US Market Open: Risk sentiment pressured and benefiting havens ex-precious metals, USD/JPY below 155; US JOLTS due

04 Jun 2024, 11:24 by Newsquawk Desk

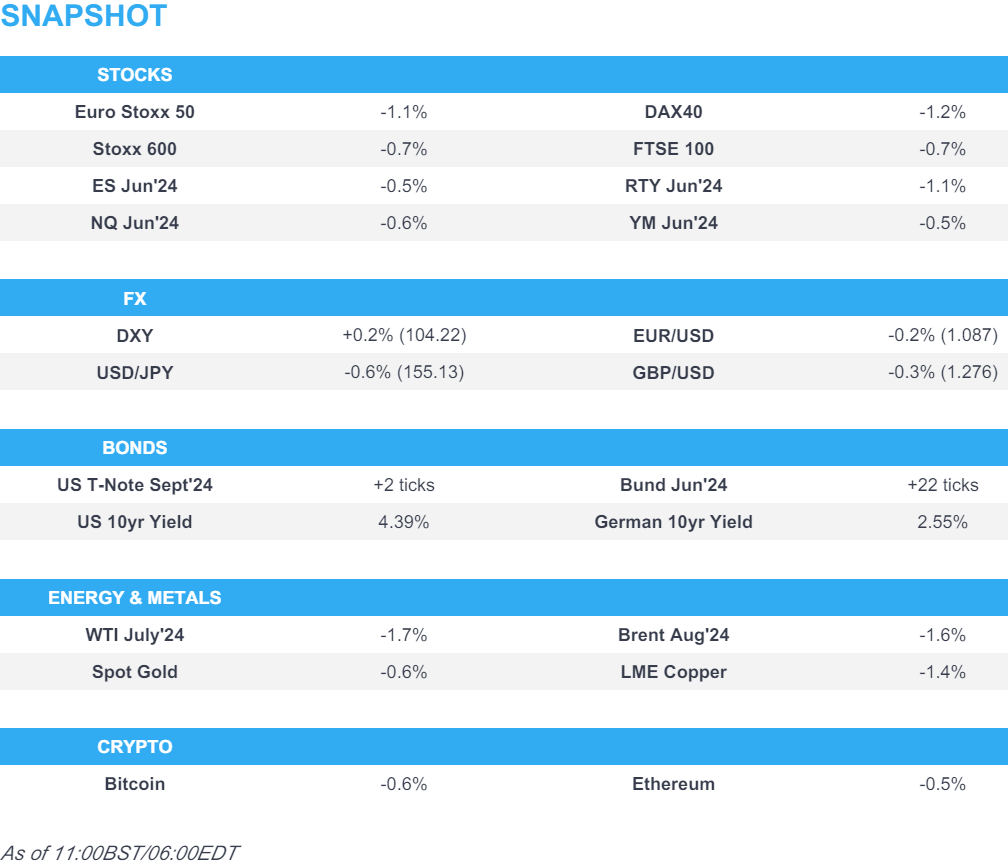

- Risk sentiment generally pressured to the benefit of havens ex-precious metals as the latest bearish driver stems from India’s election count

- Equities are entirely in the red; Energy and Basic Resources are the clear laggards, given the underperformance in the underlying commodity prices

- Dollar is firmer and attempting to claw back post-ISM losses, JPY bid with USD/JPY nearing 155, AUD slips given the risk sentiment

- Bonds are firmer in continuation of the prior day’s gains, though now off best levels following source reports relating to the BoJ’s bond buys

- Crude continues to slip, XAU and base metals suffer from USD strength, risk tone & India’s performance

- Looking ahead, US Durable Goods R, US JOLTS, US RCM/TIPP Economic Optimism Supply, UK election debate

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.5%) began the session modestly in the red and have continued to slip throughout the morning as post-ISM demand concerns weigh alongside a marked deterioration in India's performance (NIFTY 50 -5.9%) as the ongoing vote count for Modi is much less favourable than the exit poll implied.

- European sectors hold a strong negative bias; Energy and Basic Resources are found at the foot of the pile, given the broad weakness in the commodities complex. Banks are also weighed on by the relatively lower yield environment.

