US Market Open: Equities on a firmer footing, DXY gains & USD/JPY back to 156; US ISM Services due

05 Jun 2024, 11:08 by Newsquawk Desk

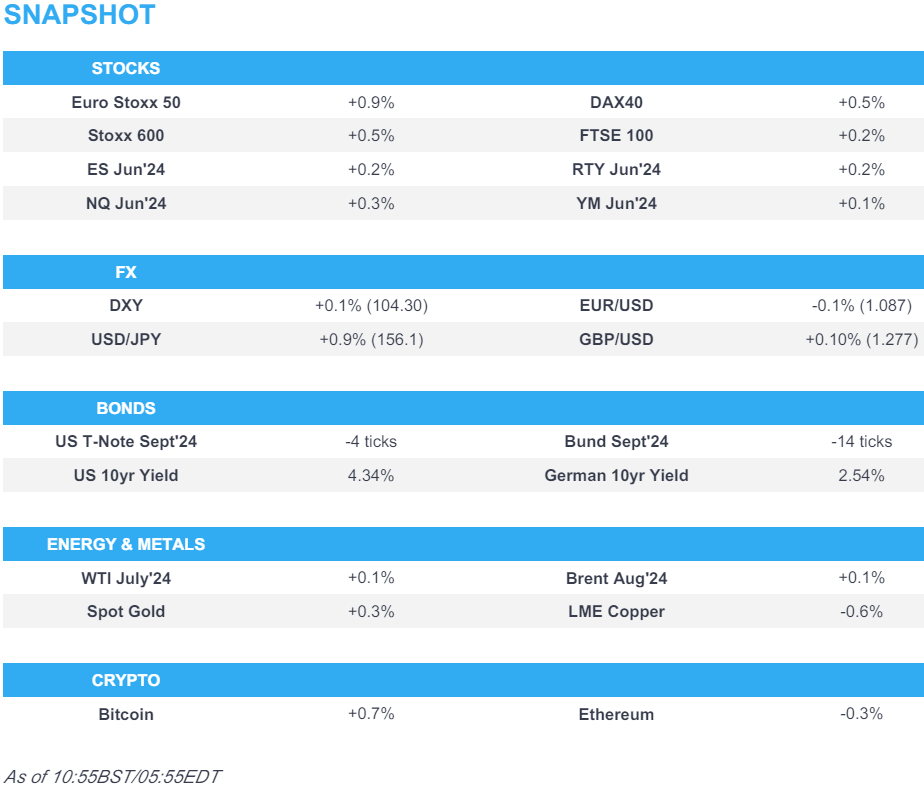

- European bourses extend gains with Tech leading; US futures are modestly firmer

- Dollar is incrementally higher, JPY gives back recent strength with USD/JPY now above 156.00

- Bonds are incrementally softer and unreactive to EZ Final PMIs

- Crude is modestly firmer in what has been a choppy session, XAU gains modestly and base metals are mixed

- Looking ahead, Canadian & US Services & Composite PMIs, US ADP National Employment, US ISM Services, NBP and BoC Policy Announcement, BoC's Macklem & Rogers

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.4%) are modestly firmer across the board, attempting to reclaim some of the losses seen in the prior session.

- European sectors hold a strong positive bias, with Tech topping the index alongside Retail, with the latter lifted by post-earning strength in Inditex (+5.5%). Banks are slightly in the red.

- US Equity Futures (ES +0.1%, NQ +0.3%, RTY +0.2%) are very modestly firmer and contained within a tight range ahead of US ADP and ISM Services.

- Barclays European Equity Strategy: Upgrades Consumer Staples to Marketweight from Overweight Upgrades Real Estate to Overweight. Upgrades Retail to Overweight. Cuts Energy to Underweight. Cuts Autos to Underweight.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- DXY is continuing to inch higher after briefly printing a 103 handle on Tuesday. 104.32 is the high watermark for today which is in close proximity to Tuesday's 104.33 peak.

