US Market Open: Price action tentative ahead of today's key US CPI & FOMC announcement

12 Jun 2024, 11:09 by Newsquawk Desk

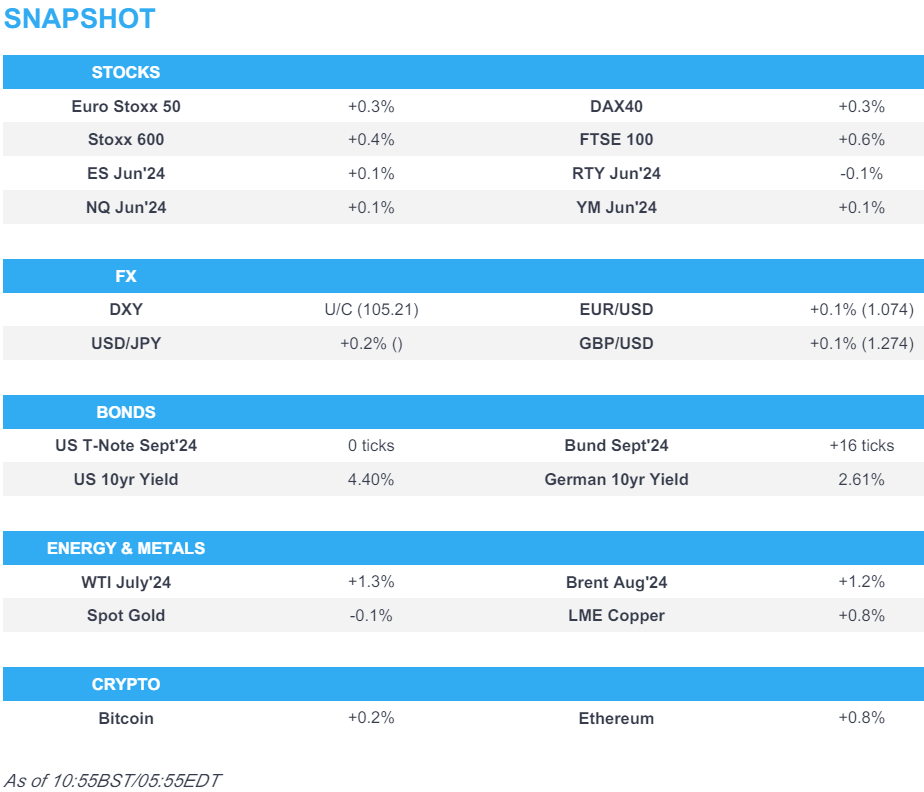

- European bourses are modestly firmer, trimming this week’s recent losses; price action tentative ahead of today’s US CPI and FOMC

- DXY is flat, G10s modestly gain vs the Dollar though the JPY dips slightly

- USTs are flat and at highs, Bunds/Gilts both move higher with the latter also factoring in the in-line GDP metrics, with focus on the soft Construction figures

- Crude is at highs amid ongoing geopolitical escalations, XAU flat while base metals trim recent losses; complex unreactive to mixed Chinese inflation data

- Looking ahead, US CPI, Fed Policy Announcement, Comments from ECB’s de Guindos, Fed Chair Powell & BoC Governor Macklem, Earnings from Broadcom

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) are entirely in the green, attempting to trim some of this week’s significant losses, sparked by political uncertainty in Europe.

- European sectors hold a strong positive bias, with Banks taking the top spot as the sector finds its footing after this week’s weakness. Autos is the clear laggard, after news that the European Commission will notify carmakers that it will provisionally impose additional duties of up to 25% on imported Chinese EVs from next month.

- US Equity Futures (ES +0.1%, NQ +0.1%, RTY -0.1%) are trading on either side of the unchanged mark with price action tentative ahead of today’s key risk events, which includes US CPI and the FOMC Policy announcement.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is flat and in a narrow range as participants await the double dose of US risk events in the form of CPI and the FOMC; DXY resides within 105.21-32 parameters, well within yesterday's 105.09-46 range.

- EUR price action has been uneventful thus far awaiting today's key risk events; EUR/USD in a 1.0733-47 range thus far.

- GBP has also been trading sideways finding intraday resistance at 1.2750 (vs low 1.2729) with little immediate move seen in the wake of in-line GDP which ultimately resulted in little change in BoE pricing.

- JPY is very modestly softer irrespective of the overnight risk aversion and firmer-than-expected PPI data; USD/JPY currently trading within a 157.03-37 range.

- Antipodeans are both modestly firmer facilitated by an attempted recovery in base metals, but with gains capped as the risk tone remains cautious ahead of the aforementioned risk events.

- PBoC set USD/CNY mid-point at 7.1133 vs exp. 7.2558 (prev. 7.1135).

- Click for a detailed summary

- Click for NY OpEx details

FIXED INCOME

- USTs are flat ahead of US CPI for one final read into the FOMC meeting where market pricing currently has a 99% chance of an unchanged rate. Currently holding near a fresh WTD high at 109-20, sparked by Tuesday's strong US auction.

