US Market Open: Chinese support measures lift metals, Dollar bid & Bunds lower amid hawkish remarks; Fed speak due

17 May 2024, 11:05 by Newsquawk Desk

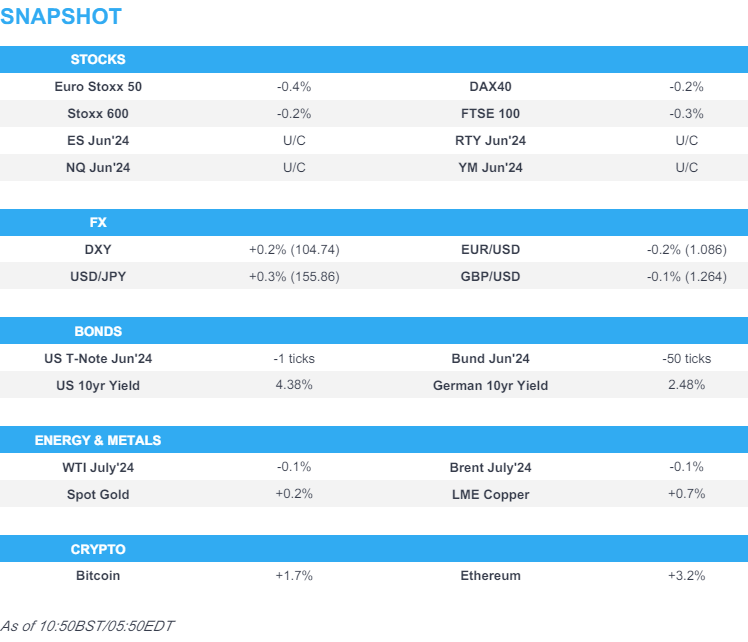

- European bourses are mostly lower, whilst US equity futures are flat

- Dollar is firmer, AUD underperforms after mixed Chinese data

- Bonds are pressured, more-so in EGBs following hawkish commentary from ECB’s Schnabel

- Crude is flat, XAU modestly firmer and base metals benefit from China's support measures despite mixed data

- Looking ahead, Comments from Fed's Waller & Daly

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.2%) are mostly on the back foot, continuing the broad weakness seen in APAC trade overnight.

- European sectors are mostly lower; Telecoms are found at the top of the pile, building on the prior day's outperformance; Tech lags.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY -0.1%) are flat, with price action circulating on either side of the unchanged mark.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- DXY is firmer, continuing to reclaim lost ground following the dovish US CPI report on Wednesday, which led the index as low as 104.07. The index currently sits towards the upper end of a 104.77-49 range.

- EUR is modestly softer vs USD, and overall unreactive to the final EZ inflation figures. EUR/USD dips beyond the lows of Thursday, printing a trough at 1.0842.

- GBP is slightly softer vs the Dollar, largely a factor of broader Greenback strength, rather than UK-related newsflow; trading towards the bottom end of today’s 1.267-264 range.

- JPY continues to trundle lower, with USD/JPY going as high as 155.98, just shy of the round 156.0 level. USD/JPY was supported after the BoJ refrained from making any further reductions in Rinban purchase amounts.

- Antipodeans are both softer vs the Dollar, with the Aussie the G10 underperformer. Chinese activity data overnight was mixed, and subsequent support measures which lifted the Yuan failed to prop up the Antipodes.

- PBoC set USD/CNY mid-point at 7.1045 vs exp. 7.2222 (prev. 7.1020)

- Click here for more details.

FIXED INCOME

- USTs are modestly softer, and to a lesser degree than EGBs; bullish-impetus from the BoJ maintaining its Rinban purchase amount is weighed up against hawkish commentary from ECB's Schnabel. Currently only a handful of ticks lower at around 109-14.

- Bunds are weighed on by remarks from ECB's Schnabel overnight who said that the data does not currently point to a cut in July. Bunds down to a 131.01 base, but with someway to go before the WTD trough from Tuesday at 130.24.

- Gilts are taking impetus from EGBs and as such are at session lows of 98.08 but again well above Tuesday's WTD base at 97.23; potential focus on extensive fiscal commentary from Chancellor Hunt, though nothing fundamentally new just yet.

- Click here for more details.

COMMODITIES

- Crude benchmarks were incrementally firmer but have been drifting from best levels as the USD picks up; WTI & Brent Jul'24 at the low-end of the day's range at USD 78.80/bbl and USD 83.37/bbl respectively.

- Precious metals are a touch firmer, torn between the stronger USD/somewhat higher yields and a general downtick in risk appetite. XAU at USD 2380/oz, still yet to test USD 2400/oz.

- Base metals are in the green, support derived from the extensive Chinese property support measures announced across the APAC/European sessions transition, despite the mixed read from the region's data overnight.

- Click here for more details.

DATA RECAP

- EU HICP Final YY (Apr) 2.4% vs. Exp. 2.4% (Prev. 2.4%); HICP-X F&E Final YY (Apr) 2.8% vs. Exp. 2.8% (Prev. 2.8%)

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos sees inflation moving toward the 2% goal in 2025. Favourable stance on cross-border consolidation in the banking sector.

