US Market Open: US equity futures modestly firmer, Dollar attempts to recoup recent losses & AUD lags post jobs data; US IJC due

16 May 2024, 11:05 by Newsquawk Desk

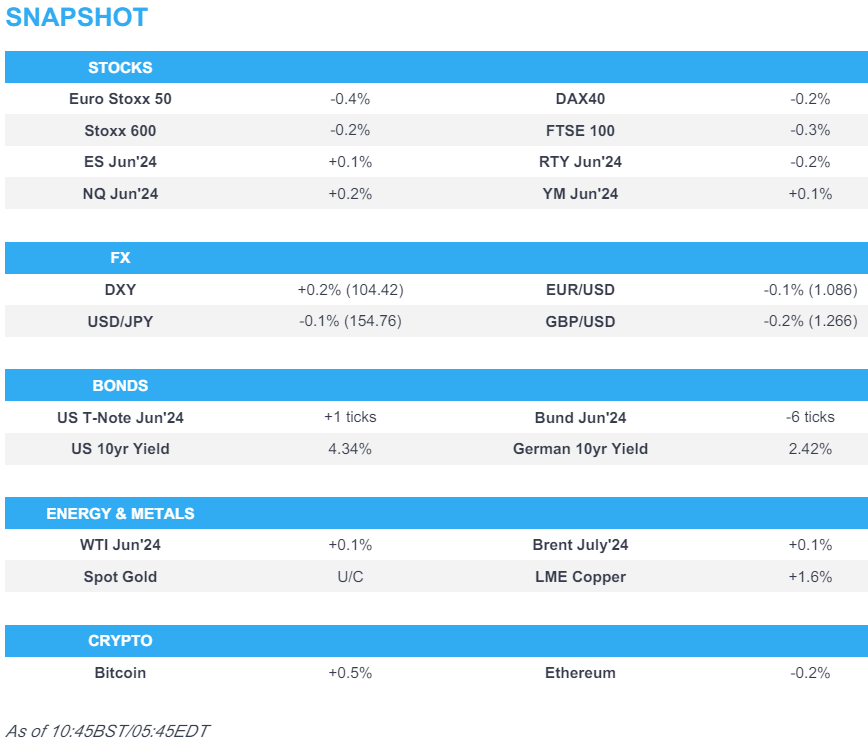

- European equities are mostly lower whilst US futures gain modestly

- Dollar is firmer paring back some of the CPI-induced losses, AUD lags after mixed employment data

- Bonds are steady, though with a very mild negative bias

- Crude benchmarks are flat, XAU is rangebound and base metals are mixed

- Looking ahead, US IJC, Philly Fed, BoE’s Greene, Fed’s Harker, Mester, Bostic & Barr. Earnings: Applied Materials, Deere & Walmart

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.3%) are mostly lower, unable to continue the US CPI-induced gains from the prior session. Bourses initially opened marginally in the red, and continued to edge lower as the morning progressed.

- European sectors are mixed; Insurance is the clear outperformer, propped up by post-earning gains in Swiss Re and Zurich Insurance. Energy is found at the foot of the pile, hampered by broader weakness in crude prices over the past few days.

- US Equity Futures (ES +0.1%, NQ +0.2%, RTY -0.2%) are mixed, with some of the post-CPI optimism seemingly fizzling out. Stock specifics today include Cisco (+4.5% pre-market), which beat on its top/bottom lines.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- DXY is attempting to recoup lost ground after the fallout from yesterday's CPI and retail sales saw the index make a low at 104.07; next up, US IJC & Philly Fed data.

- EUR/USD is marginally softer vs. the USD after EUR/USD ran out of steam ahead of 1.09. IJC could see the pair retest 1.09 given the reaction to last week's jump in claims.

- GBP is a touch softer vs. the USD in quiet trade but holding onto a bulk of yesterday's notable gains. Cable went as high as 1.27 before running into resistance. If Cable manages to resume its ascent higher and breach 1.27, the April high sits just above at 1.2709.

- JPY remains one of the main beneficiaries from yesterday's post-data dollar selling as US-Japanese rate differentials turn in Japan's favour. USD/JPY down as low as 153.61 before scaling back losses to around 154.75 currently.

- Antipodeans are both softer vs. the USD following yesterday's session of chunky gains. AUD/USD saw mixed jobs data overnight and has currently scaled back from a 0.6714 peak (highest since Jan) and retreated back onto a 0.66 handle.

- Click here for more details.

- Click here for the FX Option Expiries for today's NY cut.

FIXED INCOME

- USTs are steady thus far with benchmarks slightly shy of this morning's peak but still in the green. A relative pullback which is being led by the short-end with the 2yr basically unchanged and lagging a touch, with an unusually sizeable for the time block trade perhaps impacting; USTs in slim 109-24 to 109-31+ bounds.

- Gilt price action is similar to that seen in USTs, with Gilts just shy of today's WTD 98.76 peak with nothing of note until 99.00 and then 99.10 from mid-April.

- Bund have also drifted back towards the unchanged mark with Bunds going as low as 131.63; overall unreactive to Spanish/French auctions.

- Spain sells EUR 5.5bln vs. Exp. EUR 4.5-5.5bln 2.50% 2027, 3.50% 2029, 1.00% 2042 Bono Auction.

- France sells EUR 11.998bln vs exp. EUR 10.5-12bln 2.50% 2027, 2.75% 2029, 2.75% 2030, 2.50% 2030 Bond

- Click here for more details.

