US Market Open: Equities modestly firmer, DXY flat in catalyst thin trade, XAU & Copper hit ATHs; Fed speak due

20 May 2024, 10:50 by Newsquawk Desk

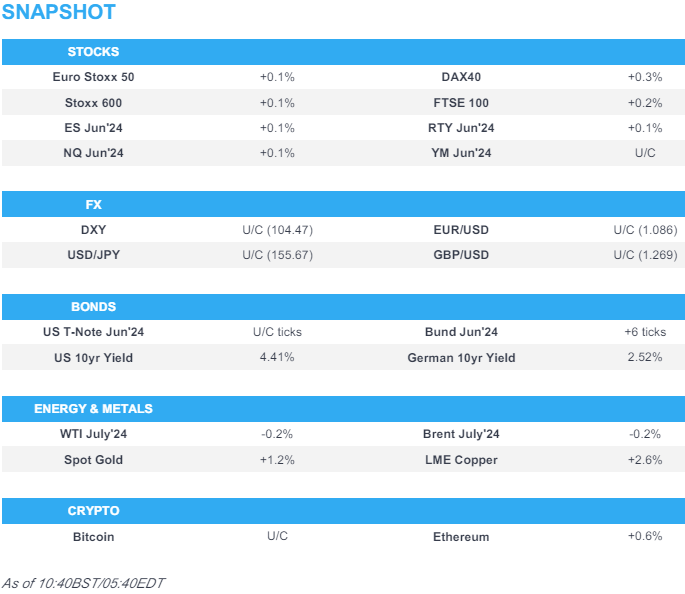

- European equities hold a mild positive bias, whilst US futures lack firm direction and holds around the unchanged mark.

- Dollar is flat alongside G10 peers, Kiwi marginally underperforms, USTs are flat in quiet newsflow, whilst Bunds are slightly softer.

- A helicopter carrying Iranian President Raisi and Foreign Minister Amir-Abdollahian crashed due to adverse weather conditions with no survivors reported; Iran’s Supreme Leader Khamenei signalled continuity.

- Spot gold printed a record high of around USD 2,450/oz while copper futures extended on gains and benchmark LME prices hit a fresh all-time peak above USD 11,100/t.

- Looking ahead, speak from Fed's Bostic, Barr, Waller, Jefferson and Mester. Holidays: Whit Monday (Switzerland, Norway, Denmark are closed).

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.1%) are modestly firmer, though with price action contained in what has been a catalyst-thin session thus far.

- European sectors are mostly firmer; Basic Resources and Energy reside as the standout outperformers amid price action in underlying commodities. Except for those two, the breadth of the market is narrow with no overarching theme or bias.

- US equity futures (ES -0.1%, NQ -0.3%, RTY -0.5%) are trading sideways and around the flat mark ahead of a slew of Fed speakers.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- USD is flat vs. peers in what has been a quiet weekend/session of newsflow thus far. DXY is currently towards the bottom end of Friday's 104.39-79 range.

- EUR/USD is unable to launch a test of 1.09 after advancing as high as 1.0894 last week. 1.09 hasn't been breached since 21st March, where 1.0942 was the high that day.

- Flat trade for the GBP vs. the USD and EUR. Cable kissed Friday's monthly peak at 1.2711 earlier in the session but was unable to break above it in quiet trade.

- For once, USD/JPY is hugging the unchanged mark which is testament to how quiet trading conditions have been today. As it stands, the pair is contained within Friday's 155.24-97 parameters.

- Antipodeans are both broadly steady vs. the USD in quiet newsflow. AUD/USD is holding just below the 0.67 mark with an overnight peak of 0.6709, which is just shy of last Thursday's peak at 0.6714.

- PBoC set USD/CNY mid-point at 7.1042 vs exp. 7.2162 (prev. 7.1045)

- Click here for more details.

FIXED INCOME

- Horizontal trade for USTs amid quiet newsflow and a sparse calendar. The back-end of last week saw profit-taking on the CPI/retail sales induced gains earlier in the week.

- Bunds are softer on the session, in a continuation of the downside seen since last Thursday. Traders are mindful of a potential improvement in upcoming PMI metrics. Currently at 130.63, and a far cry from last week's 132.11 peak.

- Gilts: Similar price action to its German counterpart with the Jun'24 Gilt contract extending on the downside seen since last week. Currently holding around 97.83, and well off last week's 98.76.

- Click here for more details.

COMMODITIES

- Crude was choppy for much of the European morning, before succumbing to selling pressure, taking the complex into the red with a lack of clear geopolitical catalyst. Although with little follow through, much of today's focus has been on the death of the Iranian President and Foreign Minister, due to a weather-related helicopter crash. Brent near session lows at around USD 83.85/bbl.

- Precious metals are mostly firmer with focus on spot silver and spot gold, with the latter notching a fresh record high overnight as it zeroes in on the USD 2,050/oz mark; XAU hit a peak at USD 2,450/oz (vs low USD 2,414.72/oz) overnight before stabilising around USD 2,435/oz.

- Base metals are firmer across the board with APAC focus on industrial metals, namely copper and iron following China's recent property support efforts. Iron ore prices hit their highest level in three months while 3M LME copper hit record highs.

- Iraqi PM said there is no progress in talks with oil companies to resume exports from Kurdistan to Turkey, according to Reuters.

