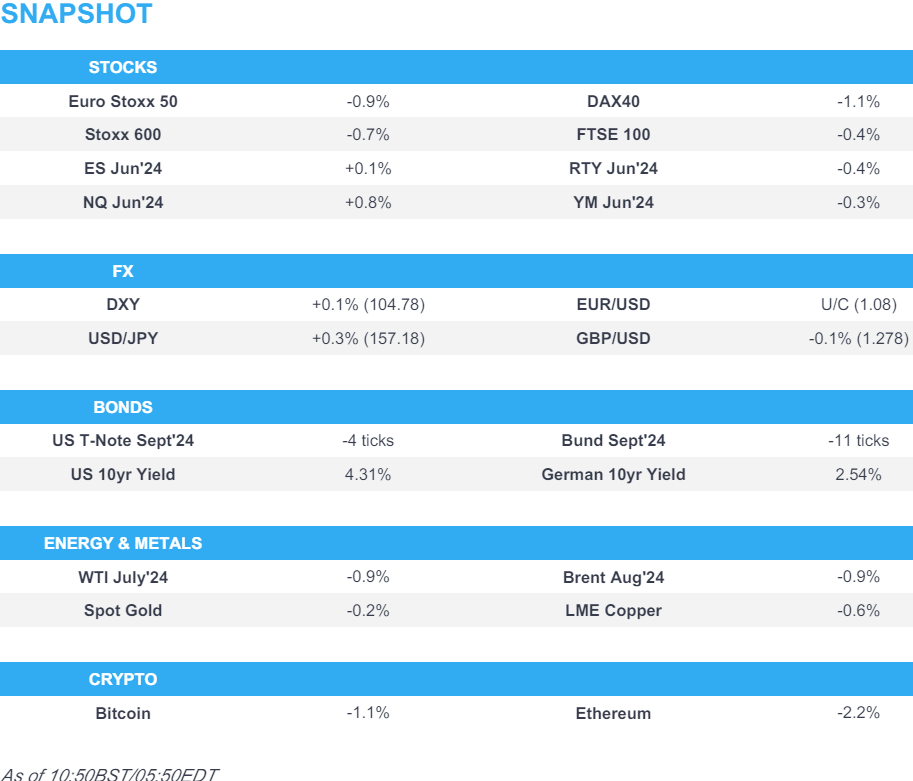

US Market Open: DXY slightly higher & Bonds tick lower post-FOMC & ahead of US PPI; NQ outperforms

13 Jun 2024, 11:03 by Newsquawk Desk

- Downbeat session for European equities whilst US futures are mixed, with NQ outperforming, propped up by pre-market gains in Tesla, Broadcom and Nvidia

- Dollar is firmer, EUR continues to test 1.08 to the downside and the JPY is the marginal underperformer

- Bonds are slightly softer as participants digest the FOMC & hawkish dot plots ahead of US PPI

- Crude is on the backfoot, XAU and base metals both lower as the Dollar continues to recoup losses

- Looking ahead, US IJC, PPI (F), NZ Manufacturing PMI, Comments from ECB’s de Guindos, BoC’s Kozicki & Fed’s Williams, Supply from the US, Earnings from Adobe

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.6%) began the session on a modestly softer footing, and continued to trundle lower as the morning progressed.

- European sectors hold a strong negative bias, with a slight defensive tilt. Autos is towards the bottom of the pile, continuing the losses seen this week. Chemical names, Covestro (-2.6%) and BASF (-1.5%) are also under pressure, after wholesale chemical products fell 13.9% Y/Y vs -0.9% in April.

- US Equity Futures (ES +0.1%, NQ +0.7%, RTY -0.4%) are mixed, with the NQ the clear outperformer, propped up by several pre-market movers within the index. Firstly, Tesla (+6.2%) gains on reports that shareholders have voted in favour of Musk’s USD 56bln pay package. Elsewhere, Broadcom (+14.8%) surges post-earnings, and Nvidia (+2.2%) continues to march forward.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is attempting to recoup more of the slump seen after US CPI yesterday, which took the index to a low of 104.25 with hawkish FOMC dot plots and Fed Chair Powell's cautious tone also helping. The DXY has been trading within a busy 104.67-85 range throughout the London session, awaiting impetus from PPI & IJC.

- EUR straddled 1.0800 throughout APAC hours before finding some support at the level. The Single-currency was little changed to the cooler German Wholesale data, with price action tentative thus far.

