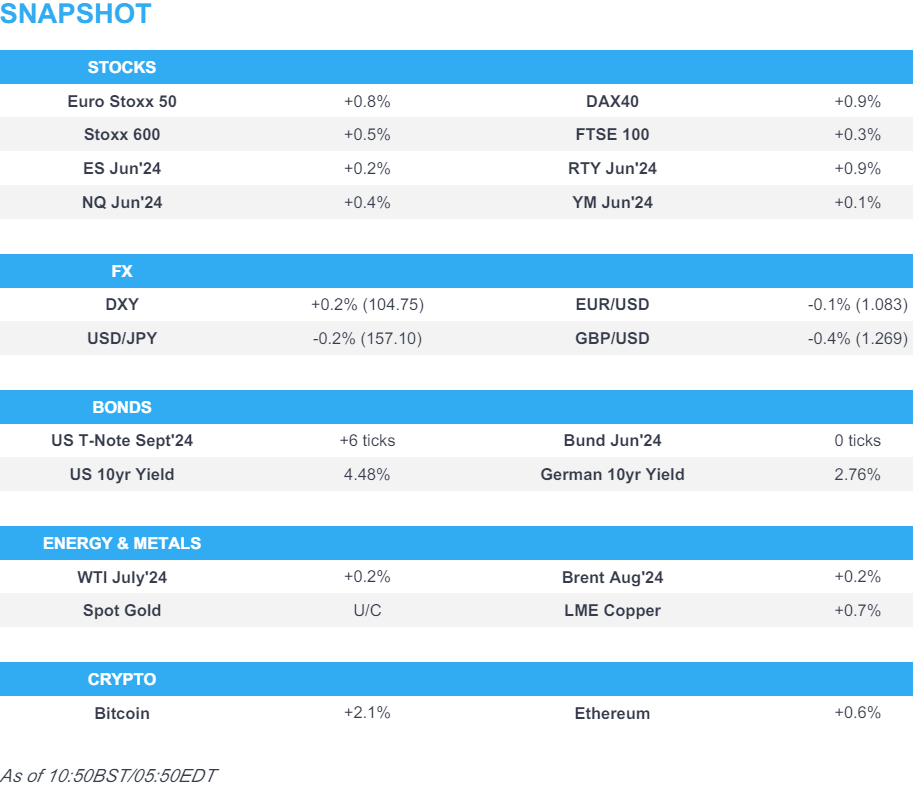

US Market Open: Equities in the green, DXY is incrementally firmer and Crude is choppy after OPEC+; US ISM Manufacturing due

03 Jun 2024, 11:14 by Newsquawk Desk

- Equities are in the green; Chip names help to prop up the tech sector, whilst meme-stock GME surges 66% pre-market

- DXY is incrementally firmer, G10s are mostly firmer against the Dollar except for the Yen, which gains marginally

- USTs continue Friday’s post-PCE advance ahead of US ISM Manufacturing

- Crude is incrementally firmer, though residing near lows post OPEC+ which outlined a future roadmap for the restoration of the supply from the voluntary cuts

- Precious metals are flat and base metals are generally firmer, benefitting from the higher-than-expected upward revision in the Caixin Manufacturing PMI

- Looking ahead, US Final Manufacturing PMI and ISM Manufacturing

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) are entirely in the green, continuing the price action seen in APAC trade overnight. Indices came under some slight selling pressure in the early portion of the morning, and has been choppy within today's range.

- European sectors hold a strong positive tilt; Construction & Materials takes the top spot, joined closely by Retail, which is lifted by significant strength in JD Sports (+7.5%). Healthcare is the clear laggard, dragged down by GSK (-9.4%) on Zantac-related lawsuits.

- US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.9%) are modestly firmer, though with price action fairly contained thus far. In terms of pre-market movers, AMD (+1.3%) gains after unveiling a new MI325X accelerator chip, whilst Nvidia (+2.2%) benefits after its CEO said the Co. is to upgrade its AI accelerators every year. GameStop (+66.4%) surges pre-market after Roaring Kitty reveals a USD 116mln position in the Co.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- DXY is incrementally firmer and within a tight 104.50-75 range as the index took a breather from Friday's post-PCE volatility as it looks ahead to this week's risk events, starting with US ISM Manufacturing later today.

