US Market Open: European assets hit by EU election results, USD continues post-NFP gains

10 Jun 2024, 10:55 by Newsquawk Desk

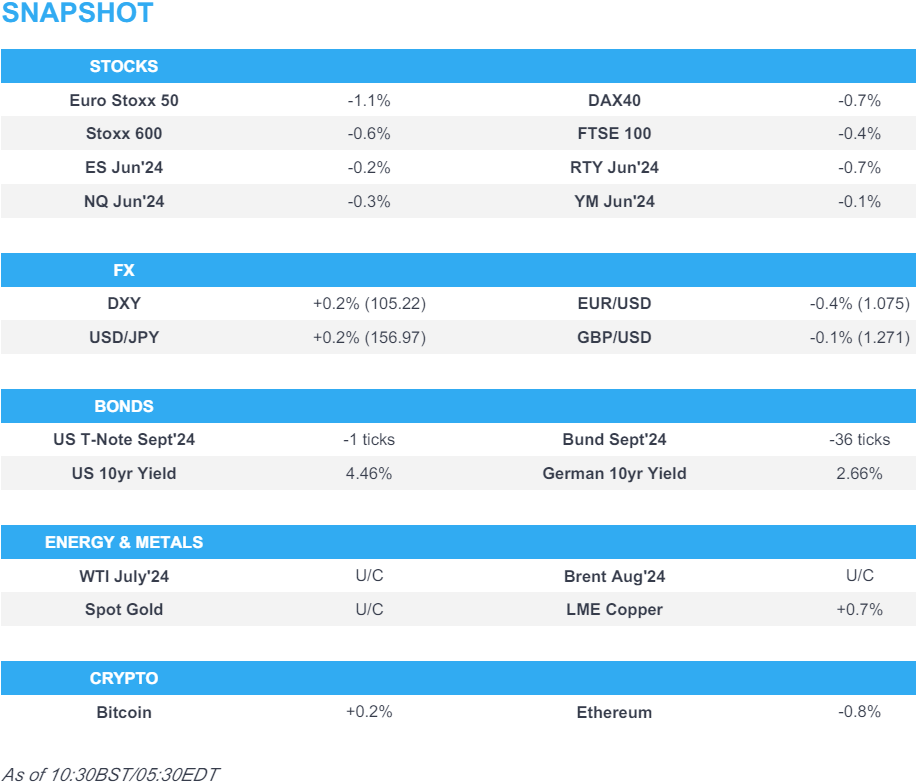

- European bourses are entirely in the red, with sentiment hit amid political uncertainty in Europe whereby the centre-right strengthened its majority although the far-right made gains; US equity futures are marginally softer, with the RTY underperforming

- Dollar is firmer in a continuation of post-NFP strength, EUR is hampered by political uncertainty

- USTs are flat and resilient to the downbeat mood in European peers; OATs underperform after French President Macron calls for a snap election

- Crude is softer after spending much of the European morning in the green, XAU is flat and base metals gain

- Looking ahead, US Employment Trends, Chinese Money Supply, Supply from the US

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600** (-1.2%), sank at the open and resides at lows amid the political uncertainty in Europe whereby the centre-right strengthened its majority although the far-right made gains - this prompted French President Macron to announce a snap election, which has resulted in the CAC 40 (-1.8%) underperforming.

- European sectors are entirely in the red. Construction & Materials are found at the bottom of the pile, alongside Autos and Banks, largely dragged down by significant losses in French stocks.

- US equity futures (ES -0.3%, NQ -0.3%, RTY -0.8%) are entirely in the red, in tandem with broader sentiment in Europe, albeit to a lesser magnitude; the RTY underperforms, continuing the post-NFP downside seen on Friday.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- USD is extending on Friday's post-NFP gains with a softer EUR helping boost DXY to a 105.30 high (highest since May 14th). Macro focus for the US this week falls on CPI and FOMC both due on Wednesday.

- EUR is the standout laggard across the majors following the EU parliamentary elections which have stoked uncertainty across the bloc, particularly in France. EUR/USD gapped lower and slipped beneath its 100 and 200DMAs with the current low at 1.0748. In terms of notable OpEx, there are also some large near-the-money clips due to roll-off.

- GBP is softer vs the Dollar though is holding up better than peers due to cross-related selling in EUR/GBP which sits at its lowest level since August'22 (0.8454 is the current session low). Cable currently holding just above 1.27.

- JPY is losing ground to the broadly firmer USD in what is a big week for the pair with rate decisions from the FOMC and BoJ. In recent trade, the USD/JPY has dipped below 157.00, and currently holds around 156.80.

- Antipodeans are both holding up relatively well vs. the USD despite the flimsy risk sentiment in the market. Performance is likely due to the particularly bruising session on Friday post-NFP which sent AUD/USD down as low as 0.6577 vs. an opening price of 0.6664.

- Click here for more details.

- Click here for NY OpEx details.