- GBP is flat with Cable attempting a test of 1.2800 but failed, with the pair within a 1.2774-99. UK-specific newsflow light today, as focus remains on the UK election and awaiting the Labour manifesto.

- JPY stands as the current G10 laggard, albeit marginally, as US yields came off best levels post-FOMC. Markets will await the BoJ policy announcement due on Friday, but for now, sits in a 156.57-157.30 range.

- Antipodeans are modestly softer amid the cautious mood in Europe whilst better-than-expected Australian jobs data only provided a brief tailwind for AUD/USD.

- PBoC set USD/CNY mid-point at 7.1122 vs exp. 7.2384 (prev. 7.1133).

- Click for a detailed summary

- Click for NY Cut OpEx details

FIXED INCOME

- USTs are slightly softer as desks digest the FOMC and as market pricing pivots away from September and towards November for the first cut. Currently trading lower by a handful of ticks ahead of PPI, which will help to form the consensus for PCE.

- Bunds are on the backfoot as participants continue to pare the post-CPI rally with the bearish action driven by Wednesday's FOMC. A handful of ECB speakers today have had little impact on price action, whilst a further cooling in German wholesale price index spurred a brief bid in Bunds to a 131.11 peak.

- Gilts gapped lower by just a handful of ticks to 97.97 which marks the current session high. Currently trading well within the prior day's 96.84-98.23 range, awaiting the Labour manifesto and US PPI.

- Italy sells EUR 9bln vs exp. EUR 7.5-9bln 3.45% 2027, 3.45% 2031, 4.15% 2039, 3.85% 2049 BTP:

- Click for a detailed summary

COMMODITIES

- Crude is subdued and towards session lows, continuing the pressure sparked by the prior day's bearish inventory data. Geopol updates out of the Middle East have been thin today, though elsewhere Reuters reports that unidentified assailants attacked soldiers guarding the Niger-Benin gas pipeline. Brent Aug towards the lower end of an 82.07-55/bbl parameter.

- Softer trade across precious metals with deeper losses seen in spot silver and palladium vs gold, with the complex pressured by the attempted recovery in the Dollar post-FOMC with gold looking ahead to this afternoon's US PPI and IJCs.

- Base metals are lower across the board, again as a function of the attempted Dollar recovery and following the cautious mood in APAC and early European markets.

- Chevron Australia has started repair works on the Wheatstone platform - expected to be completed in the coming weeks; LNG and domestic gas production to resume following safe completion of repairs.

- Unidentified assailants attack soldiers guarding Niger-Benin gas pipeline, via Reuters citing sources; pipeline not damaged. In reference to the 110k BPD pipeline which concluded construction works in March/April 2024.

- Click for a detailed summary

CRYPTO

- Bitcoin is slightly softer and holds just below USD 67.5k, whilst Ethereum dips below USD 3.5k.

NOTABLE DATA RECAP

- German Wholesale Price Index MM (May) 0.1% (Prev. 0.4%); YY (May) -0.7% (Prev. -1.8%)

- Swedish Money Mkt CPIF Inflation 1 Yr (Jun) 1.9% (Prev. 2.00%); Money Mkt CPIF Inflation 5 Yrs (Jun) 2.0% (Prev. 2.00%); CPIF Inflation 1 Year (Q2) 2.0% (Prev. 2.40%); CPIF Inflation 5 Years (Q2) 2.0% (Prev. 2.10%)

- Swiss Producer/Import Price YY (May) -1.8% (Prev. -1.8%); Producer/Import Price MM (May) -0.3% (Prev. 0.6%)

- Spanish CPI YY Final NSA (May) 3.6% vs. Exp. 3.6% (Prev. 3.6%); all metrics unrevised.

NOTABLE EUROPEAN HEADLINES

- UK opposition Labour Party leader Starmer said they are not looking at bringing in wealth taxes.

- Sky News/YouGov poll found that 64% of respondents thought Labour Party leader Starmer did better in the Sky News Leaders TV interviews, while 36% thought UK PM Sunak did better.

- ECB's Vasle says there is a risk that the disinflation process could slow. Will be data dependent. Wage momentum is still relatively strong. More 2024 cuts probable, if the baseline holds.

- ECB's Muller says ECB has not yet achieved inflation target; possible that inflation could temporarily rise again; services inflation still relatively high; wage growth still strong

NOTABLE US HEADLINES

- UBS expects the Fed to begin cutting in December (prev. September). See less than a 50% chance that the Fed cuts in September.

