US Market Open: Political uncertainty in Europe hits sentiment, JPY initially slipped post-BoJ but now flat

14 Jun 2024, 11:19 by Newsquawk Desk

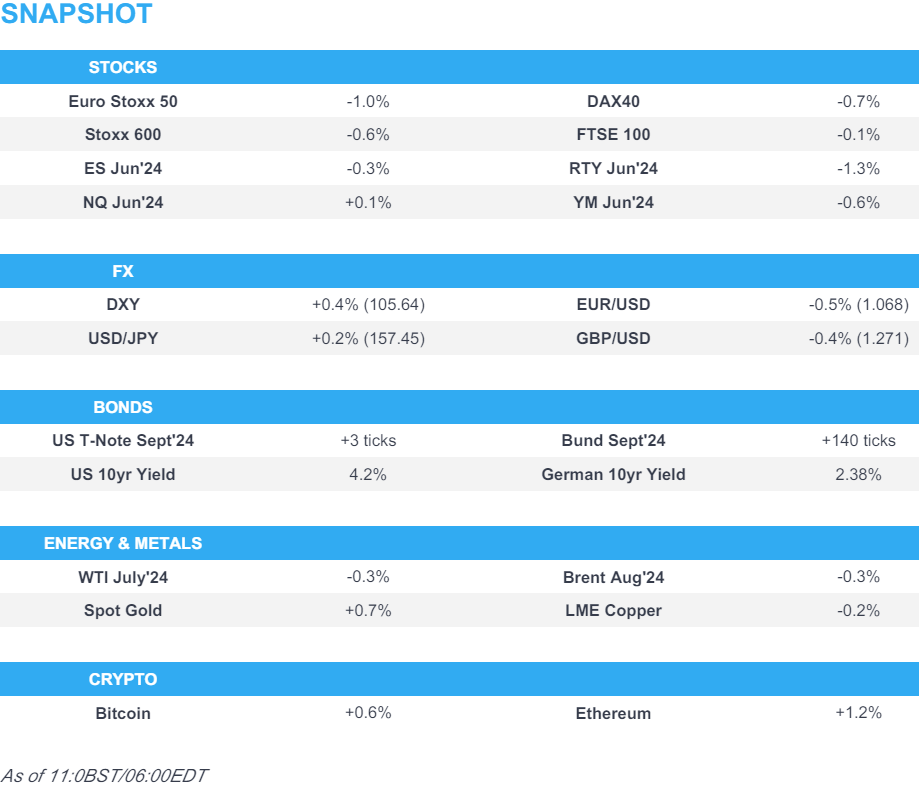

- European bourses are entirely in the red, with sentiment hampered by ongoing political angst in the EU; US futures are also lower, RTY underperforms

- DXY is bid, benefitting from the subdued EUR which dips below 1.07 and a weak JPY post-BoJ

- The BoJ kept rates unchanged but defied expectations for an immediate reduction of bond purchases, instead, it will decide on a specific bond-buying reduction plan at the next meeting

- USTs are flat, EGBs soar amid political uncertainty in the region, with the OAT-Bund spread widening to over 78bps

- Crude is subdued amid the firmer Dollar, XAU benefits from haven flows and base metals are mixed

- Looking ahead, US UoM Survey, comments from Fed’s Goolsbee, Cook & ECB's Schnabel

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.4%) are entirely in the red, with sentiment hampered amid ongoing political uncertainty; approval polls showed President Macron rating drop to the lowest in 5yrs, whilst Finance Minister Le Maire said “yes”, when asked if the current political crisis could result in a financial crisis.

- CAC 40 has now erased gains for the year and is flat YTD, future lower by over 2.0% on the session.

- European sectors hold a negative bias, with a slight defensive tilt as Healthcare tops the index. Industrials are found at the foot of the pile, with Defence names underperforming, seemingly with no clear catalyst, but potentially amid the ongoing political woes; Rheinmetall (-6.5%), Thales (-3.5%), BAE (-2.2%). Banks also lag amid the political uncertainty in Europe, with French names the most impacted as it stands.

- US Equity Futures (ES -0.2%, NQ +0.1%, RTY -1.1%) are mixed, with clear underperformance in the RTY, in continuation of the prior day’s hefty losses. In terms of stock specifics, Adobe (+15%) soars in the pre-market after the Co. reported a beat on headline metrics and raised its Q3 guidance above analyst expectations.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- A firm start for the Dollar amid external factors in the form of a weak JPY after the BoJ (see below) coupled with a weak EUR following commentary from the French Finance Minister (more in the next bullet). Dollar is currently towards the upper end of today's 105.17-65 range, approaching the May 9th high at 105.74.

- EUR was dealt a blow to a fresh YTD low by commentary from French Finance Minister Le Maire who, when asked if the current political crisis could result in a financial crisis, answered "yes". EUR/USD fell below a touted Fib around 1.0721 before accelerating losses to eventually dip under 1.0700.

