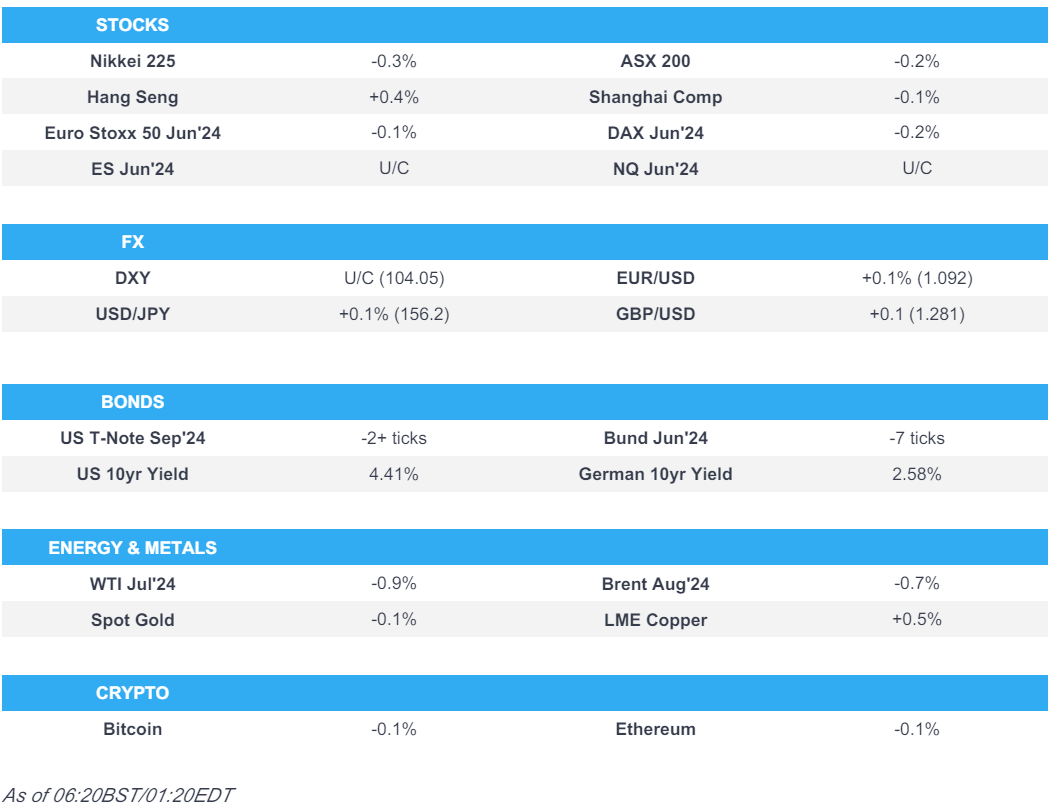

Europe Market Open: APAC stocks mixed, DXY holds just above 104.00 post-ISM & Crude continues to slip

04 Jun 2024, 06:30 by Newsquawk Desk

- APAC mixed following a similar Wall St. handover in the absence of fresh catalysts

- DXY consolidated, EUR above 1.09, GBP contained

- Fixed income rangebound after Monday's ISM move, modest upside on a strong JGB auction

- Crude continues to slip, XAU soft; geopols continue to focus on a phased truce plan

- Highlights include Swiss CPI, German Unemployment, US Durable Goods R, US JOLTS, US RCM/TIPP Economic Optimism Supply from the UK & Germany, BoJ's Himino, and the first UK election debate.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks ultimately finished the Monday session mixed. Growth fears initially weighed on sentiment after the US Manufacturing ISM headline fell by more than expected. Within the data, the Prices Paid component slipped beneath all analyst expectations.

- SPX +0.11% at 5,283, NDX +0.35% at 18,600, DJIA -0.3% at 38,571, RUT -0.5% at 2,060

- Click here for a detailed summary.

NOTABLE HEADLINES

- New York is said to plan to ban social media firms from using algorithms to steer content to children without parental consent under a tentative agreement reached by state lawmakers, WSJ sources said.