- Citi on the Fed: "Softer inflation alone will likely be enough to convince the Fed to cut policy rates in September. And a significant weakening in the labor market has us expecting that the Fed will then continue to cut at each of the next seven meetings."

- Broadcom Inc (AVGO) Q2 2024 (USD): Adj. EPS 10.96 (exp. 10.80), Revenue 12.49bln (exp. 12.03bln). Co. noted 10-for-1 forward stock split and that trading on a split-adjusted basis is expected to commence on July 15th. Semiconductor solutions revenue USD 7.20bln (exp. 7.12bln). Infrastructure software revenue USD 5.29bln (exp. 4.93bln). (Newswires)

- Tesla (TSLA) Shareholder resolutions for Musk pay package and move to Texas is to pass by wide margins, according to Reuters citing a source familiar with the preliminary tally. (Reuters)

GEOPOLITICS

MIDDLE EAST

- Hamas's request in advance for a guarantee of a permanent ceasefire complicates Gaza truce negotiations and the main sticking point in the hostage negotiation is the demand for an explicit pledge by Israel to end the war, according to The Times of Israel. it was also reported that Hamas hardened some of its positions on the truce proposal and demanded the inclusion of China, Russia and Turkey as guarantors of the agreement, according to the Israel Broadcasting Corporation.

- Hamas statement said it showed positivity in all stages of negotiations to stop the aggression, while it urged the US administration to direct its pressure on Israel which it said wants to pursue the Gaza war.

- Lebanese army chief is visiting Washington this week to discuss the situation at the border, according to Al-Monitor.

- US military said its forces successfully destroyed three anti-ship cruise missile launchers in a Houthi-controlled area of Yemen and one uncrewed aerial system launched from a Houthi-controlled area of Yemen. However, it stated that one Iranian-backed Houthi unmanned surface vessel struck M/V Tutor which is a Liberian-flagged, Greek-owned and operated vessel in the Red Sea, while the impact caused severe flooding and damage to the engine room.

- Iran is responding to last week's IAEA resolution against it by expanding uranium-enrichment capacity at two underground sites although the escalations are not as large as many feared, according to diplomats cited by Reuters.

OTHER

- Russian nuclear-powered submarine and other naval vessels arrived in Cuba for a five-day visit to the communist island in a show of force amid spiralling US-Russian tensions, according to AFP News Agency.

APAC TRADE

- APAC stocks were somewhat mixed following the key developments stateside where the S&P 500 and Nasdaq extended to fresh record levels after softer-than-expected CPI data, although participants also digested the latest FOMC meeting and hawkish dot plots which suggested just one rate cut this year vs. prev. view of three cuts.

- ASX 200 was led higher by outperformance in tech amid a softer yield environment and with stronger-than-expected jobs data.

- Nikkei 225 failed to sustain early gains and dipped back below the 39,000 level as the BoJ kick-started its two-day policy meeting, while Nikkei reported the BoJ will consider gradually reducing its JGB holdings at this meeting.

- Hang Seng and Shanghai Comp. diverged in rangebound trade with the mood in Hong Kong positive as several automakers weathered the EU announcement of tariffs on Chinese EVs and HKMA maintained its base rate at 5.75% in lockstep with the Fed, while the mainland was lacklustre despite the PBoC's latest efforts to support the property industry.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Monetary Authority maintained its base rate at 5.75%, in lockstep with the Fed.

- China hopes the EU will make some serious reconsideration on tariffs for China EVs and stop going further in the wrong direction, according to state media.

- BoJ will reportedly consider gradually reducing its Japanese government bond holdings at this week's two-day policy meeting, according to Nikkei.

- South Korea's government and ruling party are to increase fines and punishment for illegal short-selling, while the stock short-selling ban will be extended until March, according to Yonhap.

- Japanese Banking Association Chairman says under rising interest rates, banks' business models are moving towards prioritising deposits.

- Chow Tai Fook (1929 HK) FY (HKD) Op profit 12.16bln (exp. 8.58bln), +28.9% Y/Y, Revenue 108.71bln (exp. 108.45bln), +14.8% Y/Y

DATA RECAP

- Australian Employment (May) 39.7k vs. Exp. 30.0k (Prev. 38.5k)

- Australian Full Time Employment (May) 41.7k (Prev. -6.1k)

- Australian Unemployment Rate (May) 4.0% vs. Exp. 4.0% (Prev. 4.1%)

- Australian Participation Rate (May) 66.8% vs. Exp. 66.7% (Prev. 66.7%)