Europe Market Open: APAC stocks traded mixed following soft performance of US cash markets after FOMC minutes but before receiving support post-Nvidia earnings

23 May 2024, 06:31 by Newsquawk Desk

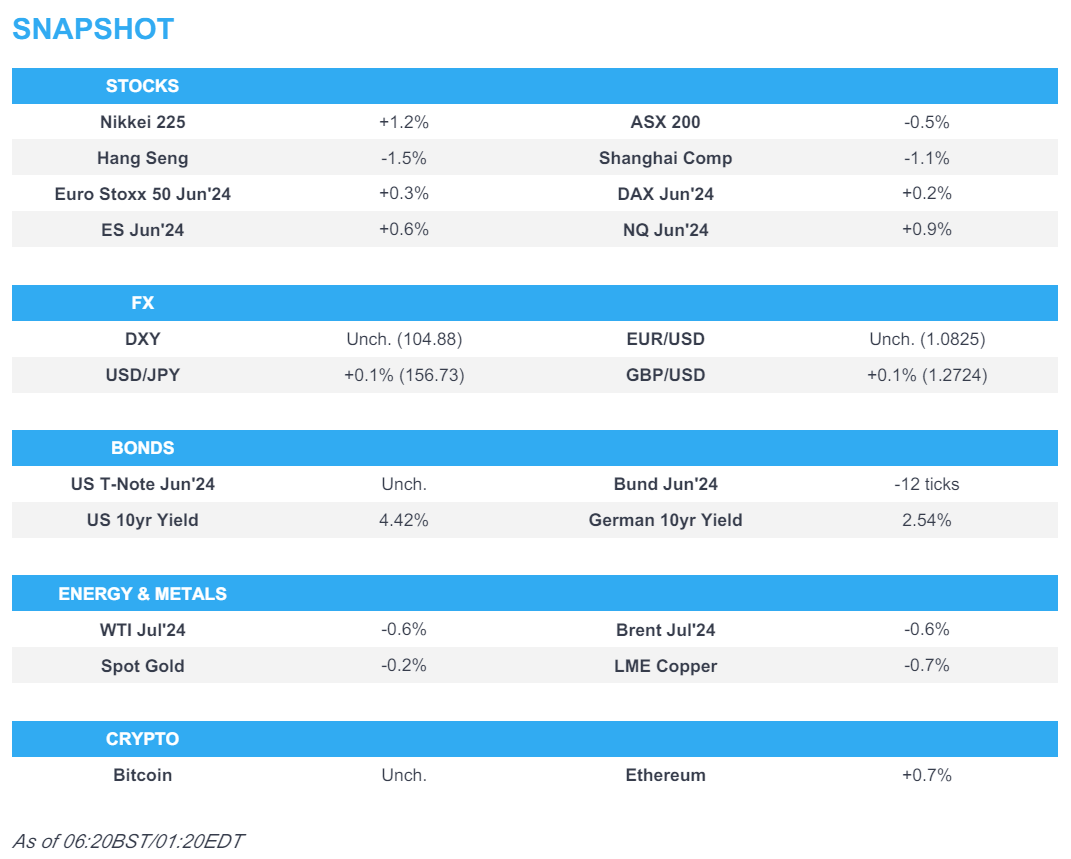

- APAC stocks traded mixed following soft performance of US cash markets before receiving support post-Nvidia earnings.

- Nvidia's earnings topped forecasts and the Co. also announced a ten-for-one stock split; +6% after-hours.

- FOMC Minutes suggested the disinflation process would take longer than previously thought.

- European equity futures indicate a positive open with the Euro Stoxx 50 future up 0.3% after the cash market closed lower by 0.4% on Wednesday.

- UK PM Sunak confirmed reports that he will call for a general election on July 4th.

- DXY held onto recent spoils and remains just below the 105 mark, NZD leads the majors once again.

- Looking ahead, highlights include EZ, UK, US PMIs, US IJC, EZ Consumer Confidence, Q1 Negotiated Wages, CBRT Announcement, Comments from Fed’s Bostic, Supply from US.

