US Market Open: US equity futures modestly firmer, Dollar softer in quiet trade and Bonds gain modestly

24 May 2024, 10:40 by Newsquawk Desk

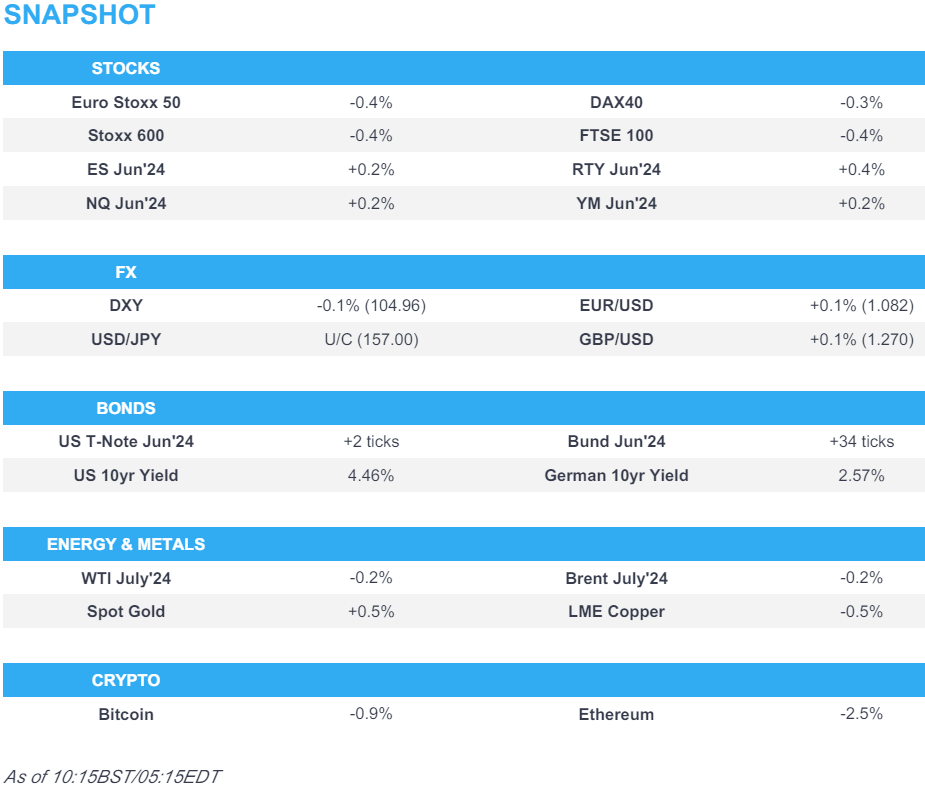

- European bourses are entirely in the red, though have recently has clambered off lows; US equities are modestly firmer.

- Dollar is slightly softer, GBP shrugs off initial Retail Sales weakness, overall trade contained.

- Bonds are very modestly firmer, attempting to claw back some of the US PMI-induced pressure.

- Crude is softer and near session lows without a clear catalyst, XAU gains whilst base metals consolidate.

- Looking ahead, US Durable Goods, Canadian Retail Sales, Comments from ECB’s de Cos, Centeno and Fed’s Waller.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.5%), are entirely in the red, though off worst levels, with Europe playing catch-up to the risk-off sentiment which reverberated from the Wall Street afternoon session.

- European sectors hold a strong negative bias; Banks and Tech reside as the laggards whilst Retail, Autos & Parts, and Media are among the better performers, albeit still mostly in the red.

- US Equity Futures (ES +0.2%, NQ Unch, YM +0.2%, RTY +0.3%) are marginally firmer attempting to pare back some of yesterday's hefty losses.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- DXY is marginally softer vs. some peers but ultimately still around yesterday's PMI-inspired best levels which saw DXY tick above the 105 mark; trough thus far at 104.92.

- EUR is a touch firmer vs. the USD after finding support above the 1.08 mark. Price action this week has largely been at the whim of the USD with yesterday's EZ PMI data overshadowed by the equivalent US release. overshadowed by the equivalent US release.

- GBP is steady vs. the USD after yesterday's PMI-induced downside, and brushes off initial pressure following the softer-than-expected Retail Sales figures. Cable currently trades on either side of 1.27.

- JPY is marginally softer vs. the USD following mixed Japanese inflation metrics overnight which warrant a cautious stance from the BoJ and an unchanged rate at the June meeting. For now, the pair is contained within yesterday's 156.50-157.19 range.

- Antipodeans are both contained vs. the USD in quiet trade. AUD/USD has been unable to launch much of a recovery from recent losses. NZD/USD is steady vs. the USD having performed much better than its antipodean counterpart this week on account of a hawkish RBNZ.

- PBoC set USD/CNY mid-point at 7.1102 vs exp. 7.2539 (prev. 7.1098).

- Click here for more details.

FIXED INCOME

- USTs are marginally firmer with prices unable to launch much in the way of a meaningful recovery after yesterday's PMI-induced losses and awaiting impetus from US Durable Goods. Today's range is well contained within yesterday's 108.17+ to 109.06 parameters.

- Bunds are attempting to claw back some of the lost ground seen yesterday in the wake of encouraging EZ PMI metrics, which were then followed up by an uptick in EZ wages and a particularly hot US PMI release.

- Gilts are attempting to atone for yesterday's downside which followed the broader dynamics within global fixed income markets. Gains are smaller than their German counterpart despite disappointing UK retail sales metrics which saw a M/M contraction of -2.3% vs. exp. -0.4%.

- Click here for more details.

