US Market Open: Equities pressured, Gilts bid post-UK jobs & USD gains; ECB speak due

11 Jun 2024, 11:05 by Newsquawk Desk

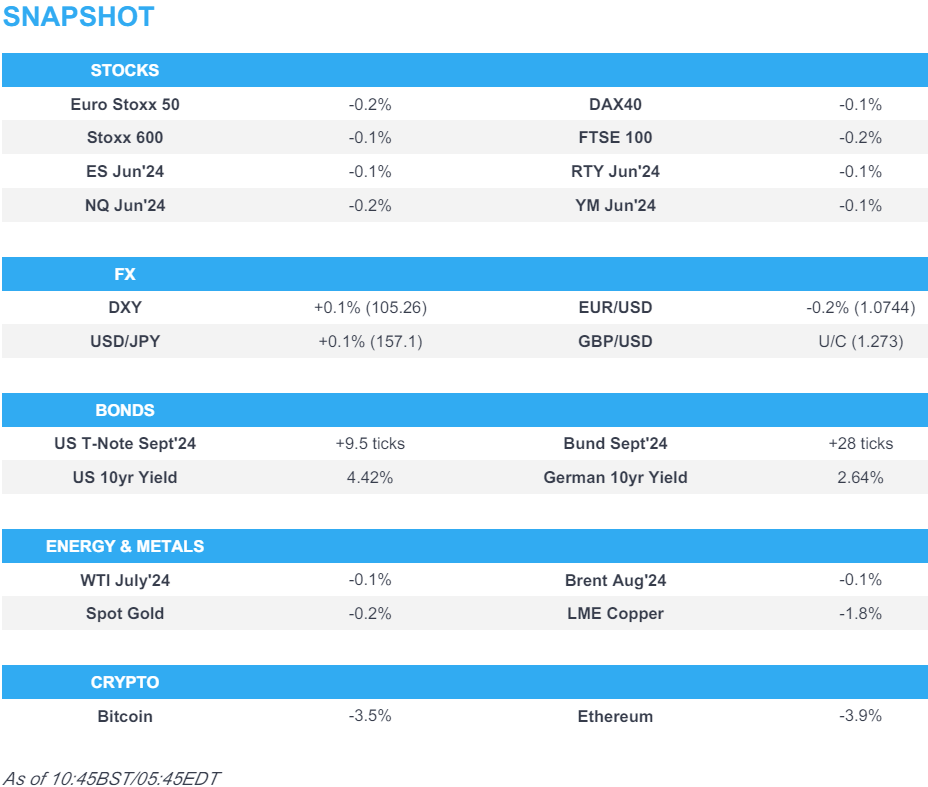

- Equities are modestly in the red, in a continuation of the downbeat mood seen in APAC trade overnight

- Dollar is incrementally firmer, EUR continues to slip and GBP is slightly softer following the UK’s job data which saw an unexpected uptick in the unemployment rate

- Bonds are in the green, attempting to recoup post-NFP losses, OATs remain pressured and Gilts outperform taking a bid after a record Gilt sale

- Crude is slightly softer, XAU is subdued and base metals are considerably weaker after poor Chinese performance overnight

- Looking ahead, US NFIB Business Optimism Index, EIA STEO & OPEC MOMR, Comments from ECB’s Lane, Holzmann, Makhlouf & Elderson, Supply from the US, Earnings from Oracle

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.4%) began the session on a modestly firmer footing, though did succumb to slight selling pressure as the morning progressed, in a continuation of the downbeat mood in APAC trade overnight.

- European sectors are mixed, with the breadth of the market fairly narrow. Basic Resources is the standout laggard, given the broader weakness in metals prices.

- US equity futures (ES -0.2%, NQ -0.3%, RTY -0.7%) are modestly in the red, with price action tentative ahead of Wednesday's key risk events, including the FOMC & US CPI.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly steady vs. peers with DXY holding above the 105 mark and within yesterday's 104.93-105.38 range; trade is contained ahead of Wednesday's CPI/FOMC where focus will reside on the M/M core rate and any adjustments to the Fed's FFR dots.

