Europe Market Open: SPX & NDX hit record highs and NVDA joins USD 3tln market cap club; ECB due

06 Jun 2024, 06:30 by Newsquawk Desk

- SPX and NDX closed at record highs whilst NVIDIA joined the USD 3tln market cap club and overtook Apple as the second-largest US company.

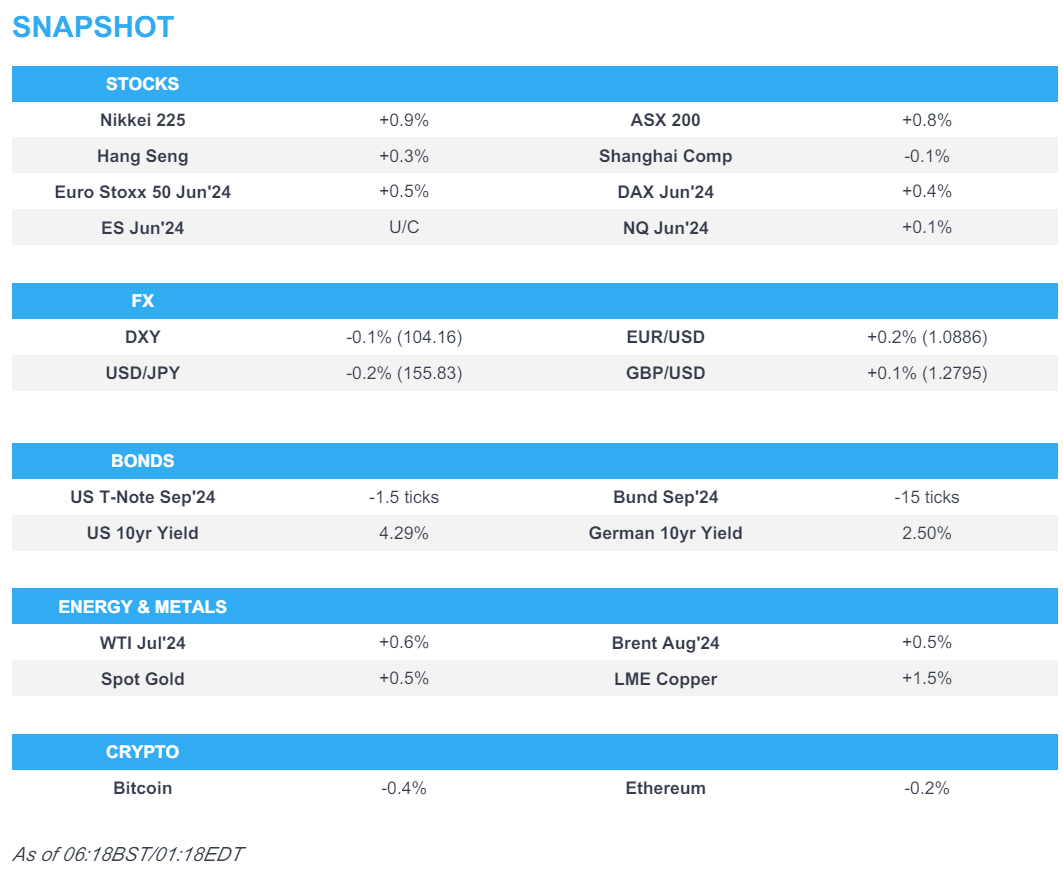

- APAC stocks traded mostly firmer as the region largely took its cue from the positive lead on Wall Street, while South Korean markets were closed due to the Memorial Day holiday.

- DXY weakened as APAC traders reacted to the pullback in yields, JPY outperformed, and JGB futures were boosted after a strong 30-year auction.

- European equity futures are indicative of a firmer cash open with Euro Stoxx 50 futures +0.5% after cash closed +1.7% on Thursday.

- Looking ahead, highlights include EZ & UK Construction PMI, Italian Retail Sales, EZ Employment (F), US Challenger Layoffs, IJC, ECB Policy Announcement and Press Conference, and Supply from Spain, and France.

US TRADE

EQUITIES

- US stocks were bid on Wednesday as markets digested a soft ADP, a BoC rate cut, and a hot US ISM Services PMI. SPX and NDX closed at record highs whilst NVIDIA joined the USD 3tln market cap club and overtook Apple as the second-largest US company.

