Europe Market Open: Mixed APAC trade with geopols in focus, DXY softer

28 May 2024, 06:55 by Newsquawk Desk

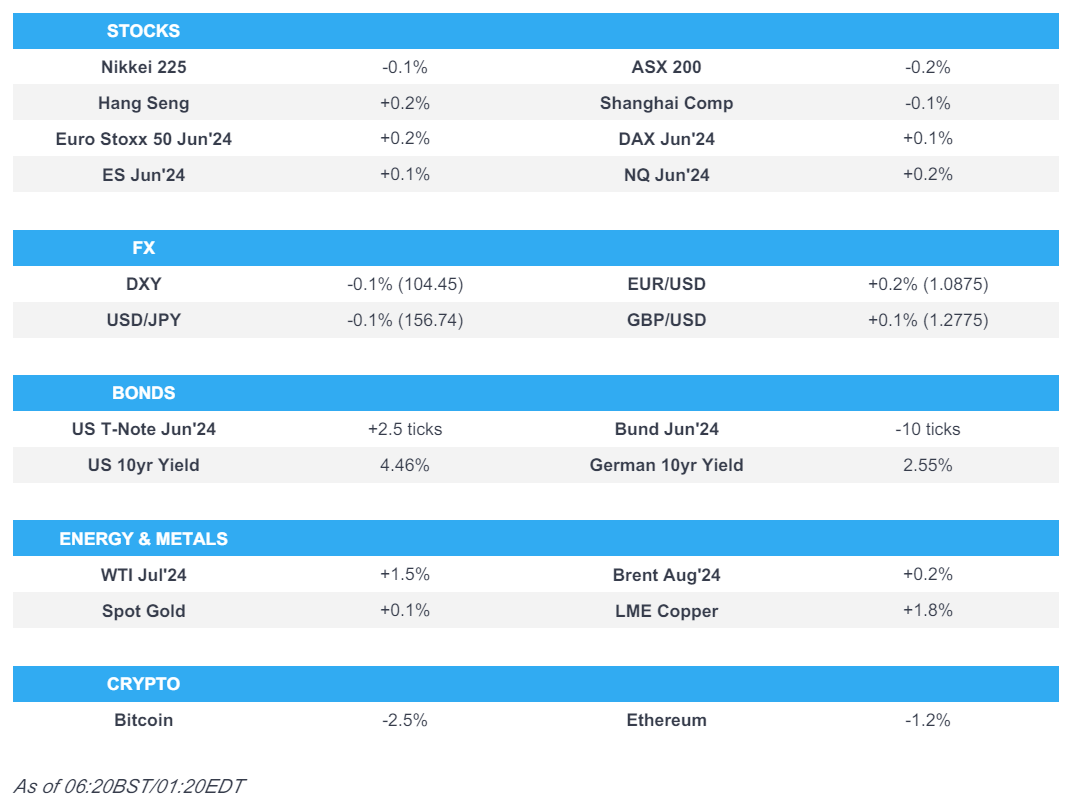

- APAC stocks were mixed with price action mostly rangebound in the absence of a lead from Wall St and as geopolitical uncertainty lingered following an Israeli strike on Rafah which killed dozens of Palestinians on Sunday.

- DXY marginally softened beneath the 104.50 level albeit with trade kept to within a very tight range following the Memorial Day holiday weekend stateside and with the Fed's preferred inflation gauge scheduled for this Friday.

- An Egyptian soldier was killed in a clash with Israeli troops at a crossing on Monday, according to Bloomberg; Both Israel and Egypt are trying to keep the event "low profile," according to Israeli Radio correspondent.

- European equity futures indicate a positive open with the Euro Stoxx 50 future up 0.2% after the cash market closed higher by 0.5% on Monday.

- Looking ahead, highlights include German Wholesale Price Index, ECB Consumer Expectations Survey, Canadian Producer Prices, Comments from ECB’s Schnabel, Fed’s Mester & Kashkari, Supply from Netherlands, Italy & US.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were closed for trade on Monday for Memorial Day.

APAC TRADE

EQUITIES

- APAC stocks were mixed with price action mostly rangebound in the absence of a lead from Wall St and as geopolitical uncertainty lingered following an Israeli strike on Rafah which killed dozens of Palestinians on Sunday.

- ASX 200 swung between gains and losses albeit in a thin range with sentiment not helped by soft retail sales.

- Nikkei 225 retreated after stalling beneath the 39,000 level as participants also digested the firm Services PPI data which accelerated by its fastest pace since 2015.

- Hang Seng and Shanghai Comp were somewhat varied as Hong Kong outperformed with Alibaba Health Information Technology front-running the gains post-earnings, while there was also notable strength in China's major oil companies after the recent upside in underlying commodity prices. Conversely, the mainland lacks conviction with only brief support seen in property stocks following Shanghai's latest measures to spur the flagging sector.

- US equity futures partially unwound some of Monday's gains as participants look to this week's data releases including the PCE price index scheduled for Friday.