- EUR is softer vs. the USD and ultimately still weighed on via the double-whammy of Friday's NFP and the weekend's EU parliamentary elections. For now, the pair is stuck on a 1.07 handle and holding above Monday's 1.0732 low.

- GBP is a touch softer vs. both the USD following UK jobs metrics which showed an unexpected uptick in unemployment, a larger-than-expected decline in employment, and mixed, but sticky wage growth. Cable ventured as low as 1.2714 but refrained from testing the 1.27 mark.

- JPY is marginally building on the losses vs. the USD seen since Friday with USD/JPY now up to 157.38.

- Antipodeans are both steady vs. the USD in quiet trade after managing to claw back some of Friday's losses during yesterday's session.

- PBoC set USD/CNY mid-point at 7.1135 vs exp. 7.2724 (prev. 7.1106).

- Click for a detailed summary

- Click for NY OpEx details

FIXED INCOME

- USTs are firmer but ultimately unable to recoup much of the lost ground seen in the wake of Friday's NFP release; price action has been tentative as focus lies on the US CPI and FOMC on Wednesday. The Sep'24 UST contract continues to hold above the 109 mark and did catch a recent bid in tandem with news that French President Macron is said to be mulling potential resignations in the case of a possible right-wing victory in early parliamentary elections, according to News AZ - although this was later denied. A record Gilt sale also played a factor.

- European debt markets are slightly more contained, though OATs remain under pressure with Moody's noting that the snap election called by Macron is negative for the nation's credit rating. Sep'24 Bund sits towards the bottom end of yesterday's 129.52-130.27 range.

- Gilts are outperforming peers on account of the latest UK jobs data, which showed an unexpected uptick in unemployment and mixed, but sticky wage growth. Gilts are currently higher by around 35 ticks, taking another leg higher after UK got a record GBP 104bln in orders for its Gilt sale, via Bloomberg; beating the prior record of GBP 100bln; pricing +4bps over UKT, pricing expected later on Tuesday.

- Click for a detailed summary

COMMODITIES

- Crude is slightly softer after spending much of the session flat in what has been a catalyst thin session, except for news that Hamas is reportedly ready to negotiate the details of the ceasefire following yesterday's UNSC vote; oil markets were unreactive to the news. Brent Aug trades within 81.37-82.02/bbl.

- Bullish price action across nat gas futures with US Henry Hub front-month back above USD 3/MMBtu for the first time since January. The rise in US prices is partly attributed to expectations of a tightening market in the medium-to-long term.

- Subdued trade across precious metals despite relatively steady markets elsewhere aside from metals. Spot gold is flat/modestly lower while spot silver and spot palladium see deeper losses to the tune of -1.5 to 1.7%.

- Considerable weakness across base metals with desks citing recent developments of US rate cuts expectations coupled with high Chinese inventories whilst a softer CNY also reduces the purchasing power of Chinese buyers.

- India Oil Minister said India state refiners in talks for long term oil import deal with Russia.

- OPEC MOMR to be released at 12:30 BST/ 07:30 EDT.

- Click for a detailed summary

CRYPTO

- Bitcoin slips below USD 68k with Ethereum also dipping towards USD 3.5k, giving back some of its overnight advances.

- Crypto insiders are said to be meeting with US Senate staffers to try to resolve a surprise crypto policy push embedded in a recent Senate spending package that cleared the intelligence committee, according to CoinDesk.

NOTABLE DATA RECAP

- UK ILO Unemployment Rate (Apr) 4.4% vs. Exp. 4.3% (Prev. 4.3%); Employment Change (Apr) -140k vs. Exp. -100k (Prev. -177k); HMRC Payrolls Change (May) -3k (Prev. -85k); Claimant Count Unem Chng (May) 50.4k (Prev. 8.9k, Rev. 8.4k); Avg Earnings (Ex-Bonus) (Apr) 6.0% vs. Exp. 6.1% (Prev. 6.0%); Avg Wk Earnings 3M YY (Apr) 5.9% vs. Exp. 5.7% (Prev. 5.7%, Rev. 5.9%)

- Czech CPI MM (May) 0.0% vs. Exp. 0.1% (Prev. 0.7%); CPI YY (May) 2.6% vs. Exp. 2.8% (Prev. 2.9%)

NOTABLE EUROPEAN HEADLINES

- ECB's Villeroy said rate reduction markets a "decisive orientation"; limited spill-over from Fed/ECB's difference in timing. Fed policy should not greatly impact the ECB's. Significant leeway to reduce rates before exiting restrictive territory. Monitoring actual inflation data, in particular for services but monthly figures will be volatile due to base effects on energy. "Noise" is not very meaningful and as such is more outlook driven. Will look more closely at inflation forecasts. Remains confident that the Bank will bring inflation to target by next year; will reach it with a soft, rather than hard landing.

