Europe Market Open: US equity pressure filters into European futures, DXY flat ahead of US Durable Goods & Fed speak

24 May 2024, 06:45 by Newsquawk Desk

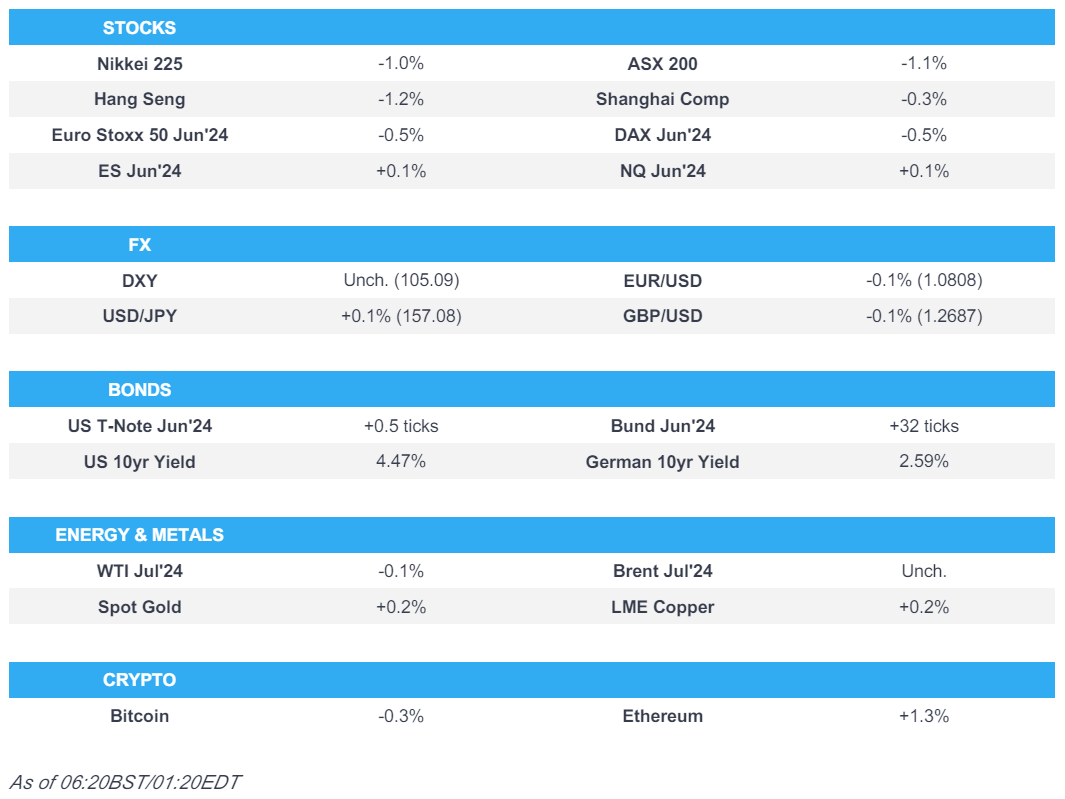

- The selling in US stocks yesterday accelerated once European desks packed for the day, with little fresh fundamentals driving the move after the US Flash PMIs.

- APAC stocks followed suit to the selling on Wall St where the initial NVIDIA-related euphoria was soured after strong US PMI data lifted the dollar and yields.

- DXY traded steadily after surmounting the 105.00 level in the aftermath of the strong US PMI data, USD/JPY marginally edged higher after reclaiming the 157.00 handle.

- European equity futures indicate a lower open with the Euro Stoxx 50 future down 0.5% after the cash market closed higher by 0.3% on Thursday.

- Looking ahead, highlights include UK Retail Sales, US Durable Goods, Canadian Retail Sales, Comments from ECB’s Schnabel & de Cos, Fed’s Waller & SNB’s Jordan.

24th May 2024

US TRADE

EQUITIES

- US stocks were pressured and futures gave back the early NVIDIA-inspired gains with headwinds from the upside in yields after the hot services PMI data which underpinned the dollar and dragged equities lower. The selling in stocks accelerated once European desks packed for the day with little fresh fundamentals driving the move.

- SPX -0.74% at 5,267, NDX -0.44% at 18,623, DJIA -1.53% at 39,869, RUT -1.60% at 2,048.

- Click here for a detailed summary.

NOTABLE HEADLINES/EARNINGS

- Fed's Bostic (voter) said the last couple of inflation numbers suggest it's going back to 2%, but going slow, while he added households and homeowners locked in low rates which limits the sensitivity of the economy to Fed rate hikes.

- US Treasury Secretary Yellen said many Americans are still struggling with inflation, while she expressed concern over 'substantial' increases in living costs, according to FT.

- The OCC announced enforcement action against Comerica (CMA) and said it found unsafe or unsound practices including those relating to the bank's risk governance framework and internal controls.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the selling on Wall St where the initial NVIDIA-related euphoria was soured after strong US PMI data lifted the dollar and yields.

- ASX 200 declined with underperformance seen in the consumer and rate-sensitive sectors.

