Europe Market Open: APAC stocks were mostly rangebound as global markets brace for the FOMC Minutes and Nvidia earnings.

22 May 2024, 06:30 by Newsquawk Desk

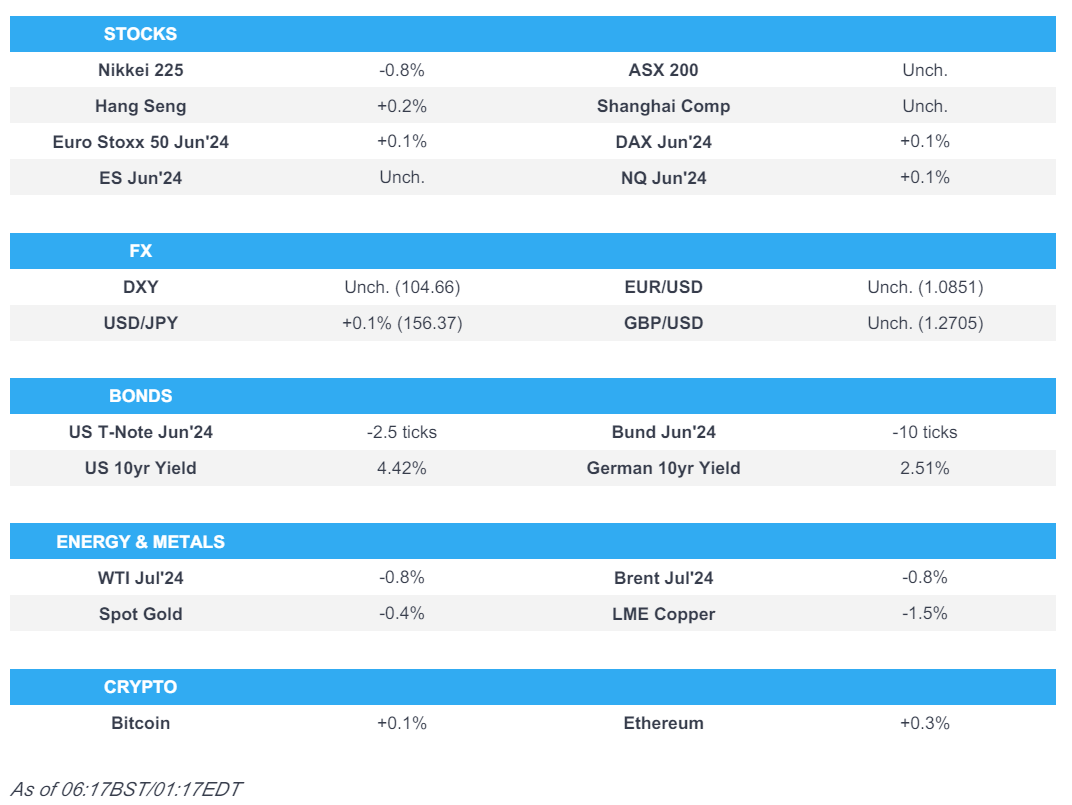

- APAC stocks were mostly rangebound as global markets brace for the FOMC Minutes and Nvidia earnings.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 futures up 0.1% after the cash market closed lower by 0.5% on Tuesday.

- RBNZ kept the OCR unchanged as expected but raised its OCR forecasts across the projection horizon.

- DXY is flat, NZD is boosted post-RBNZ, JPY marginally lags, GBP eyes UK CPI.

- Looking ahead, highlights include UK CPI/PPI, Fed Minutes, Fed’s Bostic, Mester, Collins, Goolsbee, ECB’s Lagarde & BoE’s Breeden, Supply from UK, Germany & US, Earnings from SSE, Marks & Spencer, Nvidia, Analog Devices, TJX & Target.

