Europe Market Open: Negative bias in APAC after the choppy performance stateside; S&P 500 and Nasdaq notched fresh record closes

11 Jun 2024, 06:29 by Newsquawk Desk

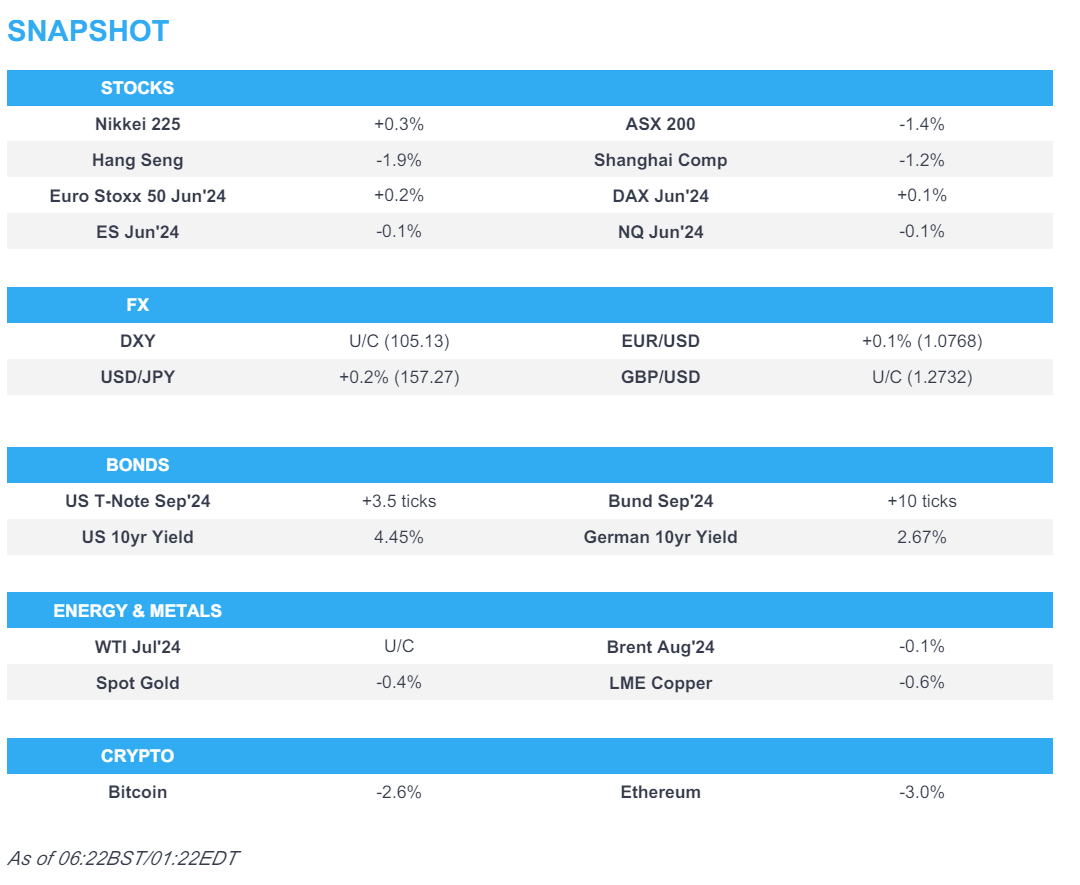

- APAC stocks traded with a negative bias after the choppy performance stateside; S&P 500 and Nasdaq notched fresh record closes.

- Apple closed down 1.9% after its WWDC event failed to ignite enthusiasm; announced an integration of ChatGPT.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 0.7% on Monday.

- DXY is holding above the 105 mark, with FX markets broadly contained, EUR/USD remains on a 1.07 handle.

- Looking ahead, highlights include UK Employment Data, US NFIB Business Optimism Index, EIA STEO & OPEC MOMR, Comments from ECB’s Lane & Elderson, Supply from Netherlands & US, Earnings from Oracle.

US TRADE

EQUITIES

- US stocks eked marginal gains after having shrugged off the downbeat mood seen in Europe following the EU Parliamentary elections over the weekend which saw far-right parties make notable gains and spurred French President Macron to call for a snap election. Nonetheless, US equities clawed back earlier losses once cash trade got underway, while the S&P 500 and Nasdaq 100 printed fresh record closes albeit with gains capped in quiet trade and as participants await upcoming risk events.

- SPX +0.26% at 5,361, NDX +0.39% at 19,075, DJI +0.18% at 38,868, RUT +0.25% at 2,032.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Apple (AAPL) announced at the WWDC its Vision OS2 and expanded Apple Vision Pro to eight new countries, while it also announced Apple Tap to Pay and confirmed a deal with OpenAI to integrate ChatGPT for iPhones. iPads and Macs.