US TRADE

EQUITIES

- US stocks were lower with underperformance in the small-cap Russell 2000 as traders awaited the pivotal Nvidia earnings after-hours and with mild hawkish headwinds following hotter-than-expected CPI data from the UK and after the FOMC Minutes noted that recent data had not increased confidence in progress towards the 2% inflation goal and suggested the disinflation process would take longer than previously thought. Nonetheless, futures saw some support after-hours following Nvidia's earnings which topped forecasts and the Co. also announced a ten-for-one stock split.

- SPX -0.27% at 5,306, NDX -0.05% at 18,705, DJIA -0.51% at 39,671, RUT -0.79% at 2,081.

- Click here for a detailed summary.

FOMC MINUTES

- FOMC Minutes stated that participants assessed it would take longer than previously anticipated to gain greater confidence in inflation moving sustainably to 2%, while participants noted recent data had not increased confidence in progress towards the 2% inflation goal and suggested the disinflation process would take longer than previously thought. Various participants mentioned a willingness to tighten policy further should risks to the outlook materialise and make such action appropriate. Furthermore, many participants commented on uncertainty about the degree of policy restrictiveness and almost all participants supported the decision to begin to slow the pace of decline of the central bank's securities holdings, while a few could have supported a continuation of the previous pace.

NOTABLE HEADLINES/EARNINGS

- US House Committee advanced a bill that would make it easier for President Biden to enforce export curbs on AI systems.

- NVIDIA Corp (NVDA) Q1 2024 (USD): Adj. EPS 6.12 (exp. 5.57), Revenue 26.04bln (exp. 24.57bln); announced ten-for-one forward stock split and cash dividend raised 150% to USD 0.01/shr on a post-split basis.

APAC TRADE

EQUITIES

- APAC stocks traded mixed after the negative performance of cash markets stateside and with US futures boosted after hours owing to Nvidia's earnings which also helped some semiconductor names in Asia.

- ASX 200 was dragged lower by underperformance in the mining sector after recent declines in underlying metal prices and with industry giant BHP pressured after Anglo American rejected its latest proposal and gave it another 7 days to make an improved offer.

- Nikkei 225 was underpinned and reclaimed the 39,000 status with the index helped by recent currency weakness and as tech stocks were inspired by Nvidia's strong earnings report.

- Hang Seng and Shanghai Comp were subdued amid ongoing frictions after the USTR posted details of the proposed tariffs on Chinese imports and China’s took countermeasures against a dozen US firms.

- US equity futures (ES +0.6%, NQ +0.9%) were lifted after the stronger-than-expected Nvidia earnings report.

- European equity futures indicate a positive open with the Euro Stoxx 50 future up 0.3% after the cash market closed lower by 0.4% on Wednesday.

FX

- DXY held on to the prior day's spoils after climbing to just shy of the 105.00 level with mild tailwinds seen following the FOMC Minutes which noted that participants assessed it would take longer than previously anticipated to gain greater confidence in inflation moving sustainably to 2%.

- EUR/USD remained contained after it recently gave up ground to the firmer buck and as comments from ECB officials continued to point towards a June rate cut.

- GBP/USD lacked conviction after fading CPI-induced advances and reverted to near the 1.2700 focal point.

- USD/JPY kept afloat but with further upside capped after stalling on approach towards the 157.00 level.

- Antipodeans picked themselves up from yesterday's retreat with outperformance in NZD despite the less hawkish comments from RBNZ Governor Orr.

FIXED INCOME

- 10-year UST futures were flat after yesterday's choppy mood, a softer 20-year auction, and as supply looms.

- Bund futures lacked direction following recent indecisiveness and as the attention turns to PMI data.

- 10-year JGB futures eked mild gains with the BoJ in the market for over JPY 1.2tln of JGBs in 1yr-10yr maturities.

COMMODITIES

- Crude futures continued to trickle lower following the recent bearish inventories data.

- Russian Energy Ministry said Russian oil production was within OPEC+ guidelines in Q1 and Russia exceeded OPEC+ quota in April due to technical reasons in output cuts, while it added that Russia is to submit a plan soon on compensation to the OPEC secretariat, according to Reuters.

- Spot gold remained lacklustre after slipping back beneath USD 2,400/oz amid recent dollar strength.

- Copper futures languished around this week's worst levels with prices not helped by the mixed sentiment in Asia.

CRYPTO

- Bitcoin was firmer overnight but with gains capped by resistance around the USD 69,500 level.