- Riksbank's Thedeen says recent data does not change the picture for rate cuts.

- UK Chancellor Hunt will claim that only the Conservative Party will cut the tax burden after the election, according to FT.

- ECB's Schnabel said depending on incoming data, a rate cut in June may be appropriate, but the path beyond June is much more uncertain, while she added that a rate cut in July does not seem warranted based on current data. Schnabel also stated that with inflation risks still being tilted to the upside, front-loading of the easing process would come with a risk of easing prematurely and cannot pre-commit to any particular rate path due to very high uncertainty, according to Nikkei.

NOTABLE US HEADLINES

- Fed's Bostic (voter) said he is pleased with inflation progress in April but added the Fed is not there yet, while he remains resolute and vigilant about inflation, as well as noting that there is still a lot of pricing pressure in the economy.

- Tesla (TSLA) is reportedly developing plans to construct a data centre within China, as an option to train AI for self-driving systems, via Reuters citing sources

GEOPOLITICS

MIDDLE EAST

- US Official says the US will agree to the Rafah operation but on conditions, via Al Arabiya; adds, the US' warnings to Israel about the operation in Rafah are serious. "The Biden administration will accept a full Israeli attack in Rafah aimed at liquidating Hamas".

- Iraqi armed factions said they targeted a "vital target" in Eilat, southern Israel, according to Asharq News.

- Israel presented a proposal to Egypt to reopen the Rafah crossing with the participation of Palestinians from Gaza and UN personnel, according to Israeli media cited by Asharq News.

- US Defence Secretary Austin reinforced to Israeli counterpart in a phone call the necessity to protect civilians and ensure uninterrupted aid flow before any potential Israeli military operation in Rafah.

- Yemen's Houthis say they downed US MQ9 plane on Thursday evening Maareb Governorate.

OTHER

- North Korean leader Kim's sister denied arms exchanges with Russia and said North Korea has no intention to export its arms, while she added that rocket launchers and missiles recently unveiled are for defence against South Korea, according to KCNA.

- South Korea said North Korea fired at least one ballistic missile towards the Sea of Japan.

CRYPTO

- Bitcoin is slightly higher and sits firmly above USD 66k, whilst Ethereum posts gains to higher magnitude, and firmly sits above USD 3k.

APAC TRADE

- APAC stocks were mostly subdued following the mild losses on Wall St where the major indices pulled back after printing fresh record levels, while participants also digested mixed activity data from China.

- ASX 200 was pressured as losses across most industries overshadowed the gains in the mining and materials.

- Nikkei 225 declined but was off worst levels amid a weaker currency and after the BoJ refrained from further cutting its bond purchases.

- Hang Seng and Shanghai Comp were indecisive with early outperformance in Hong Kong owing to tech strength before briefly wiping out all of its gains, while the mainland was constrained as the focus centred on a slew of data including a further deterioration in Home prices which saw the steepest monthly drop in 9 years, while activity data was mixed as Industrial Production topped forecasts but Retail Sales disappointed.

- Modest extension of/return of strength in the Hang Seng and Shanghai Composite on the announcement of various Chinese property support measures, incl. a cut to the housing fund loan level.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier He Lifeng says must effectively ensure the delivery of homes, adds local governments can purchase some homes for affordable housing at 'reasonable' prices, according to Xinhua.

- PBoC announces it will lower interest rates on provident housing fund loans by 25bps and China will abolish the lower limit of interest rates for housing provident fund for first and second homes at the national level.

- PBoC to create a CNY 300bln relending loan for affordable housing, expected to drive bank lending of CNY 500bln.

- China stats bureau spokesperson said complexities and uncertainties in the external environment grew outstandingly and continued economic recovery and improvement still face many challenges, while April economic operations were stable even though some indicators slowed due to a high base and holiday factors. China's stats bureau said with macro policies taking effect and economic momentum recovering, China's economic improvement will be further consolidated and strengthened but also noted that China's property sector continues to be under adjustments.

- BoJ Governor Ueda said there is no immediate plan to sell BoJ's ETF holdings and must spend time deciding the fate of BoJ's holdings including whether to unload them in the future, according to Reuters.

- BoJ may raise rates as many as three more times this year with the next move potentially coming as early as June given how much room there is to adjust its “excessively” easy settings, according to former BoJ chief economist Sekine cited by Bloomberg.

DATA RECAP

- Chinese Industrial Output YY (Apr) 6.7% vs. Exp. 5.5% (Prev. 4.5%)

- Chinese Retail Sales YY (Apr) 2.3% vs. Exp. 3.8% (Prev. 3.1%)

- Chinese Urban Investment (YTD) YY (Apr) 4.2% vs. Exp. 4.6% (Prev. 4.5%)

- Chinese Unemployment Rate Urban Area (Apr) 5.0% (Prev. 5.2%)

- Chinese China House Prices YY (Apr) -3.1% (Prev. -2.2%)