US Market Open: US equity futures tentative, Dollar flat & Antipodeans lag after mixed Chinese data

17 Jun 2024, 11:23 by Newsquawk Desk

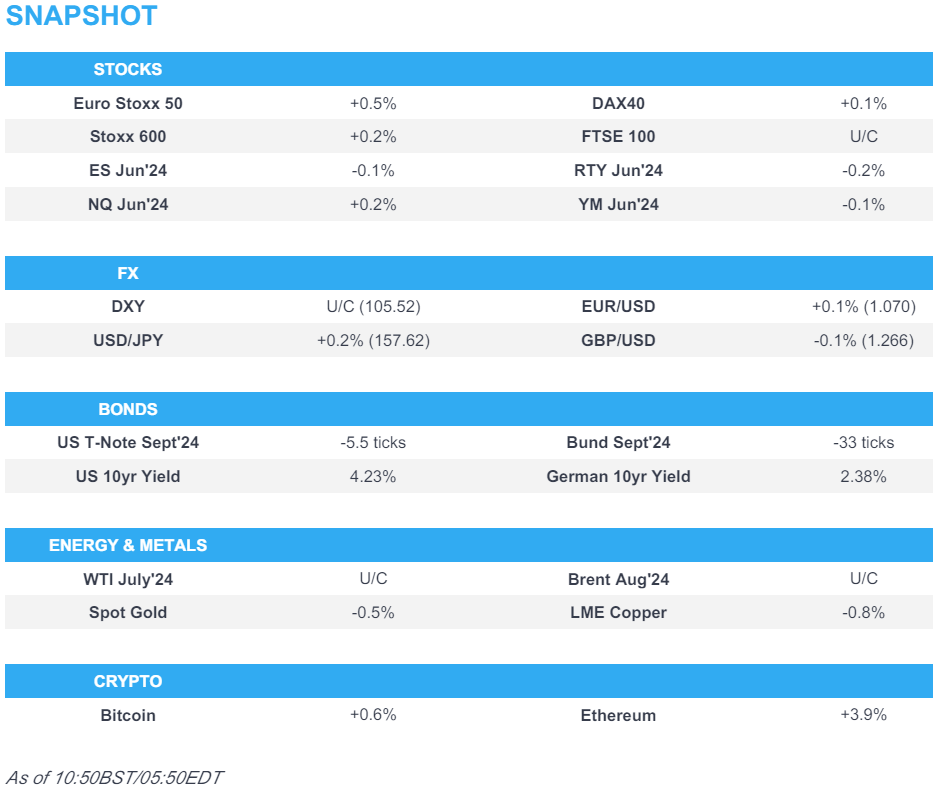

- European bourses are mostly firmer paring some of Friday’s pronounced downside, US futures are trading tentatively

- Dollar is flat, Antipodeans lag after weaker than expected Chinese industrial data

- Bonds are subdued paring recent EU political-induced upside on Friday, as participants digest ECB sources which suggest that the Bank is in no rush to discuss a French bond rescue

- Crude is flat in what has been a choppy session thus far, XAU/base metals are hampered by mixed Chinese data

- Looking ahead, US NY Fed Manufacturing, Comments from ECB’s de Guindos & Cipollone, Fed’s Williams, Harker & Cook, Earnings from Lennar

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.1%) began the session on a strong footing in a paring of Friday's pronounced downside, though some modest selling pressure has been seen in recent trade.

- European sectors hold a strong positive tilt, though with little clear bias; Tech takes the top spot, next to Travel & Leisure, whilst Healthcare lags.

- US Equity Futures (ES -0.1%, NQ +0.1%, RTY -0.1%) are mixed, and with price action tentative thus far.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is trading within a tight but busy 105.49-64 range ahead of a quiet session, with focus on US Retail Sales on Tuesday. Currently trading within the confines of Friday’s 105.17-80 range. Downside levels include its 50 DMA at 105.20, just above the trough from Friday.

- EUR is flat on the session and trading on either side of the 1.07 mark, following some of the hefty selling seen on Friday. Political uncertainty in France still looms large, although some of the fears have seemingly fizzled out in today’s trade after ECB sources suggest that the Bank is in no rush to discuss a French bond rescue.

- GBP is incrementally softer vs the Dollar, largely a factor of slight strength in the EUR/GBP cross, given the lack of UK-specific newsflow thus far.

- JPY is very slightly softer against the Dollar and ultimately unreactive to commentary from BoJ’s Ueda at his parliamentary hearing. Thus far, the Governor has echoed very familiar commentary from the Bank. Currently trading just above 157.50 and towards the upper end of today’s 157.17-66 range.

- Antipodeans (particularly the Kiwi) are the G10 underperformers, following the mixed Chinese data overnight, with focus on the weaker-than-expected Chinese Industrial Output data.

- Click for a detailed summary

- Click for OpEx details

FIXED INCOME

- USTs are incrementally softer, paring some of the pronounced gains seen on Friday. Today's focus will be on Fed's Williams, Harker & Cook, where remarks will be scrutinised to see where they place their dots and how much sway, if at all, May's CPI had on them. In narrow 6 tick parameters; yields bid across the curve which is ever so slightly flatter thus far.