FIXED INCOME

- USTs are currently immune to the downbeat mood in European fixed income markets; drivers this week for US paper include US CPI, FOMC alongside dot plots and a heavy supply slate. Sept'24 UST currently holding above the 109 mark, with the current low at 109.02.

- European bonds are pressured given the political events over the weekend, which saw the centre-right hold at an EU level, and a strong performance for the far-right. As it stands, Bunds have dipped below 130.00 and looking to test the trough from 3rd June at 129.83; OATs underperform, after French President Macron dissolved the French parliament and announced a snap election.

- Gilts are on the backfoot, in tandem with European peers, albeit to a lesser extent. The Sep'24 Gilt contract has slipped further on a 96 handle with 96.37 the current session low.

- DE/IT 10yr spread is wider by 7.5bps with the Italian 10yr yield at its highest level since December. DE/FR 10yr spread is wider by 5.6bps with the French 10yr yield at its highest level since May 31st.

- Click here for more details.

COMMODITIES

- Crude was firmer for a large part of the European morning, before succumbing to some selling pressure in tandem with the risk sentiment and stronger Dollar. Geopolitics over the weekend has not seen any major escalation. Brent Aug currently trading in a USD 79.34-80.14/bbl parameter.

- Upward tilt in spot gold and spot palladium but spot silver majorly outperform following the hefty post-NFP slump on Friday which took the metal from USD 31.50/oz highs to USD 29.10/oz lows.

- Base metals are modestly firmer as the complex attempts a recovery from the post-NFP slump on Friday, in which the pushback in US rate cut expectations hit the economy-linked base metals, whilst traders look ahead to China's inflation numbers before US CPI and FOMC on Wednesday.

- Iraq set the July Basrah medium crude official selling price to Asia at plus USD 0.60/bbl vs Oman/Dubai average and to Europe at minus USD 2.85/bbl vs dated Brent, while it set the OSP to North and South America at minus USD 0.65/bbl vs ASCI, according to SOMO.

- Iraqi Oil Minister said there was progress in talks held on Sunday with Kurdish regional government officials regarding resuming northern oil exports, according to Reuters.

- Citi on gold: Thinks support (May low and double top neckline) at USD 2,277/oz will hold short-term; if weekly close is below USD 2,277/oz, it would initiate a double top formation and could see further losses. Citi retains long-term bullish view between USD 2,500-2,523/oz.

- Click here for more details.

CRYPTO

- Bitcoin is relatively unchanged and holds around USD 69k, whilst Ethereum dips below USD 3.7k.

NOTABLE DATA RECAP

- EU Sentix Index (Jun) 0.3 vs. Exp. -1.8 (Prev. -3.6)

- Norwegian Consumer Price Index YY (May) 3.0% vs. Exp. 3.3% (Prev. 3.6%); Core Inflation YY (May) 4.1% vs. Exp. 4.0% (Prev. 4.4%); Consumer Price Index MM (May) -0.1% vs. Exp. 0.1% (Prev. 0.8%); Core Inflation MM (May) 0.5% vs. Exp. 0.4% (Prev. 0.9%)

- Swedish GDP MM (Apr) -0.7% (Prev. -0.3%, Rev. -0.4%)

- Italian Industrial Output MM SA (Apr) -1.0% vs. Exp. 0.2% (Prev. -0.5%); Industrial Output YY WDA (Apr) -2.9% (Prev. -3.5%, Rev. -3.2%)

NOTABLE EUROPEAN HEADLINES

- UK PM Sunak is set to promise another 2p cut to national insurance in the Conservative manifesto, according to The Sunday Times.

- Transatlantic trade association BritishAmerican Business chief said US companies are worried the costs of operating in the UK would increase under a Labour government, making the country a less attractive place to invest, according to FT.

- Deltapoll survey showed UK opposition Labour Party with 46% of support (-2) vs the ruling Conservative Party at 21% (-4) with the Labour Party set to gain a 416 majority.

- The centre-right European People’s Party is set to hold the most seats in the European Parliament with 189 seats, according to the latest EU-wide projections cited by Reuters. However, far-right parties made significant gains as they performed well in Germany and comfortably won in France which prompted French President Macon to dissolve parliament and announce snap elections to be held on June 30th and July 7th. Furthermore, Belgian PM Alexander De Croo announced his resignation after the defeat of his party in the European elections, according to APA.

- EU's von der Leyen said there remains a majority in the centre for a strong Europe and the centre is holding but added that extremes on the left and right have gained support, while she is confident she can win a new mandate as EU Commission President.

- ECB’s Holzmann said the ECB can declare victory on inflation when it is at 2%, while he added that they are on the path to an economic recovery.

- ECB's Kazaks said future rate cuts depend on economic outlook; too early to make a definite statement about the future of rate cuts, via Econostream.

- ECB's Kazimir said should not rush into another rate cut and should sit out the summer; September will be a pivotal month as a lot of new data are published by then. Inflation beast not broken yet and price pressures can resurface. Disinflation will be bumpy but confident ECB is moving towards target.

