Europe Market Open: Mixed Chinese data somewhat offset by property support measures

17 May 2024, 06:40 by Newsquawk Desk

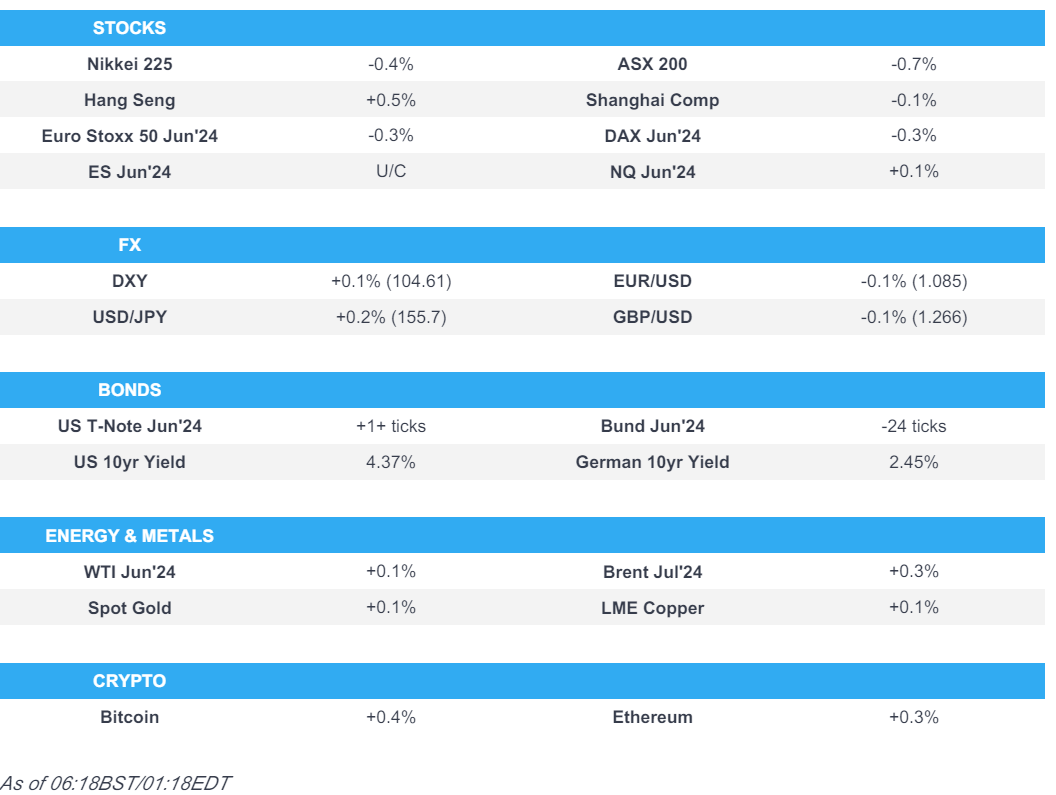

- APAC stocks initially subdued before benefitting from the latest China property support measures

- DXY bid with peers generally contained aside from slight JPY pressure, Yuan benefits from the property support despite soft/mixed data beforehand

- Fixed benchmarks uneventful ex-JGBs which outperformed as the BoJ maintained the Rinban purchase amount

- Commodities contained with specifics light, modest support on China property caveated by mixed signals from the economy

- ECB's Schnabel says a June cut may be appropriate but the current data does not seem to warrant a rate cut in July

- Looking ahead, highlights include EZ CPI (F), Comments from ECB’s de Guindos, BoE’s Mann, Fed's Waller & Daly, Earnings from Engie & Scor.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks ultimately finished with mild losses on the day after gradually paring the initial gains seen following the cash equity open as markets unwound some of the recent post-CPI moves, while participants also digested mostly weaker-than-expected data releases and hot US import prices.

- SPX -0.21% at 5,297, NDX -0.21% at 18,557, DJIA -0.10% at 39,869, RUT -0.63% at 2,096.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bostic (voter) said he is pleased with inflation progress in April but added the Fed is not there yet, while he remains resolute and vigilant about inflation, as well as noted that there is still a lot of pricing pressure in the economy.

- Fed's Mester (voter, retires in June) said the current restrictive policy will help lower inflation and monetary policy is well-positioned as the Fed reviews more data. Mester also stated that it will take longer to gain confidence inflation is moving toward 2% and a strong economy means the Fed is risking little to hold policy in place.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the mild losses on Wall St where the major indices pulled back after printing fresh record levels, while participants also digested mixed activity data from China.

- ASX 200 was pressured as losses across most industries overshadowed the gains in the mining and materials.

- Nikkei 225 declined but was off worst levels amid a weaker currency and after the BoJ refrained from further cutting its bond purchases.

- Hang Seng and Shanghai Comp were indecisive with early outperformance in Hong Kong owing to tech strength before briefly wiping out all of its gains, while the mainland was constrained as the focus centred on a slew of data including a further deterioration in Home prices which saw the steepest monthly drop in 9 years, while activity data was mixed as Industrial Production topped forecasts but Retail Sales disappointed.