- European equity futures indicate a positive open with the Euro Stoxx 50 future up 0.2% after the cash market closed higher by 0.5% on Monday.

FX

- DXY marginally softened beneath the 104.50 level albeit with trade kept to within a very tight range following the Memorial Day holiday weekend stateside and with the Fed's preferred inflation gauge scheduled for this Friday.

- EUR/USD benefitted from the softer Buck, despite continued signals of a June cut by ECB officials.

- GBP/USD further extended on its best levels in over two months although remained sub-1.2800.

- USD/JPY eventually slightly softened after firm Services PPI and currency jawboning.

- Antipodeans mildly added to recent advances in tandem with the upside in commodities.

- PBoC set USD/CNY mid-point at 7.1101 vs exp. 7.2402 (prev. 7.1091).

FIXED INCOME

- 10-year UST futures traded rangebound after the holiday lull and with key prices data due this week.

- Bund futures took a breather overnight after recently climbing in the aftermath of soft Ifo data.

- 10-year JGB futures were subdued after hot Services PPI data, while firmer demand at Japan's second-ever 10-year climate bond auction failed to spur prices.

COMMODITIES

- Crude futures held on to the prior day's gains amid geopolitical uncertainty after Israel's recent strikes on Rafah and gunfire exchange on the border with Egypt, while participants look towards the upcoming weekend's OPEC+ meeting.

- Spot gold remained afloat around USD 2,350/oz but with gains capped ahead of inflation metrics.

- Copper futures mildly extended on gains after rallying yesterday in thinned conditions and after sentiment was underpinned by the announcement of China's USD 47.5bln chip fund.

CRYPTO

- Bitcoin continued to fade Monday's initial surge and briefly tested the USD 68,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- China’s Politburo said preventing and defusing financial risks is linked to national security and people’s property security, while it added China must act to prevent and defuse financial risks, as well as promote high-quality financial development Furthermore, it stated financial risks are a major hurdle that must be overcome, according to state media.

- Shanghai adjusted the minimum down payment ratio for first-home buyers to no less than 20% and for second-home buyers to no less than 30%, while it cut the lower limit for interest rates on first-home mortgages to LPR minus 45bps. Furthermore, Shanghai is to establish and improve the housing system, explore buying housing through state-owned platform companies and other entities, as well as optimise the supply of housing security.

- Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals. Suzuki added that a weak yen boosts exporters' profits but increases the burden for consumers, while he is concerned more about the negative impact of a weak yen and is closely watching FX moves.

DATA RECAP

- Japanese Services PPI YY (Apr) 2.8% vs Exp. 2.3% (Prev. 2.3%)

- Australian Retail Sales MM Final (Apr) 0.1% vs. Exp. 0.2% (Prev. -0.4%)

CENTRAL BANKS

- Fed's Bowman (voter) would have supported either waiting to slow QT pace or more tapered slowing in balance sheet run-off, according to Reuters. 'In my view' bank reserves are not yet near 'ample' levels given the still-sizable take-up of ON-RRP. Important to keep reducing balance sheet size to reach ample reserves as soon as possible and while the economy is strong. Important to communicate any change to the run-off rate does not reflect a change in the Fed's monetary policy stance. 'Strongly' supports the principle of balance sheet holdings primarily being composed of Treasuries. A longer-run balance sheet 'tilted slightly' toward shorter maturities would allow flexibility in approach. In future, when the Fed conducts QE to restore market functioning or financial stability it should communicate that purchases will be temporary and unwound when market conditions have normalised. FOMC would have benefited from an earlier decision to taper and end QE in 2021; and would have allowed earlier rate hikes.

- Fed's Mester (voter) said would be preferable for FOMC statements to use more words to describe the current assessment of the economy and how that influences the outlook, as well as risks to that outlook, according to Reuters. Scenario analysis should also be incorporated as a standard part of Fed communications. Would like the Fed to publish an anonymised matrix of economic and policy projections so market participants can see the linkage between each participant’s outlook and their view of appropriate policy associated with that outlook. Expect the Fed will consider communications as part of its next monetary policy framework review.

- BoE Deputy Governor Broadbent rejected claims that the monetary policy committee acted too slowly and hit back at critics who have accused it of failing to control inflation, according to The Times.

- ECB’s Lane said keeping rates overly restrictive for too long could push inflation below target in the medium-term which would require corrective action that could even mean having to descend below neutral, while they think inflation over the coming months will bounce around at the current level and then will see another phase of disinflation bringing them back to the target later next year, according to Reuters. It was separately reported that ECB’s Lane said policymakers needed to keep rates in restrictive territory this year to ensure inflation kept easing, according to FT.

- ECB’s Rehn said inflation is converging to their 2% target in a sustained way and the time is thus ripe in June to ease the monetary policy stance and start cutting rates, while he added this assumes the disinflationary trend will continue and there will be no further setbacks in the geopolitical situation and energy prices.

