US Market Open: US equity futures are mixed & EUR slightly higher ahead of the ECB policy announcement

06 Jun 2024, 11:20 by Newsquawk Desk

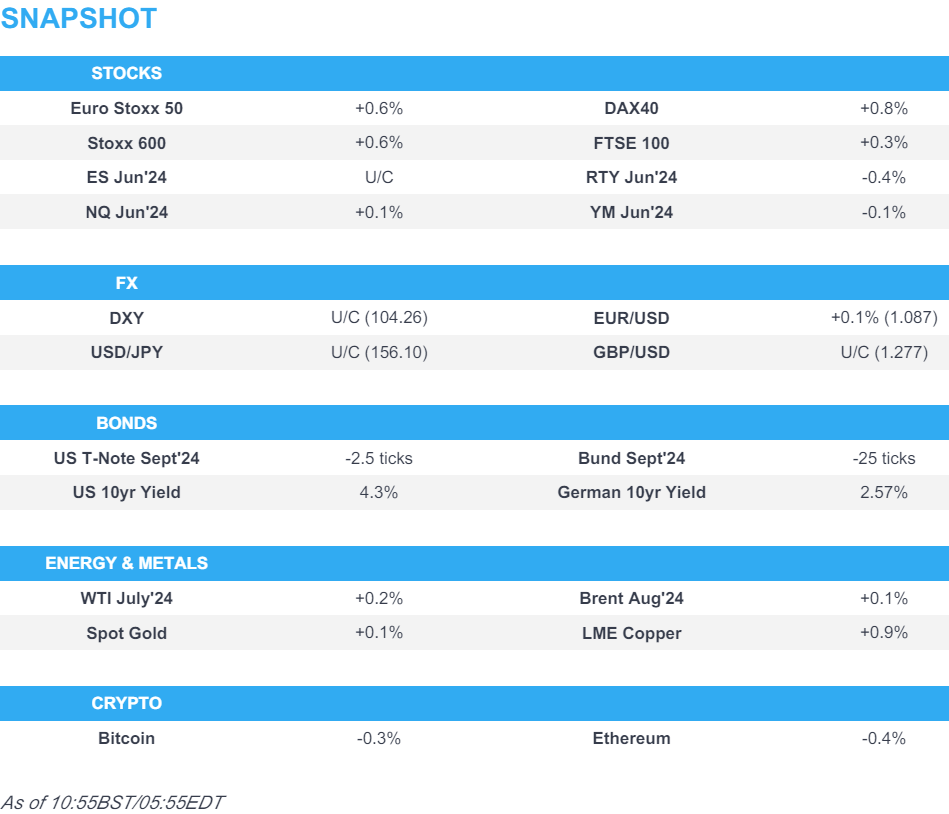

- European bourses extend gains; US futures are mixed, RTY underperforms

- Dollar is flat and EUR incrementally gains ahead of today’s ECB policy announcement

- Bonds are slightly softer, giving back some of this week’s advances

- Crude is now around flat after trading higher for much of the morning, XAU/base metals continue recent strength

- Looking ahead, US Challenger Layoffs, IJC, ECB Policy Announcement and Press Conference

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.6%) began the session on a strong footing, taking impetus from a positive APAC session. As the morning progressed, stocks continued to climb higher, and currently reside just off session highs.

- European sectors hold a strong positive bias; Tech is the clear outperformer, building on the prior day’s advances, with sentiment also lifted after Nvidia’s market cap surpassed USD 3tln. Optimised Personal Care is found at the foot of the pile.

- US Equity Futures (ES U/C, NQ U/C%, RTY -0.4%) are mixed, taking a breather from recent strength in the last trading session; the RTY underperforms.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- USD is showing varying performance vs. peers which has left the DXY flat. For now, DXY is capped by the 200 and 100DMAs at 104.40 and 104.42 respectively.

- EUR is modestly firmer vs. the USD on ECB day which is set to see the ECB deliver its first rate cut since September 2019. With a cut so widely expected, focus will be on any hints over what comes next. For reference, the next 25bps cut is priced by October with 63bps of cuts seen by year-end. EUR/USD currently within a busy 1.0869-1.0895.

- Cable briefly sat on a 1.28 handle overnight, though has since slipped lower and currently holds around 1.2785; UK-specific newsflow has been light today.

- JPY is losing marginal ground vs. the USD following cautious comments from officials overnight. USD/JPY is attempting to close the gap on Monday and Tuesday's risk-induced selling which took the pair from circa 157.47 to a weekly low of 154.52.