- Atlanta Fed GDPNow (Q2 24): 1.8% (prev. 2.7%).

- Goldman Sachs (GS) lowers US Q2 GDP tracking estimate by 0.1ppt to 2.7%.

- Alphabet (GOOG) is reportedly laying off employees from several teams in Google’s cloud unit, one of its fastest-growing businesses, CNBC sources say.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following a similar performance from Wall Street in the absence of any fresh overnight catalysts, with the tone tilting lower towards the end of the session.

- ASX 200 saw losses in the energy sector being countered by gains among gold names.

- Nikkei 225 was the regional laggard with losses among energy names, whilst autos slipped after a safety test scandal among some Japanese automakers widened on Monday, with Toyota Motor and Mazda both halting shipments of some vehicles.

- Hang Seng and Shanghai Comp were mixed with modest gains in the former amid upside in healthcare and properties, whilst the Mainland was flat/slightly softer albeit within tight ranges.

- India's Nifty 50 slipped as election results are being counted and PM Modi's lead fluctuated, with early weakness in Indian markets attributed to a narrowing lead.

- US equity futures were uneventful and traded flat following yesterday's choppy trade which ultimately saw a mixed close.

- European equity futures are indicative of a flat/subdued cash open with the Euro Stoxx 50 future -0.1% after cash closed +0.4% on Monday.

FX

- DXY consolidated after the post-ISM slump on Monday which saw the index slip from through its 100 DMA (104.40) and 200 DMA (104.39) to a low of 103.99 in APAC hours.

- EUR/USD held above 1.0900 in a 1.0902-15 range and maintained yesterday's US ISM-induced gains as the focus turns to the upcoming risk events including the ECB's meeting on Thursday.

- GBP/USD was flat on either side of 1.2800 with Cable in a 1.2796-1.2817 APAC parameter. Ahead of the UK elections, the Reform Party announced that Nigel Farage was to lead the party, although this had limited impact on the Pound.

- USD/JPY narrowly underperformed after yesterday's outperformance after US yields slipped across the curve following the US ISM data.

- Antipodeans were modestly softer amid the cautious mood across APAC markets, whilst the ANZ suggested Australian consumer confidence remains weak.

- PBoC set USD/CNY mid-point at 7.1083 vs exp. 7.2297 (prev. 7.1086)

- Brazil's Finance Ministry to announce fiscal measures on Tuesday, according to a statement cited by Reuters.

FIXED INCOME

- 10-year UST futures consolidated after the prior day's bull flattening sparked by the ISM Manufacturing PMI, which missed expectations while prices paid also eased and dipped beneath all analyst forecasts.

- Bund futures were largely uneventful and held onto a bulk of the prior day's gains, although the contract has dipped back under 130.00 after reaching a high of 130.16 yesterday.

- 10-year JGB futures held a mild upward bias at the start and then extended on gains following a well-received 10-year JGB auction.

- Japan sold JPY 2.6tln in 10-year JGB, b/c 3.66x (prev. 3.15x), average yield 1.048% (prev. 0.857%), tail 0.02 (prev. 0.05).

COMMODITIES

- Crude futures continued the softness seen in European and US hours yesterday in the aftermath of the OPEC+ meeting, which ultimately put forward a future roadmap for bringing barrels back to the market.

- Spot gold was subdued and giving back some of yesterday's gains as prices failed to sustain above the USD 2,350/oz mark in APAC hours.

- Copper futures were amid a lack of catalysts and with prices taking a breather from yesterday's volatility.

- Coalition of over 400 Japanese firms is poised to set up a USD 1bln fund as early as the fiscal half ending Sept to boost hydrogen supply chains, according to Nikkei.

- HSBC said their Brent price assumption remains USD 82/bbl for 2024, including USD 80/bbl in H2 2024, falling to USD 76.50/bbl from 2025 onwards.

- Chevron Australia confirms full LNG production has resumed at the Gorgon gas facility after a temporary outage on Monday, 3rd June, according to a spokesperson.

