood amid ongoing trade-related headwinds with Canada also preparing a tariffs plan on Chinese electric vehicles.

NOTABLE ASIA-PAC HEADLINES

- Canada is reportedly preparing a tariffs plan on Chinese electric vehicles, according to Bloomberg.

- Japanese PM Kishida is to resume utility and maintain gasoline subsidies, according to FNN. It was separately reported that Japan's government is in final preparations to adopt additional steps to ease the burden of higher electricity and gas prices, according to NHK.

- Japan's Chief Cabinet Secretary Hayashi said the inclusion to the US monitoring list does not mean that Japan's foreign exchange policy is a problem, while he added that stable forex levels are desirable and it is important that forex rates reflect fundamentals.

- BoJ Deputy Governor Uchida says Japan's economy recovering moderately albeit with some weak signs; underlying inflation likely to gradually accelerate. Uncertainty surrounding Japan's economic and price outlook remains high. Must be vigilant to financial, FX market developments and their impact on Japan's economy and prices. BoJ will decide specifics on bond tapering plan and size of reducing in bond buying will be significant. Japan's financial system remains stable as a whole. BoJ will adjust degree of monetary easing if economy and prices move in line with forecasts.

- BoJ to hold meetings with bond market participants on bond-tapering plan on July 9-10th

- China's Commerce Ministry says EU continues to escalate trade friction; may "trigger a trade war"; responsibility lies entirely with the EU side; hopes EU would meet China halfway

DATA RECAP

- Japanese National CPI YY (May) 2.8% vs. Exp. 2.9% (Prev. 2.5%)

- Japanese National CPI Ex. Fresh Food YY (May) 2.5% vs. Exp. 2.6% (Prev. 2.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (May) 2.1% vs. Exp. 2.2% (Prev. 2.4%)

- Japanese JibunBK Manufacturing PMI Flash SA (Jun) 50.1 (Prev. 50.4); Services PMI Flash SA (Jun) 49.8 (Prev. 53.8)

- Australian Judo Bank Composite PMI Flash (Jun) 50.6 (Prev. 52.1)

- Australian Judo Bank Manufacturing PMI Flash (Jun) 47.5 (Prev. 49.7); Services PMI Flash (Jun) 51.0 (Prev. 52.5)