US Market Open: US equity futures softer, DXY unwinding recent advances & JPY is bid; US Q1 GDP/PCE due

30 May 2024, 11:15 by Newsquawk Desk

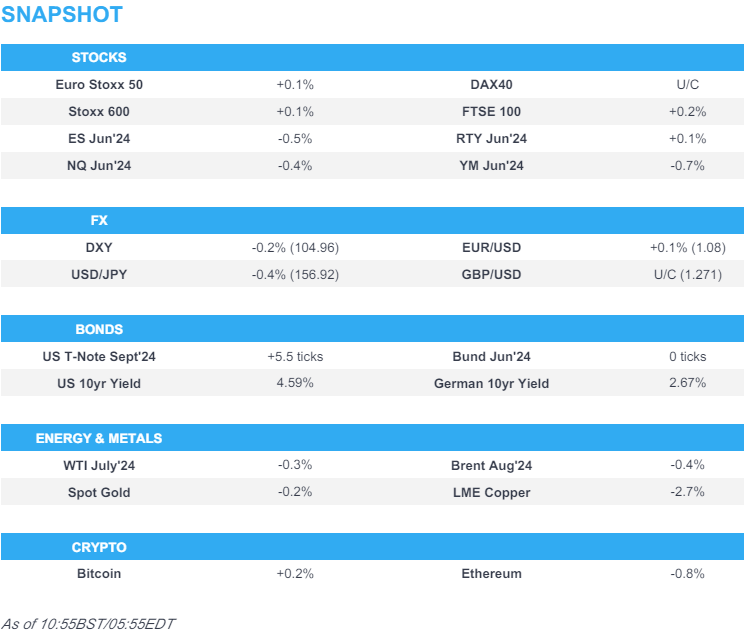

- European equities are modestly firmer, US futures are mostly lower though have been edging higher in recent trade

- Dollar is softer, haven currencies bid with USD/JPY holding around 156.85

- ZAR pressured as early vote count/models point to ANC losing the majority and securing at most 45% of the vote

- Bonds have bounced modestly from recent lows, with sentiment improving following a robust JGB auction

- Crude is modestly softer with oil-specific newsflow light, XAU and base metals also slip

- Looking ahead, US GDP Estimates, US PCE (Q1), IJC, Advance Goods Trade Balance, SARB Policy Announcement, Comments from Fed’s Williams, Logan & RBNZ Governor Orr. Earnings from Marvell, Dollar General & Best Buy

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) began the session on a mostly softer footing, continuing the price action seen in APAC trade overnight; however, sentiment improved as the morning progressed, with indices climbing modestly into the green.

- European sectors hold a positive bias; Tech is the clear laggard, with sentiment in the sector hit following weak guidance from Salesforce (-16% pre-market), which has weighed on peers such as SAP. Basic Resources is hampered by broader weakness in metals prices.

- US Equity Futures (ES -0.4%, NQ -0.4%, RTY +0.1%) are mixed, though have been edging higher in recent trade, in tandem with the broader pick-up in European stocks.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- DXY is lower and sitting just beneath the 105 mark after popping above its 50DMA at 105.09 and advancing to a 105.18 peak. US yields have been viewed as one of the main drivers for the USD's rise this week, as attention turns to the second reading of US Q1 GDP, PCE and Initial Jobless Claims later today.

- EUR/USD has moved back onto a 1.08 handle and in close proximity to its 100 DMA (1.0807) after slipping as low as 1.0789; which is just above the 200DMA at 1.0786.

- Cable is currently hugging the 1.27 mark, whilst EUR/GBP has moved back onto an 0.85 handle. Newsflow for the UK remains light aside from noise surrounding the general election.

- JPY is the best performer across the majors with some pinning the move on the recent bout of risk-aversion. USD/JPY continues to pullback from yesterday's 157.71 peak which was the highest since May 1st.

- Antipodeans are both muted vs. the USD. AUD/USD has been oscillating around the 0.66 mark in quiet trade with focus in part on fluctuations around the CNY (see below); today's 0.6591 was the lowest print since 14th May.

- USD/CNY is moving ever closer to the 7.25 mark with increasing speculation over how long the PBoC will keep the USD/CNY fix steady.

- ZAR has lost ground vs the Dollar as models predict that the ruling ANC party could lose its outright parliamentary majority. Further reports that suggest ANC is likely to get around 45% (prev. reports of 42.3%) helped to spark some modest upside for the ZAR; SARB Policy Announcement is also due today.

- PBoC set USD/CNY mid-point at 7.1111 vs exp. 7.2623 (prev. 7.1106).

- SNB's Jordan said there is a small upward risk to the SNB's inflation forecast and reasons to believe the natural rate of interest has increased or might rise, while he added that a weak CHF is the most likely source of inflation.