- Bund pullback is more pronounced than peers, though the OAT-Bund yield spread remains elevated around 75bps. ECB sources drew focus on TPI and France but nothing immediate coming from this while Chief Economist Lane made clear the current situation "is not disorderly".

- Gilts are also subdued, as attention turns to UK CPI on Wednesday and the BoE a day later. At the low-end of 98.55-98.86 bounds, pulling back from Friday's 99.05 best.

- Click for a detailed summary

COMMODITIES

- Crude is flat in what has been a choppy session thus far. The complex was subdued overnight following the weak Chinese industrial data, though caught a slight bid at the European cash open, and then taking another leg higher after PM Netanyahu disbanded his war cabinet.

- Precious metals are pressured despite the strong Chinese retail data with the metrics overall pointing to a sluggish May for China, metrics the likes of ING believe will increase calls for rate cuts from the PBoC. XAU is holding at the lower end of USD 2315-2332/oz bounds.

- Base metals are weighed on by the poor Chinese industrial production number, strength in the USD and only modestly constructive risk tone after Friday's pronounced pressure.

- US President Biden is ready to reopen US oil stockpile if petrol price surge again, according to FT.

- Ukraine planned record power imports on Saturday after significant energy infrastructure damage. In relevant news, US Vice President Harris announced over USD 1.5bln to bolster Ukraine’s energy sector, according to Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Wages In Euro Zone (Q1) 5.3% (Prev. 3.1%, Rev. 3.2%); Labour Costs YY (Q1) 5.1% (Prev. 3.4%)

- UK Rightmove House Price Index MM (Jun) 0.0% (Prev. 0.8%); YY (Jun) 0.6% (Prev. 0.6%)

- Italian Consumer Prices Final MM (May) 0.2% vs. Exp. 0.2% (Prev. 0.2%); YY (May) 0.8% vs. Exp. 0.8% (Prev. 0.8%); unrevised.

NOTABLE EUROPEAN HEADLINES

- UK PM Sunak’s Conservative Party is headed for a historic wipeout in the July 4th general election, according to three new polls by Survation, Opinium and Savanta published in Sunday newspapers cited by Bloomberg.

- ECB's Lane says we are seeing significant wage increases in some countries; cost pressures to be muted next year. (regarding France) Need to distinguish between markets repricing fundamentals and disorderly dynamics; current situation is not disorderly. We need to see domestic services inflation momentum come down.

- ECB is in no rush to discuss a French bond rescue and policymakers have not discussed emergency bond purchases for France, according to sources. Furthermore, sources said ECB policymakers have no immediate plan to debate using the Transmission Protection Instrument for France and some policymakers would wait until a new French government is formed before any discussion about TPI, according to Reuters.

- Italian PM Meloni said G7 leaders agreed on the need for a fairer international taxation system and global minimum tax.

NOTABLE US HEADLINES

- Fed's Goolsbee (non-voter) said on Friday that recent CPI data was very good and they would be feeling very good if they got a lot of months like May's CPI data, while he added they have to see more progress and his feeling was relief.

- Fed’s Kashkari (non-voter) said they need to see more evidence to convince them inflation is heading to 2% and they are in a good position to take their time and get more data before deciding on rates. Kashkari also stated it is reasonable that a rate cut could occur in December and the median projection is for one cut which is likely to be towards the end of the year, according to CBS' Face the Nation.

- Tesla (TSLA) reduces the price of its Model 3 Long-Range AWD vehicles in the US by USD 250, taking it to USD 47,490, according to Reuters

GEOPOLITICS

MIDDLE EAST

- Israel's military said it will hold a tactical pause of military activity for humanitarian purposes between 06:00BST-17:00BST daily along the road from the Kerem Shalom Crossing to Salah Al-Din Road and then northwards, according to Reuters. However, it was separately reported that Israeli PM Netanyahu denounced as ‘unacceptable’ the plans by Israel’s military for a limited pause in operation near a crossing into Gaza intended to help aid distribution, according to FT.

- Israel Defence Forces said intensified cross-border fire from Hezbollah on Israel could lead to dangerous escalation and is bringing them to the brink of what could be a wider escalation that could have devastating consequences for Lebanon and the entire region, according to a video statement cited by Reuters.

- Hamas leader Haniyeh said the group’s response to the latest Gaza ceasefire proposal is consistent with the principles of US President Biden’s plan, according to Reuters. It was also reported that the Palestinian Islamic Jihad armed wing said the only way to return Israeli hostages is through withdrawing from Gaza and reaching a hostages-for-prisoners deal.

- White House said Qatar and Egypt plan talks with Hamas on a Gaza ceasefire, while the White House later said that President Biden's senior adviser Amos Hochstein will be in Israel on Monday for meetings.

- US National Security Adviser Sullivan said President Biden wants to see a cessation of hostilities in Gaza and see hostages return home, while he added that they work tirelessly with Israelis to ensure unhindered humanitarian access.