- US Equity Futures (ES -0.6%, NQ -0.6%, RTY -1.1%) are entirely in the red, conforming to the sentiment seen in Europe/India. Nvidia (-0.8%) is softer in the pre-market after reports that the TSMC new Chair has hinted that the Co. could increase the price of AI chip production services.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- DXY is attempting to claw back some of yesterday's ISM-induced losses which sent the index down as low as 103.99 during APAC trade. Interim resistance is provided by the 200DMA at 104.39 and 100DMA at 104.40. Next up, US JOLTS.

- EUR/USD ventured as high as 1.0915 during APAC trade but the pair's move above 1.09 proved to be short-lived, and currently holds around 1.087.

- GBP is on the backfoot vs. the USD and steady vs. the EUR. Cable went as high as 1.2817 in APAC trade in an extension of yesterday's price action before succumbing to broader Dollar strength, taking the pair back down to c.1.276.

- JPY is benefitting vs. peers amid its safe-haven appeal, narrowing yield differentials and jawboning from various Japanese officials. USD/JPY down as low as 155.21 with not much in the way of support ahead of the 155 figure.

- Antipodeans are both suffering in the current risk environment but AUD more so alongside declines in iron ore prices and ANZ suggesting that Australian consumer confidence remains weak.

- EUR/CHF was initially slightly choppy following Swiss inflation metrics before lifting from 0.9744 to 0.9781 over the course of five minutes. The odds of a 25bp cut at the June meeting have increased to circa. 51% from around 40% earlier in the week. Move has since pared given haven allure for CHF.

- INR is pressured amid some concern over the results of the Indian elections, as while the BJP-led NDA alliance is ahead and on course for victory the margin of result looks to be much less than initial exit polls had suggested and potentially indicative of BJP alone not hitting the 272 simple majority level as they have previously done.

- Reuters reports that the RBI is likely on offer near 83.50 in USD/INR via state-run banks, citing traders; offers described as "mild".

- PBoC set USD/CNY mid-point at 7.1083 vs exp. 7.2297 (prev. 7.1086)

- Brazil's Finance Ministry to announce fiscal measures on Tuesday, according to a statement cited by Reuters.

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are firmer and continue to extend on the the post-ISM upside, with additional bullishness stemming from a well received JGB sale overnight and the general risk tone. Since, Bloomberg reported that the BoJ is said to mull bond buys as early as the June meeting, sparking some modest pressure across the fixed income complex; as such, USTs are off best levels but still in the green.

- Bunds are in-fitting with Treasury action; German employment data led to very modest upside due to the higher-than-expected unemployment change. Bunds as high as 130.48, just about above last Tuesday's best, though has since pulled off best.

- Gilts are tracking the broader tone and as such entered the morning's auction with upside of almost 40 ticks. An auction which sparked a pullback of around 10 ticks given the chunky tail but still leaves Gilts comfortably in the green and broadly in-fitting with peers.

- UK sells GBP 2bln 4.00% 2063 Gilt: b/c 3.10 (prev. 2.92x), average yield 4.557% (prev. 4.518%), tail 1.3bps (prev. 0.6bps)

- Germany sells EUR 3.689bln vs exp. EUR 4.5bln 2.90% 2026 Schatz: b/c 2.7x (prev. 2.5x) & avg. yield 3.01% (prev. 2.93%) and retention 18.02% (prev. 18.00%)

- Saudi's PIF gives initial price guidance of circa. Gilts +135bps for its GBP 5yr note and Gilts +145bps for GBP 15yr notes, via IFR

- Japan sold JPY 2.6tln in 10-year JGB, b/c 3.66x (prev. 3.15x), average yield 1.048% (prev. 0.857%), tail 0.02 (prev. 0.05).

- Click here for more details.

COMMODITIES

- Crude continues to slump following the OPEC+ 'roadmap' and the growth concerns triggers by Monday's US ISM Manufacturing print. Benchmarks at lows of USD 72.63/bbl and 76.89/bbl for WTI Jul'24 and Brent Aug'24 respectively.

- Nat gas futures were initially only taking a breather from Monday's marked upside after issues to a Norwegian-Britain pipeline. Thereafter, more significant pressure emerged as Gassco announced that the work to repair the crack is a matter of days not weeks.

