Europe Market Open: Softer than expected Chinese CPI into US CPI & the FOMC

12 Jun 2024, 06:35 by Newsquawk Desk

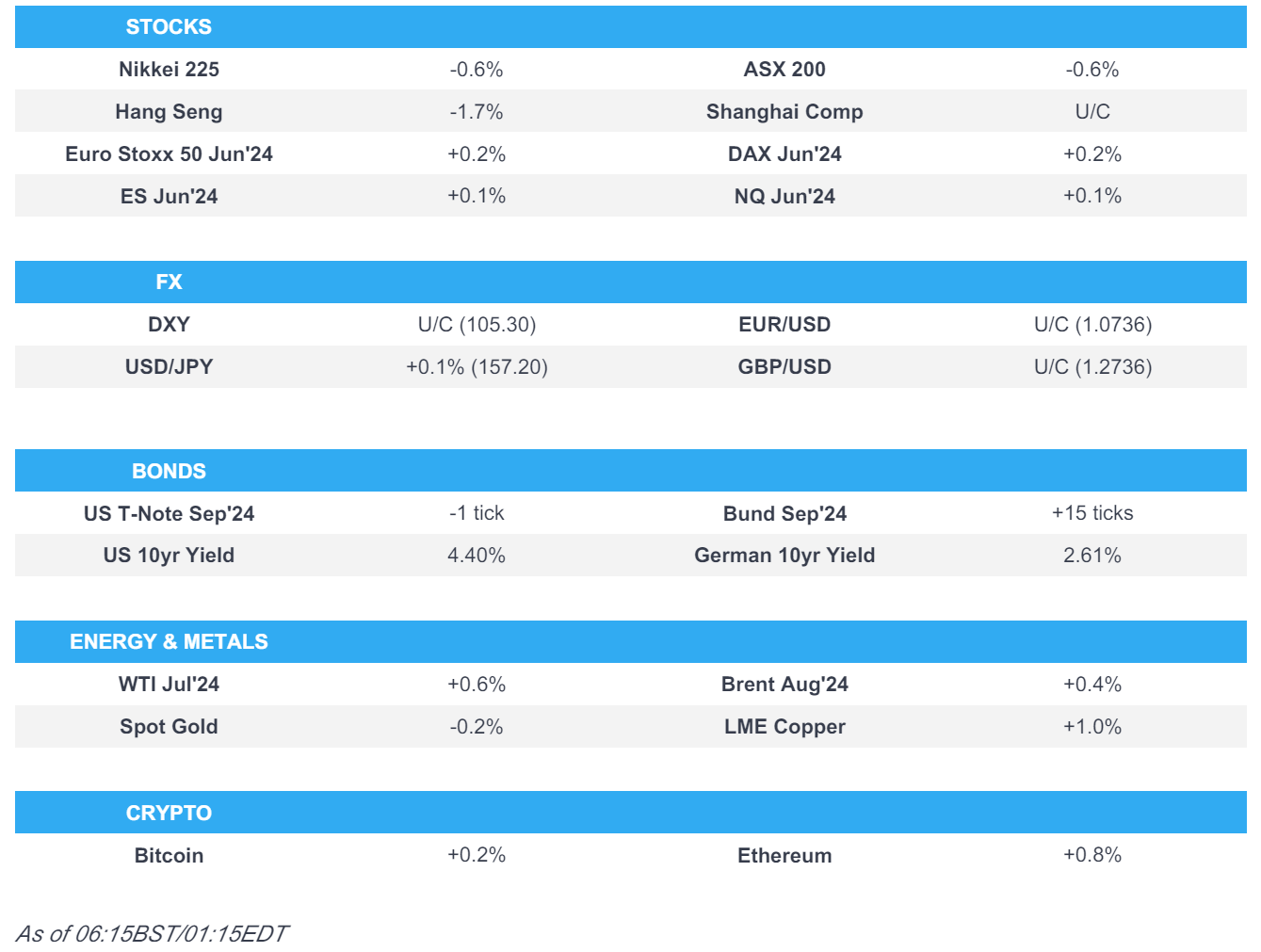

- APAC stocks were mostly subdued after the mixed handover from US peers as markets braced for the incoming US CPI data and the FOMC announcement.