- EUR/USD is back on a 1.08 handle after venturing as high as 1.0916 yesterday. For now, the pair is managing to hold above Tuesday's 1.0858 low with ING of the view that the pair's "neutral range" could be between 1.0850-1.09.

- GBP is marginally firmer vs. the USD and EUR in quiet newsflow with last night's general election debate not having any follow-through given it is unlikely to reverse the polls. Cable remains tucked within Tuesday's 1.2743-1.2818 range.

- USD/JPY is markedly higher and reversing a bulk of Tuesday's selling which brought the pair as low as 154.44. Next upside level for the pair is Tuesday's best at 156.48.

- Antipodeans remain resilient amid the recent Dollar advances helped by the recovery in risk sentiment. AUD has shrugged off the disappointing growth figures overnight. NZD/USD also firmer but ran into resistance just below the 0.62 mark.

- CAD is steady vs. the USD ahead of an expected rate reduction by the BoC (market pricing 77% probability of a cut). USD/CAD is currently tucked within yesterday's 1.3619-99 range.

- PBoC set USD/CNY mid-point at 7.1097 vs exp. 7.2418 (prev. 7.1083)

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are slightly softer in a breather from this week's upside ahead of US ISM Services and ADP National Employment. Treasuries are currently holding around the low of 109-26+ with no follow-through from the morning's European/UK data points.

- Bunds are also incrementally softer and holding around the 131.00 mark. There was no real follow-through from the PMIs despite final EZ figure showing a slight easing of inflationary pressures in the service sector; fleeting upside on a robust 2030 tap.

- Gilt price action is in-fitting with peers, though has pulled back slightly more than EGBs. PMIs passed without reaction and was little changed to a well received UK auction; currently holding around 97.33.

- UK sells GBP 4bln 3.75% 2027 Gilt: b/c 3.27x (prev. 3.68x), average yield 4.505% (prev. 4.204%) & tail 0.6bps (prev. 0.3bps)

- Germany sells EUR 2.442bln vs exp. EUR 3bln 2.40% 2030 Bund: b/c 2.6x (prev. 2.10x), average yield 2.55% (prev. 2.30%) & retention 18.6% (prev. 18.00%)

- Click here for more details.

COMMODITIES

- Crude is modestly firmer in what has been a choppy session for the complex; initially taking a breather from the hefty WTD pressure post-OPEC/demand concerns but with price action choppy at times. Brent currently holding around USD 77.60/bbl.

- Precious metals are essentially flat, though have been attempting to nudge into the green but not making any real ground as the USD picks up and yields have an upward bias.

- Base metals are mixed, continuing the similar price action seen in APAC trade overnight.

- US Private Energy Inventory Data: Crude +4.05mln (exp. -2.3mln), Cushing +0.983mln, Distillates +4.03mln (exp. +2.5mln), Gasoline +1.98mln (exp. +2mln).

- US Energy Secretary Granholm said the global oil market is well stocked and feels comfortable that there will be no huge increase in oil and gas prices in the 'next short while'. The US could boost the rate of replenishing the Strategic Petroleum Reserve as maintenance work at two sites winds down. Work at SPR will be finished by the end of year. Creating a Strategic Resilience Reserve for stockpiles of critical minerals with allies to help energy transition is a good idea. US talking with allies on critical minerals production, stockpile goals, could release details 'soon'. Granholm said even OPEC countries recognize there is only so much they can do to manipulate oil prices. Granholm said 'We should all be concerned' about oil industry consolidation. The US aims to complete the LNG export review in Q1 2025. She doesn’t expect permitting a pause to damage US competitiveness in the global LNG market.

- UAE's ADNOC set July Murban crude OSP at USD 83.93/bbl (prev. USD 89.14/bbl in June).

- Aluminium name Novelis has postponed its IPO due to market conditions; Novelis will continue to evaluate the timing of the offering in the future, according to PR Newswire.

- Click here for more details.