- Nikkei 225 gapped down at the open beneath the 39,000 level amid the headwinds from the US, while participants digested mixed inflation data which slowed in pace from the prior month.

- Hang Seng and Shanghai Comp were lower with the former weighed on by losses in the property sector and with tech stocks pressured by mixed earnings, while the downside was limited in the mainland amid a lack of catalysts.

- US equity futures attempted to find some composure following yesterday's heavy selling pressure.

- European equity futures indicate a lower open with the Euro Stoxx 50 future down 0.5% after the cash market closed higher by 0.3% on Thursday.

FX

- DXY traded steadily after surmounting the 105.00 level in the aftermath of the strong US PMI data.

- EUR/USD remained lacklustre following the prior day's whipsawing and slump to near the 1.0800 level.

- GBP/USD price action was contained beneath the 1.2700 handle as the focus turns to UK Retail Sales.

- USD/JPY marginally edged higher after reclaiming the 157.00 handle on the recent upside in US yields.

- Antipodeans languished around the prior day's lows amid the risk-off mood and subdued commodities.

- PBoC set USD/CNY mid-point at 7.1102 vs exp. 7.2539 (prev. 7.1098).

FIXED INCOME

- 10-year UST futures saw a slight reprieve from the recent data-induced selling pressure.

- Bund futures nursed some of this week's losses and reclaimed the 130.00 level.

- 10-year JGB futures were choppy after mixed-to-inline CPI data and with brief pressure following softer demand at the enhanced-liquidity auction long to super-long JGBs.

COMMODITIES

- Crude futures remained lacklustre after declining for the fourth straight session yesterday.

- Spot gold was stuck at this week's lows with prices constrained after recent dollar strength.

- Copper futures traded rangebound following recent indecision and the risk-off mood.

CRYPTO

- Bitcoin was choppy with prices contained beneath the USD 68,000 level, while Ethereum prices were only mildly supported after the SEC approved plans to list ETH ETFs.

- US SEC approved plans from NYSE, CBOE and Nasdaq for the listing of spot Ethereum ETFs.

NOTABLE ASIA-PAC HEADLINES

- RBNZ Deputy Governor Hawkesby said while near-term inflation risks are to the upside, he is confident medium-term inflation is returning to the target. Hawkesby said no single data point will cause a rate hike and he is watching domestic inflation pressures and expectations, while he added that cutting interest rates is not part of the near-term discussion and there is a lot of uncertainty about tradable inflation going forward.

- RBNZ Assistant Governor Silk said RBNZ is concerned about near-term inflation risks and adjusts its models after underestimating domestic inflation.

DATA RECAP

- Japanese National CPI YY (Apr) 2.5% vs. Exp. 2.4% (Prev. 2.7%)

- Japanese National CPI Ex. Fresh Food YY (Apr) 2.2% vs. Exp. 2.2% (Prev. 2.6%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Apr) 2.4% vs. Exp. 2.5% (Prev. 2.9%)

GEOPOLITICS

MIDDLE EAST

- Israeli army announced the elimination of the commander of the Hamas Beit Hanoun Brigade, Hussein Fayyad, during operations in Jabalia, according to Sky News Arabia.

- Israel’s PM and ministers decided to expand the mandate of the negotiating team during the war cabinet meeting on Wednesday night, according to Axios' Ravid citing an Israeli senior official, although the official noted that it is not certain that it will be possible to achieve a breakthrough in the talks on abductees.

- All the heads of the establishment and negotiating team presented a united front regarding the need to act urgently to obtain a hostage deal, even at the cost of a willingness to discuss Hamas' latest proposal and make more compromises, according to Axios' Ravid.

- CIA director Burns will travel to Europe in the next few days for a meeting with Mossad director David Barnea to try and revive Gaza hostage talks, while Qatari and Egyptian officials might also participate in the meeting, according to Axios’s Ravid citing officials.

- American and British aircraft launched two raids on Hodeidah Airport in Yemen. It was later reported that a Yemeni official said about ten Houthi leaders and experts were killed and wounded in the marches and missiles as the coalition targeted an operations room in Hodeidah, according to Sky News Arabia.

OTHER

- Ukrainian President Zelensky is set to attend the G7 leaders meeting in a fresh push for aid, according to Bloomberg. It was separately reported that House Speaker Johnson said they would soon host Israeli PM Netanyahu for a joint session of Congress.

- Japan imposed sanctions against Russian-related entities and an individual. It was separately reported that South Korea imposed sanctions on seven North Korean individuals and two Russian vessels.

- China's Defence Ministry said military drill exercises around Taiwan continued and they will test the ability to jointly seize power, strike jointly, and occupy and control key areas.

- US, Australia, Britain, Canada, Japan, Czech Republic, Lithuania and German offices in Taipei issued a joint statement supporting Taiwan's participation at the WHO meeting.

EU/UK

DATA RECAP

- UK GfK Consumer Confidence (May) -17.0 vs. Exp. -18.0 (Prev. -19.0)