- Modest extension of/return of strength in the Hang Seng and Shanghai Composite on the announcement of various Chinese property support measures, incl. a cut to the housing fund loan level.

- US equity futures languished around the prior day's lows amid the cautious mood in Asian peers.

- European equity futures indicate a softer open with Euro Stoxx 50 futures down 0.4% after the cash market closed down 0.6% on Thursday.

FX

- DXY traded marginally higher and continued to claw back its mid-week inflation-triggered losses, while the recent Fed rhetoric continued to suggest a lack of confidence regarding inflation moving sustainably to the target.

- EUR/USD trickled lower after stalling near the 1.0900 handle and as ECB rhetoric continued to flag a June cut.

- GBP/USD remained lacklustre after its pullback from the 1.2700 level with little in the way of pertinent catalysts.

- USD/JPY was supported after the BoJ refrained from making any further reductions in Rinban purchase amounts.

- Antipodeans mildly softened amid the subdued risk appetite and mixed data releases from China.

- Yuan picked up a touch on the latest Chinese property support measures.

- PBoC set USD/CNY mid-point at 7.1045 vs exp. 7.2222 (prev. 7.1020)

FIXED INCOME

- 10-year UST futures were uneventful after fading some of the post-CPI advances and following hot import prices.

- Bund futures languished near the prior day's lows following the recent failure to sustain the 132.00 status.

- 10-year JGB futures tracked global counterparts lower although moved off lows and were boosted after the BoJ kept its Rinban purchases unchanged which spurred a dovish reaction as some feared the BoJ could continue cutting purchase amounts after its reduction earlier this week.

COMMODITIES

- Crude futures traded rangebound amid a cautious mood and lack of oil-specific news flow.

- Spot gold lacked direction after yesterday's gradual retreat from resistance near the USD 2400/oz level.

- Copper futures were contained following the mixed signals from China's economy.

- Chile Copper Commission Cochilco raised its 2024 average copper price estimate to USD 4.30/lb (prev. USD 3.85/lb) and raised its 2025 estimate to USD 4.25/lb (prev. 3.90).

CRYPTO

- Bitcoin was mildly underpinned and gradually climbed north of the USD 65,500 level.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier He Lifeng says must effectively ensure the delivery of homes, adds local governments can purchase some homes for affordable housing at 'reasonable' prices, according to Xinhua.

- PBoC announces it will lower interest rates on provident housing fund loans by 25bps and China will abolish the lower limit of interest rates for housing provident fund for first and second homes at the national level.

- China stats bureau spokesperson said complexities and uncertainties in the external environment grew outstandingly and continued economic recovery and improvement still face many challenges, while April economic operations were stable even though some indicators slowed due to a high base and holiday factors. China's stats bureau said with macro policies taking effect and economic momentum recovering, China's economic improvement will be further consolidated and strengthened but also noted that China's property sector continues to be under adjustments.

- BoJ Governor Ueda said there is no immediate plan to sell BoJ's ETF holdings and must spend time deciding the fate of BoJ's holdings including whether to unload them in the future, according to Reuters.

- BoJ may raise rates as many as three more times this year with the next move potentially coming as early as June given how much room there is to adjust its “excessively” easy settings, according to former BoJ chief economist Sekine cited by Bloomberg.

DATA RECAP

- Chinese Industrial Output YY (Apr) 6.7% vs. Exp. 5.5% (Prev. 4.5%)

- Chinese Retail Sales YY (Apr) 2.3% vs. Exp. 3.8% (Prev. 3.1%)

- Chinese Urban Investment (YTD) YY (Apr) 4.2% vs. Exp. 4.6% (Prev. 4.5%)

- Chinese Unemployment Rate Urban Area (Apr) 5.0% (Prev. 5.2%)

- Chinese China House Prices YY (Apr) -3.1% (Prev. -2.2%)

GEOPOLITICS

MIDDLE EAST

- Iraqi armed factions said they targeted a "vital target" in Eilat, southern Israel, according to Asharq News.

- Israel presented a proposal to Egypt to reopen the Rafah crossing with the participation of Palestinians from Gaza and UN personnel, according to Israeli media cited by Asharq News.

- Israeli Finance Minister plans to impose 100% tariffs on imports from Turkey until the end of Turkish President Erdogan's term.

- US Defence Secretary Austin reinforced to Israeli counterpart in a phone call the necessity to protect civilians and ensure uninterrupted aid flow before any potential Israeli military operation in Rafah.

OTHER

- North Korean leader Kim's sister denied arms exchanges with Russia and said North Korea has no intention to export its arms, while she added that rocket launchers and missiles recently unveiled are for defence against South Korea, according to KCNA.

- US Defence Secretary Austin will meet with his Chinese counterpart this month, according to FT.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Hunt will claim that only the Conservative Party will cut the tax burden after the election, according to FT.

- ECB's Schnabel said depending on incoming data, a rate cut in June may be appropriate, but the path beyond June is much more uncertain, while she added that a rate cut in July does not seem warranted based on current data. Schnabel also stated that with inflation risks still being tilted to the upside, front-loading of the easing process would come with a risk of easing prematurely and cannot pre-commit to any particular rate path due to very high uncertainty, according to Nikkei.