Europe Market Open: Indecisive and cagey trade into US PPI and Fed's Powell

14 May 2024, 06:35 by Newsquawk Desk

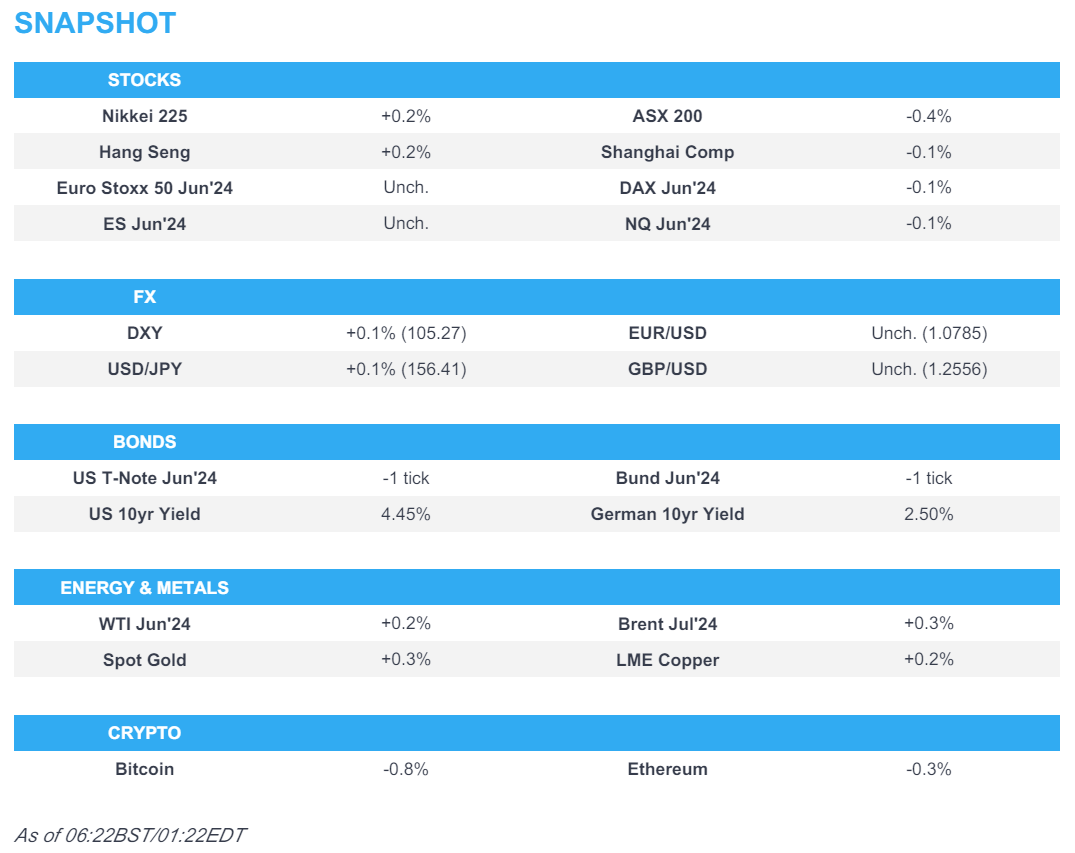

- APAC stocks lacked firm conviction after the indecisive performance in the US ahead of key events.

- European equity futures indicate a flat to incrementally firmer open with Euro Stoxx 50 futures near the unchanged mark after the cash market closed down by 0.1% on Monday.

- FX markets are contained with DXY caged in a tight range, EUR/USD failed to sustain a 1.08 handle, USD/JPY gained a firmer footing above 156.

- Bunds were steady overnight and Crude futures traded with little in the way of conviction.

- Looking ahead, highlights include UK Employment Data, German ZEW, US PPI, OPEC MOMR, Comments from BoE’s Pill, ECB’s Schnabel, Fed Chair Powell & Cook, Supply from Netherlands, UK & Germany

US TRADE

EQUITIES

- US stocks were mixed and finished relatively flat in what seemed to be the calm before the storm with light catalysts ahead of the looming key events, while the initial advances in equity futures pre-market trade were faded from the open with lows in stocks later seen in the US afternoon. Furthermore, an underwhelming Open AI Spring update which included the announcement of Chat GPT-4o (which will be free), briefly weighed on chip names and Microsoft (MSFT), while Google (GOOGL) caught a bid on the lack of search engine announcement and meme stocks (GME, AMC) surged on the return of "TheRoaringKitty" on X (formerly Twitter).

- SPX -0.02% at 5,221, NDX +0.21% at 18,198, DJIA -0.21% at 39,431, RUT +0.11% at 2,062.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Moody's revised the outlook on 412 US local government issuers from stable to no outlook, while it affirmed issuer and long-term underlying ratings, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks lacked firm conviction after the indecisive performance in the US ahead of key events.

- ASX 200 was dragged lower by weakness in real estate and consumer staples ahead of the federal budget announcement, while Australian Treasurer Chalmers had previously cautioned against expectations for a welfare 'cash splash'.

- Nikkei 225 was choppy amid a weaker currency, mixed earnings releases and relatively in-line PPI data.

