Europe Market Open: Positive Wall St. handover continues into US CPI

15 May 2024, 06:35 by Newsquawk Desk

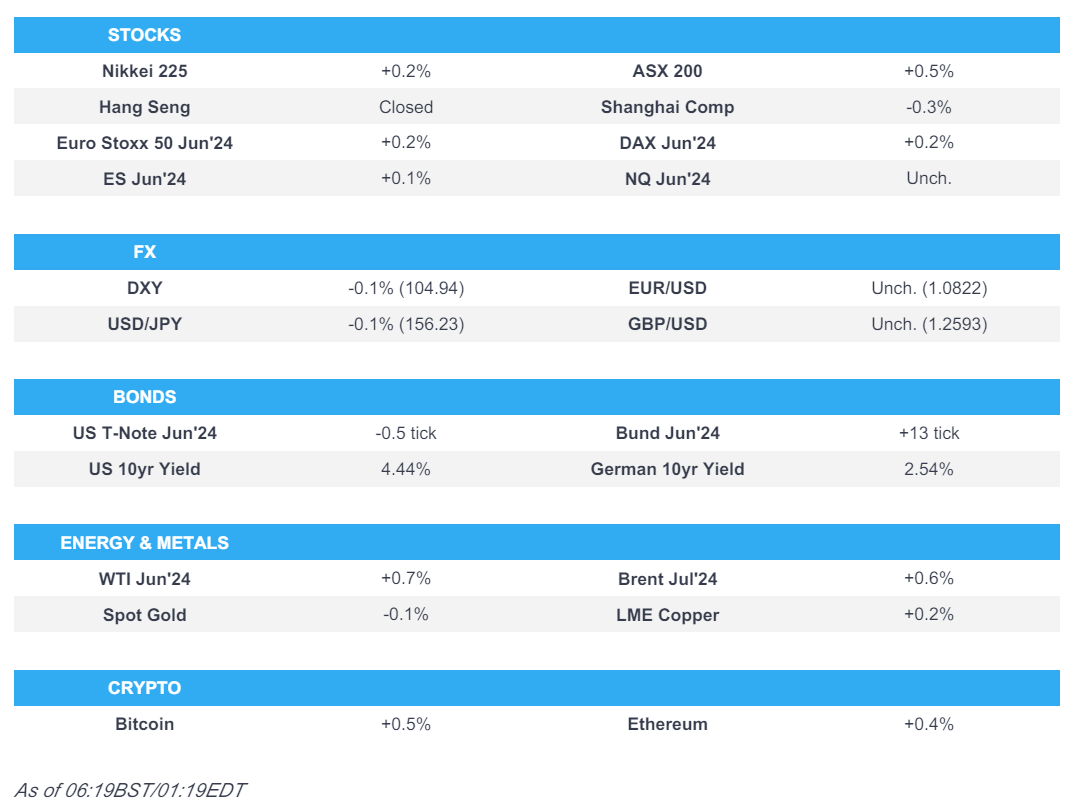

- APAC stocks traded mostly higher following the momentum from the US where the Nasdaq posted a fresh record close.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.2% after the cash market closed flat on Tuesday.

- DXY is sub-105, EUR/USD sits on a 1.08 handle, Cable tested 1.26 and antipodeans outperform.

- Crude futures rebounded from the prior day's losses with prices helped by private sector inventory data.

- Looking ahead, highlights include EZ Employment, US CPI & Retail Sales, Riksbank Minutes, IEA OMR, Comments from Fed’s Kashkari, Supply from UK & Germany, Earnings from Merck, RWE, Thyssenkrupp, Allianz, Commerzbank, JD Sports, Compass, Ubisoft, Telecom Italia & Cisco Systems.

US TRADE

EQUITIES

- US stocks were higher on the day and the Nasdaq posted a fresh record close with two-way price action seen in which the initial broad-based hawkish reaction to the mixed PPI data was swiftly pared as participants digested the details and awaited remarks from Fed Chair Powell who provided little new but noted that confidence in inflation moving back down is lower than it was before.

- SPX +0.48% at 5,246, NDX +0.68% at 18,322, DJIA +0.32% at 39,557, RUT +1.14% at 2,085.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Mester (voter) said the Fed is in a good place to study the economy before charting a rate path and she isn't eager to consider a rate hike, while she noted it was appropriate for the Fed to hold rates steady as it awaits evidence that price pressures are easing further. Mester said it’s too early to conclude that they stalled out or that inflation is going to reverse but noted there are definite signs that the real side of the economy is moderating which is helping to bring balance back to the economy, according to WSJ.

- Fed's Schmid (non-voter) said policy is in the correct place and continued vigilance and flexibility are necessary, while he is prepared to be patient as inflation eases back towards 2%, as well as noted that inflation is still too high and the Fed has more work to do. Schmid also stated interest rates could remain high for some time and doesn't think they should have slowed the balance sheet runoff.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher following the momentum from the US where the major indices ultimately gained and the Nasdaq posted a fresh record close with two-way price action seen following PPI data.