CRYPTO

- Bitcoin continues to gain and currently holds above USD 70k as Bitcoin ETF's continue to take focus.

NOTABLE DATA RECAP

- EU HCOB Services Final PMI (May) 53.2 vs. Exp. 53.3 (Prev. 53.3); Composite Final PMI (May) 52.2 vs. Exp. 52.3 (Prev. 52.3)

- German HCOB Services PMI (May) 54.2 vs. Exp. 53.9 (Prev. 53.9); Composite Final PMI (May) 52.4 vs. Exp. 52.2 (Prev. 52.2)

- French HCOB Composite PMI (May) 48.9 vs. Exp. 49.1 (Prev. 49.1); Services PMI (May) 49.3 vs. Exp. 49.4 (Prev. 49.4)

- Italian HCOB Services PMI (May) 54.2 vs. Exp. 54.5 (Prev. 54.3); Composite PMI (May) 52.3 (Prev. 52.6)

- UK S&P Global PMI Composite Output (May) 53 vs. Exp. 52.8 (Prev. 52.8); Services PMI (May) 52.9 vs. Exp. 52.9 (Prev. 52.9)

- EU Producer Prices YY (Apr) -5.7% vs. Exp. -5.3% (Prev. -7.8%); MM (Apr) -1.0% vs. Exp. -0.4% (Prev. -0.4%, Rev. -0.5%)

- Swedish PMI Services (May) 49.5 (Prev. 48.1, Rev. 48.0)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazimir says inflation is on a good trajectory and the ECB is approaching its first interest rate cut. Note, these comments are being made in the ECB's quiet period.

- YouGov/Sky News Snap Debate Poll: PM Sunak won the first head-to-head election debate (Sunak 51%, Starmer 49%). Snap YouGov poll of 1,657 viewers reveals how people feel each party leader performed, and who they think came across best.

NOTABLE US HEADLINES

- Treasury Secretary Yellen said the Treasury never tries to time the market in debt management. She added the issuance of Treasury Bills is in line with historical averages. Market participants believe that short-term rates will come down. She said short-term bill issuance is in line with recommendations from the TBAC. Yellen said there is nothing about issuing short-term debt that creates a 'sugar high' for the economy, according to Reuters.

- A group backed by BlackRock (BLK) and Citadel Securities is planning to start a new national stock exchange in Texas, according to WSJ.

- Nike (NKE) has cut staff in its European HQ as part of a multiyear cost-cutting plan, according to Bloomberg.

- Nio (9866 HK) has received approval to construct a 3rd factory within China, will have capacity of 600k, via Reuters citing sources; taking total approved capacity to 1mln.

- NXP (NXPI) and TSMC (TSM) affiliate plan to build USD 7.8bln Singapore chip plant, via Bloomberg.

- Bridgewater's Dalio says Chinese assets are attractively priced, Bridgewater has done well operating in the region over the past five years.

- Dollar Tree (DLTR) is exploring the sale of Family Dollar, according to WSJ

GEOPOLITICS

MIDDLE EAST

- Israeli military chief of staff said Israel is prepared to shift offense along the Northern border with Lebanon, nearing a decision point.

- "Israeli tanks penetrate downtown Rafah for the first time since the start of the Israeli invasion of the area", according to Sky News Arabia.

- Israel Ministry of Defense said it has signed an agreement with the US government for a third squadron of F-35 stealth aircraft for the Israeli Air Force, according to Reuters.

- US military said in the past 24 hours, Iranian-backed Houthis launched two anti-ship ballistic missiles (ASBM) from Houthi-controlled areas of Yemen into the Red Sea

OTHERS

- White House said US President Biden will attend the G7 leaders summit in Apulia, Italy on June 13-14. They will advance efforts to make use of Russia's immobilised sovereign assets to help Ukraine.

- Taiwan Defence Ministry said in the past 24 hours, 26 Chinese Air Force planes were detected operating around Taiwan.

