Europe Market Open: Disappointing Chinese PMIs capped gains, former President Trump found guilty

31 May 2024, 06:35 by Newsquawk Desk

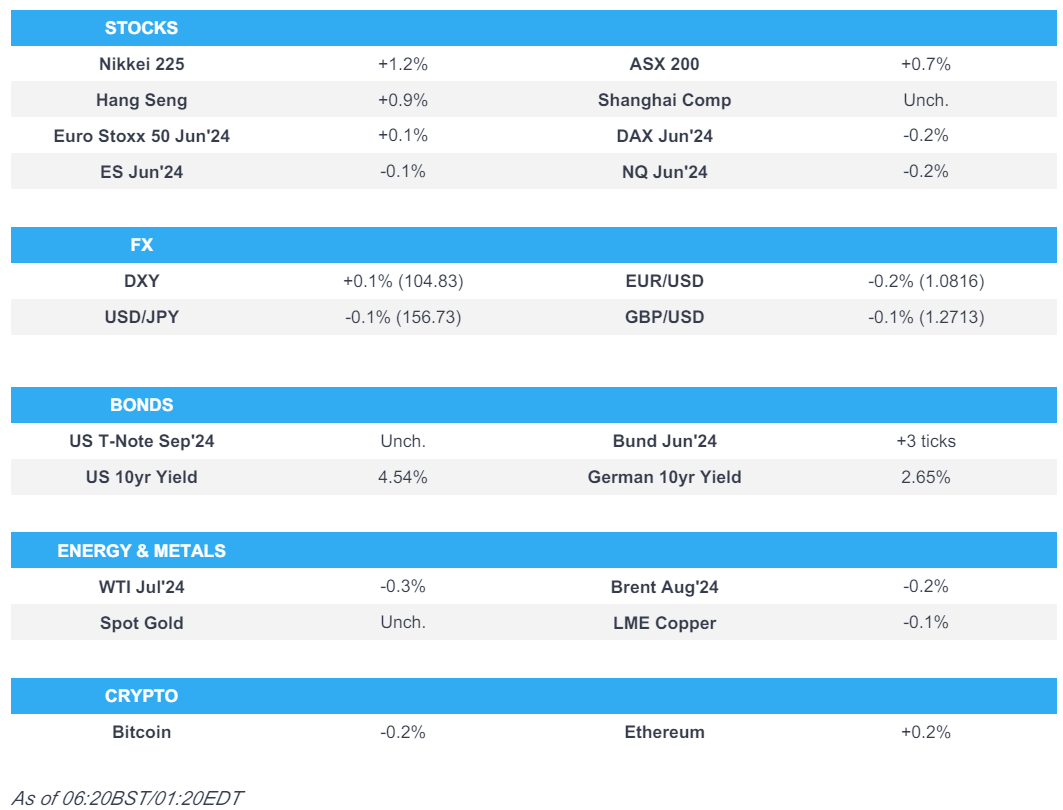

- APAC stocks traded mostly in the green and shrugged off the weak lead from the US but with gains capped by disappointing official Chinese PMIs.

- Former US President Trump was found guilty by a jury verdict on all 34 counts he faced at the hush money trial and will be sentenced on July 11th.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.4% on Thursday.

- DXY remains below the 105 mark, EUR/USD holds above 1.08 ahead of CPI, major FX pairs are broadly contained.

- Looking ahead, highlights include German Import Prices, Retail Sales, French CPI, EZ CPI, US PCE (Apr), Canadian GDP, France Credit Rating Review & Comments from Fed’s Bostic.

US TRADE

EQUITIES

- US stocks remained pressured and the major indices finished in the red despite the reprieve in treasuries after the second look at US GDP data in Q1 in which the headline was revised lower, as expected, and many of the inflation gauges cooled, while consumer spending also saw a downward revision. The data provided some slight relief for stocks although this was short-lived and the attention now turns to the Fed's preferred inflation gauge due on Friday.

- SPX -0.60% at 5,235, NDX -1.06% at 18,539, DJI -0.86% at 38,111, RUT +1.00% at 2,056.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Williams (voter) said there has been a dearth of progress on lowering inflation and inflation is still too high but should moderate in H2, while he added that policy is well positioned to get inflation back to the target. Williams said during the Q&A that he does not know when the Fed will change monetary policy and that at some point, interest rates will need to come down. Furthermore, he does not feel an urgency to act on monetary policy but noted the Fed does not need to be at exactly 2% inflation before it cuts rates.

- Fed's Bostic (voter) said the outlook is that inflation will come down very slowly, according to Fox.

- Fed's Goolsbee (non-voter) said the issue now is whether the US will face a traditional trade-off between inflation and unemployment, while he added it is "extremely important" that the Fed hits the 2% inflation target since it has centred expectations around that number.

- Cleveland Fed model suggested inflation may need years to return to 2%.

- Fed's Logan (non-voter) said there are good reasons to think we are still on the path to 2% inflation but it is bumpy, while she added it is too soon to think about rate cuts and policy may not be as restrictive as we might think. Furthermore, she said there are good reasons to believe the neutral rate is higher now than before the pandemic and if the neutral rate is higher than before, it suggests rates won't go back down to pre-pandemic levels.

- Former US President Trump was found guilty by a jury verdict on all 34 counts he faced at the hush money trial and will be sentenced on July 11th. Following the verdict, Trump said this was a disgrace and the real verdict will be on November 5th (US election), while he added that he is innocent and this was a rigged decision. There were also comments from House Speaker Johnson who said this was a shameful day in American history and that "President Trump will rightfully appeal this absurd verdict—and he will win".

