Europe Market Open: Wall St. gains reverberated into APAC trade, JPY climbs further

16 May 2024, 06:35 by Newsquawk Desk

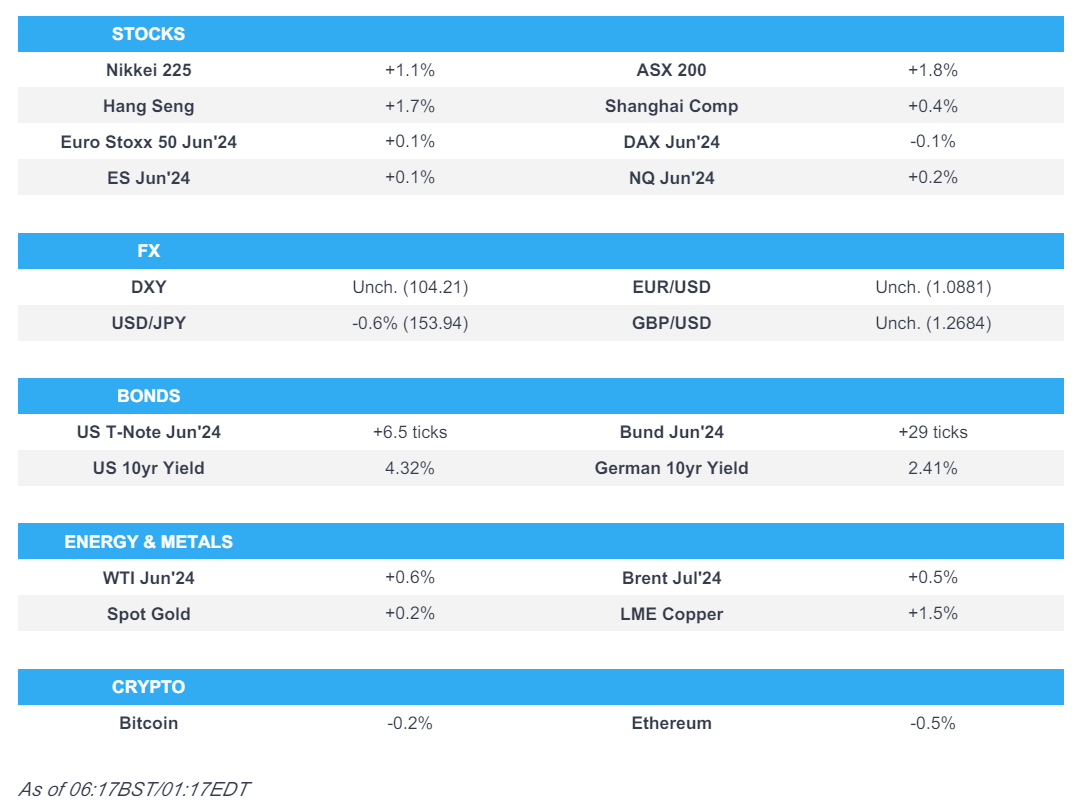

- APAC stocks took impetus from the gains on Wall St where major indices rallied to fresh record highs.

- European equity futures indicate a positive open with Euro Stoxx 50 future up 0.2% after the cash market closed up 0.4% on Wednesday.

- DXY took a breather from yesterday's data-induced losses, JPY continues to gain vs. the USD.

- Bund futures continued their advances and crude futures remained underpinned.

- Looking ahead, highlights include US IJC, Philly Fed, BoE’s Greene, Fed’s Harker, Mester, Bostic & Barr, Supply from Spain, France & US, Earnings from Deutsche Telekom, Siemens, easyJet, Applied Materials, Deere & Walmart.

US TRADE

EQUITIES

- US stocks and bonds rallied after soft CPI data boosted Fed rate cut bets with markets back to fully pricing two rate cuts this year with the first move now fully priced for September. The CPI data was the main driver, while Retail Sales also printed weaker-than-expected which added to the dovish impulse and propelled the major indices to fresh all-time highs.

- SPX +1.17% at 5,308, NDX +1.49% at 18,597, DJI +0.88% at 39,908, RUT +1.14% at 2,109.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kashkari (non-voter) said the Fed is focussed on underlying demand in the economy to get inflation down and reiterated that the biggest question now is how restrictive policy levels are, while he added that the Fed probably needs to sit here for a while longer to figure out where inflation is headed.

- Fed's Goolsbee (non-voter) said it's great if the decrease in housing inflation seen in April CPI data continues, while he added that he is still optimistic and his read of the evidence is that house price inflation comes down substantially, according to a Marketplace interview. It was also reported that Goolsbee said he is optimistic inflation will continue on a downward trajectory, according to a CNN interview.

- Kansas City Fed said the annual Economic Policy Symposium will be on August 22nd-24th in Jackson Hole where the topic will be "Reassessing the Effectiveness and Transmission of Monetary Policy".