- ECB’s Villeroy said they have significant room for rate cuts with the Deposit Facility rate at 4% and barring a surprise, a rate cut in June is a done deal, while Villeroy added that he doesn’t say they should commit already on July but they should keep their freedom on the timing and pace.

- ECB's Schnabel said QE could have weakened the transmission of monetary policy during the recent tightening cycle, according to Reuters.

- RBNZ activated debt-to-income restrictions which will create limits on the amount of high-DTI lending banks can make and will include an allowance for banks to do 20% of their lending outside of our specified limits, while banks must comply with new restrictions from July 1st.

- BoJ Monetary Affairs Department Director-General Masaki said changes in wages in real terms will move to positive territory on a Y/Y basis and need to keep an eye on energy prices and forex moves, according to Reuters.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said something went tragically wrong regarding the Israeli air strike on Rafah and it will be investigated, while Israel’s government said initial reports are that Rafah civilians died from a fire that broke out after an Israeli strike on Hamas chiefs.

- Israeli PM Netanyahu reportedly intends to dissolve the War Council so that he does not have to include Ben-Gvir and Smotrich in it, according to the Israel Broadcasting Corporation.

- Israel is waiting to hear Hamas’s stance before deciding on re-joining hostage talks, according to Times of Israel.

- Palestinian media reported intensive Israeli shelling in the vicinity of the Emirati hospital west of Rafah in the southern Gaza Strip, according to Al Arabiya.

- Pro-Iranian militias in Iraq claimed responsibility for launching three drones at military targets in Eilat, while Israel said three drones launched from Iraq were intercepted.

- White House noted devastating images following the Israeli strike in Rafah on Sunday, while it is actively engaging the IDF and partners on the ground to assess what happened. Furthermore, the White House said Israel must take every precaution possible to protect civilians.

- French President Macron said he is outraged by the Israeli strikes that have killed many displaced persons in Rafah and called for these operations to stop.

- EU’s Borrell said he is horrified by news out of Rafah regarding Israeli airstrikes killing dozens of displaced persons including small children and condemned this in the strongest terms, while he called for attacks to stop immediately. EU Borrell also stated that he has the green light from EU ministers to reactivate the Rafah border mission.

- UN Secretary-General Guterres said they condemned Israel’s practices that led to the killing of dozens of innocent people seeking shelter from the conflict and called for the terror to stop, according to Reuters.

- An Egyptian soldier was killed in a clash with Israeli troops at a crossing on Monday, according to Bloomberg.

- Yemen’s Houthis said they launched attacks on three ships in the Indian Ocean and Red Sea, while Houthis also stated that they targeted two US destroyers in the Red Sea, according to Reuters.

- IAEA report stated that Director General Grossi deeply regrets that Iran has not reversed its decision to bar several experienced inspectors, while it noted that outstanding safeguard issues including uranium traces at undeclared sites remain unresolved. It also stated that according to the IAEA’s definition, Iran’s stock of uranium enriched up to 20% is theoretically enough to produce a nuclear bomb if enriched further, according to Reuters.

OTHER

- Ukrainian President Zelensky will visit Belgium on Tuesday to sign the latest in a string of security accords with Western allies, according to the Belgian PM's office cited by Reuters.

- Ukrainian commander said French military instructors are to visit Ukrainian training centres, according to Reuters.

- Russia’s Foreign Ministry said Russia will respond to the restriction on Russian diplomats’ movement in Poland, according to TASS.

- China’s Foreign Ministry said US lawmakers paid a visit to Taiwan despite China’s strong opposition and it urged them to stop playing the Taiwan card and stop using excuses to interfere in China’s internal affairs, while it also lodged stern representations against the visit, according to Reuters.

- China and the US held talks on maritime issues and exchanged views on May 24th, while they will continue negotiations to avoid a misunderstanding and agreed to manage maritime risks, according to China's Foreign Ministry. Furthermore, China and the US agreed to maintain dialogue and China urged the US to refrain from intervening in maritime disputes between China and its neighbours, while it added the US should refrain from ganging up to 'use the sea to control China' and should immediately stop supporting and condoning 'Taiwan independence' forces.

- China Maritime Safety Authority said China is to conduct military exercises in the Yellow Sea between May 28th and June 3rd and will conduct sea rocket launches in the Yellow Sea on May 28th-31st, according to Reuters.

- North Korea launched a rocket carrying a spy satellite which exploded in the first stage of the launch. South Korea and Japan condemned North Korea’s launch, while the US said North Korea’s launch is a brazen violation of UN Security Council resolutions and raises tensions. Furthermore, the launch was said to have involved technologies directly involved in North Korea’s ICBM program and the US is assessing the situation but noted that the launch did not pose an immediate threat, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak is to announce a GBP 2.4bln tax cut for pensioners in a bid to shore up the key Conservative 'grey vote' and stabilise the party's chaotic start to the general election campaign, according to FT.

DATA RECAP

- UK BRC Shop Price Index YY (May) 0.6% vs Exp. 1.0% (Prev. 0.8%)