- EUR is softer vs. the USD as we enter into ECB week, which is set to see the central bank deliver its first rate cut since September 2019. EUR/USD is yet to approach Friday's 1.0811 low amid a potential lack in conviction for positioning ahead of upcoming risk events.

- GBP is a touch softer vs. both USD and EUR with not much in the way of pertinent UK newsflow as the BoE remains quiet in the run up to next month's election. Cable is managing to hold above the 1.27 mark which coincides with Friday's low.

- JPY is marginally outmuscling the USD with Japanese fundamentals not seeing much in the way of developments over the weekend. USD/JPY ran into support around the 157 mark.

- Antipodeans are both a touch softer vs. the USD with AUD unable to benefit from an upward revision to Chinese Caixin Manufacturing PMI. AUD/USD is currently in consolidation mode, respecting Friday's 0.6626-0.6672 range and sitting just above its 10 and 21DMAs which both sit at 0.6635.

- EM FX: South Africa’s ANC lost its 30-year majority and as such, will now look to form a coalition (USD/ZAR -0.1%). Exit polls point to landslide victories for India’s Modi (USD/INR -0.4%) and Mexico’s Sheinbaum (USD/MXN +1.0%) with focus on whether the latter will be able to obtain a super-majority and enact policies which could be deemed as less market friendly.

- PBoC sets USD/CNY mid-point at 7.1086 vs exp. 7.2378 (prev. 7.1111)

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are firmer as Friday's PCE momentum remains in the driving seat into the ISM Manufacturing PMI. Within this, the Prices Paid metric will draw scrutiny following the jump to 60.9 (prev. 55.8) which took it into strong expansion territory.

- A relatively contained start for Bunds holding onto Friday's PCE-induced upside while APAC-session updates were unable to significantly move the dial; JGB action essentially just catch up to Friday.

- Gilts are in-fitting with peers but marginally outperforming EGBs, despite the lack of UK-specific newsflow, with the region's final PMIs unable to spark any real reaction. Gilts as high as 96.61 with last week's 97.13 high the next point of resistance.

- OAT price action follows the broader complex though with the magnitude of gains shy of its German-peer, likely a follow through from S&P downgrading France on Friday.

- Click here for more details.

COMMODITIES

- Crude prices headed lower in the aftermath of the of the OPEC+ meeting which outlined a future roadmap for the restoration of the supply from the voluntary cuts. In the European session, WTI/Brent have bounced off worst levels, albeit marginally so; Brent currently around USD 81.30/bbl.

- Precious metals are flat as the haven metals are torn between the stronger USD/constructive risk tone and a post-PMI downtick in yields. As it stands, XAU is unchanged at the mid-point of USD 2314-2331/oz parameters.

- Base metals are a touch firmer after the last 8/9 sessions have ended in the red. Albeit, upside is very modest thus far as the broader macro backdrop for the metal has not changed this morning despite two potentially bullish updates.

- JP Morgan is of the view that current oil prices are USD 8bbl too cheap and continues to make the bullish case for oil in Q3 amid its demand outlook. Anticipates global oil demand accelerating by 2.5mln BPD from end of April to the end of August. This would raise global refinery runs by 4mln BPD over the same period.

- Russia-China gas pipeline deal reportedly stalls over Beijing's price demands, according to the FT. China is said to have asked to pay prices close to Russia's subsidised domestic prices and would only commit to purchasing a smaller fraction of the Siberia 2 pipeline's annual capacity, sources said.

- An oil refinery in northwest Russia near the city of Ukhta was operating normally after a fire broke out on Sunday, according to Reuters.

- South Korean President Yoon said a vast amount of oil and gas reserve possibly undersea off South Korea's east coast; has approved exploration of possible oil and gas reserve; reserves could amount to up to 14bln barrels of oil and gas, according to Reuters.

- Magnitude 5.7 earthquake hit Antofagasta, Chile region, according to EMSC.

- Copper miners Freeport Indonesia has not received copper concentrate export permit extension, according to a spokesperson.

- Click here for more details.

OPEC+

- OPEC+ has agreed to extend its collective production cuts, which total around 3.6mln BPD, until the end of 2025 (prev. until the end of 2024). Additionally, the eight states that implemented voluntary cuts of 2.2mln BPD will extend these cuts until the end of Q3 2024 (prev. Q2 2024, exp. at least Q3 2024), after which they will gradually increase production from October 2024 to September 2025, contingent on market conditions.