- US House voted to pass the FIT21 cryptocurrency regulations bill that creates a path for cryptocurrencies to be exempt from many securities regulations if they achieve a sufficient level of decentralisation.

NOTABLE ASIA-PAC HEADLINES

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision unanimous, while it stated that consumption recovery is modest and it will maintain a restrictive policy stance for a sufficient period of time. BoK said exports are to sustain growth and it is to monitor trends of slowing inflation and risks to financial stability. BoK Governor Rhee said chances of a policy interest rate increase are "limited" and that one board member said the path to a rate cut should be opened for the next three months, while Rhee added it is unclear when they will start discussing interest rate cuts given the uncertainty in inflation path and they have not discussed the size of cuts needed.

- South Korea announced a KRW 26tln support package for the chip industry and President Yoon announced they are to establish a KRW 17tln semiconductor financial assistance program at state-run Korea Development Bank, while they will extend the tax credit for the semiconductor industry set to expire at the end of this year.

- MAS said the current policy stance remains appropriate and the prevailing rate of the exchange policy band is needed to keep restraining imported inflation and domestic cost pressures.

- RBNZ Governor Orr said it is disappointing how stubborn domestic component inflation remains and the biggest risk we run is that we don't get inflation low and stable, according to Reuters. RBNZ Governor Orr also commented in a Bloomberg interview that another rate hike would only be meaningful if they believed inflation was getting away from them and noted that patience on inflation is not exhausted. Furthermore, he said inflation will not hinge on any single piece of data and that they can start to ease before inflation hits 2%.

DATA RECAP

- Singapore GDP QQ (Q1 F) 0.1% vs Exp. 0.1% (prev. 1.2%)

- Singapore GDP YY (Q1 F) 2.7% vs Exp. 2.5% (prev. 2.7%)

- Japanese JibunBK Manufacturing PMI Flash SA (May) 50.5 (Prev. 49.6)

- Japanese JibunBK Services PMI Flash SA (May) 53.6 (Prev. 54.3)

- Australian Judo Bank Manufacturing PMI Flash (May) 49.6 (Prev. 49.6)

- Australian Judo Bank Services PMI Flash (May) 53.1 (Prev. 53.6)

- New Zealand Retail Sales Volumes QQ (Q1) 0.5% vs. Exp. -0.3% (Prev. -1.9%)

- New Zealand Core Retail Sales QQ (Q1) 0.4% vs Exp. 0.0% (Prev. -1.7%)

GEOPOLITICS

MIDDLE EAST

- US Defense Secretary Austin advocated during a call with Israeli Defence Minister Gallant for an effective mechanism to deconflict humanitarian and military operations in Gaza, according to the Pentagon.

- EU countries reportedly agreed on 10 new subjects to be added to Iran sanctions, according to Reuters citing sources.

OTHER

- Blasts were heard in Russia's Belgorod after missile attack warning, according to RIA.

- China's military began joint military drills surrounding Taiwan, according to Chinese state media.

- Chinese state broadcaster said Taiwan President Lai's May 20th speech was a 'complete confession' of Taiwan independence and seriously 'provoked' the One-China principle, as well as undermined peace and stability across the Taiwan Strait. China's state broadcaster stated that Lai's speech was 'extremely harmful' and used 'country' to refer to Taiwan throughout his speech, while Lai has no sincerity in promoting cross-strait exchanges and China's drills around Taiwan are 'punishment' for Lai's provocation.

- Taiwan Defence Ministry said it expresses strong condemnation of Chinese military drills and has dispatched forces, while it will take practical actions to protect freedom and democracy, as well as have the 'ability, determination and confidence to ensure national security'. Taiwan's Defence Ministry said ground forces have reinforced defence coordination and safety of military camps, while air defence and land-based missile forces are collecting intelligence on targets.

- Taiwan's Presidential Office said it is regrettable to see China threatening Taiwan's democratic freedoms and regional peace and stability with unilateral military provocation and Taiwan's consistent position is that maintaining regional peace and stability is the common responsibility and goal of both sides of the strait.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak confirmed reports that he will call for a general election on July 4th.

- ECB's Schnabel said if data confirms the outlook, a June cut is likely and she sees a slight revival in the Euro-area economy, while she added that inflation is likely to return to 2% without a recession. Furthermore, Schnabel said wage growth is slowing gradually.