Europe Market Open: Rangebound start to a packed day of Central Bank action

20 Jun 2024, 06:35 by Newsquawk Desk

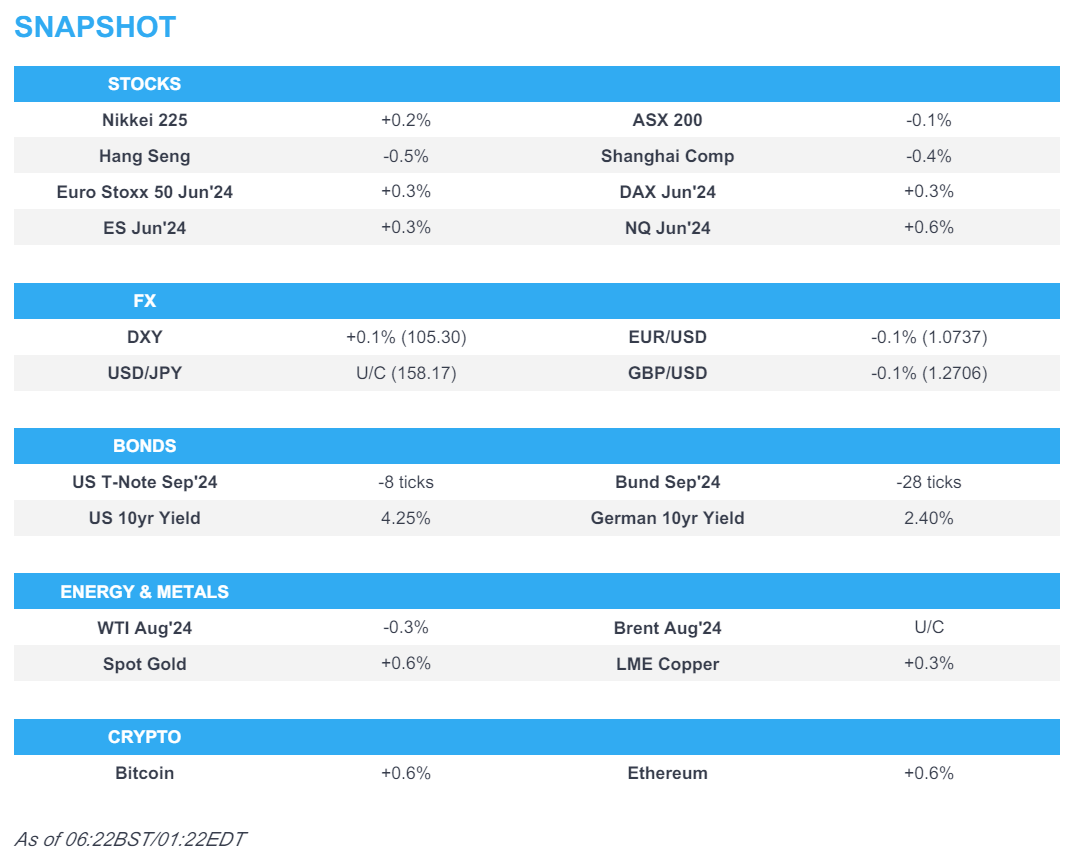

- APAC stocks were subdued in rangebound trade amid a lack of catalysts and following the US holiday lull.

- European equity futures indicate a firmer open with Euro Stoxx 50 future up 0.3% after the cash market closed higher by 0.7% on Wednesday.

- DXY is steady on a 105 handle with FX markets broadly contained, Cable holds above 1.27 ahead of the BoE announcement.

- Bunds are lower, whilst crude markets are contained after WTI hit resistance around USD 81/bbl.

- Looking ahead, highlights include US IJC & Philly Fed Index, SNB, Norges & BoE Policy Announcements, Comments from SNB's Jordan, Norges Bank Governor Bache, Fed’s Barkin & Kashkari, Supply from Spain, France & US

US TRADE

EQUITIES

- US stock markets were closed for Juneteenth

APAC TRADE

EQUITIES

- APAC stocks were subdued in rangebound trade amid a lack of catalysts and following the US holiday lull.

- ASX 200 was lacklustre as underperformance in defensives outweighed the gains in energy and real estate.

- Nikkei 225 retreated with weakness in the heavy industries clouding over exporter optimism.

- Hang Seng and Shanghai Comp. were lower with the former choppy amid resistance around 18,500, while the mainland was uninspired after China's Loan Prime Rates were unsurprisingly kept unchanged and the PBoC also reverted to a tepid liquidity operation.

- US equity futures (ES +0.3%, NQ +0.6%) were mostly firmer following the recent US holiday closure and ahead of Friday's witching hour.

- European equity futures indicate a firmer open with Euro Stoxx 50 future up 0.3% after the cash market closed higher by 0.7% on Wednesday.

FX

- DXY kept to within tight parameters above the 105.00 level following the Juneteenth holiday closure, while participants look ahead to several data releases and a couple of Fed speakers scheduled later.

- EUR/USD languished beneath 1.0750 amid a lack of pertinent catalysts for the single currency.

