Europe Market Open: Indecisive US performance amid a firmer yield environment

29 May 2024, 06:35 by Newsquawk Desk

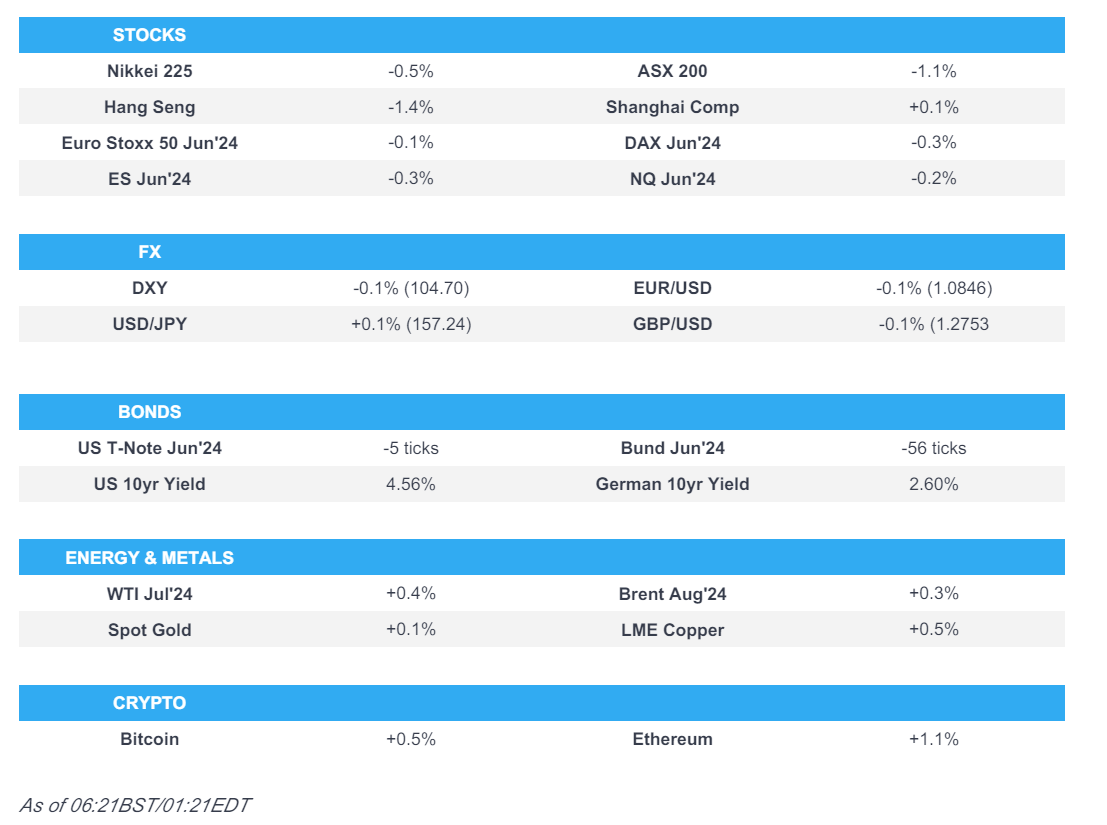

- APAC stocks traded mostly lower after the indecisive performance stateside amid the rising yield environment.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.6% on Tuesday.

- DXY trades in a tight range above 104.50, EUR/USD is a touch softer below 1.0850, AUD shrugged off hot CPI.

- BoJ Board Member Adachi said the BoJ is not yet at a stage where they are convinced that there is a sustained achievement of the price target.

- Looking ahead highlights include German GfK Consumer Sentiment, German CPI, US Richmond Fed Index, comments from Fed’s Williams & Bostic, Supply from UK, Germany & US

US TRADE

EQUITIES

- US stocks were mixed on return from the long weekend as participants digested several data releases including firm US Consumer Confidence metrics and with yields edging higher following soft US 2-year and 5-year auctions, while the latest Fed rhetoric failed to add anything incremental to the narrative although Kashkari once again warned that if inflation does not progress lower, then rate hikes could be on the agenda. Nonetheless, the Nasdaq-100 was supported by continued upside in NVDA post-earnings, while the S&P 500 was flat and the DJIA underperformed.

- SPX +0.03% at 5,306, NDX +0.32% at 18,869, DJIA -0.55% at 38,853, RUT -0.14% at 2,067.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) said new technologies often reallocate labour with a 'painful gap' for some workers.

- Fed's Kashkari (non-voter) said he would not pencil in more than two interest rate cuts this year.

- Fed Discount Rate minutes noted that all Fed reserve banks voted to hold the discount rate in April.

APAC TRADE

EQUITIES

- APAC stocks traded mostly lower after the indecisive performance stateside amid the rising yield environment.

- ASX 200 was dragged lower amid a jump in yields and after disappointing data including firmer-than-expected monthly CPI for April and a surprise contraction in Construction Work Done during Q1.

- Nikkei 225 failed to sustain an early momentum and a brief foray above 39,000 with headwinds from rising yields.

- Hang Seng and Shanghai Comp were mixed with notable losses in tech and consumer stocks front-running the declines in Hong Kong, while the mainland bucked the trend after more Chinese cities announced property support measures and the PBoC also conducted a relatively substantial liquidity injection heading into month-end.

