US Market Open: European bourses slip whilst US futures hold flat, DXY softer and Crude subdued; Fed speak due

21 May 2024, 11:05 by Newsquawk Desk

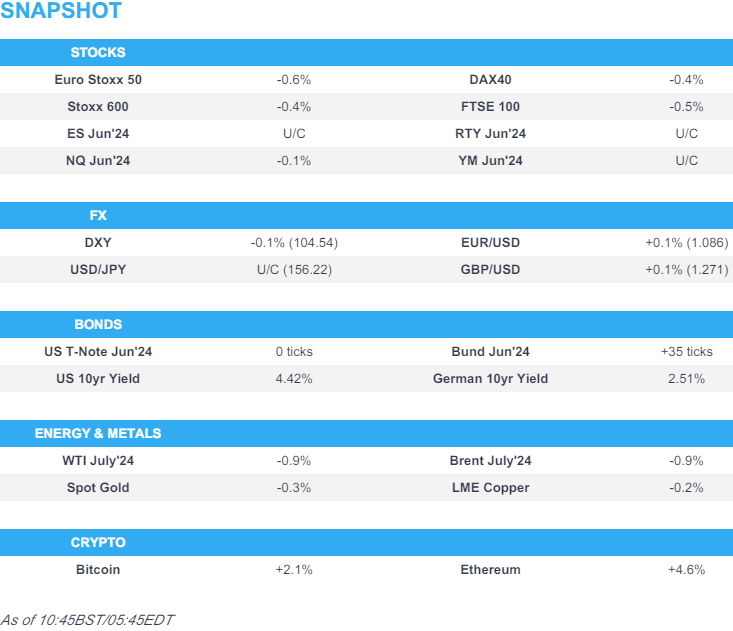

- European bourses are entirely in the red, whilst US futures hold around the unchanged mark

- G10s are flat/mixed; DXY is very modestly softer and underpinning some G10 peers

- Treasuries are flat, whilst Bunds narrowly outperform following softer than expected German PPI before coming off best levels amid higher EZ Labour Costs Prelim data

- Crude is subdued in catalyst-thin trade, XAU and base metals take a breather from their recent surge

- Looking ahead, Canadian CPI, US Philadelphia Fed Non-mfg Business Outlook Survey, ECB Governing Council Retreat, NBH Policy Announcement, Fed’s Bostic, Barkin, Waller, Williams, Barr & BoE’s Bailey, Earnings from Macys & Autozone

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.4%) opened on a softer footing and continued to trundle lower throughout the European morning.

- European sectors are mostly lower; Healthcare takes the top spot, led higher by gains in AstraZeneca (+1.5%) after outlining its 2030 plan, while giants Novo Nordisk, Roche, and Novartis resume trade after the Whit Monday holiday.

- US Equity Futures (ES U/C, NQ -0.1%, RTY -0.2%) are flat/modestly lower amid a lack of catalysts and after yesterday's indecisive Wall Street session.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- USD is incrementally softer vs. peers with DXY respecting yesterday's 104.39-79 range. A slew of Fed speakers may help to guide further price action.

- EUR is slightly firmer vs the Dollar, due to broader Dollar weakness rather than fresh EZ catalysts. After failing to recently launch a test of 1.09, the pair has since drifted lower with today's 1.0852 trough.

- GBP gains modestly vs. the USD. Focus for the GBP remains on Wednesday's inflation metrics, which could sway pricing for the June meeting. For now, Cable remains contained within yesterday's 1.2690-1.2726 range.

- USD/JPY near the unchanged mark after a bout of selling pressure in early European trade (not driven by any obvious catalyst) dragged the pair back from its overnight peak at 156.54. The pair is currently consolidating on a 156 handle awaiting fresh impetus.

- Antipodeans are both flat vs. the USD in quiet newsflow. AUD/USD unfazed by RBA minutes overnight but has made a fresh low at 0.6647 following yesterday's session of losses.

- CAD steady vs. the USD ahead of upcoming inflation data. ING posits that if the BoC's preferred core gauge (“median”) came in below 3.0%, that would "place all key inflation measures, core and headline, within the 1-3% inflation target band.

- PBoC set USD/CNY mid-point at 7.1069 vs exp. 7.2366 (prev. 7.1042).

- Click here for more details.

- Click here for NY Opex details.

FIXED INCOME

- USTs are flat trade with the recent slew of Fed speakers unable to have any meaningful sway on price action in what has been a quiet start to the week. For now, the Jun'24 contract is holding above the 109 mark and within yesterday's 108.30+-109.09 range.

- Bunds are leading peers in the wake of slightly softer-than-expected German PPI metrics. Price action could also be seen as an inevitable bounce following losses endured since last Thursday. Jun'24 Bund has recovered to circa 130.86 after basing out yesterday at 130.47. Modest downticks were seen on the Q1 EZ labour cost increase, with no reaction seen to the Bund auction.

- Gilts are firmer on the session but to a lesser extent than its German peer, and overall unreactive to a well-received Gilt auction. For now, Gilts are tucked within yesterday's 97.50-98.01 range.

- UK sells GBP 2.25bln 4.75% 2043 Gilt: b/c 3.67x (prev. 3.67x), average yield 4.580% (prev. 4.495%) & 0.4bps (prev. 0.1bps tail).

- Germany sells EUR 3.33 vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.8x (prev. 2.6x), average yield 2.56% (prev. 2.41%) & retention 16.75% (prev. 18.25%)

- Click here for more details.