- Bunds are firmer with initial impetus stemming from Tuesday's strong US auction and perhaps some marginal follow through from UK GDP numbers. Bunds are within a 130.21-130.50 bound, and have edged down towards the mid-point of the range after a poorly received Bund auction.

- Gilts are firmer, in tandem with broader strength in EGBs/USTs; amidst this, the morning's UK GDP metrics were broadly in-line but the internals around Construction/Manufacturing were soft and sparked a very modest dovish move to BoE pricing.

- Germany sells EUR 3.3bln vs exp. EUR 4bln 2.20% 2034 Bund: b/c 2.0x (prev. 2.8x), average yield 2.6% (prev. 2.53%) & retention 16.75% (prev. 17.9%).

- UK sells GBP 900mln 0.625% I/L Gilt 2045: b/c 3.88x real yield 1.304%

- Click for a detailed summary

COMMODITIES

- Crude is firmer and at session highs, continuing to build on yesterday's bullish private inventory data which saw a larger than expected draw in crude and gasoline. Additionally, geopolitical updates out of Israel/Hezbollah point towards recent escalations within the region. Brent Aug currently around USD 82.85/bbl.

- Precious metals are flat/mixed as traders look ahead to the US CPI and FOMC; XAU sits in a USD 2,310.60-2,317.70/oz range.

- Base metals are attempting a recovery from the recent slide in prices induced by Fed expectations following Friday's NFP data. Chinese inflation did little to sway prices as trades await upcoming US macro events.

- IEA Oil Market Report: lowers 2024 demand growth forecast by 100k BPD to 960k BPD; 2025 oil demand growth seen at 1mln BPD amid a muted economy and clean energy tech deployment; major oil surplus seen this decade as demand peaks.

- UBS says on Gold "we have raised our 2024 avg. forecast and year-end target by 8% to USD 2365 and USD 2600 respectively"

- US Private Inventory Report (bbls): Crude -2.4mln (exp. -1.05mln), Cushing -1.9mln, Distillate +1mln (exp. +1.6mln), Gasoline -2.5mln (exp. +0.9mln).

- Azerbaijan oil production was 62.1k/T day in May.

- Click for a detailed summary

CRYPTO

- Bitcoin in consolidation mode in-fitting with broader markets; currently sitting just above USD 67k.

NOTABLE DATA RECAP

- UK GDP Estimate MM (Apr) 0.0% vs. Exp. 0.00% (Prev. 0.40%); YY (Apr) 0.6% vs. Exp. 0.60% (Prev. 0.70%); 3M/3M (Apr) 0.7% vs. Exp. 0.70% (Prev. 0.60%)

- UK GDP Estimate 3M/3M (Apr) 0.7% vs. Exp. 0.70% (Prev. 0.60%); GDP Estimate YY (Apr) 0.6% vs. Exp. 0.60% (Prev. 0.70%)

- UK Services YY (Apr) 1.1% vs. Exp. 0.80% (Prev. 1.00%); Services MM (Apr) 0.2% vs. Exp. -0.10% (Prev. 0.50%)

- UK Goods Trade Balance GBP (Apr) -19.607B GB vs. Exp. -14.2B GB (Prev. -13.967B GB, Rev. -13.967B GB)

- UK Construction O/P Vol YY (Apr) -3.3% vs. Exp. -1.8% (Prev. -2.2%); Construction O/P Vol MM (Apr) -1.4% (Prev. -0.4%)

- UK Manufacturing Output YY (Apr) 0.4% vs. Exp. 1.6% (Prev. 2.3%); Manufacturing Output MM (Apr) -1.4% vs. Exp. -0.2% (Prev. 0.3%)

- UK Industrial Output YY (Apr) -0.4% vs. Exp. 0.3% (Prev. 0.5%); Industrial Output MM (Apr) -0.9% vs. Exp. -0.1% (Prev. 0.2%)

- German CPI Final MM (May) 0.1% vs. Exp. 0.1% (Prev. 0.1%); HICP Final YY (May) 2.8% vs. Exp. 2.8% (Prev. 2.8%); HICP Final MM (May) 0.2% vs. Exp. 0.2% (Prev. 0.2%); CPI Final YY (May) 2.4% vs. Exp. 2.4% (Prev. 2.4%)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks sees hopes of further rate cuts this year. Need to be convinced that inflation will not return.

- ECB's Villeroy says inflation will be below 2% in France starting next year, even at 1.7%.

- ECB Schnabel says the economy is recovering gradually, last mile of disinflation is proving bumpy; first indications of easing wage growth.

- UBS expects BoE to start cutting interest rates in August (prev. forecast June)

- French President Macron says they have not been able to form lasting coalitions. EU vote clear, could not be ignored.