- Additionally, the UAE has been permitted to increase its production by 0.3mln BPD from 2025, according to Reuters.

- Baseline revisions have been pushed back a year to 2026. "That’s because some countries like Russia are under embargo and the independent companies are not able to have access to data to support the assessment process.", according to Energy Intel's Bakr.

- "Under the agreement today there are no barrels that are immediately going to be added to the market. The partial return of the voluntary cuts in q4 this year is subject to market conditions. The agreement also does not stray away from the cautious path the group has been following. Even the possible return of the voluntary cuts is being done cautiously.", according to Energy Intel's Bakr.

- Saudi Energy Ministry said 2.2mln bpd voluntary oil cuts are to be extended till September and to be gradually phased out on a monthly basis till Sept 2025, according to Reuters citing a statement. Saudi Energy Ministry said the gradual monthly phase-out may be reversed according to market conditions, and added OPEC meeting welcomes Iraq, Russia, and Kazakhstan's renewed commitment to adhere to OPEC production cuts. Saudi Energy Ministry said the OPEC meeting also welcomes Iraq, Russia, and Kazakhstan's plan to resubmit their updated compensation for overproduction since January 2024 before the end of June, the statement said.

- Saudi Energy Minister said discussions among eight countries implementing voluntary cuts started two or three weeks ago, and "we are waiting for interest rates to come down, better trajectory of global growth, that would probably cause demand to increase with a clear path", according to Reuters. Saudi Energy Minister said some ministers gathered in Riyadh to make sure they interacted with each other and the message was comprehensively understood and agreed upon.

BANK COMMENTARY ON OPEC+

- Barclays says the OPEC+ outcome was mildly negative on net relative to their baseline balances view; given recent compliance numbers Barclays' oil balances would be 500k/BPD tighter in H2 and looser by 550k/BPD in 2025.

- UBS says OPEC+ announcement "could be seen as slightly bearish oil for very near term but decisions taken also reduce downside risk in the medium-term". Announcement does not change near-term outlook for oil. Sees oil supply deficit of 1.2 MB/D in Q3'24, expect it to support prices over the next few weeks; lifting Bren to "mid to high USD 80s".

CRYPTO

- Bitcoin saw modest gains overnight but remains within recent ranges of around USD 68,000.

- US President Biden said he is vetoing congressional disapproval of US SEC bulletin on crypto-assets, according to Reuters.

NOTABLE DATA RECAP

- EU HCOB Manufacturing Final PMI (May) 47.3 vs. Exp. 47.4 (Prev. 47.4)

- German HCOB Manufacturing PMI (May) 45.4 vs. Exp. 45.4 (Prev. 45.4)

- French HCOB Manufacturing PMI (May) 46.4 vs. Exp. 46.7 (Prev. 46.7)

- Italian HCOB Manufacturing PMI (May) 45.6 vs. Exp. 48.0 (Prev. 47.3)

- UK S&P Global Manufacturing PMI (May) 51.2 (Prev. 51.3)

- Turkish CPI MM (May) 3.37% vs. Exp. 3.0% (Prev. 3.18%); Turkish CPI YY (May) 75.45% vs. Exp. 74.8% (Prev. 69.8%)

NOTABLE EUROPEAN HEADLINES

- Deutsche Bank lifts its Euro-area 2024 GDP growth view to 0.9% (prev. 0.4%)

- German Engineering Orders +10% Y/Y in April (Domestic +3%; Foreign Orders +13%)

- Citi/YouGov UK inflation expectations: 1 year ahead at 3.1% (prev. 3.3%, now the lowest since July 2021), 5-10 years at 3.2% (prev. 3.5%).

- Online fashion Co. Shein, which was valued at USD 66bln in its last fundraising, will file a GBP 50bln London float this month, according to Sky News.

- Sanofi (SAN FP) reportedly pushes ahead with a EUR 20bln consumer healthcare spin-off, according to the FT.

- S&P cut France to AA- from AA; Outlook stable; downgrade on deterioration of budgetary position.

- Fitch affirmed Greece at 'BBB-'; outlook stable.

- Fitch upgraded Ireland to 'AA'; outlook stable

NOTABLE US HEADLINES

- Fed's Kashkari (non-voter) said rates to stay on hold for an “extended” time, and added that the US economy is strong, the labour market is strong, and inflation is coming down, via an FT interview from May 27th (ahead of the blackout period) but published on Monday.