US TRADE

EQUITIES

- US stocks finished mostly in the green in which the S&P 500 and Nasdaq 100 posted fresh record closes although the major indices were relatively little changed and sectors were mixed as markets continued to lack any major catalysts heading into the FOMC Minutes and Nvidia's earnings on Wednesday. Nonetheless, the attention was on central bank speakers with comments from Fed's Waller the main highlight as he stuck to his line that "several more months of good inflation data" are still needed to support an easing in policy despite the recent CPI data and noted further increases in the policy rate are probably unnecessary.

- SPX +0.25% at 5,321, NDX +0.21% at 18,713, DJIA +0.17% at 39,873, RUT -0.20% at 2,098.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Barr (voter) said the economy is quite strong overall but still need to finish the job on inflation and sit tighter for longer than we previously thought, while he added that interest-rate risk will continue and needs to be managed.

- Fed's Mester (voter) said expect above-trend growth for the year and keeping rates restrictive is not that big of a risk right now given job market strength. Mester said she raised her estimate of the long-run neutral rate in the last projection and the current level of policy may not be "as restrictive" as it might otherwise have been, while she needs to see a few more months of inflation coming down and is also watching expectations.

- Fed's Waller (voter) reiterated he does not think the Fed will need to raise rates, while rate cuts depend on the data and the Fed needs to be confident on inflation first. Waller also reiterated data dependency and noted if they get enough data going the right way, they can think about cutting rates later this year and beginning of next year, according to CNBC.

- Fed's Collins (non-voter) said elevated uncertainty continues to be a feature of the economy and cannot overreact to any data point, while she added this is a period when patience really matters and uncertainty is a key factor at this point. Furthermore, she said there are a lot of reasons to think Fed policy is "moderately" restrictive with some impacts still in the pipeline and the neutral rate may be higher at least in the medium term.

APAC TRADE

EQUITIES

- APAC stocks were mostly rangebound as global markets brace for the FOMC Minutes and Nvidia earnings.

- ASX 200 just about kept afloat as strength in the heavy industries picked up the slack from the sluggish consumer and tech sectors.

- Nikkei 225 underperformed following a retreat beneath the 39,000 level and amid mixed data releases as trade data disappointed but machinery orders topped forecasts and showed a surprise M/M expansion.

- Hang Seng and Shanghai Comp were somewhat varied as the former mildly resumed its advances with XPeng among the notable gainers in Hong Kong due to its Q2 delivery guidance, while the mainland was contained amid a lack of drivers and lingering trade frictions.

- US equity futures took a breather near the prior day's best levels after some of the major US indices notched record closes.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 futures up 0.1% after the cash market closed lower by 0.5% on Tuesday.

FX

- DXY traded in a tight range ahead of the FOMC Minutes, while Fed comments did little to spur price action.

- EUR/USD struggled for direction following recent choppy performance on both sides of the 1.0850 level.

- GBP/USD continued its sideways momentum around the 1.2700 level with traders awaiting UK inflation.

- USD/JPY eked mild gains above the 156.00 level but with gains capped after mixed data releases from Japan.

- Antipodeans were mixed with NZD/USD underpinned following the RBNZ meeting where it kept the OCR unchanged at 5.50% as expected but raised its OCR forecasts across the projection horizon with the OCR suggesting a delay in the timing for the first rate cut to late 2025, while the language remained hawkish and the minutes revealed the committee discussed the possibility of a hike at the meeting.

- PBoC set USD/CNY mid-point at 7.1077 vs exp. 7.2376 (prev. 7.1069).

FIXED INCOME

- 10-year UST futures were rangebound ahead of the FOMC minutes and after the latest Fed speak did little to shift the dial.

- Bund futures lacked demand after yesterday's failed attempt at the 131.00 level ahead of supply from both sides of the Atlantic.

- 10-year JGB futures conformed to the uninspired mood across global peers with prices not helped by weaker demand at the 40yr JGB auction.

COMMODITIES

- Crude futures were lower after surprise builds for crude and gasoline in private sector inventory data.