- Chinese inflation data saw softer-than-expected CPI and a narrower deflation in factory gate prices but with little follow-through to markets.

- Israel said it received the Hamas response to the ceasefire proposal via mediators and that Hamas changed the proposal's main parameters.

- Fitch Ratings said France's snap election heightens fiscal and reform uncertainty but there are no immediate implications for France's AA-/Stable rating.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 1.0% on Tuesday.

- Looking ahead, highlights include German HICP (F), UK GDP Estimate, US CPI, Fed Policy Announcement, IEA OMR Comments from ECB’s Schnabel & de Guindos, Fed Chair Powell & BoC Governor Macklem, Supply from UK & Germany, Earnings from Broadcom.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mixed on the eve of the FOMC and US CPI release with outperformance in the Nasdaq amid firm gains in Apple (AAPL) (+7%) after an upgrade from DA Davidson in the wake of the WWDC event on Monday. Meanwhile, the morning weakness surrounding French election uncertainty had unwound once Europe had left for the day and a slump in UST yields following a stellar 10-year auction stateside underpinned US indices to session highs.

- SPX +0.27% at 5,375, NDX +0.71% at 19,210, DJI -0.31% at 38,747, RUT -0.36% at 2,024.

- Click for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued after the mixed handover from US peers as markets braced for the incoming US CPI data and the FOMC announcement.

- ASX 200 was pressured amid weakness in mining, tech, and the defensive sectors.

- Nikkei 225 retreated beneath the 39,000 level as participants digested firmer-than-expected PPI data which rose at the fastest annual pace in 9 months.

- Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong as China Evergrande New Energy Vehicle shares dropped around 20% amid the threat of losing key assets after local administrative bodies demanded repayment of CNY 1.9bln in subsidies by its units. Meanwhile, the mainland was cautious amid frictions with the US and after mixed Chinese inflation data including softer-than-expected CPI and a narrower deflation in factory gate prices.

- US equity futures traded sideways with a lack of conviction ahead of the major risk events.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 1.0% on Tuesday.

FX

- DXY remained above the 105.00 level and lacked commitment as participants awaited US CPI data and the FOMC announcement, while WSJ's Timiraos noted the May CPI release could move one or two rate projections in the SEP and that the line between a median of 1 or 2 cuts seems like a toss-up.

- EUR/USD languished firmly beneath 1.0800 amid the ongoing political uncertainty, while a recent slew of ECB speakers did little to spur the currency including Chief Economist Lane who noted a high level of uncertainty and that still-elevated price pressures were evident in the indicators for domestic inflation.

- GBP/USD lacked direction after yesterday's choppy performance with Industrial, Manufacturing, and Construction Output data scheduled for today alongside monthly GDP estimates.

- USD/JPY traded sideways just above the 157.00 level and largely ignored the risk aversion and firmer-than-expected PPI data.

- Antipodeans were rangebound in the absence of tier-1 releases from both sides of the Tasman and with currencies also unmoved by the mixed Chinese inflation data.

- PBoC set USD/CNY mid-point at 7.1133 vs exp. 7.2558 (prev. 7.1135).

FIXED INCOME

- 10-year UST futures were little changed overnight ahead of today's double bonanza of macro risk events in the US and after prices found some reprieve on Tuesday from a stellar 10-year auction.

- Bund futures sat near yesterday's best levels after rallying back above 130.00 but with further upside restricted ahead of German supply.

- 10-year JGB futures tracked the gains in global peers with the BoJ present in the market for JPY 1.3tln of JGBs.

COMMODITIES

- Crude futures were mildly underpinned after bullish crude and gasoline private sector inventory data.