- US equity futures (ES -0.3%) traded subdued after yesterday's uninspired performance as markets await key data.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.6% on Tuesday.

FX

- DXY traded within a thin range north of the 104.50 level after yesterday's initial weakness was reversed amid the upside in yields and a firmer-than-expected Consumer Confidence report, while Fed's Kashkari thought rate hikes were unlikely but not ruled out.

- EUR/USD marginally softened ahead of inflation data and after ECB officials echoed views of a June rate cut.

- GBP/USD remained lacklustre after pulling back from resistance at the 1.2800 level.

- USD/JPY edged slight gains at the 157.00 handle but with further upside limited amid firmer Japanese yields and a slew of rhetoric from BoJ's Adachi.

- Antipodeans lacked conviction with only brief support seen after firmer-than-expected monthly Australian CPI data as participants also digested disappointing Construction Work Done for Q1.

- PBoC set USD/CNY mid-point at 7.1106 vs exp. 7.2528 (prev. 7.1101).

FIXED INCOME

- 10-year UST futures continued to edge lower after bear steepening yesterday amid hot consumer confidence, rising inflation expectations and weak 2-yr and 5-yr auctions, while a 7-yr auction is also scheduled later.

- Bund futures remained pressured beneath the 130.00 level, while the attention turns to German CPI.

- 10-year JGB futures followed suit to the losses in global peers with 5yr and 10yr JGBs yields at their highest since 2011.

COMMODITIES

- Crude futures held on to the prior day's gains with WTI above USD 80/bbl amid geopolitical uncertainty.

- Iraq’s oil ministry called for a meeting with Kurdish authorities to reach a deal on the resumption of oil exports through Turkey's port of Ceyhan.

- Algeria's Sonatrach set June Saharan blend Crude oil OSP at a USD 0.15 premium to dated Brent (prev. 0.25 premium in May), according to Reuters citing a trade source.

- Norway's Kollsnes and Troll A platform are expected to restart today, according to the Power Exchange.

- Venezuela revoked the invitation for the EU to send electoral observers, according to the head of the electoral council.

- Spot gold was rangebound ahead of this week's key inflation metrics from different parts of the world.

- Copper futures were indecisive amid the mostly negative risk tone across the region but were kept afloat as the red metal's largest purchaser bucked the overall trend.

CRYPTO

- Bitcoin gradually climbed during the session and briefly tested USD 68,800 to the upside.

NOTABLE ASIA-PAC HEADLINES

- IMF upgraded China's 2024 economic growth target to 5% from 4.6% after "strong" Q1 and upgraded China's 2025 economic growth target to 4.5% from 4.1%, while IMF's Deputy Managing Director said they see scope for a more comprehensive policy package to address property sector issues and China's central government resources should be deployed to assist buyers of pre-sold unfinished homes.

- BoJ Board Member Adachi said changing monetary policy frequently to stabilise FX moves would lead to big changes in rate moves and if interest rate moves are too big, that would cause disruptions in household and corporate investment. Adachi said responding to short-term FX moves with monetary policy would affect price stability but noted if excessive yen falls are prolonged and are expected to affect the achievement of the price target, responding with monetary policy becomes an option. Adachi also commented that the BoJ must maintain accommodative financial conditions until the price goal is achieved and they are not yet at a stage where they are convinced that there is a sustained achievement of the price target, so must maintain accommodative conditions and must absolutely avoid raising interest rates prematurely. Furthermore, he said they will likely reduce JGB purchases at some stage in the future but warned reducing the BoJ's JGB bond buying at a sharp pace could cause damage to the economy, as well as noted that if yen declines accelerate or become prolonged, inflation could re-accelerate faster than expected and may require the BoJ to quicken the interest rate hike.

DATA RECAP

- Australian Weighted CPI YY (Apr) 3.60% vs. Exp. 3.40% (Prev. 3.50%)

- Australian Construction Work Done (Q1) -2.9% vs. Exp. 0.5% (Prev. 0.7%)

GEOPOLITICS

MIDDLE EAST

- Hamas is reportedly withdrawing from ceasefire talks after the attack on displaced persons camp resulted in 45 deaths, according to sources cited by MiddleEastEye.

- Algeria's UN envoy said they will propose a draft UN Security Council resolution on Gaza "to stop the killing in Rafah", according to Reuters.

- US military said Iranian-backed Houthis launched five anti-ship ballistic missiles from Houthi-controlled areas of Yemen into the Red Sea, while M/V LAAX which is a Marshall Islands-flagged, Greek-owned and operated bulk carrier, was struck by three of the missiles but continued its voyage.

OTHER

- French President Macron said Ukraine should be allowed to hit military targets in Russia, according to FT.

- North Korean leader Kim Jong Un said owning spy satellites will help the country's self-defence capabilities against US military provocation and that the recent satellite launch failed due to abnormal operation of the first-stage engine. Kim said the satellite launch was conducted with transparency and compliance with international law, while he added they will never give up efforts to own space reconnaissance capabilities.

- China's Taiwan Affairs Office said a difference in systems is not an impediment to "reunification" with Taiwan, while it added that as long as Taiwan independence provocations continue, China military's actions will too.

EU/UK

NOTABLE HEADLINES

- Survation Poll puts the opposition Labour Party in front by 23 points ahead of the UK Election in July with Labour seen at 47% (-1) and Conservative Party seen at 24% (-3).