COMMODITIES

- Crude is modestly softer in what has been a catalyst-thin session thus far; Brent sits in a USD 81.05-81.55/bbl.

- Spot gold and silver attempt to recover from yesterday's steep losses in the absence of fresh catalysts this morning; XAU sits in a USD 2,325.47-2,340.69/oz intraday range.

- Mixed/contained trade across base metals as prices consolidate from this week's choppiness which saw 3M LME copper print record highs on Monday before tumbling over USD 700/t throughout the week.

- OPEC+ to meet virtually on June 2nd, according to statement (prev. June 1st)

- Click here for more details.

CRYPTO

- Bitcoin is modestly softer and holds just above USD 67k, whilst Ethereum slips below USD 3.7k.

- US SEC approved plans from NYSE, CBOE and Nasdaq for the listing of spot Ethereum ETFs.

NOTABLE DATA RECAP

- UK GfK Consumer Confidence (May) -17.0 vs. Exp. -18.0 (Prev. -19.0)

- UK Retail Sales YY (Apr) -2.7% vs. Exp. -0.2% (Prev. 0.8%, Rev. 0.4%); MM (Apr) -2.3% vs. Exp. -0.4% (Prev. 0.0%, Rev. -0.2%); Ex-Fuel YY (Apr) -3.0% vs. Exp. -1.1% (Prev. 0.4%, Rev. 0.0%); Ex-Fuel MM (Apr) -2.0% vs. Exp. -0.6% (Prev. -0.3%, Rev. -0.6%)

- German GDP Detailed YY NSA (Q1) -0.9% vs. Exp. -0.9% (Prev. -0.9%); GDP Detailed QQ SA (Q1) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

NOTABLE EUROPEAN HEADLINES

- ECB's Schnabel says some elements of inflation are proving persistent; would caution against moving too fast on rates

- UK Ofgem Energy Price Cap (GBP): 1,568 (exp. 1,574; prev. 1,690), -7% (exp. -7%) for dual-fuel households.

- Barclays expects the BoE to begin lowering rates in August with rate cuts to follow in November and December.

NOTABLE US HEADLINES

- Tesla (TSLA) to cut Model Y output at Shanghai plant by at least 20% during March-June 2024, via Reuters citing sources

- US Treasury Secretary Yellen said many Americans are still struggling with inflation, while she expressed concern over 'substantial' increases in living costs, according to FT.

GEOPOLITICS

CHINA/TAIWAN

- China on Friday sent multiple bombers to conduct mock missile strikes in the Taiwanese drills, with dozens of missiles used in the drills, according to Chinese state media.

MIDDLE EAST

- Israel’s PM and ministers decided to expand the mandate of the negotiating team during the war cabinet meeting on Wednesday night, according to Axios' Ravid citing an Israeli senior official, although the official noted that it is not certain that it will be possible to achieve a breakthrough in the talks on abductees.

- American and British aircraft launched two raids on Hodeidah Airport in Yemen. It was later reported that a Yemeni official said about ten Houthi leaders and experts were killed and wounded in the marches and missiles as the coalition targeted an operations room in Hodeidah, according to Sky News Arabia.

OTHER

- Russian President Putin is reportedly ready to halt the war in Ukraine with a negotiated ceasefire which recognises current battlefield lines, according to Reuters sources; but is prepared to fight on if Ukraine and the West do not respond

- Ukrainian President Zelensky is set to attend the G7 leaders meeting in a fresh push for aid, according to Bloomberg. It was separately reported that House Speaker Johnson said they would soon host Israeli PM Netanyahu for a joint session of Congress.

- Japan imposed sanctions against Russian-related entities and an individual. It was separately reported that South Korea imposed sanctions on seven North Korean individuals and two Russian vessels.

- China's Defence Ministry said military drill exercises around Taiwan continued and they will test the ability to jointly seize power, strike jointly, and occupy and control key areas.

- US, Australia, Britain, Canada, Japan, Czech Republic, Lithuania and German offices in Taipei issued a joint statement supporting Taiwan's participation at the WHO meeting.

- Azerbaijan takes control of four villages on the border with Armenia, according to Tass

APAC TRADE

- APAC stocks followed suit to the selling on Wall St where the initial NVIDIA-related euphoria was soured after strong US PMI data lifted the dollar and yields.

- ASX 200 declined with underperformance seen in the consumer and rate-sensitive sectors.

- Nikkei 225 gapped down at the open beneath the 39,000 level amid the headwinds from the US, while participants digested mixed inflation data which slowed in pace from the prior month.

- Hang Seng and Shanghai Comp were lower with the former weighed on by losses in the property sector and with tech stocks pressured by mixed earnings, while the downside was limited in the mainland amid a lack of catalysts.

NOTABLE ASIA-PAC HEADLINES

- RBNZ Deputy Governor Hawkesby said while near-term inflation risks are to the upside, he is confident medium-term inflation is returning to the target. Hawkesby said no single data point will cause a rate hike and he is watching domestic inflation pressures and expectations, while he added that cutting interest rates is not part of the near-term discussion and there is a lot of uncertainty about tradable inflation going forward.

- RBNZ Assistant Governor Silk said RBNZ is concerned about near-term inflation risks and adjusts its models after underestimating domestic inflation.

DATA RECAP

- Japanese National CPI YY (Apr) 2.5% vs. Exp. 2.4% (Prev. 2.7%); National CPI Ex. Fresh Food YY (Apr) 2.2% vs. Exp. 2.2% (Prev. 2.6%); National CPI Ex. Fresh Food & Energy YY (Apr) 2.4% vs. Exp. 2.5% (Prev. 2.9%)