CRYPTO

- Bitcoin traded with mild gains on either side of USD 69,000.

NOTABLE ASIA-PAC HEADLINES

- BoJ Gov Ueda said if underlying inflation moves as BoJ projects, BoJ will adjust the degree of monetary support. If economic and price projections and assessment of risks change, that will also be a reason to change interest rate levels. The policy goal is price stability, so will not guide policy to fund fiscal spending. The basic stance is to allow markets to set long-term interest rates. Ready to conduct nimble market operations if there are sharp rises in long-term rates.

- Japanese Finance Minister Suzuki said forex intervention had certain effects; intervention was intended to respond to speculative moves; will continue to respond appropriately

- Japan's economy is recovering moderately but consumption is stalling, and wages are not rising enough to offset rising prices, according to a draft roadmap; Japan's govt to call on the need for vigilance to impact of weak yen on households' purchasing power in long-term.

- Japanese PM Kishida not to call a snap election during the current parliament session, according to Asahi newspaper.

- ANZ-Roy Morgan Australian Consumer Confidence changed little, increasing 0.3pts to 80.5pts. Overall confidence is very weak. The series has been below neutral for over 2yrs. Inflation expectations rose 0.1pts to 5.0%.

- The Bank of Korea said inflation is expected to ease gradually as projected in May.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- TSMC (2330 TT/TSM) said they have had conversations with customers about whether to move TSMC's fabs out of Taiwan amid China tensions; added it is impossible to move TSMC's fabs out of Taiwan as 80%-90% of production capacity is in Taiwan.

DATA RECAP

- South Korea CPI Growth YY (May) 2.7% vs. Exp. 2.8% (Prev. 2.9%); MM (May) 0.1% vs. Exp. 0.2%. (Prev. 0.0%)

- Australian Business Inventories (Q1) 1.3% vs. Exp. 0.7% (Prev. -1.7%, Rev. -1.6%)

- Australian Gross Company Profits (Q1) -2.5% vs. Exp. -0.6% (Prev. 7.4%, Rev. 7.1%)

- Australian Current Account Balance SA (Q1) -4.9B AU vs. Exp. 5.1B AU (Prev. 11.8B AU)

- Australian Net Exports Contribution (Q1) -0.9% vs. Exp. -0.6% (Prev. 0.6%)

- Australian Business Inventories (Q1) 1.3% vs. Exp. 0.7% (Prev. -1.7%)

- Australian Gross Company Profits (Q1) -2.5% vs. Exp. -0.6% (Prev. 7.4%)

- Australian Company Profits Pre-Tax (Q1) -8.4% (Prev. 4.7%)

GEOPOLITICS

- "Major differences between Israel and the United States over the second phase of the truce deal", according to Sky News Arabia quoting an Israeli official cited by local press.

- Hamas is slated to send a delegation to Cairo today to discuss the latest Israeli hostage deal proposal, according to Times of Israel sources.

- "Lebanese media: Renewed fires in the forests of several border towns in southern Lebanon as a result of the throwing of Israeli phosphorus bombs", according to Sky News Arabia.

- Israeli PM Netanyahu's office said "No date has yet been set for Prime Minister Netanyahu's speech to both houses of Congress. In any case, the speech will not take place on June 13 due to the second holiday of Shavuot".

- UK, France and Germany have formally submitted a draft resolution against Iran to the IAEA Board of Governors, according to Reuters citing diplomats.

EU/UK

NOTABLE HEADLINES

- Maersk (MAERSKB DC) raises 2024 guidance; FY underlying EBITDA seen at USD 7-9bln, and EBIT of USD 1-3bln; FY FCF of at least USD 1bln.

- Sky News/YouGov poll: 2024 seat projections - Labour 422 (+222), Conservatives 140 (-232). Change in relation to the 2019 results based on new boundaries.

DATA RECAP

- UK BRC Retail Sales YY (May) 0.4% (Prev. -4.4%)

- UK Barclays May Consumer Spending +1.0% Y/Y - the smallest rise since Feb 2021.