COMMODITIES

- Crude benchmarks were in the green, though now off best levels (now flat) as the Dollar attempts to pare back some of its recent CPI-induced losses; Brent July hovers around USD 83/bbl, whilst WTI trades around USD 79/bbl.

- Precious metals are mixed; spot gold is flat whilst spot silver sees mild losses. XAU topped out at USD 2397/oz after failing to breach USD 2400/oz.

- Base metals hold little bias as the post-CPI move pauses for breath into more US data and Fed speak. In addition to pressure emanating from modest USD strength.

- Azerbaijan Oil production at 476k in April (prev. 481k M/M)

- LME says daily stock data has been delayed; investigating the situation

- Click here for more details.

DATA RECAP

- Norwegian GDP Month Mainland (Mar) -0.2% (Prev. -0.2%, Rev. -0.3%); Q1 0.2% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%)

- Italian Consumer Prices Final MM (Apr) 0.1% vs. Exp. 0.2% (Prev. 0.2%); Consumer Prices Final YY (Apr) 0.8% vs. Exp. 0.9% (Prev. 0.9%)

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos says price falls in CRE market to continue but at a slower pace than last year; rise in NPLs and rise in funding costs to weigh on bank profits this year

- Statistics Swiss says domestic GDP likely 0.2% in Q1.

- Bank of Spain says to start process to establish bank's countercyclical buffer in Q4; plans to establish countercyclical buffer at 0.5%.

- Norges Bank Expectations Survey Q2'24. The economists expect goods and services inflation 12 months ahead to be 3.6%, down 0.1pp from the previous quarter. The economists expect the average rise in real wages will be 1.2% in 2024, up 0.3pp from the previous quarter.

NOTABLE US HEADLINES

- Fed's Goolsbee (non-voter) said it's great if the decrease in housing inflation seen in April CPI data continues, while he added that he is still optimistic and his read of the evidence is that house price inflation comes down substantially, according to a Marketplace interview. It was also reported that Goolsbee said he is optimistic inflation will continue on a downward trajectory, according to a CNN interview.

- Kansas City Fed said the annual Economic Policy Symposium will be on August 22nd-24th in Jackson Hole where the topic will be "Reassessing the Effectiveness and Transmission of Monetary Policy".

- Cisco Systems Inc (CSCO) Q3 2024 (USD): Adj. EPS 0.88 (exp. 0.82), Revenue 12.70bln (exp. 12.53bln). Shares +4.5% pre-market

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu rejected US calls for a post-war plan in Gaza, while Arab governments have rejected the idea of establishing an Arab-led civilian administration in Gaza, according to WSJ.

- Hamas's chief said the fate of truce talks is uncertain as Israel insists on occupying Rafah crossing, according to AFP News Agency.

- Lebanon's Hezbollah launched drones at a military base west of Israel's Tiberias in the deepest strike into Israeli territory thus far.

- Massive Israeli airstrikes were reported in Baalbek, Lebanon, according to Kann's Amichai Stein.

- Islamic Resistance in Iraq said it launched a drone attack on a “vital” target in Eilat, southern Israel, according to Iran International.

OTHER

- Chinese President Xi said in a meeting with Russian President Putin that China will always be a good neighbour, friend, and partner of mutual trust with Russia, while he added China is ready to work together with Russia to achieve development and rejuvenation of our respective countries and uphold world equity and justice. Furthermore, Russian President Putin said Moscow and Beijing have acquired solid baggage of practical cooperation and Russia-China cooperation stands as a stabilising factor for the world.

- Ukrainian military said "intensive" enemy fire prompted the move of some troops to new positions in the Kupiansk direction, east of Kharkiv.

CRYPTO

- Bitcoin is incrementally firmer and now holds firmly above USD 66k, with Ethereum also sitting above USD 3k.

APAC TRADE

- APAC stocks took impetus from the gains on Wall St where the major indices rallied to fresh record highs after softer CPI data boosted Fed rate cut bets.

- ASX 200 was led by strength in the rate-sensitive sectors such as real estate and tech amid a drop in yields.

- Nikkei 225 gained but was off today's best levels as participants digested a firmer currency, steeper-than-expected contraction in Japanese GDP and mega bank earnings.

- Hang Seng and Shanghai Comp were positive with developers front-running the advances in Hong Kong on return from holiday as they reacted to the recent property support proposal, while the upside was capped in the mainland amid little fresh pertinent catalysts aside from Russian President Putin arrival in China where he seeks to deepen the strategic partnership with Chinese President Xi.

NOTABLE ASIA-PAC HEADLINES

- Japanese Economy Minister Shindo said regarding GDP that the economy is expected to continue moderate recovery, while he added that they need to pay close attention to risks related to forex fluctuations that would push up domestic prices.

- Baidu Inc (BIDU) Q1 2024 (CNY): EPS 19.91 (exp. 21.00), Revenue 31.5bln (exp. 31.5bln).

DATA RECAP

- Japanese GDP QQ (Q1) -0.5% vs. Exp. -0.4% (Prev. 0.1%, Rev. 0.0%); Annualised (Q1) -2.0% vs. Exp. -1.5% (Prev. 0.4%, Rev. 0.0%)

- Australian Employment (Apr) 38.5k vs. Exp. 23.7k (Prev. -6.6k); Full-Time Employment (Apr) -6.1k (Prev. 27.9k)

- Australian Unemployment Rate (Apr) 4.1% vs. Exp. 3.9% (Prev. 3.8%)