- Precious metals have come under increasing pressure as the European morning progresses; specifics light, although Dollar has been edging higher in today's session.

- Base metals are also suffering on the demand angle post-PMIs, USD strength and a deterioration in the broader risk tone driven by India alongside negative updates regarding Nvidia.

- Coalition of over 400 Japanese firms is poised to set up a USD 1bln fund as early as the fiscal half ending Sept to boost hydrogen supply chains, according to Nikkei.

- HSBC said their Brent price assumption remains USD 82/bbl for 2024, including USD 80/bbl in H2 2024, falling to USD 76.50/bbl from 2025 onwards.

- UBS on OPEC+ announcements: Expects some near-term volatility on supply concerns, but retains modestly positive outlook for crude prices; says "does not think plan to unwind output cuts will tilt markets into oversupply". Expects Brent to trade around USD 87/bbl at year-end.

- Gassco says we have received a repair schedule from the operator of the Sleipner riser platform and is expected to take 2 days to repair; repairs may take longer than 2 days or could go faster; not a matter of weeks to repair

- Chevron Australia confirms full LNG production has resumed at the Gorgon gas facility after a temporary outage on Monday, 3rd June, according to a spokesperson.

- Click here for more details.

CRYPTO

- Bitcoin and Ethereum are both modestly softer thus far; BTC at USD 68.7k.

NOTABLE DATA RECAP

- German Unemployment Chg SA (May) 25.0k vs. Exp. 10.0k (Prev. 10.0k); Unemployment Rate SA (May) 5.9% vs. Exp. 5.9% (Prev. 5.9%); Unemployment Total SA (May) 2.762M (Prev. 2.732M); Unemployment Total NSA (May) 2.723M (Prev. 2.75M)

- Swiss CPI YY (May) 1.4% vs. Exp. 1.4% (Prev. 1.4%); CPI MM (May) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- UK BRC Retail Sales YY (May) 0.4% (Prev. -4.4%)

- UK Barclays May Consumer Spending +1.0% Y/Y - the smallest rise since Feb 2021.

NOTABLE EUROPEAN HEADLINES

- Airbus (AIR FP) is reportedly in discussions to sell over 100 widebody jets to China, via Bloomberg

NOTABLE US HEADLINES

- Tesla (TSLA) sold 72.5k vehicles in China during May vs. 62.2k in April, according to the CPCA.

- Tesla (TSLA) investor KLP is to vote in support of motion urging Tesla to to engage in wage and other labour talks.

- TSMC (2330 TT/TSM) new Chairman has hinted that the Co. could increase the price of his company's AI chip production services, according to The Nikkei; already spoken with Nvidia (NVDA) CEO about this.

- New York is said to plan to ban social media firms from using algorithms to steer content to children without parental consent under a tentative agreement reached by state lawmakers, WSJ sources said.

- Atlanta Fed GDPNow (Q2 24): 1.8% (prev. 2.7%).

- Alphabet (GOOG) is reportedly laying off employees from several teams in Google’s cloud unit, one of its fastest-growing businesses, CNBC sources say.

GEOPOLITICS

- "A Hamas official told Al-Mayadeen that no delegation from the group went to Cairo, and that it did not accept what was offered by the mediators", via Guy Elster on X

- "Media close to Hezbollah: Diplomatic letters have arrived in Beirut in recent days warning of the threat of an imminent Israeli strike", according to Sky News Arabia

- "Major differences between Israel and the United States over the second phase of the truce deal", according to Sky News Arabia quoting an Israeli official cited by local press.

- Hamas is slated to send a delegation to Cairo today to discuss the latest Israeli hostage deal proposal, according to Times of Israel sources.

- "Lebanese media: Renewed fires in the forests of several border towns in southern Lebanon as a result of the throwing of Israeli phosphorus bombs", according to Sky News Arabia.

- Israeli PM Netanyahu's office said "No date has yet been set for Prime Minister Netanyahu's speech to both houses of Congress. In any case, the speech will not take place on June 13 due to the second holiday of Shavuot".

- UK, France and Germany have formally submitted a draft resolution against Iran to the IAEA Board of Governors, according to Reuters citing diplomats.