- Antipodeans are both a touch softer vs. the USD with AUD/USD continuing to pivot around the 0.6650 mark having been stuck on a 0.66 handle throughout the week.

- PBoC set USD/CNY mid-point at 7.1108 vs exp. 7.2436 (prev. 7.1097)

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are consolidating between five and ten ticks from Wednesday's 110-12+ WTD peak. Specifics light thus far with the macro focus firmly on the ECB, with US Challenger Layoffs and Initial Jobless Claims also on the docket.

- Bunds are a slightly softer and was unreactive to the miss in German Industrial Orders; Supply from Spain passed with no issue while the chunky French tap sparked some choppiness and an incremental new low for Bunds at 131.15.

- Gilt price action is in-fitting with EGBs. However, the BoE DMP sparked a turnaround in fortunes for the UK benchmark lifting it by around 20 ticks to a 97.72 peak, driven by the moderation in wage growth expectations within the survey.

- Spain sells EUR 5.865bln vs exp. EUR 5-6bln 2.50% 2027, 0.10% 2031, 4.00% 2054 Bono & EUR 0.51bln vs exp. EUR 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 12bln vs exp. EUR 10.5-12bln 3.00% 2034, 1.25% 2038, 3.25% 2055 OAT

- Click here for more details.

COMMODITIES

- Crude benchmarks were grinding higher throughout the European morning, though the upside has since dissipated (now flat), despite a lack of clear catalysts. Brent holding around USD 78.50/bbl.

- Precious metals are contained after the strength seen in the prior session. Rangebound action which currently sees XAU hold around the lower-end of USD 2354-2374/oz bounds.

- Base metals are firmer and continuing the turnaround in fortunes for the likes of copper that occurred yesterday alongside the broader risk-on trade.

- OPEC SecGen says demand for oil is still good, fundamentals drove their decisions. Adds, as travel is picking up, demand for oil should be strong.

- Qatar has set July Marine crude OSP at Oman/Dubai plus USD +1.10bbl; land crude OSP at Oman/Dubai plus USD +0.35bbl, according to a pricing document.

- Goldman Sachs says US retail gasoline prices in October could rise to nearly USD 4/gal if the hurricane season is extreme and positioning normalises.

- Canada Energy Regulator said it is updating an order that will allow Nova Gas to temporarily increase operating pressure by 5% in a section of the Grande Prairie mainline.

- JP Morgan price outlook calls for Brent to average USD 75/bbl in 2025; sharply down from UD 83/bbl in 2024, with prices exiting the year at USD 64/bbl

- Click here for more details.

CRYPTO

- Bitcoin holds around USD 71k in quiet trade, whilst Ethereum holds onto USD 3.8k.

NOTABLE DATA RECAP

- German Industrial Orders MM (Apr) -0.2% vs. Exp. 0.5% (Prev. -0.4%, Rev. -0.8%)

- Italian Retail Sales NSA YY (Apr) -1.9% (Prev. 2.0%); Retail Sales SA MM (Apr) -0.1% (Prev. 0.0%)

- EU Retail Sales YY (Apr) 0.0% vs. Exp. 0.1% (Prev. 0.7%); Retail Sales MM (Apr) -0.5% vs. Exp. -0.3% (Prev. 0.8%, Rev. 0.7%)

- German HCOB Construction PMI (May) 38.5 (Prev. 37.5)

- Italian HCOB Construction PMI (May) 49.0 (Prev. 48.5)

- EU HCOB Construction PMI (May) 42.9 (Prev. 41.9)

- French HCOB Construction PMI (May) 43.4 (Prev. 41.5)

- UK S&P Global Construction PMI (May) 54.7 vs. Exp. 52.5 (Prev. 53)

NOTABLE EUROPEAN HEADLINES

- BoE Monthly Decision Maker Panel: 1-year ahead CPI inflation expectations remained unchanged at 2.9% in May. 3-year ahead CPI inflation expectations remained unchanged at 2.6% in May. Expected year-ahead wage growth fell by 0.3ppts to 4.5% on a three-month moving-average basis in May.

- ISTAT lifts Italy's 2024 GDP growth forecast to 1.0% (prev. 0.7%)

NOTABLE US HEADLINES

- Chinese battery firms which are linked with the likes of Ford (F) and Volkswagen (VOW3 GY) should be banned from shipping to the US, via WSJ citing a Republican lawmaker group

- US FTC has reportedly opened a probe into Microsoft's (MSFT) AI deal with Inflection AI, according to WSJ; probe looks into whether MSFT structured the deal to avoid a government antitrust review of the transaction.

