Europe Market Open: Yields continue to drive action after another soft US auction

30 May 2024, 06:25 by Newsquawk Desk

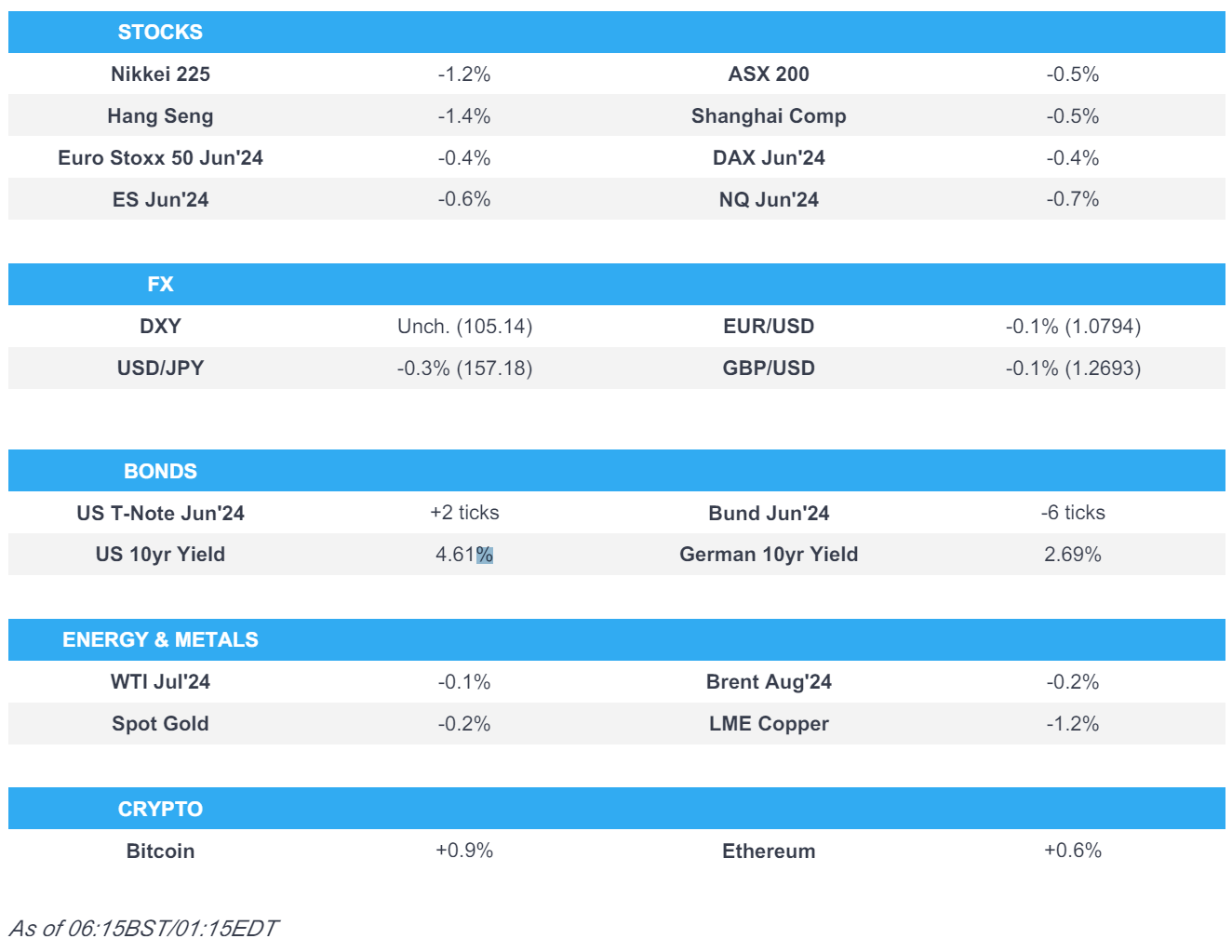

- APAC stocks were on the back foot amid spillover selling from Wall St owing to the further upside in yields; Nikkei 225 slumped at the open and briefly fell beneath the 38,000 level.