APAC TRADE

- APAC stocks traded mixed following a similar performance from Wall Street in the absence of any fresh overnight catalysts, with the tone tilting lower towards the end of the session.

- ASX 200 saw losses in the energy sector being countered by gains among gold names.

- Nikkei 225 was the regional laggard with losses among energy names, whilst autos slipped after a safety test scandal among some Japanese automakers widened on Monday, with Toyota Motor and Mazda both halting shipments of some vehicles.

- Hang Seng and Shanghai Comp were mixed with modest gains in the former amid upside in healthcare and properties, whilst the Mainland was flat/slightly softer albeit within tight ranges.

- India's Nifty 50 slipped as election results are being counted and PM Modi's lead fluctuated, with early weakness in Indian markets attributed to a narrowing lead.

NOTABLE ASIA-PAC HEADLINES

- BoJ Gov Ueda said if underlying inflation moves as BoJ projects, BoJ will adjust the degree of monetary support. If economic and price projections and assessment of risks change, that will also be a reason to change interest rate levels. The policy goal is price stability, so will not guide policy to fund fiscal spending. The basic stance is to allow markets to set long-term interest rates. Ready to conduct nimble market operations if there are sharp rises in long-term rates.

- Japanese Finance Minister Suzuki said forex intervention had certain effects; intervention was intended to respond to speculative moves; will continue to respond appropriately

- Japan's economy is recovering moderately but consumption is stalling, and wages are not rising enough to offset rising prices, according to a draft roadmap; Japan's govt to call on the need for vigilance to impact of weak yen on households' purchasing power in long-term.

- Japanese PM Kishida not to call a snap election during the current parliament session, according to Asahi newspaper.

- ANZ-Roy Morgan Australian Consumer Confidence changed little, increasing 0.3pts to 80.5pts. Overall confidence is very weak. The series has been below neutral for over 2yrs. Inflation expectations rose 0.1pts to 5.0%.

- The Bank of Korea said inflation is expected to ease gradually as projected in May.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- TSMC (2330 TT/TSM) said they have had conversations with customers about whether to move TSMC's fabs out of Taiwan amid China tensions; added it is impossible to move TSMC's fabs out of Taiwan as 80%-90% of production capacity is in Taiwan.

- BoJ's Himino says firms will likely have more freedom in setting prices flexibly when prices and wages are rising moderately in tandem. In economy facing effect zero lower bound, asset price moves such as FX, stocks and property prices are likely to serve as key transmission channel of monpol. Guiding monpol to attain a situation where underlying inflation moves to around 2%; several measures have underlying inflation short of this figure, but gradually accelerating towards it. Need to look at price data and various factors such as wages and firm activity when judging underlying inflation. Inappropriate for monetary policy to target FX. FX fluctuations have various impacts, not just through import costs but on activity as well. Must be very vigilant to FX action. Must look at various aspects in guiding policy, should not automatically respond to FX moves in setting rates. Need to consider the whole economy and prices when considering what to do with the balance sheet. Desirable for market forces to set long-term rates. Must avoid abrupt bond market moves.

- BoJ is said to mull reducing bond buys as early as the June meeting, via Bloomberg.

DATA RECAP

- South Korea CPI Growth YY (May) 2.7% vs. Exp. 2.8% (Prev. 2.9%); MM (May) 0.1% vs. Exp. 0.2%. (Prev. 0.0%)

- Australian Business Inventories (Q1) 1.3% vs. Exp. 0.7% (Prev. -1.7%, Rev. -1.6%)

- Australian Gross Company Profits (Q1) -2.5% vs. Exp. -0.6% (Prev. 7.4%, Rev. 7.1%)

- Australian Current Account Balance SA (Q1) -4.9B AU vs. Exp. 5.1B AU (Prev. 11.8B AU)

- Australian Net Exports Contribution (Q1) -0.9% vs. Exp. -0.6% (Prev. 0.6%)

- Australian Business Inventories (Q1) 1.3% vs. Exp. 0.7% (Prev. -1.7%)

- Australian Gross Company Profits (Q1) -2.5% vs. Exp. -0.6% (Prev. 7.4%)

- Australian Company Profits Pre-Tax (Q1) -8.4% (Prev. 4.7%)