- US Private Inventory Report (bbls): Crude -2.4mln (exp. -1.05mln), Cushing -1.9mln, Distillate +1mln (exp. +1.6mln), Gasoline -2.5mln (exp. +0.9mln).

- EIA STEO raised its 2024 world oil demand growth forecast by 180k BPD and now sees a 1.1mln BPD Y/Y increase, while it raised the 2025 world oil demand growth view by 80k BPD and now sees 1.5mln BPD Y/Y increase.

- Spot gold was contained as markets braced for the incoming key risk events.

- Copper futures eked mild gains following yesterday's intraday recovery but with advances limited amid the cautious risk tone and mixed Chinese inflation data.

CRYPTO

- Bitcoin was little changed after recovering from an early dip beneath the USD 67,000 level.

NOTABLE ASIA-PAC HEADLINES

- US weighs more limits on China's access to chips needed for AI, US officials are reportedly in early talks on high-bandwidth memory curbs, according to Bloomberg.

- US President Biden's administration is to widen sanctions on Wednesday on the sale of semiconductor chips and other goods to Russia, according to Reuters sources. US will change export controls to include US-branded goods and not just those made in the US, while the measures are aimed at targeting third-party sellers in China and Hong Kong that are supplying Russia.

- China reportedly weighs a ban on bank distribution of hedge fund products, according to Bloomberg.

DATA RECAP

- Chinese CPI MM (May) -0.1% vs. Exp. 0.0% (Prev. 0.1%)

- Chinese CPI YY (May) 0.3% vs. Exp. 0.4% (Prev. 0.3%)

- Chinese PPI YY (May) -1.4% vs. Exp. -1.5% (Prev. -2.5%)

- Japanese Corp Goods Price MM (May) 0.7% vs. Exp. 0.4% (Prev. 0.3%, Rev. 0.5%)

- Japanese Corp Goods Price YY (May) 2.4% vs. Exp. 2.0% (Prev. 0.9%, Rev. 1.1%)

GEOPOLITICAL

MIDDLE EAST

- Hamas and Palestinian Islamic Jihad said they have submitted a response to the proposed Gaza ceasefire deal to Qatari and Egyptian mediators, according to a joint statement. Furthermore, the Hamas response contained amendments to the Israeli proposal such as a new timeline for a permanent ceasefire and withdrawal from Gaza including Rafah, according to a Reuters source.

- Hamas official said their response to the Gaza ceasefire deal is responsible, serious, and positive, while the official added the response opens a wide way to reach an agreement.

- Israeli official said Hamas has rejected the proposal for a hostage release presented by US President Biden, while the official added that Israel received the Hamas response via mediators and that Hamas changed the proposal's main parameters.

- Israeli airstrike on south Lebanon killed four people including a senior Hezbollah field commander, according to three security sources cited by Reuters. It was later noted that the Hezbollah commander killed in an Israeli airstrike on Tuesday was the most senior member killed in the last 8 months.

- US Pentagon said Secretary of Defense Austin discussed with his Israeli counterpart by phone efforts to calm tensions along the Israeli-Lebanese border, according to Sky News Arabia.

OTHER

- EU is proposing to sanction Russian oil-shipping giant Sovcomflot, according to Bloomberg.

- EU is pushing ahead with Chinese electric vehicle tariffs that are set to bring in more than EUR 2bln a year, despite opposition from Germany, according to FT. European Commission will notify carmakers that it will provisionally impose additional duties of up to 25% on imported Chinese EVs from next month. Note, it was reported that yesterday Chinese Auto Industry Association CPCA said the EU could impose a 20% tariff on Chinese EVs, which is an understandable trade practice.

- Japan mulls sanctioning groups including Chinese firms for aiding Russia's invasion of Ukraine, according to NHK.

EU/UK

NOTABLE HEADLINES

- Fitch Ratings said France's snap election heightens fiscal and reform uncertainty, while it has increased uncertainty around policy settings but there are no immediate implications for France's AA-/Stable rating.