- UK, France, and Germany’s governments condemned Iran’s latest steps as reported by the IAEA to further expand its nuclear program which they said is especially concerning, while they remain committed to a diplomatic solution preventing Iran from developing nuclear weapons, according to Reuters.

- Iranian Foreign Ministry spokesperson Kanaani said the G7 should distance itself from destructive policies in the past. It was also separately reported that Iran’s Foreign Ministry condemned the ‘invalid’ E3 statement on its nuclear program, according to IRNA.

- US naval forces rescued a crew from a Greek-owned ship that was struck by Houthis in the Red Sea, while Yemen’s Houthis said they carried out three military operations against an American destroyer and two ships in the Red and Arabian Seas, according to Reuters.

OTHER

- Russia’s Kremlin said President Putin is not ruling out talks with Ukraine but wants guarantees and a legitimate record of their outcome is needed, according to Russian agencies including TASS. In relevant news, Russian forces took control of the village in Ukraine’s Zaporizhzhia region, according to Ifax citing the Defence Ministry.

- Ukrainian peace summit communiqué stated that Russia’s ongoing war against Ukraine continues to cause large-scale human suffering and destruction, as well as creates risks and crises with global repercussions, while it stated that any threat or use of nuclear weapons in the context of the ongoing war against Ukraine is inadmissible.

- Ukrainian Foreign Minister said the peace summit communiqué text is complete and Kyiv’s positions have been addressed, while there were no alternative peace plans discussed at the summit in Switzerland and Kyiv won’t let Russia speak in the language of ultimatums. Furthermore, the Austrian Chancellor said there is a desire for a follow-up Ukraine conference although it is too early to say what the format will be and have to see whether Russians can be there.

- US National Security Adviser Sullivan said Russia’s latest peace proposal for Ukraine would lead to further domination of Ukraine and is a completely absurd vision.

- Swedish armed forces spokesperson said a Russian air plane violated Swedish airspace on Friday and was met by Swedish fighter jets, according to TT news agency.

- China's Coast Guard said a Philippine supply ship illegally intruded into waters adjacent to Second Thomas Shoal on June 17th and the vessel deliberately approached the Chinese ship in an unprofessional and dangerous manner which resulted in a collision, while it added that the Philippine transport and replenishment ship ignored China's repeated solemn warnings.

- China is expanding its nuclear arsenal faster than any other country but still lags behind the US and Russia, according to a report cited by SCMP.

- US, South Korea and Japan are to lock in security ties and will sign a deal this year to formalise a security partnership against threats from North Korea's nuclear weapons before the inauguration of the next US President in January, according to Bloomberg.

CRYPTO

- Bitcoin is modestly firmer and holds around USD 66k, whilst Ethereum posts larger gains and holds above USD 3.5k

APAC TRADE

- APAC stocks were mostly negative as markets reflected on the latest soft Chinese data releases.

- ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education.

- Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months.

- Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted CNY 182bln (vs CNY 237bln maturing) in 1-year MLF with the rate kept at 2.50%.

- China's NBS spokesperson said domestic demand is insufficient despite efforts and the property market shows positive changes but is still in the middle of adjustments, while she added that more time was needed to see the effect of property measures and China's economy likely to continue to recover despite the complex external environment.

- China still has room to lower interest rates but the ability to adjust monetary policy faces internal and external constraints, according to PBoC-backed Financial News.

- China Securities Regulatory Commission announced in a statement that it'll further evaluate and refine rules for margin trading and securities lending, while it will increase regulation of "illicit" short-selling as it aims to ensure market stability.

- Australia and China signed memorandums of understanding on the economy, trade and education in Canberra, while Australian PM Albanese said they aim to strengthen the relationship with China and Chinese Premier Li announced that China will include Australia in its visa waiver program, according to Reuters.

- China's Commerce Ministry is conducting anti-dumping investigation on pork and its by-products which are imported from the EU, investigation begins immediatelyInvestigation should end within 12-months, could be extended by another 6-months under special conditions.

- BoJ Governor Ueda says service prices continue to rise moderately reflecting wage rises; will scrutinise FX moves and impact on import prices.

- Japanese PM Kishida says Government and BoJ share view consumption lacks strength as wage growth fails to catch up to pace of inflation.

DATA RECAP

- Chinese Industrial Output YY (May) 5.6% vs. Exp. 6.0% (Prev. 6.7%)

- Chinese Retail Sales YY (May) 3.7% vs. Exp. 3.0% (Prev. 2.3%)

- Chinese Urban Investment (YTD) YY (May) 4.0% vs. Exp. 4.2% (Prev. 4.2%)

- Chinese China House Prices MM (May) -0.71% (Prev. -0.58%); YY (May) -3.9% (Prev. -3.1%)

- Japanese Machinery Orders MM (Apr) -2.9% vs. Exp. -3.1% (Prev. 2.9%)

- Japanese Machinery Orders YY (Apr) 0.7% vs. Exp. -0.1% (Prev. 2.7%)