- US Private Energy Inventory Data (bbls): Crude +2.5mln (exp. -2.5mln), Cushing +1.8mln, Gasoline +2.1mln (exp. -0.7mln), Distillate -0.3mln (exp. -0.4mln).

- US DoE said it will sell nearly 1mln bbls of gasoline from its northeast gasoline supply reserve with bids due on May 28th with fuel to be sold in quantities of 100k bbls.

- Spot gold was pressured with demand sapped as markets await this week's looming risk events.

- Copper futures eventually weakened after oscillating around the USD 5.10/lb level amid the mixed risk appetite.

CRYPTO

- Bitcoin mildly declined with prices reverting to beneath the USD 70,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBNZ kept the OCR unchanged at 5.50% as expected, while it noted that monetary policy needs to be restricted and it raised its OCR projections with the OCR seen at 5.61% in September 2024 (prev. 5.60%), 5.54% in June 2025 (prev. 5.33%), 5.40% in September 2025 (prev. 5.15%) and at 2.99% in June 2027. RBNZ said restrictive monetary policy has reduced capacity pressures in the New Zealand economy and lowered consumer price inflation, as well as noted that annual consumer price inflation is expected to return to within the committee's 1%-3% target range by the end of 2024. RBNZ Minutes noted the committee agreed that interest rates need to remain at a restrictive level for a sustained period to ensure annual headline CPI inflation returns to the 1%-3% target range, while the committee agreed that interest rates may have to remain at a restrictive level for longer than anticipated in the February Monetary Policy Statement to ensure the inflation target is met. Furthermore, the committee discussed the possibility of increasing the OCR at this meeting.

- RBNZ Governor Orr said during the press conference that it would take time for domestic inflation to decline, while he added the economy has a lower potential growth rate and he is unsure if that is temporary. Orr also commented that they have limited upside room for inflation surprises and the OCR track is a central projection not an absolute prediction, as well as noted that they had a real consideration on raising rates at this meeting.

DATA RECAP

- Japanese Trade Balance (JPY)(Apr) -462.5B vs. Exp. -339.5B (Prev. 387.0B)

- Japanese Exports YY (Apr) 8.3% vs. Exp. 11.1% (Prev. 7.3%)

- Japanese Imports YY (Apr) 8.3% vs. Exp. 9.0% (Prev. -5.1%)

- Japanese Machinery Orders MM (Mar) 2.9% vs. Exp. -2.2% (Prev. 7.7%)

- Japanese Machinery Orders YY (Mar) 2.7% vs. Exp. 2.3% (Prev. -1.8%)

GEOPOLITICS

MIDDLE EAST

- Irish government is to announce on Wednesday that it is recognising the Palestinian state, according to a source familiar with the matter cited by Reuters.

- US senior official said negotiators are nearing a final set of arrangements for the US-Saudi defence deal and it is 'pretty much there to do’, while the deal includes a security component and nuclear agreement but the deal is not done and requires more work. The official said elements such as a credible pathway to Palestinian statehood still have to be completed, while the US talked with Israeli officials and reinforced President Biden's concerns about a Rafah ground invasion. Furthermore, the official said they had a very detailed discussion with Israelis about how to transition to a stabilisation phase in Gaza.

OTHER

- China's Foreign Minister Wang said in talks with Iran's Deputy Foreign Minister that China will continue to strengthen strategic cooperation with Iran, safeguard common interests, and make endeavours for regional and world peace, according to Reuters.

- Russian Foreign Ministry said Russia's response will not only be political if France sends troops to Ukraine, according to RIA.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said for financial stability reasons, he thinks the central bank balance sheet will remain larger than before the financial crisis though not as large as today and a range of GBP 345bln-490bln is not a bad starting point. Bailey also commented that he expects quite a drop in April inflation data and thinks the next move on rates will be a cut.

- ECB President Lagarde said she is confident that they have inflation under control.

- ECB's Nagel said a June rate cut does not mean the ECB will cut in subsequent meetings, while he added that wage developments are heading in the right direction and there is no sign of a wage-price spiral.