APAC TRADE

EQUITIES

- APAC stocks traded mostly in the green and shrugged off the weak lead from the US but with gains capped amid a deluge of data releases at month-end including disappointing official Chinese PMIs.

- ASX 200 traded higher with outperformance seen in gold mining stocks and the defensive sectors.

- Nikkei 225 advanced with the index ultimately unfazed by the mixed data mixed data from Japan including mostly in-line Tokyo CPI, a surprise contraction in Industrial Production and better-than-expected Retail Sales.

- Hang Seng and Shanghai Comp conformed to the positive tone albeit with gains capped in the mainland after disappointing Chinese PMI data in which Manufacturing PMI unexpectedly slipped into contraction territory.

- US equity futures were lacklustre after yesterday's uninspired performance and heading into PCE price data.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.4% on Thursday.

FX

- DXY languished beneath the 105.00 level after weakening yesterday on softer Q1 GDP and PCE figures, while there was a lack of conviction across the FX space overnight as participants await the key April PCE price data.

- EUR/USD marginally softened ahead of a slew of releases including Eurozone inflation data.

- GBP/USD traded rangebound amid the lack of pertinent catalysts from the UK to spur price action.

- USD/JPY was contained after failing to sustain the 157.00 level which has since acted as resistance.

- Antipodeans were somewhat mixed as participants reflected on the mostly positive risk appetite and weak Chinese PMIs.

FIXED INCOME

- 10-year UST futures continued to partially nurse some of this week's declines with some reprieve seen after yesterday's downward GDP revision and softer Q1 PCE data, although price action was calm overnight with the Fed's preferred inflation gauge on the horizon.

- Bund futures marginally edged higher after reclaiming the 129.00 level ahead of a slew of data from the bloc.

- 10-year JGB futures were initially rangebound amid mixed data from Japan and after BoJ maintained its Rinban purchase amounts, although prices then gradually alongside a mild uptick in yields.

COMMODITIES

- Crude futures marginally extended on recent losses with prices not helped by weak Chinese factory activity.

- OPEC+ is discussing extending some oil output cuts expiring in 2024 into 2025, according to sources cited by Reuters. OPEC+ extension of some cuts into 2025 will likely come on top of voluntary cuts extension into Q3 to Q4 2024, according to three sources. Furthermore, OPEC+ will make cuts into 2025 conditional on agreeing on individual member output capacity figures later in 2024, according to two sources.

- Spot gold lacked firm direction as participants looked ahead to the Core PCE data.

- Copper futures remained subdued following yesterday's retreat and disappointing Chinese PMI data.

CRYPTO

- Bitcoin eked mild gains with price action choppy around the USD 68,500 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese state media said China has richer and more powerful countermeasures if the US continues to violate and endanger China's sovereignty and security interests on core issues, or squeeze the development space of Chinese firms and individuals. Furthermore, it warned that in the future, whether the US will suffer greater backlash and losses depends on its sincerity and actual actions.

- US Commerce Department is reportedly probing whether a South Korean maker of parts for machines that produce semiconductors has been selling to Chinese companies that are subject to US sanctions, according to The Information citing sources.

- US is reportedly reining in AI chip sales to the Middle East by Nvidia (NVDA) and AMD (AMD), while the US is reportedly worried about the technology getting diverted to China and it is also conducting a national security review of the region's AI use, according to Bloomberg.

- TikTok is reportedly working on a US copy of the app's core algorithm, according to Reuters citing sources who added that it may result in a version that operates independently of Bytedance and be more palatable to US lawmakers. However, TikTok later stated that the Reuters story published was misleading and inaccurate.

- Japan is to shift USD 640bln in public pension money into active investment, according to Nikkei.

DATA RECAP

- Chinese NBS Manufacturing PMI (May) 49.5 vs. Exp. 50.4 (Prev. 50.4)

- Chinese NBS Non-Manufacturing PMI (May) 51.1 vs. Exp. 51.5 (Prev. 51.2)

- Chinese Composite PMI (May) 51.0 (Prev. 51.7)

- Japanese Industrial Production MM (Apr P) -0.1% vs. Exp. 0.9% (Prev. 4.4%)

- Japanese Retail Sales YY (Apr) 2.4% vs. Exp. 1.9% (Prev. 1.2%, Rev. 1.1%)

- Tokyo CPI YY (May) 2.2% vs. Exp. 2.1% (Prev. 1.8%)

- Tokyo CPI Ex. Fresh Food YY (May) 1.9% vs. Exp. 1.9% (Prev. 1.6%)

- Tokyo CPI Ex. Fresh Food & Energy YY (May) 1.7% vs. Exp. 1.7% (Prev. 1.8%)

GEOPOLITICS

MIDDLE EAST

- Hamas said they are ready to reach a complete agreement, including a comprehensive hostage/prisoner exchange deal if Israel stops the war on Gaza, according to Reuters.

- US military said American and British forces conducted strikes against 13 Houthi targets in Yemen, while Houthi Al Masirah TV said one person was killed in the US-British strikes on Yemen's Hodeidah.

OTHER

- US President Biden secretly gave permission to strike inside Russia with US weapons, while a person familiar with the discussions between Washington and Kyiv said a final decision to ease that ban was “very close now”, hinting that the Biden administration will give the green light soon, according to Politico. It was separately reported that President Biden partially lifted the ban on Ukraine using US arms in strikes on Russian territory to defend Kharkiv, according to AP citing US officials.

- China has told other governments it will not join the Swiss peace conference on Ukraine and said the peace conference does not meet its conditions since Russia is not attending, according to Reuters sources.

- North Korean leader Kim guided a demonstration of large-scale multiple rocket launchers, according to KCNA.

EU/UK

DATA RECAP

- UK Lloyds Business Barometer (Apr) 50 (Prev. 42)