- JPY is the marked laggard after the BoJ caught markets off-guard again in which it defied expectations for an immediate reduction of bond purchases, but instead will decide on a specific bond buying reduction plan at the next meeting. USD/JPY rose to a 158.25 high (vs 156.98 low) before waning off best levels following the hawkish-leaning commentary from Ueda (full comments in the BoJ section below).

- Antipodeans are lagging vs the Dollar amid the broader risk aversion sparked by the political angst in the EU possibly resulting in a financial crisis in France.

- PBoC set USD/CNY mid-point at 7.1151 vs exp. 7.2620 (prev. 7.1122).

- Click for a detailed summary

FIXED INCOME

- USTs are flat with specifics light and the marked widening of European spreads not having much influence in USTs just yet. BoJ the main macro event thus far which saw rates maintained and the announcement that they will be reducing the bond buying place; however, this will not be unveiled/enacted until the July meeting.

- EGBs are bid across the board but OATs remain out of sync with Bunds after the marked drop at the start of the week and as such today's rally is heightening focus on spreads between the nations; OAT-Bund yield spread widens above 78bps, to levels not seen since 'Frexit' concern.

- Gilts are firmer alongside the broader EGB moves and seemingly paring the modest relative underperformance seen yesterday after the Labour manifesto. Unreactive to the latest BoE inflation attitude survey, currently holding near a fresh WTD peak of 98.69.

- Click for a detailed summary

COMMODITIES

- Crude is softer on the session thus far, amid the stronger Dollar, broader risk aversion arising from the political crisis in the EU and ongoing tensions between Israel/Lebanon. Brent Aug sits near USD 82.25/bbl in a USD 81.92-82.55/bbl parameter. Some modest upside was seen after the G7 Draft promised additional sanctions on those engaged in deceptive practices while transporting Russian oil; upside well within today's ranges.

- Precious metals are mostly firmer despite the stronger Dollar in what could be a function of some haven flows amid this morning's risk aversion. XAU/USD resides in a USD 2,301-2,321.59/oz and within yesterday's 2,295.48-2,326.49/oz parameter.

- Base metals are mixed and somewhat resilient to the soaring Dollar, but after a week of losses for the complex.Draft G7 statement promises additional sanctions on those engaged in deceptive practices while transporting Russian oil

- Click for a detailed summary

CRYPTO

- Bitcoin back on a firmer footing and holds just of USD 67k, whilst Ethereum climbs above USD 3.5k.

NOTABLE DATA RECAP

- Swedish CPIF YY (May) 2.3% vs. Exp. 2.1% (Prev. 2.3%); CPIF Ex Energy YY (May) 3.0% vs. Exp. 2.70% (Prev. 2.90%)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks says uncertainty high but ECB on the path to lower inflation; market expectations on rates are reasonable; deviation from baseline would require sizeable and persistent data surprises.

- UK Reform Party has overtaken the Conservative party in a poll for the first time, according to a YouGov survey for The Times.

- Budget stand-off reportedly pushes Germany's coalition to the brink, according to FT.

- Germany is said to be trying to prevent or soften EU tariffs on Chinese EVs, according to Bloomberg.

- Greek PM says they are to reshuffle the cabinet following a worse than expected EU vote result.

- Germany's DIW Institute revises up 2024 GDP forecast to +0.3% (prev. 0%); expected to grow by 1.3% in 2025 (prev. 1.2%)

- BoE Survey: UK Public Inflation Expectation for year-ahead 2.8% (prev. 3.0%) in February.

- Draft G7 statement says they will be restricting access to financial systems for targeted entities, incl. Chinese, who support the Russian war effort. Promises additional sanctions on those engaged in deceptive practices while transporting Russian oil. Pledges to continue efforts to reduce Russian revenue from metals. Calls on China to refrain from adopting export control measures, particularly regarding critical minerals.

- BoFA Global Research lifts the UK 2024 GDP growth forecast to 0.7% (prev. 0.2%)

NOTABLE US HEADLINES

- US Treasury Secretary Yellen said strong US growth is lifting global growth and that the labour market remains strong, while she added that US labour market pressures have eased and wages are rising more slowly.

- China Market Regulator says Tesla (TSLA) China recalls 5826 imported Model 3, Model S and Model X vehicles.

- Adobe Inc (ADBE) Q2 2024 (USD): Adj. EPS 4.48 (exp. 4.39), Revenue 5.31bln (exp. 5.29bln). Sees Q3 Adj. EPS USD 4.50-4.55 (exp. 4.48). Sees Q3 rev. USD 5.33bln-5.38bln (exp. 5.40bln). Raised FY Adj. EPS guidance to USD 18.00-18.20 from USD 17.60-18.00 (exp. 18.02). Adjusts FY rev. guidance to USD 21.40bln-21.50bln from USD 21.30bln-21.50bln (exp. 21.46bln). Shares +15% pre-market

GEOPOLITICS

MIDDLE EAST

- Hamas leader Osama Hamdan told CNN that neither they nor anyone has any idea how many live hostages there are, according to Al Jazeera.