- NVIDIA (NVDA) CEO Huang stated the Co. to upgrade its AI accelerators every year. CEO said on Sunday that the Co. next-generation artificial intelligence chip platform, called Rubin, would be rolled out in 2026, according to Reuters.

- AMD (AMD) CEO unveiled new MI325X accelerator chip at Computex event in Taipei, to be available in Q4 2024, AMD CEO said the Co. is aiming for an annual cadence for AI chips.

GEOPOLITICS

ISRAEL-HAMAS, European Morning

- Israel PM Netanyahu's office reportedly conveyed to Ben Gvir a message that contrary to President Biden's words, there is no clause in the draft agreement that includes stopping the war, and that the other clauses will not constitute a "surrender deal.

ISRAEL-HAMAS

- Israeli PM aide confirmed on Sunday that Israel had accepted a framework deal for winding down the Gaza war being advanced by US President Biden, according to Reuters. The aid however described the plan as flawed and in need of much more work. The aide added that Israeli conditions, including "the release of the hostages and the destruction of Hamas" have not changed.

- Hamas said they view US President Biden's latest proposal for a ceasefire as 'positive' and affirmed its readiness to deal positively with any proposal that offers a permanent ceasefire, complete withdrawal of Israeli forces from Gaza, reconstruction of the strip, return of displaced and a 'serious' hostage exchange, according to Reuters.

- Axios' Ravid posts "Israeli officials told me the Israeli hostage deal proposal President Biden presented in his speech exhausted Israel's manoeuvring space. There will not be a better one. If Hamas rejects it, the conflict will likely escalate."

- Qatar, the US, and Egypt jointly called on Hamas and Israel to finalise the agreement embodying the principles outlined by US President Biden, according to a joint statement.

- Israeli Defence Minister said in any process to bring about the end of the war, Israel will not accept the rule of Hamas in Gaza, according to Reuters.

- Israeli Finance Minister Smotrich called for the Gaza offensive to be pursued until Hamas is destroyed and all hostages are rescued, saying he would not stay in government otherwise, according to a post on X.

- Israeli National Security Minister Ben-Gvir threatened to bring down the coalition government if PM Netanyahu agreed to a deal that would include ending the war without eliminating Hamas, according to a post on X.

- US National Security spokesperson Kirby said the US has every expectation that if Hamas agrees to the proposal, then Israel will say yes, according to an ABC News interview.

- Yemen's Houthis said they conducted six military operations including targeting a US aircraft carrier and destroyer, and added they targeted 'Maina ship, Aloraiq ship and Abliani ship', according to Reuters.

- US CENTCOM said On June 1, it destroyed one Iranian-backed Houthi uncrewed aerial system (UAS) in the southern Red Sea, and also observed two other UAS crash into the Red Sea. No injuries or damage were reported. Additionally, USCENTCOM forces successfully engaged two Houthi anti-ship ballistic missiles in the southern Red Sea, according to Reuters.

- Israeli PM Netanyahu has accepted an invitation to address both houses of the US Congress, according to Reuters.

- Airstrikes said to hit a copper factory in Aleppo, Syria, according to Times of Israel; cites a post showing at least three explosions in quick succession; cites another post noting "This area has a huge presence for the Iranian militias and Hezbollah". "Al-Arabiya sources: Raids likely to be Israeli targeting northern Aleppo", according to Al-Arabiya

RUSSIA-UKRAINE

- Ukrainian President Zelenskiy said he received a signal from China they will not take part in the peace summit, according to Reuters.

- Russian Defence Ministry said Russia struck Ukraine's energy facilities working for the military-industrial complex, and hit depots with Western weapons, according to RIA.

- Russia has announced plans to raise taxes on businesses and the wealthy amid the need for additional revenue to fund the war in Ukraine, according to Sky News.

CHINA-TAIWAN

- Chinese Defence Minister, at the Shangri-La dialogue, said China will take resolute actions to curb Taiwan's independence and make sure such a plot never succeeds, and anyone who dares to separate Taiwan from China will only end up in self-destruction. He added China stays committed to peaceful reunification, however, this prospect is increasingly being eroded by separatists for Taiwan's independence and foreign forces, according to Reuters.

- Taiwan government reiterated Taiwan has never been a part of the People's Republic of China and added that China has repeatedly openly threatened Taiwan with force at international events, whilst maintaining peace in the Taiwan Strait is the common responsibility of both sides of the strait, according to Reuters.