NOTABLE US HEADLINES

- Oracle (ORCL) Q4 2024 (USD): Adj. EPS 1.63 (exp. 1.65), revenue 14.30bln (exp. 14.59bln); Cloud services and license support revenue rose 9.2% Y/Y to 10.23bln (exp. 10.2bln). Cloud license and on-premise license revenue fell 15% Y/Y to USD 1.84bln (exp. 2.09bln). Hardware revenue fell 0.9% Y/Y to USD 842mln (exp. 796.3mln). Service revenue fell 6.3% Y/Y to USD 1.37bln (exp. 1.4bln). Sees continued strong AI demand to push sales and RPO even higher throughout fiscal year 2025 and result in double-digit revenue growth. Guides Q1 EPS 1.31-1.35 or 1.33-1.37 in constant currency (exp. 1.32) guides rev. to grow 5-7% or 6-8% cc (exp. 7.2%). Additionally, Oracle (ORCL) and Alphabet's (GOOG) Google Cloud announce a ground-breaking multicloud partnership in which OpenAI selects Oracle Cloud infrastructure to extend Microsoft's (MSFT) Azure AI platform. ORCL +8.5% in pre-market trade.

GEOPOLITICS

MIDDLE EAST

- Rocket sirens are reportedly sounding over several towns in Northern Israel, according to Horowitz on X; Israeli media says "Heavy bombardment from Lebanon towards northern Israel, and sirens activated in Tiberias, Safed, and Galilee" via Sky News Arabia.

- IDF Radio reports "More than 100 rockets fired from the south Lebanon on Safed, Tiberias and their surroundings in a few minutes".

- Hamas official said their response to the Gaza ceasefire deal is responsible, serious, and positive, while the official added the response opens a wide way to reach an agreement.

- Israeli official said Hamas has rejected the proposal for a hostage release presented by US President Biden, while the official added that Israel received the Hamas response via mediators and that Hamas changed the proposal's main parameters.

- Israeli airstrike on south Lebanon killed four people including a senior Hezbollah field commander, according to three security sources cited by Reuters. It was later noted that the Hezbollah commander killed in an Israeli airstrike on Tuesday was the most senior member killed in the last 8 months.

- US Pentagon said Secretary of Defense Austin discussed with his Israeli counterpart by phone efforts to calm tensions along the Israeli-Lebanese border, according to Sky News Arabia.

- Rocket sirens are reportedly sounding over several towns in Northern Israel, according to Horowitz on X; Israeli media says "Heavy bombardment from Lebanon towards northern Israel, and sirens activated in Tiberias, Safed, and Galilee" via Sky News Arabia; IDF Radio reports "More than 100 rockets fired from the south Lebanon on Safed, Tiberias and their surroundings in a few minutes".

OTHER

- EU is proposing to sanction Russian oil-shipping giant Sovcomflot, according to Bloomberg.

- EU is pushing ahead with Chinese electric vehicle tariffs that are set to bring in more than EUR 2bln a year, despite opposition from Germany, according to FT. European Commission will notify carmakers that it will provisionally impose additional duties of up to 25% on imported Chinese EVs from next month. Note, it was reported that yesterday Chinese Auto Industry Association CPCA said the EU could impose a 20% tariff on Chinese EVs, which is an understandable trade practice.

- Japan mulls sanctioning groups including Chinese firms for aiding Russia's invasion of Ukraine, according to NHK.

APAC TRADE

- APAC stocks were mostly subdued after the mixed handover from US peers as markets braced for the incoming US CPI data and the FOMC announcement.

- ASX 200 was pressured amid weakness in mining, tech, and the defensive sectors.

- Nikkei 225 retreated beneath the 39,000 level as participants digested firmer-than-expected PPI data which rose at the fastest annual pace in 9 months.

- Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong as China Evergrande New Energy Vehicle shares dropped around 20% amid the threat of losing key assets after local administrative bodies demanded repayment of CNY 1.9bln in subsidies by its units. Meanwhile, the mainland was cautious amid frictions with the US and after mixed Chinese inflation data including softer-than-expected CPI and a narrower deflation in factory gate prices.

NOTABLE ASIA-PAC HEADLINES

- US President Biden's administration is to widen sanctions on Wednesday on the sale of semiconductor chips and other goods to Russia, according to Reuters sources. US will change export controls to include US-branded goods and not just those made in the US, while the measures are aimed at targeting third-party sellers in China and Hong Kong that are supplying Russia.

- China reportedly weighs a ban on bank distribution of hedge fund products, according to Bloomberg.

- Chinese Foreign Ministry says EU tariffs on Chinese EVs violate market economy principles and international trade rules; China will take all measures to firmly defend interests.

- EU intends to impose provisional tariffs on Chinese EV's of 21% for cooperating companies, 38.1% for those which have not

DATA RECAP

- Chinese CPI MM (May) -0.1% vs. Exp. 0.0% (Prev. 0.1%); YY (May) 0.3% vs. Exp. 0.4% (Prev. 0.3%)

- Chinese PPI YY (May) -1.4% vs. Exp. -1.5% (Prev. -2.5%)

- Japanese Corp Goods Price MM (May) 0.7% vs. Exp. 0.4% (Prev. 0.3%, Rev. 0.5%); YY (May) 2.4% vs. Exp. 2.0% (Prev. 0.9%, Rev. 1.1%)