- China Maritime Safety Administration said they are to shut an area in the Northern Yellow Sea from June 5-7 due to planned live firing.

APAC TRADE

- APAC stocks traded mixed as the cautious mood from Wall Street reverberated into Asia-Pacific, with macro newsflow overnight on the lighter side.

- ASX 200 was modestly firmer with defensive sectors among the better performers, whilst lagging sectors include gold names, mining stocks, and energy companies. Little immediate reaction was seen on commentary from RBA Governor Bullock and the softer-than-expected Q1 GDP report.

- Nikkei 225 was the regional laggard and dipped under the 38,500 mark with mining and industrial firms among the losers, whilst autos continued to feel the woes of the latest safety scandal in the country.

- Hang Seng and Shanghai Comp varied with the former propped up by auto stocks after some firms were permitted to test out advanced levels of autonomous driving. Mainland markets shrugged off the improvement in Caixin Services PMI which also noted "China’s economy is generally stable and remains on the road to recovery."

NOTABLE ASIA-PAC HEADLINES

- Some Chinese AI chip firms are reportedly designing less powerful processors to retain access to TSMC (TSM /2330 TT) production in the face of US sanctions, according to Reuters sources.

- RBA Governor Bullock expected Q1 GDP growth to be quite low; the economy is weak and that is showing up in consumption; not ruling anything in or out on policy. Looking for a soft landing for the economy. Inflation is coming down but only slowly. The board won't hesitate to act on rates if inflation does not come down as expected. Still judges inflation risks as balanced. Q2 inflation data will be important for monetary policy, not the single most important thing.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- Fitch affirmed India at BBB-, outlook Stable.

- Fitch lowers 2024 China new home sales forecast, expects it to decline by 15-20% to CNY 8.3-8.8tln.

- Foxconn (2317 TT) May Revenue +22.1%; due to higher than expected demand from AI servers, current visibility for Q2 is expected to beat expectations.

- China May Retail Car Sales -3% Y/Y, via PCA cited by Bloomberg

DATA RECAP

- Chinese Caixin Services PMI (May) 54.0 (Prev. 52.5); "China’s economy is generally stable and remains on the road to recovery."

- Australian Real GDP QQ SA (Q1) 0.1% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); YY SA** (Q1) 1.1% vs. Exp. 1.2% (Prev. 1.5%, Rev. 1.6%)

- Australian GDP Chain Price Index (Q1) 0.8% (Prev. 2.0%)

- Australian Final Consumption Exp QQ SA (Q1) 0.6% (Prev. 0.2%)

- Australian Gross Fixed Capital Exp SA (Q1) -0.9% (Prev. -0.2%)

- Australian Judo Bank Composite PMI Final (May) 52.1 (Prev. 52.6); Services PMI Final (May) 52.5 (Prev. 53.1)

- Australian AIG Manufacturing Index (May) -31.1 (Prev. -13.9); Construction Index (May) -68.1 (Prev. -25.6)

- New Zealand Export Prices SA (Q1) -0.3% vs. Exp. 1.5% (Prev. -4.2%); Import Prices SA (Q1) -5.1% vs. Exp. -1.0% (Prev. 3.8%)

- New Zealand Terms of Trade QQ (Q1) 5.1% vs. Exp. 1.6% (Prev. -7.8%)

- New Zealand Export Volumes SA (Q1) 6.3% (Prev. 2.6%)

- South Korean GDP Growth QQ Revised (Q1) 1.3% (Prev. 1.3%); YY Revised (Q1) 3.3% (Prev. 3.4%)

- Japanese JibunBK Services PMI Final SA (May) 53.8 (Prev. 53.6); Composite Op Final SA (May) 52.6 (Prev. 52.4)

- Japanese Overall Lab Cash Earnings (Apr) -2.1% (Prev. 0.6%, Rev. 1.0%); Overtime Pay (Apr) -0.6% (Prev. -1.5%, Rev. -0.5%)