- ASX 200 was led by the mining, materials and healthcare sectors, while participants also digested the recent budget announcement with the government planning to boost spending next year ahead of an election.

- Nikkei 225 gained but was well off today's best levels with newsflow dominated by earnings releases including from Sony and Sharp, while the Japanese megabanks are also scheduled to announce their results today.

- Shanghai Comp was pressured after the recent US tariff announcement and with Stock Connect trade shut owing to the holiday closure in Hong Kong, although the real estate industry found solace from news that China is mulling purchases of unsold homes to ease the glut.

- US equity futures sat around the prior day's best levels with participants now awaiting the US CPI data.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.2% after the cash market closed flat on Tuesday.

FX

- DXY remained lacklustre and just about trickled beneath 105.00 after ultimately weakening yesterday in the aftermath of the two-way price action seen post-US PPI, while the attention now shifts to the looming CPI data.

- EUR/USD held on to recent gains after reclaiming the 1.0800 status on the back of a softer dollar.

- GBP/USD traded steadily after having breached several key DMA levels and tested 1.2600 to the upside.

- USD/JPY was contained within a tight range owing to the absence of fresh drivers and a quiet overnight calendar.

- Antipodeans extended on recent gains and AUD/USD printed a two-month high despite the softer-than-expected Australian Wage Price Index, with support seen alongside a firmer yuan after news of China mulling support for the real estate sector.

FIXED INCOME

- 10-year UST futures took a breather above 109.00 after having unwound the initial hawkish post-PPI reaction.

- Bund futures nursed some of the prior day's losses but with the rebound limited ahead a 30yr Bund Auction.

- 10-year JGB futures struggled for direction amid a quiet overnight calendar and absence of BoJ purchases.

COMMODITIES

- Crude futures rebounded from the prior day's losses with prices helped after private sector inventory data showed a larger-than-expected draw for headline crude inventories, while other components of the release were also bullish.

- US Energy Inventory Data (bbls): Crude -3.1mln (exp. -0.5mln), Cushing -0.6mln, Gasoline -1.3mln (exp. +0.5mln), Distillate +0.3mln (exp. +0.8mln).

- Explosion was reported after a drone attack at Russia's Rostov fuel depot, according to Russian agencies.

- Spot gold traded little changed with participants on the fence ahead of the US inflation data.

- Copper futures remained underpinned and eventually climbed above the USD 5/lb level amid the mostly positive risk tone and as China mulls support for the property sector.

CRYPTO

- Bitcoin gradually edged higher and approached closer to the USD 62,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted CNY 125bln (CNY 125bln maturing) in 1-year MLF with the rate kept unchanged at 2.50%.

- China mulls government purchases of millions of unsold homes from distressed developers at steep discounts to ease the glut, while Beijing is seeking feedback on the preliminary proposal, according to Bloomberg sources.

- US President Biden said China heavily subsidises products that are dumped on foreign markets.

DATA RECAP

- Australian Wage Price Index QQ (Q1) 0.8% vs. Exp. 0.9% (Prev. 0.9%, Rev. 1.0%)

- Australian Wage Price Index YY (Q1) 4.1% vs. Exp. 4.2% (Prev. 4.2%)

GEOPOLITICS

MIDDLE EAST

- A Hezbollah commander was killed in an Israeli airstrike targeting a car in southern Lebanon's Tyre, according to two Lebanese security sources cited by Reuters.

- Iraqi armed factions targeted an Israeli military target in Eilat with drones, according to Sky News Arabia.

- Rafah crossing closure is due to Israeli escalation and not Egypt's responsibility, while Egypt told Israel it is dangerous to continue blocking aid to Gaza, according to Al Qahera citing a senior source.

- Senior US official told Axios the Biden administration reached an understanding with Israel that any Rafah operation would not be significantly expanded before National Security Adviser Sullivan's visit.

- US President Biden would veto the Israeli bill on the floor this week, according to Punchbowl citing the White House. It was separately reported that the US State Department moved USD 1bln weapons aid for Israel to a congressional review process, according to a senior official cited by Reuters.

OTHER

- Ukrainian officials are making a new push to get the Biden administration to lift its ban on using US-made weapons to strike inside Russia, according to POLITICO.

- France and Netherlands seek EU sanctions on global financial institutions that help Russia's military, according to a proposal seen by Reuters.

- Russian President Putin said Russia and China are promoting the prosperity of both nations through expanded equal and mutually beneficial cooperation, as well as noted that Russian-Chinese economic ties have great prospects. Furthermore, Putin said China clearly understands the roots of the Ukraine crisis and its global geopolitical impact, while he is open to a dialogue on Ukraine, but added that such negotiations must take into account the interests of all countries involved in the conflict, including theirs, according to Xinhua.

- North Korean leader Kim oversaw a tactical missile weapon system on Tuesday, according to KCNA.