- Libya began operating the new pipeline from its North Hamada oilfield with the initial transfer capacity expected at 2k bpd, according to the National Oil Corporation cited by Reuters.

- Ukrainian intelligence sources said the SBU and military drones struck an oil refinery and airfield in Russia’s southern Krasnodar region in an overnight attack, according to Reuters.

- Click here for more details.

CRYPTO

- Bitcoin is flat and holds just beneath USD 67k, whilst Ethereum posts mild gains and holds just above USD 3.1k.

NOTABLE US HEADLINES

- Fed Chair Powell did not comment on monetary policy or the economy in remarks prepared for delivery to Georgetown Law School’s commencement ceremony.

DATA RECAP

- UK Rightmove House Price Index MM 0.8% (Prev. 1.1%)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks said the rate-cutting process must be cautious and gradual; will look at the data again after June's meeting; June meeting is quite likely to be the start of ECB rate cuts.

- BoE's Broadbent said direct effect on inflation of the pandemic and the war have now faded; now left with the more persistent, second-round effects of that earlier surge on domestic inflation; possible Bank Rate could be cut some time over the summer.

- Rightmove said asking prices for UK homes hit a record high in the four weeks to mid-May although the pace of increase was the slowest YTD.

GEOPOLITICS

MIDDLE EAST

- A helicopter carrying Iranian President Raisi and Foreign Minister Amir-Abdollahian crashed due to adverse weather conditions, according to state TV. Iran’s Supreme Leader Khamenei reassured Iranians the country’s management would not be affected by the incident and that no disruption would occur in Iran’s state affairs, while it was later confirmed that all passengers including President Raisi were killed in the crash.

- Israel said it is not involved the death of Iranian president Raisi, according to an Israeli official cited by Reuters.

- Israel's Gallant tells US advisor Sullivan that "we are committed to broadening the Rafah ground operation"

- Israel’s Gantz demanded that the war cabinet agree to a six-point plan for the Gaza conflict by June 8th which should lay out a post-war vision for Gaza governance and equitable Israeli military conscription. Furthermore, Gantz warned his party would quit the emergency coalition government if Israeli PM Netanyahu does not meet expectations, according to Reuters.

- White House National Security Adviser Sullivan discussed with Israelis methods to ensure the defeat of Hamas while minimising harm to civilians, while Sullivan reiterated US President Biden's longstanding position on Rafah and proposed a series of concrete measures to ensure more aid flows into Gaza. Furthermore, Sullivan held constructive meetings in Saudi Arabia and briefed Israeli PM Netanyahu on the Saudi meetings and the potential that may now be available for Israel and the Palestinians, according to Reuters citing the White House.

- US Central Command said Houthis launched an anti-ship ballistic missile into the Red Sea and struck M/T Wind which is a Panamanian-flagged, Greek-owned oil tanker which caused flooding and resulted in a loss of propulsion and steering. However, the crew was able to restore propulsion and steering, and there were no casualties reported, according to Reuters.

OTHER

- Ukrainian forces destroyed a Russian Black Sea fleet minesweeper, according to the Ukrainian navy.

- Russia’s Defence Ministry said Russian forces took control of Starytsia in Ukraine’s Kharkiv region, according to TASS. In relevant news, Russia's Defence Ministry said Russia shot down US ATACMS missiles and drones Ukraine used to attack Russian regions overnight, according to Reuters.

- North Korea said it would reconsider measures necessary for improving the overall nuclear deterrence posture after the recent US subcritical nuclear test, while it added that the US subcritical nuclear test fuels an international nuclear arms race, according to KCNA.

APAC TRADE

- APAC stocks began the week on the front foot despite last Friday's indecisive performance on Wall St where the major indices traded sideways but remained near record levels, while there was also a lack of fresh macro developments over the weekend.

- ASX 200 was led by outperformance in miners after gold and copper prices climbed to fresh record levels.

- Nikkei 225 surged above the 39,000 level with the index unfazed by the mild uptick in yields and absence of fresh drivers.

- Hang Seng and Shanghai Comp conformed to the positive mood but with gains capped in the mainland amid lingering frictions after China

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (May) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5Y (May) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- China MOFCOM announced symbolic sanctions against Boeing Defense, Space & Security, General Atomics Aeronautical Systems Inc. and General Dynamics Land Systems Inc. which were added to China's “unreliable entity” list for providing weapons to Taiwan.

- China’s Mofcom launched an anti-dumping probe into polyoxymethylene copolymers (used in electronics and cars) from the EU, US, Taiwan and Japan, according to FT.

- Taiwan's President Lai was sworn in and called on China to stop threatening Taiwan politically and militarily, while he called on Taiwan and China to take on the global responsibility of maintaining peace and stability in the region. President Lai said they seek peace but cannot have illusions and must work together with democratic countries to form deterrence and avoid war, as well as noted that Taiwan will maintain the status quo and cannot make any concessions on democracy and freedom.

- South Korea plans to partially lift the short-selling ban in June, according to Yonhap.

- BoJ survey finds many firms say they can no longer hire enough workers if they curb wages and more firms are starting to pass on rising labour costs to sales prices.

- Chinese financial market regulators will meet Europe funds this week to attract investments, according to Bloomberg. Vice head of CSRC will meet investors from Wednesday, along with PBoC senior officials, according to Bloomberg.