- South African Election Commission: Governing African National Congress (ANC) is on 42.3% of the vote with 10% of polling stations reported; thereafter, South Africa's ruling ANC party could win 41.5% of votes, according to Bloomberg citing a model.

- Most recently, South African Broadcaster ENCA says ANC is likely to get around 45% of the national vote and will fall short of a majority

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs have bounced modestly following Wednesday's soft 7yr auction, in part thanks to a robust JGB auction. USTs are near highs of 108-09+ vs Wednesday's 107-31 post-auction WTD base.

- Bunds are following USTs/JGBs but with magnitudes slightly more contained; Spanish harmonised inflation metrics Y/Y ticked up slightly, though was unable to spark any material move. Bunds up to a 129.23 peak.

- Gilt price action is following peers, going as high as 95.81 but someway to go before a retest of 96.43, 97.09 and 97.32 highs from earlier in the week.

- Italy to sell EUR 7.5bln vs exp. EUR 6-7.5bln 3.35% 2029, 3.85% 2029, 3.85% 2034 BTP and EUR 2bln vs exp. EUR 1.5-2bln 2029, 2032 CCTeu

- Click here for more details.

COMMODITIES

- Subdued trade for the crude complex as prices continue to trim the gains seen earlier this week and as attention turns to the OPEC+ confab on Sunday; Brent Aug sits between a 82.94-83.58/bbl range.

- Another downbeat session for precious metals despite the softer Dollar amid an intraday pullback in yields. Spot gold sees its losses more cushioned vs silver and palladium after the yellow metal found support near its 50 DMA; XAU trades within a USD 2,322.66-2,339.95/oz parameter.

- A devastating session for base metals thus far following the recent rise in yields and the Dollar, whilst the downbeat mood across Chinese markets overnight only added the pessimism in the complex.

- US Private Energy Inventory Data: Crude -6.5mln (exp. -2mln), Cushing -1.7mln, Distillates +2mln (exp. -0.2mln), Gasoline -0.5mln (exp. -0.5mln).

- Click here for more details.

CRYPTO

- Bitcoin is modestly firmer and holds around USD 67.5k, whilst Ethereum loses ground.

NOTABLE DATA RECAP

- Spanish CPI YY Flash NSA (May) 3.6% vs. Exp. 3.70% (Prev. 3.30%); Core 3.0% (prev. 2.9%); CPI MM Flash NSA (May) 0.3% vs. Exp. 0.30% (Prev. 0.70%); HICP Flash MM (May) 0.2% vs. Exp. 0.20% (Prev. 0.60%); HICP Flash YY (May) 3.8% vs. Exp. 3.7% (Prev. 3.4%)

- EU Industrial Sentiment (May) -9.9 vs. Exp. -9.4 (Prev. -10.5, Rev. -10.4); Consumer Confid. Final (May) -14.3 vs. Exp. -14.3 (Prev. -14.3); Services Sentiment (May) 6.5 vs. Exp. 6.5 (Prev. 6.0, Rev. 6.1); Economic Sentiment (May) 96.0 vs. Exp. 96.2 (Prev. 95.6); Selling Price Expec (May) 6.4 (Prev. 5.4, Rev. 5.6); Cons Infl Expec (May) 12.5 (Prev. 11.6); Unemployment Rate (Apr) 6.4% vs. Exp. 6.5% (Prev. 6.5%); Business Climate (May) -0.39 (Prev. -0.53, Rev. -0.51)

- Italian Producer Prices YY (Apr) -5.9% (Prev. -9.6%); Producer Prices MM (Apr) -0.9% (Prev. -0.2%)

- Swiss KOF Indicator (May) 100.3 vs. Exp. 102.3 (Prev. 101.8, Rev. 101.9); GDP YY (Q1) 0.6% vs. Exp. 0.6% (Prev. 0.6%, Rev. 0.5%); GDP QQ (Q1) 0.5% vs. Exp. 0.3% (Prev. 0.3%)

- Swedish Overall Sentiment (May) 94.0 (Prev. 95.0); Manufacturing Confidence (May) 98.5 (Prev. 100.5); Total Industry Sentiment (May) 94.6 (Prev. 96.3); Consumer Confidence SA (May) 91.3 (Prev. 88.9)

NOTABLE EUROPEAN HEADLINES

- UK PM Sunak promises interest rate cuts if he wins the election, according to The Times. PM Sunak said the economy was ‘heading in the right direction’ and that a vote for the Tories is a vote for cuts to interest rates as he set out a vision for a “more prosperous, more secure, more united country” if he wins the election.

- British Chambers of Commerce business lobby group said the next UK government must forge better trade relations with Europe and warned that companies face ever higher costs stemming from Brexit, according to FT.