- DXY traded flat but held on to the prior day's gains above the 105.00 level after benefitting from higher yields, USD/JPY gradually eased back from its recent peak amid mild haven flows.

- 10-year UST futures were contained after the recent continued bear-steepening owing to a weak 7-year auction, Bund futures remained subdued.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 1.3% on Wednesday.

- Looking ahead, highlights include Spanish CPI, Swiss GDP, EZ Sentiment, EZ Unemployment Rate, Italian Producer Prices, US GDP Estimates, US PCE (Q1), IJC, Advance Goods Trade Balance, SARB Policy Announcement, Comments from Fed’s Williams, Logan & RBNZ Governor Orr, Supply from Italy, Earnings from Marvell, Dollar General & Best Buy.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks declined amid a lack of fresh macro catalysts and as yields edged higher again following another weak US auction, while the calendar was quiet with German inflation the main highlight which printed in line with estimates and participants continue to await looming key events. Futures were also pressured after-hours, especially Dow futures as Salesforce shares slumped around 17% post-earnings.

- SPX -0.74% at 5,267, NDX -0.70% at 18,737, DJI -1.06% at 38,442, RUT -1.48% at 2,036

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Beige Book stated national economic activity continued to expand from early April to mid-May. However, conditions varied across industries and districts as most Districts reported slight or modest growth, while two noted no change in activity. Furthermore, retail spending was flat to up slightly, reflecting lower discretionary spending and heightened price sensitivity among consumers.

- Fed’s Bostic (voter) said the inflation path will be bumpy but the general trend is down and the path to 2% inflation is not assured, while he added that the Fed is vigilant and the job market is tight but not as tight. Furthermore, he said the breadth of price gains is still pretty significant and less inflation breadth would add to confidence for a cut.

APAC TRADE

EQUITIES

- APAC stocks were on the back foot amid spillover selling from Wall St owing to the further upside in yields.

- ASX 200 was pressured with underperformance in miners after recent declines in underlying commodity prices.

- Nikkei 225 slumped at the open and briefly fell beneath the 38,000 level but is well off worse levels.

- Hang Seng and Shanghai Comp conformed to the uninspiring mood in which the Hong Kong benchmark gradually weakened with notable losses in mining and property stocks, while the mainland was rangebound following another substantial liquidity injection by the PBoC and after the central bank also vowed several support efforts including promoting trade and investment facilitation.

- US equity futures were pressured with Dow futures the worst hit as Salesforce shares fell 16% post-earnings.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 1.3% on Wednesday.

FX

- DXY traded flat but held on to the prior day's gains above the 105.00 level after benefitting from higher yields.

- EUR/USD trickled to just below 1.0800 but with further losses stemmed amid large option expiries at that level.

- GBP/USD was lacklustre after struggling to sustain the 1.2700 status and with little pertinent catalysts.

- USD/JPY gradually eased back from its recent peak amid mild haven flows into the Japanese currency.

- Antipodeans were contained amid the mostly downbeat mood and after mixed Building Approvals and Capex data from Australia, while the PBoC also continued to marginally weaken the CNY reference rate.

- PBoC set USD/CNY mid-point at 7.1111 vs exp. 7.2623 (prev. 7.1106).

- SNB's Jordan said there is a small upward risk to the SNB's inflation forecast and reasons to believe the natural rate of interest has increased or might rise, while he added that a weak CHF is the most likely source of inflation.

FIXED INCOME

- 10-year UST futures were contained after the recent continued bear-steepening owing to a weak 7-year auction.

- Bund futures remained subdued after slipping beneath the 129.00 level after yesterday's heavy selling.

- 10-year JGB futures followed suit to the weakness in global peers as Japan's 10-year yield briefly rose above 1.10%, while prices were later choppy following the somewhat mixed 2-year auction results.

