US Market Open: Equities flat ahead of US CPI, Dollar lower & Antipodeans lifted on reports of Chinese support measures

15 May 2024, 11:17 by Newsquawk Desk

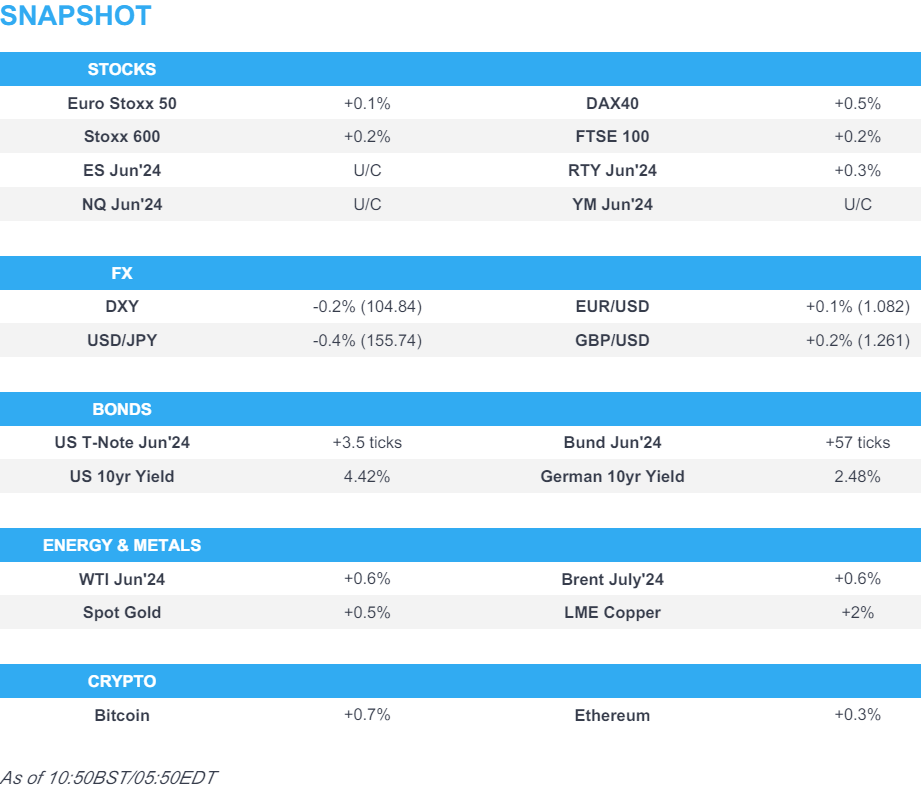

- European bourses are mostly firmer, US futures flat ahead of US CPI & Retail Sales

- Dollar is weaker, Antipodeans lifted on reports of Chinese support measures, USD/JPY dips

- Bonds are firmer, continuing the post-PPI strength

- Crude is in the green, XAU is supported given the softer Dollar & base metals are in the green

- Looking ahead, US CPI & Retail Sales. Comments from Fed’s Kashkari. Earnings from Cisco Systems

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.2%) are mostly firmer, continuing the positive sentiment seen in APAC trade overnight.

- European sectors hold a strong positive tilt; Real Estate is the clear outperformer, lifted by post-earning gains in Leg Immobilien (+2.9%). Basic Resources is lifted by broader strength in underlying metals prices. Consumer Products & Services is weighed on by losses in the Luxury sector, namely Burberry (-3.1%).

- US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are modestly firmer, attempting to build on the prior session’s advances, though still mindful of the upcoming US CPI & Retail Sales.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- DXY has continued its descent below the 105 mark and is approaching its 100DMA at 104.78 ahead of today's US CPI & Retail Sales.

- EUR/USD is on firmer footing vs. USD and now above the 1.08 mark, with its 100DMA at 1.0822. EZ-specific updates have been non-incremental for today's session.

- GBP is a touch firmer vs. peers with nothing in the way of UK-specific drivers. As such, the dollar side of the equation will likely prove more pivotal. A dovish CPI print could see GBP/USD test the May high at 1.2634.

- Antipodeans are both performing well vs. the USD with some support seen after reports that China is mulling purchases of unsold homes to ease the glut; has helped prop up metals prices. AUD/USD has printed a new high for the month at 0.6651.