- SPX +1.18% at 5,354, NDX +2.04% at 19,035, DJI +0.25% AT 38,807, RUT +1.47% at 2,064.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US FTC has reportedly opened a probe into Microsoft's (MSFT) AI deal with Inflection AI, according to WSJ; probe looks into whether MSFT structured the deal to avoid a government antitrust review of the transaction.

APAC TRADE

EQUITIES

- APAC stocks traded mostly firmer as the region largely took its cue from the positive lead on Wall Street, while South Korean markets were closed due to the Memorial Day holiday.

- ASX 200 saw its upside spearheaded by gold and IT with all sectors in the green but Consumer Staples and Telecoms with the shallowest gains.

- Nikkei 225 surged at the open and briefly rose above USD 39,000 as industrials and Tech led the gains whilst autos saw another dire session amid the ongoing safety scandal. The index waned off best levels heading into the Tokyo lunch break.

- Hang Seng and Shanghai Comp varied for most of the session with the former conforming to the positive mood across the region whilst the latter saw subdued and contained trade within a tight range, with news flow on the quieter side ahead of the upcoming risk events.

- US equity futures traded flat with a mild upward bias with the futures holding onto the gains partly fuelled by NVIDIA's 5%+ rally on Wednesday as US traders look ahead to Friday's US jobs report.

- European equity futures are indicative of a firmer cash open with Euro Stoxx 50 futures +0.5% after cash closed +1.7% on Wednesday.

FX

- DXY experienced a soft session within a 104.04-24 range as APAC traders reacted to the pullback in yields. The index printed a 104.46 peak yesterday in the wake of the hot US ISM Services before trimming around half of the gains during the rest of the US session.

- EUR/USD saw overnight tailwinds from the softer Dollar with EUR/USD within a 1.0869-95 range but EUR/GBP flat on either side of 0.8500 ahead of the ECB confab.

- GBP/USD saw modest gains as the softer Dollar pushed Cable back above 1.2800 from a 1.2779 APAC low.

- USD/JPY lagged as JPY was among the performers and beneficiaries of the softer Dollar and Tuesday's fall in yields, with USD/JPY towards the bottom of a 155.37-156.11 band. The pair briefly trimmed some losses after BoJ's Nakamura said based on current data, it is appropriate to keep policy intact for the time being. USD/JPY then reached session highs just shy of 156.00 after BoJ Governor Ueda signalled a cautious approach on rates.

- Antipodeans saw firmer trade throughout the session as the high-beta currencies experienced tailwinds from the broader risk appetite alongside the rebound in commodities.

- PBoC set USD/CNY mid-point at 7.1108 vs exp. 7.2436 (prev. 7.1097)

FIXED INCOME

- 10-year UST futures traded flat but held onto the prior day's gains as futures rose into settlement despite a fleeting move lower on the hot ISM Services PMI.

- Bund futures similarly held onto a bulk of the prior day's upside, with traders gearing up for a heavily telegraphed ECB rate cut, with Bund Sep futures in a 131.36-44 APAC range vs yesterday's 130.94-131.58 parameters.

- 10-year JGB futures saw a firm bias in fitting with the gains in Western counterparts during the prior session, with upside bolstered after a strong 30-year JGB auction.

COMMODITIES

- Crude futures edged higher as the complex attempted to trim the post-OPEC+ slump and as geopolitics focuses on the rising tensions between Israel and Lebanon, with heavy fighting between the two reported overnight.

- Spot gold was propped up by the softer Dollar with the yellow metal breaching its recent range to the upside and now eyeing the 23rd May high at USD 2,383.79/oz

- Copper futures rebounded from recent hefty losses with the broader risk mood and softer Dollar helping prop up the base metals complex, helping 3M LME copper reclaim USD 10,000/t+ status.

- Saudi Aramco confirmed it sets July Arab Light crude oil OSP to Asia at plus USD 2.40 vs Oman/Dubai average (prev. USD 2.90 M/M).

- Canada Energy Regulator said it is updating an order that will allow Nova Gas to temporarily increase operating pressure by 5% in a section of the Grande Prairie mainline.

CRYPTO

- Bitcoin was relatively uneventful and traded north of USD 71,000 for most of the session.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said inflation expectations gradually rising but yet to reach 2%; Inflation expectations must accelerate to 2% and stay there, for actual inflation to move around 2%; proceeding cautiously on interest rates, according to Reuters and Bloomberg.