- ECB's Simkus said it is too early to declare victory over inflation; rates can be cut more if ECB is sure the 2% inflation target will be met.

- ECB's Rehn said monetary policy has dampened price pressures; considerable progress has been made. ECB knows the inflation path is a bumpy road, but sees stabilisation ahead

- France's National Rally party and lawmaker Marion Marechal are in talks about potentially joining forces to oppose President Macron in the upcoming elections, according to Bloomberg.

- Moody's said France's snap election is negative for France's credit rating; said outlook and rating could move to negative if interest payments relative to revenue and GDP are seen to be significantly larger than peers.

- French President Macron is said to be mulling potential resignations in the case of a possible right-wing victory in early parliamentary elections, according to News AZ.

- French Elysee Palace has reportedly denied media reports suggesting that French President Macron might resign.

- French President Macron is to hold a press conference on June 12 around 11:00 BST/ 06:00 EDT.

NOTABLE US HEADLINES

- Tesla (TSLA) exported 17,358 China-made vehicles in May (vs 30,746 in April), according to China's CPCA.

GEOPOLITICS

MIDDLE EAST

- Israel conducted raids on the Hosh al-Sayed Ali area of the Hermel district near the Lebanese-Syrian border, according to Al Jazeera.

- US State Department said Secretary of State Blinken discussed with Israeli Defence Minister Gallant on Monday the Gaza ceasefire proposal.

- "Hamas ready to implement ceasefire agreement: Senior official", via IRNA; Senior Hamas official Mahmoud al-Mardawi said that the Hamas movement is ready to cooperate for the implementation of the ceasefire agreement. According to the Palestinian Samaa News Agency, al-Mardawi made the remarks in reaction to a United Nations Security Council (UNSC) resolution; Wider reporting: Hamas agreed to Security Council ceasefire resolution and is ready to negotiate details, according to a Hamas official cited by Reuters.

- "Israeli media: About 40 rockets were launched from southern Lebanon and one landed in the Upper Galilee", according to Sky News Arabia.

OTHERS

- US President Biden is to lift the ban on allowing a controversial Ukrainian unit to use US weapons, according to The Washington Post.

- South Korean military said it fired warning shots after North Korean soldiers briefly crossed the border on Sunday, according to Yonhap.

APAC TRADE

- APAC stocks traded with a negative bias after the choppy performance stateside where the S&P 500 and Nasdaq notched fresh record closes but the gains were capped ahead of the mid-week key events.

- ASX 200 declined amid broad weakness across sectors and as miners led the descent.

- Nikkei 225 bucked the trend as it benefitted from recent currency weakness.

- Hang Seng and Shanghai Comp. were pressured amid ongoing property sector concerns after a Hong Kong court issued a wind-up order to Chinese property developer Dexin China.

NOTABLE ASIA-PAC HEADLINES

- China's Auto Industry CPCA said China sold 1.72mln passenger cars in May, -2.2% Y/Y; said China's pure EV exports saw a temporary decline in May amid Red Sea shipping issues alongside other factors; still have strong growth momentum despite disruptions in European markets.

- China saw 110mln domestic tourist trips during the three-day Dragon Boat Festival holiday and official data showed that Chinese cross-border trips rose 45.1% Y/Y during the three-day holiday.

- Hong Kong court issued a wind-up order to Chinese property developer Dexin China (2019 HK), while it was later reported that Dexin China suspended trading in Hong Kong.

DATA RECAP

- Australian NAB Business Confidence (May) -3.0 (Prev. 1.0)

- Australian NAB Business Conditions (May) 6.0 (Prev. 7.0)