- US President Biden said he hasn't lost hope but Hamas has to step up regarding a Gaza ceasefire.

- US State Department said the recent report issued by the IAEA makes it clear that Iran aims to continue expanding its nuclear program in ways that have no credible peaceful purpose. Furthermore, the US remains in close coordination with partners and allies and they are prepared to continue to increase pressure on Iran should its non-cooperation with the IAEA continue.

- US military said it destroyed two Houthi patrol boats, one unmanned surface vessel, and one drone over the Red Sea.

- US Centcom said Houthis launched two anti-ship cruise missiles into the Gulf of Aden and M/V Verbena reported damage and subsequent fires, according to Reuters.

- "Rocket barrage fired from southern Lebanon and sirens sound in Kiryat Shmona, Beit Hillel, Metulla and Miskaf", according to Sky News Arabia

OTHER

- US President Biden vowed that the US will support Ukraine ‘until they prevail in this war’, while he said Washington will send more Patriot air defence systems to Kyiv as G7 steps up support, according to FT.

- South Korean and US diplomats held an emergency phone call over the possible visit by Russian President Putin to North Korea, while South Korea told the US that Putin's visit to North Korea should not result in deeper military cooperation in breach of U.N. Security Council resolutions, according to the Foreign Ministry.

- Japanese Chief Cabinet Secretary Hayashi said they are poised to soon officially announce a new sanctions package against Russia and are considering new sanctions against organisations in China, India, UAE and others related to Russia.

- "An air alert went on throughout Ukraine, This is related to the activity of a potential carrier of hypersonic missiles", according to Kyiv Post.

- "An air alert went on throughout Ukraine, This is related to the activity of a potential carrier of hypersonic missiles", according to Kyiv Post.

- Finnish border guard suspects four Russian planes violated Finnish airspace on June 10th.

BOJ

- BoJ kept its short-term policy rates at 0.0%-0.1%, as expected, while it decided to conduct JGB purchases in accordance with the decision at the March meeting but will trim bond buying and decide on a specific reduction plan for the next 1-2 years at the next meeting. BoJ's decision on rates was made by unanimous vote and the decision on JGB purchases was made by 8-1 vote in which BoJ board member Nakamura dissented citing the bank should decide to reduce purchases after reassessing developments in economic activity and prices in the July 2024 outlook report. Furthermore, the BoJ said it will hold a meeting with bond market participants on today's policy decision and it expects that underlying inflation is to gradually accelerate, as well as noted it is necessary to pay due attention to developments in financial and forex markets.

UEDA

- The reduction of JGB purchases will be a considerable volume. Will start reduction of JGB purchases immediately after deciding at the July meeting; reduction announced today to avoid uncertainties as much as possible. Want to show guidance for JGB tapering for one-two years to increase visibility; don't think we can reach the state of JGB holdings which is desirable in the long-term within a year. Decided to put off detailed plan of JGB tapering until July's meeting to have a considered discussion with markets. Adds, a July hike is naturally possible, depending on data.

APAC TRADE

- APAC stocks were mostly subdued after the mixed performance stateside where soft data took centre stage, while participants turned their attention to the BoJ policy announcement.

- ASX 200 was dragged lower by underperformance in tech and commodity-related sectors.

- Nikkei 225 recovered early losses and was underpinned after the BoJ policy decision in which the central bank maintained short-term rates at 0.0%-0.1% and kept bond purchases in accordance with its decision in March, while it announced to trim bond buying but will decide on a specific reduction plan for the next 1-2 years at the next policy meeting.

- Hang Seng and Shanghai Comp. were pressured with the former back below the 18,000 level amid tech and auto weakness, while the mainland is also lacklustre amid Western sanction threats on Chinese entities for supplying Russia's war machine.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Suzuki said they will monitor the impact of China's excess production on the Japanese economy and warned of possible deflationary pressure due to overcapacity in China, according to Reuters.

- Chinese firms have formally applied for an anti-dumping investigation into pork imports from the European Union after the EU decided to impose anti-subsidy duties on Chinese-made EVs, according to Global Times.

- China is reportedly internally moving ahead with the procedure to raise the temporary tariff rate on imported cars with large displacement engines, according to Global Times citing sources.

- China May Vehicle Sales +1.5% Y/Y vs +9.3% in April; Jan-May +8.3% Y/Y vs 11.1% Y/Y, via Industry Association

- Japan Chief Cabinet Secretary Hayashi says they will continue to closely monitor the FX market. No comment on possible market impact from the BoJ. Important for FX moves to be stable and reflect fundamentals. Expects BoJ to conduct appropriate monetary policy and working closely with the government.