- A two-way reaction for the SEK post-CPI. Initially, EUR/SEK moved lower from 11.6760 to 11.6520 with the focus likely on the hot ex-energy M/M. However, this swiftly retraced with EUR/SEK surpassing pre-release levels and going as high as 11.7035 given the slight uptick in the headline Y/Y was less than expected.

- Click here for more details.

- Click here for the FX Option Expiries for today's NY cut.

FIXED INCOME

- USTs are firmer by a handful of ticks at a fresh WTD peak of 109-07+, with the complex continuing to build on the post-PPI gains; data which whilst is hawkish at first-glance, contained some softer components relevant to the US PCE.

- Gilts are the modest outperformer as the complex continues to pick up from Wednesday's PPI-induced downside, alongside broader fixed benchmarks, and as the dovish commentary from Pill remains the main development for the Gilt market in recent sessions. Gilts holding above 98.0 at a fresh WTD peak of 98.18.

- Bund price action is in-fitting with peers, but less-so than Gilts. Bunds are holding just above the 131.00 mark and matching the 131.13 double-top from Monday & Tuesday; price action was little reactive to the dual-tranche 30yr Bund auction, which was strong.

- Click here for more details.

COMMODITIES

- Crude is in the green with magnitudes comparable to equity performance as the complex appears to be following the overall risk tone and perhaps taking some impetus from USD downside into CPI. Brent July currently holds around USD 82.80/bbl, whilst WTI hovers USD 76.50.

- Gas benchmarks outperform after commentary from the QatarEnergy and TotalEnergies CEO around significant gas demand and there being no chance of a LNG surplus currently.

- Precious metals are supported given the cooler-take from PPI for CPI/PCE and after Chair Powell's comments on the readings. XAU around USD 2372/oz, just shy of last week's USD 2378/oz peak.

- Base metals are entirely in the green with sentiment lifted amid reports of further Chinese support measures.

- IEA OMR: cuts 2024 oil demand growth forecast by 140k BPD to 1.1mln BPD, 2025 demand expected to grow by 1.2mln BPD (vs. prev. forecast of 1.1mln BPD). 2024 demand forecast lowered due to weak deliveries, notably in Europe, shifted Q1 OECD demand into contraction. World oil supply to rise by 580k BPD in 2024 to a record 102.7mln BPD. Oil market looks more balanced in 2024. Even in the event that OPEC+ voluntary production cuts were to remain, global oil supply could rise by 1.8mln BPD in 2025 compared to the 580k BPD rise in 2024.

- US Energy Inventory Data (bbls): Crude -3.1mln (exp. -0.5mln), Cushing -0.6mln, Gasoline -1.3mln (exp. +0.5mln), Distillate +0.3mln (exp. +0.8mln).

- Explosion was reported after a drone attack at Russia's Rostov fuel depot, according to Russian agencies.

- Click here for more details.

DATA RECAP

- EU GDP Flash Estimate QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%); GDP Flash Estimate QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%); GDP Flash Estimate YY (Q1) 0.4% vs. Exp. 0.4% (Prev. 0.4%)

- EU Employment Flash YY (Q1) 1.0% vs. Exp. 1.0% (Prev. 1.2%); Employment Flash QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- EU Industrial Production YY (Mar) -1.0% vs. Exp. -1.2% (Prev. -6.4%, Rev. -6.3%); Industrial Production MM (Mar) 0.6% vs. Exp. 0.5% (Prev. 0.8%, Rev. 1.0%)

- Swedish CPIF YY (Apr) 2.3% vs. Exp. 2.4% (Prev. 2.2%); ex-energy (Apr): Y/Y 2.9% vs exp. 3.0% (prev. 2.9%), M/M 0.4% vs exp. 0.5% (prev. 0.0%)

- French CPI (EU Norm) Final MM (Apr) 0.6% vs. Exp. 0.6% (Prev. 0.6%); CPI (EU Norm) Final YY (Apr) 2.4% vs. Exp. 2.4% (Prev. 2.4%)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn says if the confidence that inflation is approaching its target in a sustainable manner continues to strengthen, the restrictiveness of monpol can be reduced.

- European Commission Forecasts (Spring 2024): A gradual expansion amid high geopolitical risks. Click here for details.

- Riksbank Minutes: Floden said "Monetary policy will remain contractionary even after a policy rate cut to 3.75 per cent. If these developments continue, it will therefore be appropriate to continue to cut the rate by a few more steps". Click here for more details.