OTHERS

- China State Security Ministry alleges British Secret Intelligence Service MI6 turned two staff members of Chinese central state organs to spy for the British government, according to a ministry statement.

- North Korea is to temporarily suspend sending balloons carrying trash, but will resume if South Korea sends anti-North Korea leaflets, according to KCNA citing the North Korean Vice Defence Minister.

APAC TRADE

- APAC stocks opened higher and then extended on gains as the region reacted to the softer-than-expected US Core PCE data on Friday alongside the prospect of a potential Israel-Hamas deal brokered by the US. The broader chip sector in the region was supported by NVIDIA CEO Huang stating the Co. is to upgrade its AI accelerators every year, later followed by an update from AMD at the Computex event in Taipei.

- ASX 200 saw its upside led by a broader strength across energy and financials, whilst Australia's Final Manufacturing PMI saw a modest revision higher from the prelim.

- Nikkei 225 briefly rose back above 39,000 with the upside also led by energy and financials, whilst capex data showed company profits surprisingly accelerated in Q1.

- India's Nifty 50 opened sharply higher by almost 3.5% at a record high after exit polls pointed to a landslide win by PM Modi.

- Hang Seng and Shanghai Comp were mixed as the former soared at the open with heavyweight stocks Alibaba and Tencent among the top gainers, whilst the latter initially bucked the regional trend and lagged despite any major headlines aside from China stating it will not join the Swiss peace conference on Ukraine, although losses were briefly trimmed after the Chinese Final Manufacturing PMI was revised higher than expected.

NOTABLE ASIA-PAC HEADLINES

- Moody's Ratings has raised China's growth forecast to 4.5% (prev. 4.0%) for 2024, according to Reuters.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- China has allocated CNY 6.44bln for vehicle trade-in subsidies, according to CCTV.

- BoJ Executive Director Kato said BoJ has no plan to immediately unload its ETF holdings; and hopes to spend time examining how to unload BoJ's ETF holdings in the future.

- Japanese MOF official said capex data reflects moderate economic recovery but attention is needed on corporate situation amid risks of global slowdown rising.

- Japanese Economy Minister Shindo states that real economic growth of 1.3% in FY 2025 is not so unrealistic, according to Reuters.

- Australia's minimum wage and award wages will increase by 3.75% from July 1st, the Fair Work Commission has announced, via ABC.

- BoJ Quarterly Bond Markey Survey: index gauging bond market function at -24 (prev. -29), fifth consecutive quarter of improvement

DATA RECAP

- Chinese Caixin Manufacturing PMI Final (May) 51.7 vs. Exp. 51.5 (Prev. 51.4)

- Australian Judo Bank Manufacturing PMI Final (May) 49.7 (Prev. 49.6).

- Japanese JibunBK Manufacturing PMI Final SA (May) 50.4 (Prev. 50.5)

- Japanese Business Capex (MOF) YY* (Q1) 6.8% (Prev. 16.4%)

- Japanese Capital Spending Ex Software Y/Y: 6.8% (exp. 8.4%; prev. 11.7%)

- Japanese Company Profits Y/Y: 15.1% (exp. 8.3%; prev. 13.0%)

- Japanese Company Sales Y/Y: 2.3% (exp. 2.4%; prev. 4.2%)

GLOBAL

- MSCI said due to the significant size of Saudi Aramco's secondary offering, MSCI intends to implement changes in MSCI indexes resulting from the offering, according to Reuters.

ELECTIONS

- South Africa's ANC lost its 30-year majority and won 159 out of 400 seats (prev. 230 seats) in South Africa's National Assembly, according to the electoral commission. South African President Ramaphosa said the election results represent a victory for democracy in South Africa, according to Reuters. South Africa's biggest opposition party, the Democratic Alliance, has appointed a negotiating team to speak with other political parties about forming a majority coalition, according to Reuters.

- Indian PM Modi’s BJP alliance is projected to win a majority in the general election, according to CNN-News18 exit poll; projected to win 355 to 370 seats in the general election.

- Mexico's Claudia Sheinbaum is seen winning the presidency with a landslide 56% effective vote vs 30% for Galvez, according to Parametria exit polls. Mexico’s Morena Party Chief said Claudia Sheinbaum has won the presidency. Mexico's Morena Party is projected to have a simple majority in Congress, according to party head Mario Delgado speaking to Milenio TV.