- GBP/USD conformed to the rangebound picture across the FX space as the BoE rate decision looms.

- USD/JPY eked marginal gains after its return to the 158.00 handle but with upside capped amid a lack of drivers.

- Antipodeans were rangebound with only brief support in NZD/USD following stronger-than-expected GDP.

- PBoC set USD/CNY mid-point at 7.1192 vs exp. 7.2653 (prev. 7.1159).

- Brazil Central Bank maintained the Selic Rate at 10.50%, as expected, with the decision unanimous, while it stated it decided to interrupt the easing cycle due to the uncertain global scenario, resilient activity in Brazil, higher inflation projections, and unanchored inflation expectations. Furthermore, it said monetary policy should continue being contractionary until the consolidation of both the disinflation process and the anchoring of expectations around the targets, as well as noted that the committee will remain vigilant and future changes in the interest rate will be determined by the firm commitment to reaching the inflation target.

- BoC Minutes noted that the Governing Council considered the merits of waiting until the July 24th meeting to cut rates prior to the June 5th rate announcement and while members recognised the risk that progress on inflation could stall, there was consensus indicators showed enough progress to warrant a cut. Furthermore, members agreed that any future monetary policy easing would likely be gradual and the timing of cuts would depend on the data and implications for the future path of inflation.

FIXED INCOME

- 10-year UST futures were lacklustre in post-holiday trade with US supply ahead including a 5-year TIPS auction.

- Bund futures trickled lower with a lack of demand after the recent whipsawing and German 30-year supply.

- 10-year JGB futures tracked the losses in global counterparts amid light catalysts and a quiet calendar, while the latest 5-year JGB auction results were mixed and showed a slightly higher b/c but lower accepted prices than the previous month.

COMMODITIES

- Crude futures traded rangebound following Wednesday's holiday-quietened performance and after WTI hit resistance around USD 81/bbl, while the latest delayed DoE inventories are scheduled for release later.

- Spot gold slightly picked up as Shanghai commodities trade got underway and as silver breached USD 30/oz.

- Copper futures were mildly higher alongside the positive mood in the metals complex but with gains capped by the cautious risk tone.

CRYPTO

- Bitcoin eked marginal gains after returning to above the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Jun) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5Y (Jun) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- PBoC will make clear it will start to use a short-term interest rate as its main policy rate after reducing the importance of the MLF rate as a policy benchmark, according to PBoC-backed Financial News citing unnamed industry people.

DATA RECAP

- New Zealand GDP QQ (Q1) 0.2% vs. Exp. 0.1% (Prev. -0.1%)

- New Zealand GDP YY (Q1) 0.3% vs. Exp. 0.2% (Prev. -0.3%, Rev. -0.2%)

GEOPOLITICAL

MIDDLE EAST

- Lebanon's Hezbollah chief said nowhere in Israel will be safe from the group's attacks in case of war including targets in the Mediterranean and if war is 'imposed' on Lebanon, the group will fight with 'no rules and no ceilings', while Cyprus allowing Israel use of its airports means that it has become a part of the war and that Hezbollah will deal with it as such. In relevant news, Hezbollah announced it was targeting the positions of Israeli soldiers in Jal Al-Alam, Al-Baghdadi and Al-Raheb, according to Sky News Arabia.

- Nine Palestinians were killed in an Israeli air strike targeting a group of citizens and merchants waiting for aid in Gaza, according to medical sources cited by Reuters.

- Israeli media said the US told Israel that Qatar is close to imposing sanctions on Hamas to resume negotiations, according to Sky News Arabia.

- A meeting between US envoy Hochstein and Israeli PM Netanyahu was said to be bad and Hochstein said accusations about withholding weapons are false, according to Axios citing informed sources. Furthermore, US officials said the new dispute between Netanyahu and the Biden administration hinders US-Israeli diplomatic efforts to calm tensions on the border between Lebanon and Israel, while it was reported by Sky News Arabia that President Biden wants to meet with Israeli PM Netanyahu as soon as possible.

- US Central Command said it conducted an air strike in Syria that killed a senior Islamic State official on June 16th.

OTHER

- North Korean leader Kim said Russian President Putin's visit was a meaningful step in developing bilateral ties and protecting world peace and stability, while it was noted that each country is to provide all available military and other assistance if the other faces armed aggression under the North Korea-Russia pact, according to KCNA.

- Japanese Chief Cabinet Secretary Hayashi expressed grave concern that Russian President Putin did not rule out military technology cooperation at the summit with North Korean leader Kim, while he added Putin's comment that the UN Security Council should review North Korean sanctions is utterly unacceptable.

- NATO Secretary General Stoltenberg warned there will be consequences for China if it continues to support Russia's war economy, according to FT.

- US Secretary of State Blinken discussed with his Philippine counterpart China’s actions in the South China Sea which Manila and Washington said was escalatory, according to Reuters.

EU/UK

NOTABLE HEADLINES

- Savanta poll for Telegraph predicts UK PM Sunak to lose his seat at the July 4th election.