- BoJ Board Member Nakamura stated that Japan's economy is recovering moderately, albeit showing some weak signs; Based on current data, it is appropriate to keep policy intact for the time being, according to Reuters. "My view is that inflation may not reach 2% from fiscal 2025 onward if consumption weakens." He said they will focus on whether inflation-adjusted consumption turns positive in deciding future monetary policy, and said the pass-through of wages to inflation remains weak but he is closely monitoring the situation. Nakamura is not confident that wage growth will be sustained and said a cycle of rising prices and wages is beginning to kick off.

- Japan to raise the cap on state backing for copper mine stakes to 75%, according to Reuters.

- China Securities Journal noted "Experts said that entering June, it is unlikely that the capital will be significantly tightened, and the central bank will continue to reasonably... to maintain reasonable and abundant liquidity".

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- US Commerce Secretary Raimondo said Global Infrastructure Partners, KKR, and Indo-Pacific Partners are forming a coalition to fund infrastructure projects; to invest USD 25bln, according to Reuters.

DATA RECAP

- Japanese Foreign Invest JP Stock w/e 282.0B (Prev. 82.4B)

- Japanese Foreign Bond Investment w/e 1323.4B (Prev. -297.9B, Rev. -310.4B)

- New Zealand ANZ Commodity Price (May) M/M: 1.1% (Prev. 0.5%)

- Australian Invest Hous'g Fin MM (Apr) 5.60% (Prev. 3.80%)

- Australian Balance on Goods (Apr) 6,548 vs. Exp. 5,400M (Prev. 5,024M, Rev. 4,841)

- Australian Goods/Services Imports (Apr) -7.2% (Prev. 4.20%)

- Australian Owner-Occp'd Hous'g Fin MM (Apr) 4.30% vs. Exp. 1.20% (Prev. 2.80%)

GEOPOLITICS

MIDDLE-EAST

- Heavy Israeli bombardment of South Lebanon was reported, according to Al Monitor Senior Correspondent Karam

- Yemen's Houthis said they have conducted three military operations in the Red Sea and Arabian Sea, according to Reuters.

- Israeli War Council to meet Thursday to discuss the hostage exchange deal and the Lebanon front, Al Arabiya reports.

RUSSIA-UKRAINE

- US expected to sign a new USD 225mln weapons package for Ukraine this week, according to sources cited by Reuters.

- Russia's President Putin said it has to defend gas pipelines on the bed of the Black Sea from Ukraine's attacks. Ukraine attacked gas facilities meant for Turkey on the Black Sea. Ships that protect these gas pipelines are being constantly attacked by drones, which are supplied to Ukraine by Europe.

- Russian President Putin said he has no intention to attack NATO, according to Reuters.

- US officials have notified relevant Congressional committees about expected Russian activity, according to a senior US official cited by Reuters. The temporary Russian deployment is likely to include combat vessels but is not seen by the US as a threatening move. The US is expecting Russian naval and air exercises in the Caribbean this summer with port calls likely in Cuba and possibly Venezuela.

CHINA-TAIWAN

- US State Department has approved the possible sale of F-16 parts to Taiwan for USD 80mln, according to the Pentagon

- Taiwan Defence Ministry said in the past 24 hours, 1 Chinese Air Force plane was detected operating around Taiwan.

OTHERS

- IAEA passed a resolution calling on Iran to improve cooperation with IAEA, and reverse its barring of inspectors, diplomats said.

- Lawmakers are reportedly pushing for a probe of Chinese solar companies, according to Bloomberg.

- White House said Indian PM Modi and US President Biden discussed National Security Adviser Sullivan's upcoming travel to New Delhi, according to Reuters.

EU/UK

NOTABLE HEADLINES

- FTSE Reshuffle: Darktrace (DARK LN, LondonMetric Property (LMP LN) and Vistry Group (VTY LN) are set to replace Ocado (OCDO LN), RS Group (RS1 LN) and St James's Place (STJ LN)

LATAM

- Mexico Health Ministry said a fatal case of bird flu was detected in a man in Mexico state with chronic kidney disease, type 2 diabetes; bird flu detected in humans in Mexico does not represent a risk to the population. So far no evidence of person-to-person transmission, according to Reuters.