- ECB is to impose the first-ever fines on banks for climate failures.

NOTABLE US HEADLINES

- Fed’s Bostic (voter) said the inflation path will be bumpy but the general trend is down and the path to 2% inflation is not assured, while he added that the Fed is vigilant and the job market is tight but not as tight. Furthermore, he said the breadth of price gains is still pretty significant and less inflation breadth would add to confidence for a cut.

- HP Inc (HPQ) Q2 2024 (USD): Adj. EPS 0.82 (exp. 0.81), Revenue 12.8bln (exp. 12.6bln). (Newswires) Shares +6.1% pre-market

- Salesforce Inc (CRM) Q1 2024 (USD): Adj. EPS 2.44 (exp. 2.38), Revenue 9.13bln (exp. 9.15bln). Weak guidance: Q2 adj. EPS view 2.34-2.36 (exp. 2.40), revenue view 9.2-9.25bln (exp. 9.34bln). FY EPS view 9.86-9.94 (exp. 9.76), FY Revenue view 37.7-38bln (exp. 37.98bln). (Newswires) Shares -16% pre-market

GEOPOLITICS

MIDDLE EAST

- Israel's army said Hamas is in Rafah and is holding Israeli hostages, so they are launching military operations there and will not stop fighting in Rafah until the hostages are freed.

- US official said the US is to boycott UN tribute to Iran's late President Raisi on Thursday, according to Reuters.

- "Hearing from sources that American resistance to the E3 censure resolution (on Iran) is fading; recognising the reality that E3 are pushing ahead", according to WSJ's Norman

OTHER

- Russian Foreign Minister Lavrov said China could arrange a peace conference in which Russia and Ukraine would participate, while he added that Russia regards planned supplies of F-16 fighters to Ukraine as a "signal action" by NATO in a nuclear area, according to RIA.

- North Korea fired what was suspected to be a ballistic missile which fell shortly after the launch announcement and appeared to have landed outside of Japan's exclusive economic zone, according to the Japanese Coast Guard and press. It was later reported that South Korea said North Korea fired what appeared to be multiple short missiles that flew about 350km.

- China's Defence Ministry says the recent Taiwan drills "reached expected goals"

APAC TRADE

- APAC stocks were on the back foot amid spillover selling from Wall St owing to the further upside in yields.

- ASX 200 was pressured with underperformance in miners after recent declines in underlying commodity prices.

- Nikkei 225 slumped at the open and briefly fell beneath the 38,000 level but is well off worse levels.

- Hang Seng and Shanghai Comp conformed to the uninspiring mood in which the Hong Kong benchmark gradually weakened with notable losses in mining and property stocks, while the mainland was rangebound following another substantial liquidity injection by the PBoC and after the central bank also vowed several support efforts including promoting trade and investment facilitation.

NOTABLE ASIA-PAC HEADLINES

- PBoC Deputy Governor Tao Ling said they will coordinate the relationship between short-term tasks and long-term goals, stable growth and risk prevention, and internal and external balances, as well as accelerate implementation and effectiveness of a relending facility for science and technology innovation. Tao said they will promote trade and investment facilitation, support the development of the offshore yuan market and support small- and medium-sized tech firms' first-time loans and equipment upgrades in key areas with big efforts.

- Chinese President Xi said at the China-Arab States Cooperation Forum that China is willing to build China-Arab relations as a benchmark for maintaining world peace and stability, while China is ready to work with the Arab side to explore ways to resolve hotspot issues conducive to upholding fairness, justice and achieving long-term peace and stability. Furthermore, he said China will accelerate the building of a China-Arab community of a shared future, as well as build a larger-scale investment and finance landscape with the Arab side.

- US officials reportedly escalated a crackdown on the controversial customs exemption that Temu, Shein and other e-commerce firms use to send cheap items from overseas to American shoppers without paying tariffs, according to The Information.

- RBA chief economist Hunter said they agree with the Treasury forecast on inflation and noted that CPI confirmed there was strength in some price sectors. Hunter added the Board is focused on inflation staying out of the band and there is strength in the inflation.

- PBoC says it is playing close attention to current bond market changes and potential risks; will sell low risk bonds including govt bonds when necessary.

- Some of China’s regional authorities reportedly are guiding firms to slow purchases of foreign currencies in a sign the nation is taking further measures to discourage capital outflows amid yuan weakness, according to Bloomberg.

DATA RECAP

- Australian Capital Expenditure (Q1) 1.0% vs. Exp. 0.5% (Prev. 0.8%)

- Australian Private Capital Expenditure 2024-2025 (AUD)(Est. 2) 155.4B (Prev. 145.6B)

- Australian Building Approvals (Apr) -0.3% vs. Exp. 1.5% (Prev. 1.9%, Rev. 2.7%)