- Mexico Health Ministry said a fatal case of bird flu was detected in a man in Mexico state with chronic kidney disease, type 2 diabetes; bird flu detected in humans in Mexico does not represent a risk to the population. So far no evidence of person-to-person transmission, according to Reuters.

GEOPOLITICS

MIDDLE-EAST

- Israel's cabinet has cancelled their planned meetings amid reports that Hamas has rejected the truce proposal, according to Israeli media cited by journalist Elster

- Heavy Israeli bombardment of South Lebanon was reported, according to Al Monitor Senior Correspondent Karam.

RUSSIA-UKRAINE

- Russian President Putin said he has no intention to attack NATO, according to Reuters.

- US officials have notified relevant Congressional committees about expected Russian activity, according to a senior US official cited by Reuters. The temporary Russian deployment is likely to include combat vessels but is not seen by the US as a threatening move. The US is expecting Russian naval and air exercises in the Caribbean this summer with port calls likely in Cuba and possibly Venezuela.

CHINA-TAIWAN

- US State Department has approved the possible sale of F-16 parts to Taiwan for USD 80mln, according to the Pentagon

- Taiwan Defence Ministry said in the past 24 hours, 1 Chinese Air Force plane was detected operating around Taiwan.

OTHERS

- White House said Indian PM Modi and US President Biden discussed National Security Adviser Sullivan's upcoming travel to New Delhi, according to Reuters.

APAC TRADE

- APAC stocks traded mostly firmer as the region largely took its cue from the positive lead on Wall Street, while South Korean markets were closed due to the Memorial Day holiday.

- ASX 200 saw its upside spearheaded by gold and IT with all sectors in the green but Consumer Staples and Telecoms with the shallowest gains.

- Nikkei 225 surged at the open and briefly rose above USD 39,000 as industrials and Tech led the gains whilst autos saw another dire session amid the ongoing safety scandal. The index waned off best levels heading into the Tokyo lunch break.

- Hang Seng and Shanghai Comp varied for most of the session with the former conforming to the positive mood across the region whilst the latter saw subdued and contained trade within a tight range, with news flow on the quieter side ahead of the upcoming risk events.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said inflation expectations gradually rising but yet to reach 2%; Inflation expectations must accelerate to 2% and stay there, for actual inflation to move around 2%; proceeding cautiously on interest rates, according to Reuters and Bloomberg.

- BoJ Board Member Nakamura stated that Japan's economy is recovering moderately, albeit showing some weak signs; Based on current data, it is appropriate to keep policy intact for the time being, according to Reuters. "My view is that inflation may not reach 2% from fiscal 2025 onward if consumption weakens." He said they will focus on whether inflation-adjusted consumption turns positive in deciding future monetary policy, and said the pass-through of wages to inflation remains weak but he is closely monitoring the situation. Nakamura is not confident that wage growth will be sustained and said a cycle of rising prices and wages is beginning to kick off.

- Japan to raise the cap on state backing for copper mine stakes to 75%, according to Reuters.

- China Securities Journal noted "Experts said that entering June, it is unlikely that the capital will be significantly tightened, and the central bank will continue to reasonably... to maintain reasonable and abundant liquidity".

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- US Commerce Secretary Raimondo said Global Infrastructure Partners, KKR, and Indo-Pacific Partners are forming a coalition to fund infrastructure projects; to invest USD 25bln, according to Reuters.

- UMC (2303 TT) May Sales +3.89% Y/Y vs. +6.9% Y/Y in April

DATA RECAP

- Japanese Foreign Invest JP Stock w/e 282.0B (Prev. 82.4B)

- Japanese Foreign Bond Investment w/e 1323.4B (Prev. -297.9B, Rev. -310.4B)

- New Zealand ANZ Commodity Price (May) M/M: 1.1% (Prev. 0.5%)

- Australian Invest Housing MM (Apr) 5.60% (Prev. 3.80%)

- Australian Balance on Goods (Apr) 6,548 vs. Exp. 5,400M (Prev. 5,024M, Rev. 4,841)

- Australian Goods/Services Imports (Apr) -7.2% (Prev. 4.20%)

- Australian Owner-Occupied Housing Fin MM (Apr) 4.30% vs. Exp. 1.20% (Prev. 2.80%)