- WSJ’s Timiraos posted on X that the April core PCE index probably rose between 0.20% and 0.26%, according to the forecasters who map the CPI and PPI into the PCE, although noted it could change with Thursday's import price data.

APAC TRADE

EQUITIES

- APAC stocks took impetus from the gains on Wall St where the major indices rallied to fresh record highs after softer CPI data boosted Fed rate cut bets.

- ASX 200 was led by strength in the rate-sensitive sectors such as real estate and tech amid a drop in yields.

- Nikkei 225 gained but was off today's best levels as participants digested a firmer currency, steeper-than-expected contraction in Japanese GDP and mega bank earnings.

- Hang Seng and Shanghai Comp were positive with developers front-running the advances in Hong Kong on return from holiday as they reacted to the recent property support proposal, while the upside was capped in the mainland amid little fresh pertinent catalysts aside from Russian President Putin arrival in China where he seeks to deepen the strategic partnership with Chinese President Xi.

- US equity futures remained firmer after the recent fresh record highs seen on Wall St.

- European equity futures indicate a positive open with Euro Stoxx 50 future up 0.2% after the cash market closed up 0.4% on Wednesday.

FX

- DXY took a breather from yesterday's post-CPI and retail sales sell-off whereby a softer print slightly boosted Fed rate cut bets which saw money markets fully price in the first rate cut in September.

- EUR/USD held on to recent gains after ascending to near 1.0900 territory on the back of a softer dollar.

- GBP/USD kept afloat but with further upside capped after hitting resistance around the 1.2700 level.

- USD/JPY remained pressured and dipped beneath 154.00 as US yields softened post-inflation data.

- Antipodeans retained most of the prior day's spoils but with mild headwinds seen in AUD/USD following mixed jobs data which showed headline Employment topped forecasts but was solely fuelled by part-time jobs and the Unemployment Rate rose more than expected.

FIXED INCOME

- 10-year UST futures extended on the post-CPI rally to just shy of the 110.00 level amid rate cut bets.

- Bund futures continued their advances to just above 132.00, while the attention turns to Buba speakers.

- 10-year JGB futures tracked the gains in global counterparts with the upside also facilitated by weak GDP data.

COMMODITIES

- Crude futures remained underpinned after having benefitted from a softer dollar and bullish inventories.

- Spot gold briefly edged closer towards the USD 2,400/oz level following the dovish reaction to US CPI data.

- Copper futures bounced back from yesterday's initial retreat with the recovery facilitated by the soft US inflation and heightened risk appetite.

CRYPTO

- Bitcoin traded indecisively in which price action oscillated back and forth of the USD 66,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Commerce Secretary Raimondo said the department expects to issue rules on Chinese connected vehicles this fall.

- US House Republicans proposed legislation to hike tariffs on Chinese-made drones by 30%.

- US reportedly opened a trade probe of Asian solar imports, according to Bloomberg.

- Japanese Economy Minister Shindo said regarding GDP that the economy is expected to continue moderate recovery, while he added that they need to pay close attention to risks related to forex fluctuations that would push up domestic prices.

DATA RECAP

- Japanese GDP QQ (Q1) -0.5% vs. Exp. -0.4% (Prev. 0.1%, Rev. 0.0%)

- Japanese GDP QQ Annualised (Q1) -2.0% vs. Exp. -1.5% (Prev. 0.4%, Rev. 0.0%)

- Australian Employment (Apr) 38.5k vs. Exp. 23.7k (Prev. -6.6k)

- Australian Full-Time Employment (Apr) -6.1k (Prev. 27.9k)

- Australian Unemployment Rate (Apr) 4.1% vs. Exp. 3.9% (Prev. 3.8%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said Hamas's elimination must be pursued without excuses.

- Israeli PM Netanyahu rejected US calls for a post-war plan in Gaza, while Arab governments have rejected the idea of establishing an Arab-led civilian administration in Gaza, according to WSJ.

- Hamas's chief said the fate of truce talks is uncertain as Israel insists on occupying Rafah crossing, according to AFP News Agency.

- Lebanon's Hezbollah launched drones at a military base west of Israel's Tiberias in the deepest strike into Israeli territory thus far.

- Massive Israeli airstrikes were reported in Baalbek, Lebanon, according to Kann's Amichai Stein.

- Islamic Resistance in Iraq said it launched a drone attack on a “vital” target in Eilat, southern Israel, according to Iran International.

OTHER

- Chinese President Xi said in a meeting with Russian President Putin that China will always be a good neighbour, friend, and partner of mutual trust with Russia, while he added China is ready to work together with Russia to achieve development and rejuvenation of our respective countries and uphold world equity and justice. Furthermore, Russian President Putin said Moscow and Beijing have acquired solid baggage of practical cooperation and Russia-China cooperation stands as a stabilising factor for the world.

- Ukrainian military said "intensive" enemy fire prompted the move of some troops to new positions in the Kupiansk direction, east of Kharkiv.