COMMODITIES

- Another downbeat session for the crude complex after July futures settled lower by around USD 0.30/bbl apiece in choppy trade; Brent July resides towards to bottom end of a current USD 82.81-83.76/bbl intraday range.

- Downbeat trade across precious metals as prices continue to pull back despite quiet newsflow but amid a lack of major geopolitical updates/escalations. XAU trades in the middle of a USD 2,406.16-2,433.14/oz intraday band.

- Base metals are mixed after the complex extended its rally yesterday, with copper prices breaking above USD 11,000/t and hitting record highs.

- Chinese April crude iron output +11.5% Y/Y at 87.90mln metric tons, according to the stats bureau; refined copper output +9.2%, lead +1.1% Y/Y, zinc -0.8% Y/Y

- Click here for more details.

CRYPTO

- Bitcoin holds at elevated levels, though has slipped slightly below USD 71k, with Ethereum holding onto its gains and sits firmly above USD 3.6k.

- CoinDesk reported that exchanges that want to list spot Ether ETFs are abruptly being asked by regulators to update key filings related to these products, according to three people familiar with the matter which suggests regulators may be moving to approve these applications ahead of Thursday's deadline.

DATA RECAP

- German Producer Prices YY (Apr) -3.3% vs. Exp. -3.1% (Prev. -2.9%); Producer Prices MM (Apr) 0.2% vs. Exp. 0.3% (Prev. 0.2%)

- EU Current Account NSA, EUR (Mar) 44.53B (Prev. 31.64B); current Account SA, EUR* (Mar) 35.77B (Prev. 29.45B)

- Eurozone Labour Costs Prelim Y/Y (Q1) 4.9% (prev. 3.4%)

NOTABLE EUROPEAN HEADLINES

- EU's von der Leyen suggested making access to EU subsidies conditional on economic reforms as a potential method to improve the bloc's competitiveness, according to FT.

- Kantar UK Grocery Market Share: Grocery price inflation has also fallen for the fifteenth month in a row to 2.4%, the lowest level since October 2021.

- ASML (ASML NA) and TSMC (2330 TT) can disable chip machines if China invades Taiwan, according to Bloomberg

NOTABLE US HEADLINES

- WSJ's Timiraos posted on X that Fed staff expect core PCE rose 2.75% in April from a year earlier, while he added that most analysts likewise have core PCE rising by 0.24% in April which would put the 6-month annualised rate of core PCE inflation at 3.2%.

- US FDIC Chairman Gruenberg told staff he plans to step down after a successor is confirmed, according to a WSJ reporter post on X. It was later reported that a White House spokesperson stated President Biden will soon put forward a new nominee for FDIC chair.

- US Treasury Secretary Yellen, in remarks to bankers, urges European banks to heighten compliance measures and increase focus on Russian evasion attempts. Click here for full details.

GEOPOLITICS

MIDDLE EAST

- Israeli media on a source said National Security Advisor "Sullivan after meeting Netanyahu felt there was no strategy to end the war", via Al Arabiya

- "Israel has decided to shelve plans for a major offensive in the Gaza Strip’s southern city of Rafah, and will act in a more limited manner in the city, after discussions with the US on the matter", via Times of Israel citing WaPo analyst's sources.

- Yemen's Houthis said they have downed a US drone over the Baydaa Province, according to a statement

- US President Biden said what's happening in Gaza is not genocide and the US wants Hamas beaten, according to Reuters and Times of Israel.

- Deputy US Representative said the US proposed alternatives to a major ground offensive in Rafah and believes it will better advance Israel's goal, according to Al Jazeera.

OTHER

- US top general said they are confident Ukraine has not used long-range US weaponry inside of Russia.

APAC TRADE

- APAC stocks were subdued following the somewhat indecisive performance on Wall St where price action was choppy amid a lack of catalysts and as participants await this week's key risk events.

- ASX 200 was lower as losses in materials and mining stocks offset the tech outperformance.

- Nikkei 225 was lifted at the open owing to recent currency weakness but then steadily gave back all of its initial gains alongside the downbeat risk appetite across most of its regional peers.

- Hang Seng and Shanghai Comp declined with underperformance in Hong Kong amid tech losses and with Li Auto shares down nearly 20% on weak earnings, while the mainland also conformed to the risk-averse mood albeit with downside limited by quiet newsflow.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Suzuki said a weak yen has positive and negative aspects, while he noted that at this point, they are concerned about the negative aspects of a weak yen and closely watching FX moves. Furthermore, Suzuki said they will deal appropriately as needed on forex and that it is desirable for forex to move in a stable manner, according to Reuters.

- RBA Minutes from the May 6th-7th meeting stated they considered whether to raise rates but judged the case for steady policy was the stronger one and the Board agreed it was difficult to either rule in or rule out future changes in the Cash Rate. RBA stated the flow of data had increased risks of inflation staying above target for longer and the Board expressed limited tolerance for inflation returning to target later than 2026, while a rate rise could be appropriate if forecasts proved overly optimistic and risks around forecasts were judged to be balanced.

- Carlyle has launched a new Japanese fund worth JPY 430bln (it's largest ever), according to the Nikkei

DATA RECAP

- Australian Consumer Sentiment MM (May) -0.3% (Prev. -2.4%)

- Australian Westpac Consumer Sentiment Index (May) 82.2 (Prev. 82.4)