Europe Market Open: APAC stocks were subdued following the somewhat indecisive performance on Wall St

21 May 2024, 06:29 by Newsquawk Desk

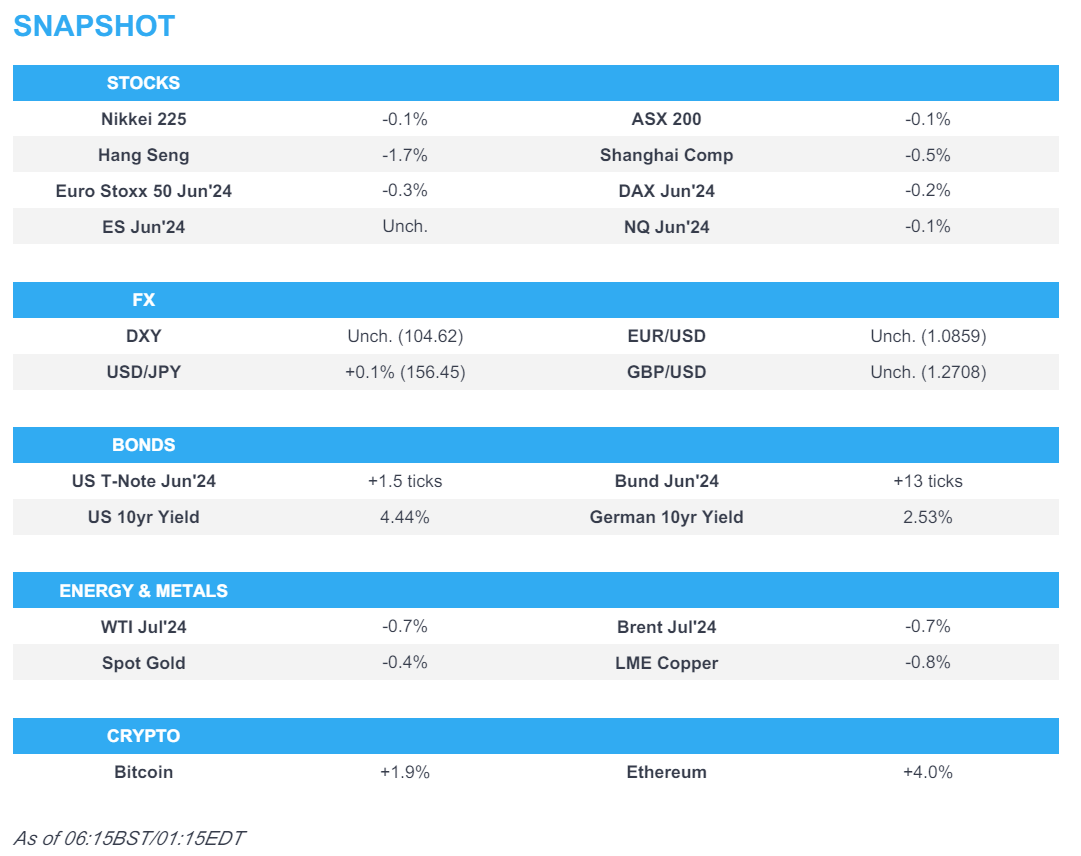

- APAC stocks were subdued following the somewhat indecisive performance on Wall St.

- European equity futures indicate a lower open with Euro Stoxx 50 future down 0.3% after the cash market closed up 0.2% on Monday.

- DXY is contained within narrow parameters, USD/JPY has extended upside, AUD marginally lags.

- Bunds struggled for direction, crude futures continued to retreat amid a lack of geopolitical escalation.

- Looking ahead, highlights include German PPI, Canadian CPI, US Philadelphia Fed Non-mfg Business Outlook Survey, ECB Governing Council Retreat, NBH Policy Announcement, Fed’s Bostic, Barkin, Waller, Williams, Barr & BoE’s Bailey, Supply from Germany & UK, Earnings from Generali, Kingfisher, Lowe's Companies, Macys & Autozone.

US TRADE

EQUITIES

- US stocks were choppy to start the week amid very thin newsflow and as participants await key events such as FOMC Minutes, Nvidia (NVDA) earnings and UK inflation data due on Wednesday followed by US PMIs on Thursday. US indices ended the day somewhat mixed with the NDX the biggest gainer amid tech strength as Nvidia shares were lifted ahead of earnings on Wednesday and following a couple of PT raises at different brokerages, while the DJIA underperformed as it pulled back from a fresh record high to beneath the 40,000 milestone.

- SPX +0.09% at 5,308, NDX +0.69% at 18,674, DJIA -0.50% at 39,807, RUT +0.32% at 2,102.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) said she is not yet confident that inflation is coming down sustainably to 2% and does not see any evidence of a need to raise rates, while she expects there will be an improvement in shelter inflation but won't be rapid.

- Fed's Mester (voter, retires in June) said she thinks monetary policy is restrictive and inflation progress stalled in the first three months. Mester added it is too soon to tell what path inflation is on and they need to gather more evidence on the inflation path to determine it is sustainably headed to 2%, while she noted that inflation risks are tilted to the upside.