- European Commission this week is expected to disclose the tariff rate for Chinese EVs amid "excessive subsidies", according to Reuters.

NOTABLE US HEADLINES

- Nvidia (NVDA) will trade with its 10-to-1 stock-split price today.

GEOPOLITICS

MIDDLE EAST

- Gaza health ministry said 274 Palestinians were killed and 698 were injured during an Israeli offensive on a Nuseirat camp, while a Palestinian Islamic Jihad official said Israel’s offensive at Nuseirat will not affect the prisoners/hostages swap deal.

- Hamas chief Haniyeh said Israel cannot force its choices on them and they won’t accept any deal that doesn’t achieve security for their people. It was also reported that the Hamas armed wing said three Israeli hostages were killed including a US citizen during an Israeli hostage-freeing operation in Gaza.

- Israeli minister Gantz resigned from the emergency government and called for early elections, while he accused PM Netanyahu of mishandling Israel’s war in Gaza, according to FT.

- US circulated a new draft UN Security Council resolution calling on Hamas to accept the hostage and ceasefire deal, while a vote is expected on Monday, according to two sources with direct knowledge cited by Axios' Ravid.

- Hezbollah said it fired a salvo of Falaq 2 rockets at Israel for the first time.

- Yemen’s Houthis said they targeted a British destroyer and two related ships in the Red Sea with ballistic missiles, although the UK Defence Ministry said assertions by Houthis that they attacked a British destroyer in the Red Sea are false.

- UKMTO said a vessel was hit by an unknown projectile 70 NM southwest of Yemen’s Aden which resulted in a fire although no casualties were reported.

- "The Biden administration discussed the possibility of negotiating a unilateral deal with Hamas independently of Israel to release American hostages through Qatari mediators", via Sky News Arabia citing NBC

OTHERS

- Russian forces appeared to have made headway in the key Ukrainian town of Chasiv Yar, according to sources cited by Reuters.

- Senior Russian Lawmaker says F-16 jets and their bases beyond Ukraine will be legitimate goals for Russian forces if they take part in combat missions

- US National Security Advisor said the Ukrainian army carried out strikes with US weapons on targets in Russian territory, according to Asharq News.

- US President Biden and French President Macron committed to supporting efforts to bring forward extraordinary profits from immobilised Russian sovereign assets for the benefit of Ukraine. Furthermore, they expressed strong concern about transfers of weapons especially from Iran and North Korea, as well as dual-use materials from China to support Russia’s war against Ukraine, while they support actions to curtail access to US and French financial systems for such transfers.

- G7 plans to warn small Chinese banks over helping Russia evade Western sanctions, according to sources cited by Reuters.

- South Korea restarted loudspeaker broadcasts in response to North Korea's sewage balloons, according to Asahi. It was separately reported that North Korean leader Kim's sister warned of new responses against South Korea’s loudspeaker broadcasts and leafleting, while she called for South Korea to stop dangerous acts. Furthermore, the South Korean military later announced that North Korea sent around 310 trash-carrying balloons in its latest launch, according to Yonhap.

- Philippines National Security Adviser said they reaffirmed a commitment to uphold their sovereign rights and jurisdiction over the second Thomas Shoal, while they will continue to maintain and supply their outposts in the South China Sea without seeking permission from any other nation.

APAC TRADE

- APAC stocks began mixed ahead of key events including the FOMC and BoJ policy decisions, as well as US and Chinese CPI data, while it was a holiday-thinned start to the week with markets in Australia, China, Hong Kong and Taiwan all closed for holiday.

- Nikkei 225 advanced on the back of recent currency weakness and after revised GDP data showed a slightly narrower annualised contraction in Japan's economy than initially reported.

- KOSPI traded subdued amid ongoing geopolitical tensions after South Korea restarted loudspeaker broadcasts and North Korea sent another round of waste balloons and warned of new responses.

NOTABLE ASIA-PAC HEADLINES

- China and Pakistan agreed to strengthen mining development and industrial cooperation, while they are willing to actively promote investment and cooperation between Chinese firms in the mining industry in Pakistan and jointly strengthen the planning of mining industry parks including deep processing of ores.

- BoJ is expected to consider whether to scale back its roughly JPY 6tln in monthly government bond purchases at the upcoming meeting as it moves toward policy normalisation, according to a report in Nikkei on Friday.

- Japan's government said in a draft economic blueprint that it will work closely with the BoJ and guide policy 'flexibly' as monetary policy has entered a new stage, while it added that consumption is lacking momentum and the price outlook is uncertain due partly to the declines of the yen.

DATA RECAP

- Japanese GDP Revised QQ (Q1) -0.5% vs. Exp. -0.5% (Prev. -0.5%); GDP Revised Annualised (Q1) -1.8% vs. Exp. -1.9% (Prev. -2.0%)