COMMODITIES

- Crude futures were rangebound after retreating yesterday amid headwinds from a firmer dollar, while the private sector inventory report did little to spur prices despite the larger-than-expected draw in headline crude stockpiles.

- US Private Energy Inventory Data: Crude -6.5mln (exp. -2mln), Cushing -1.7mln, Distillates +2mln (exp. -0.2mln), Gasoline -0.5mln (exp. -0.5mln).

- Spot gold languished around this week's worst levels after recent dollar strength and a rise in yields.

- Copper futures extend on their declines in tandem with the overall downbeat risk tone.

CRYPTO

- Bitcoin mildly gained throughout the session and tested the USD 68,000 level to the upside.

NOTABLE ASIA-PAC HEADLINES

- PBoC Deputy Governor Tao Ling said they will coordinate the relationship between short-term tasks and long-term goals, stable growth and risk prevention, and internal and external balances, as well as accelerate implementation and effectiveness of a relending facility for science and technology innovation. Tao said they will promote trade and investment facilitation, support the development of the offshore yuan market and support small- and medium-sized tech firms' first-time loans and equipment upgrades in key areas with big efforts.

- Chinese President Xi said at the China-Arab States Cooperation Forum that China is willing to build China-Arab relations as a benchmark for maintaining world peace and stability, while China is ready to work with the Arab side to explore ways to resolve hotspot issues conducive to upholding fairness, justice and achieving long-term peace and stability. Furthermore, he said China will accelerate the building of a China-Arab community of a shared future, as well as build a larger-scale investment and finance landscape with the Arab side.

- US officials reportedly escalated a crackdown on the controversial customs exemption that Temu, Shein and other e-commerce firms use to send cheap items from overseas to American shoppers without paying tariffs, according to The Information.

- European Commission will postpone its decision on Chinese electric vehicle tariffs until after the European election on June 9th, according to Spiegel citing sources.

- RBA chief economist Hunter said they agree with the Treasury forecast on inflation and noted that CPI confirmed there was strength in some price sectors. Hunter added the Board is focused on inflation staying out of the band and there is strength in the inflation.

DATA RECAP

- Australian Capital Expenditure (Q1) 1.0% vs. Exp. 0.5% (Prev. 0.8%)

- Australian Private Capital Expenditure 2024-2025 (AUD)(Est. 2) 155.4B (Prev. 145.6B)

- Australian Building Approvals (Apr) -0.3% vs. Exp. 1.5% (Prev. 1.9%, Rev. 2.7%)

GEOPOLITICS

MIDDLE EAST

- Israel's army said Hamas is in Rafah and is holding Israeli hostages, so they are launching military operations there and will not stop fighting in Rafah until the hostages are freed.

- US official said the US is to boycott UN tribute to Iran's late President Raisi on Thursday, according to Reuters.

OTHER

- Russian Foreign Minister Lavrov said China could arrange a peace conference in which Russia and Ukraine would participate, while he added that Russia regards planned supplies of F-16 fighters to Ukraine as a "signal action" by NATO in a nuclear area, according to RIA.

- North Korea fired what was suspected to be a ballistic missile which fell shortly after the launch announcement and appeared to have landed outside of Japan's exclusive economic zone, according to the Japanese Coast Guard and press. It was later reported that South Korea said North Korea fired what appeared to be multiple short missiles that flew about 350km.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak promises interest rate cuts if he wins the election, according to The Times. PM Sunak said the economy was ‘heading in the right direction’ and that a vote for the Tories is a vote for cuts to interest rates as he set out a vision for a “more prosperous, more secure, more united country” if he wins the election.

- British Chambers of Commerce business lobby group said the next UK government must forge better trade relations with Europe and warned that companies face ever higher costs stemming from Brexit, according to FT.

- ECB is to impose the first-ever fines on banks for climate failures.