- WSJ's Timiraos posted on X that Fed staff expect core PCE rose 2.75% in April from a year earlier, while he added that most analysts likewise have core PCE rising by 0.24% in April which would put the 6-month annualised rate of core PCE inflation at 3.2%.

- US FDIC Chairman Gruenberg told staff he plans to step down after a successor is confirmed, according to a WSJ reporter post on X. It was later reported that a White House spokesperson stated President Biden will soon put forward a new nominee for FDIC chair.

APAC TRADE

EQUITIES

- APAC stocks were subdued following the somewhat indecisive performance on Wall St where price action was choppy amid a lack of catalysts and as participants await this week's key risk events.

- ASX 200 was lower as losses in materials and mining stocks offset the tech outperformance.

- Nikkei 225 was lifted at the open owing to recent currency weakness but then steadily gave back all of its initial gains alongside the downbeat risk appetite across most of its regional peers.

- Hang Seng and Shanghai Comp declined with underperformance in Hong Kong amid tech losses and with Li Auto shares down nearly 20% on weak earnings, while the mainland also conformed to the risk-averse mood albeit with downside limited by quiet newsflow.

- US equity futures struggled for direction with markets tentative ahead of the key events due mid-week.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.3% after the cash market closed up 0.2% on Monday.

FX

- DXY kept to within a tight range of between 104.59-104.70 amid light catalysts and as participants await the mid-week risk events including FOMC Minutes and Nvidia earnings, while there was a slew of Fed speakers although very little new was said and more are scheduled for Tuesday.

- EUR/USD slightly softened after the latest ECB rhetoric from Kazaks continued to point to a June cut although the downside was cushioned by support around the 1.0850 level.

- GBP/USD traded rangebound amid a lack of drivers and battled to retain the 1.2700 status.

- USD/JPY gradually edged further above 156.00 which spurred a rehash of familiar jawboning.

- Antipodeans were pressured alongside the downbeat risk tone and commodity-related headwinds, while the RBA minutes had little impact as the Board agreed it was difficult to either rule in or rule out future rate changes.

- PBoC set USD/CNY mid-point at 7.1069 vs exp. 7.2366 (prev. 7.1042).

FIXED INCOME

- 10-year UST futures languished at the prior day's lows in quiet trade but with a floor around the 109.00 level.

- Bund futures lacked direction with price action contained ahead of German PPI and a Bobl auction.

- 10-year JGB futures attempted to nurse losses but were thwarted amid the subdued performance in global peers and in the absence of additional JGB purchases by the BoJ which instead offered a dollar supply operation and to buy corporate bonds.

COMMODITIES

- Crude futures retreated amid pressure across commodities and in the absence of any geopolitical escalation.

- Russian President Putin said Russian oil output has declined year to date to 195.7mln tons and that is due to the OPEC+ deal, while natgas output in Jan-April increased to 246.4BCM, according to Interfax.

- Russia’s government said it suspended the gasoline export ban until June 30th.

- Spot gold was subdued and took a breather following the recent surge to record levels.

- Copper futures gave back early gains amid the mostly subdued risk appetite and after pulling back from all-time highs.

CRYPTO

- Bitcoin paused after surging yesterday to above the USD 71,000 level and Ethereum prices extended on gains amid hopes the SEC could approve Ether ETFs after sources suggested 'abrupt progress' in the filing process.

- CoinDesk reported that exchanges that want to list spot Ether ETFs are abruptly being asked by regulators to update key filings related to these products, according to three people familiar with the matter which suggests regulators may be moving to approve these applications ahead of Thursday's deadline.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Suzuki said a weak yen has positive and negative aspects, while he noted that at this point, they are concerned about the negative aspects of a weak yen and closely watching FX moves. Furthermore, Suzuki said they will deal appropriately as needed on forex and that it is desirable for forex to move in a stable manner, according to Reuters.

- RBA Minutes from the May 6th-7th meeting stated they considered whether to raise rates but judged the case for steady policy was the stronger one and the Board agreed it was difficult to either rule in or rule out future changes in the Cash Rate. RBA stated the flow of data had increased risks of inflation staying above target for longer and the Board expressed limited tolerance for inflation returning to target later than 2026, while a rate rise could be appropriate if forecasts proved overly optimistic and risks around forecasts were judged to be balanced.

DATA RECAP

- Australian Consumer Sentiment MM (May) -0.3% (Prev. -2.4%)

- Australian Westpac Consumer Sentiment Index (May) 82.2 (Prev. 82.4)

GEOPOLITICS

MIDDLE EAST

- US President Biden said what's happening in Gaza is not genocide and the US wants Hamas beaten, according to Reuters and Times of Israel.

- Deputy US Representative said the US proposed alternatives to a major ground offensive in Rafah and believes it will better advance Israel's goal, according to Al Jazeera.

OTHER

- US top general said they are confident Ukraine has not used long-range US weaponry inside of Russia.

EU/UK

NOTABLE HEADLINES

- EU's von der Leyen suggested making access to EU subsidies conditional on economic reforms as a potential method to improve the bloc's competitiveness, according to FT.