APAC TRADE

EQUITIES

- APAC stocks traded with a negative bias after the choppy performance stateside where the S&P 500 and Nasdaq notched fresh record closes but the gains were capped ahead of the mid-week key events.

- ASX 200 declined amid broad weakness across sectors and as miners led the descent.

- Nikkei 225 bucked the trend as it benefitted from recent currency weakness.

- Hang Seng and Shanghai Comp. were pressured amid ongoing property sector concerns after a Hong Kong court issued a wind-up order to Chinese property developer Dexin China.

- US equity futures were lacklustre amid the risk aversion in Asia and as key risk events loom.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed down 0.7% on Monday.

FX

- DXY traded steadily overnight slightly above the 105.00 level amid a lack of fresh drivers and as participants await Wednesday's US CPI release, the FOMC rate decision and the latest SEPs.

- EUR/USD remained contained after the recent politically triggered underperformance and with a few ECB speakers scheduled later today.

- GBP/USD eked slight gains after recovering from a brief dip beneath the 1.2700 handle, while the focus for GBP turns to the looming UK Employment Change and Average Earnings data.

- USD/JPY mildly extended above 157.00 amid light catalysts and the absence of jawboning.

- Antipodeans were lacklustre with headwinds from the mostly negative risk tone and following weaker NAB Business Surveys from Australia which showed business confidence slipped into negative territory.

- PBoC set USD/CNY mid-point at 7.1135 vs exp. 7.2724 (prev. 7.1106).

FIXED INCOME

- 10-year UST futures attempted to nurse some of its post-NFP losses after finding support around the 109.00 level but with the recovery limited ahead of a 10-year auction and Wednesday's key risk events.

- Bund futures were off the prior day's lows although remained sub-130.00 as attention turned to upcoming ECB speakers, while Lagarde recently noted they can keep rates on hold for as long as needed.

- 10-year JGB futures partially recovered some of the recent lost ground heading into an enhanced liquidity auction for long to super-long JGBs which saw a muted reaction despite attracting firmer interest.

COMMODITIES

- Crude futures were little changed overnight and held on to most of the prior day's spoils after rallying on upcoming summer fuel demand and lingering geopolitical risks.

- European officials are reportedly in talks to keep gas flowing through a key Russia-Ukraine pipeline, according to Bloomberg.

- Spot gold traded rangebound heading closer to the mid-week key events and after having reclaimed the USD 2,300/oz level.

- Copper futures were subdued after the recent sideways price action and amid the downbeat risk tone in its largest purchaser China amid property sector concerns.

CRYPTO

- Bitcoin was pressured overnight and slipped firmly beneath the USD 69,000 level.

- Crypto insiders are said to be meeting with US Senate staffers to try to resolve a surprise crypto policy push embedded in a recent Senate spending package that cleared the intelligence committee, according to CoinDesk.

NOTABLE ASIA-PAC HEADLINES

- China saw 110mln domestic tourist trips during the three-day Dragon Boat Festival holiday and official data showed that Chinese cross-border trips rose 45.1% Y/Y during the three-day holiday.

- Hong Kong court issued a wind-up order to Chinese property developer Dexin China (2019 HK), while it was later reported that Dexin China suspended trading in Hong Kong.

DATA RECAP

- Australian NAB Business Confidence (May) -3.0 (Prev. 1.0)

- Australian NAB Business Conditions (May) 6.0 (Prev. 7.0)

GEOPOLITICAL

MIDDLE EAST

- Israel conducted raids on the Hosh al-Sayed Ali area of the Hermel district near the Lebanese-Syrian border, according to Al Jazeera.

- US State Department said Secretary of State Blinken discussed with Israeli Defence Minister Gallant on Monday the Gaza ceasefire proposal.

OTHER

- US President Biden is to lift the ban on allowing a controversial Ukrainian unit to use US weapons, according to The Washington Post.

- South Korean military said it fired warning shots after North Korean soldiers briefly crossed the border on Sunday, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak pledged to 'keep cutting people's taxes' as part of the Tory election manifesto, according to The Standard. It was also reported that the Conservative Party unveiled a 100% capital gains tax break for landlords who sell properties to their tenants, according to The Telegraph.

- French President Macron is to give a press conference on Tuesday to explain his decision to call early elections and to appeal to voters to reject the far right, according to Eurasia Group.

- France's National Rally party and lawmaker Marion Marechal are in talks about potentially joining forces to oppose President Macron in the upcoming elections, according to Bloomberg.

- ECB President Lagarde said interest rates are not necessarily on a linear declining path and there might be periods when they hold, while she said it is possible the ECB will hold rates for longer than a single meeting and noted that time-dependent guidance on rates is not helpful. It was separately reported in FT that Lagarde said the ECB can keep rates on hold for as long as needed.