NOTABLE US HEADLINES

- Fed's Mester (voter) said the Fed is in a good place to study the economy before charting a rate path and she isn't eager to consider a rate hike, while she noted it was appropriate for the Fed to hold rates steady as it awaits evidence that price pressures are easing further. Mester said it’s too early to conclude that they stalled out or that inflation is going to reverse but noted there are definite signs that the real side of the economy is moderating which is helping to bring balance back to the economy, according to WSJ.

- Fed's Schmid (non-voter) said policy is in the correct place and continued vigilance and flexibility are necessary, while he is prepared to be patient as inflation eases back towards 2%, as well as noted that inflation is still too high and the Fed has more work to do. Schmid also stated interest rates could remain high for some time and doesn't think they should have slowed the balance sheet runoff.

- Boeing (BA) US DoJ says Boeing breached obligations under 2021 737 MAX deferred prosecution agreement and failed to design, implement, and enforce a compliance and ethics program to prevent and detect violations of fraud laws throughout its operations. DoJ is still determining how it will proceed in the Boeing matter. -1.5% in pre-market trade

- Tesla (TSLA) To lay off an additional 601 employees in California.

GEOPOLITICS

MIDDLE EAST

- A Hezbollah commander was killed in an Israeli airstrike targeting a car in southern Lebanon's Tyre, according to two Lebanese security sources cited by Reuters.

- Iraqi armed factions targeted an Israeli military target in Eilat with drones, according to Sky News Arabia.

- US President Biden would veto the Israeli bill on the floor this week, according to Punchbowl citing the White House. It was separately reported that the US State Department moved USD 1bln weapons aid for Israel to a congressional review process, according to a senior official cited by Reuters.

- Israel's Defence Minister Galliant set to to give security briefing to press at 16:00 BST/11:00ET.

OTHER

- Ukrainian officials are making a new push to get the Biden administration to lift its ban on using US-made weapons to strike inside Russia, according to POLITICO.

- France and Netherlands seek EU sanctions on global financial institutions that help Russia's military, according to a proposal seen by Reuters.

- Russian President Putin said Russia and China are promoting the prosperity of both nations through expanded equal and mutually beneficial cooperation, as well as noted that Russian-Chinese economic ties have great prospects. Furthermore, Putin said China clearly understands the roots of the Ukraine crisis and its global geopolitical impact, while he is open to a dialogue on Ukraine, but added that such negotiations must take into account the interests of all countries involved in the conflict, including theirs, according to Xinhua.

- North Korean leader Kim oversaw a tactical missile weapon system on Tuesday, according to KCNA.

CRYPTO

- Bitcoin is modestly firmer and hovers around USD 62k, whilst Ethereum fails to reclaim USD 3k.

APAC TRADE

- APAC stocks traded mostly higher following the momentum from the US where the major indices ultimately gained and the Nasdaq posted a fresh record close with two-way price action seen following PPI data.

- ASX 200 was led by the mining, materials and healthcare sectors, while participants also digested the recent budget announcement with the government planning to boost spending next year ahead of an election.

- Nikkei 225 gained but was well off today's best levels with newsflow dominated by earnings releases including from Sony and Sharp, while the Japanese megabanks are also scheduled to announce their results today.

- Shanghai Comp was pressured after the recent US tariff announcement and with Stock Connect trade shut owing to the holiday closure in Hong Kong, although the real estate industry found solace from news that China is mulling purchases of unsold homes to ease the glut.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted CNY 125bln (CNY 125bln maturing) in 1-year MLF with the rate kept unchanged at 2.50%.

- China mulls government purchases of millions of unsold homes from distressed developers at steep discounts to ease the glut, while Beijing is seeking feedback on the preliminary proposal, according to Bloomberg sources.

EARNINGS

- Sumitomo Mitsui Financial (8316 JT) FY23/24 (JPY): Net Profit 962bln, +19.5%; Recurring 1.47tln, +26.3%. To conduct a 3-1 stock split for shareholders as of 30th September.

- Japan Post Holdings (6178 JT) 2023/24 (JPY): Net 268.6bln, -37%; Recurring 668bln, +1.6%. FY24/25 guidance: Net 280bln, +4.2%; Recurring 760bln, +13.7%. Buyback for as much as 10% of Co. shares, worth JPY 350bln.

DATA RECAP

- Australian Wage Price Index QQ (Q1) 0.8% vs. Exp. 0.9% (Prev. 0.9%, Rev. 1.0%); YY (Q1) 4.1% vs. Exp. 4.2% (Prev. 4.2%)