- Hang Seng & Shanghai Comp were initially boosted at the open with strength in tech and real estate although the Hong Kong benchmark eventually faded most of the gains, while sentiment was dampened in the mainland amid the threat of looming US tariffs which are expected to be unveiled today, while developer default concerns also lingered after Agile Group missed a coupon payment and flagged an inability to fulfil all payment obligations.

- US equity futures (ES -0.1%) were little changed as markets braced for the incoming potential storm.

- European equity futures indicate a flat to incrementally firmer open with Euro Stoxx 50 futures near the unchanged mark after the cash market closed down by 0.1% on Monday.

FX

- DXY was contained within a tight range between 105.20-105.29 ahead of upcoming key risk events including comments from Fed Chair Powell at a Netherlands banking event today and with US PPI also scheduled later ahead of tomorrow's CPI release.

- EUR/USD was quiet after recently failing to sustain the 1.0800 status and was stuck near its 50- and 200-DMAs.

- GBP/USD plateaued overnight above the 1.2550 level after surmounting its 200-DMA, while the attention turns to UK employment and wages data, as well as the incoming comments from BoE's Pill scheduled later.

- USD/JPY gained a firmer footing above the 156.00 level which prompted fresh jawboning by Japanese Finance Minister Suzuki.

- Antipodeans were lacklustre amid the flimsy risk appetite and absence of tier-1 data releases.

- PBoC set USD/CNY mid-point at 7.1053 vs exp. 7.2307 (prev. 7.1030).

- SNB Chair Jordan said the fight against inflation is far advanced and the outlook for Swiss inflation is now much better, while he added that uncertainty remains.

FIXED INCOME

- 10-year UST futures lacked conviction after the prior day's choppy performance as Fed speakers and US inflation metrics loom.

- Bund futures were uneventful with prices languishing beneath the 131.00 level ahead of German supply.

- 10-year JGB futures retreated as Japanese yields printed their highest levels in over a decade but later eventually found some solace from the somewhat mixed 5-year auction results.

COMMODITIES

- Crude futures took a breather amid light oil-specific newsflow and as participants await the next catalysts.

- Spot gold eventually eked mild gains and found some slight reprieve following yesterday's pullback.

- Copper futures marginally extended on advances albeit with upside capped amid the mixed risk environment.

- Peru copper production dipped slightly in March and was down 0.1% Y/Y, according to government data.

CRYPTO

- Bitcoin retreated overnight after hitting resistance around the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen is hopeful that China will see that US actions on tariffs are targeted and will see what happens, while she responded that will ensure counterparts are informed when asked if she will inform China ahead of any US tariff action. Furthermore, she said China is pursuing a conscious industrial policy targeting investment in advanced manufacturing and that virtually all Chinese investment that had been going into the property sector is now going into advanced manufacturing.

- China's embassy said China remains open to cooperating with the US on repatriation of illegal immigrants but the US side should also demonstrate sincerity and address China's concerns, creating a suitable atmosphere for such cooperation, according to Global Times.

- Japanese Finance Minister Suzuki said it is important for the government and BoJ to coordinate policy and it is important for currencies to move in a stable manner reflecting fundamentals, while he added they will take a thorough response for forex and are closely watching FX moves, according to Reuters.

DATA RECAP

- Japanese PPI MM (Apr) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

- Japanese PPI YY (Apr) 0.9% vs. Exp. 0.8% (Prev. 0.8%, Rev. 0.9%)

GEOPOLITICS

MIDDLE EAST

- Member of the Hamas Political Bureau told Al Arabiya they are committed to the path of the exchange deal negotiations.

- Heavy Israeli artillery shelling and heavy gunfire reported in the centre and east of the city of Rafah in the southern Gaza Strip, according to Al Jazeera.

- US officials said Israel has mobilised enough forces to launch a large-scale operation in Rafah but they are not sure if We are not sure if Israel has made a final decision to launch a large-scale operation in Rafah, according to CNN.

- White House National Security Advisor Sullivan said he cannot predict when or if a deal will come on a ceasefire and expects in-person meetings with Israeli officials to take place in a matter of days, not weeks. Furthermore, he said negotiations have bumps and variables but added that a ceasefire is possible tomorrow if Hamas releases elderly hostages and women.

- US Deputy Secretary of State said we do not believe that the complete victory that Israel seeks to achieve is likely or possible, according to CNN.

- Hezbollah said it targeted two buildings used by enemy soldiers in the settlement of Metulla and achieved a direct hit, according to Al Jazeera.

OTHER

- US Secretary of State Blinken arrived in Ukraine on a previously undisclosed trip and intends to send the signal of reassurance to Ukraine at a 'very difficult moment', while US-supplied artillery, ATACMS long-range missiles and air defence interceptors are already reaching Ukraine's front lines from the new US aid package approved on April 24th, according to a US official cited by Reuters.

- US and Taiwan navies quietly held Pacific drills in April, while the exercises involved about a half-dozen ships from both sides but officially didn't take place, according to a Reuters source. Furthermore, a source added that exercises were dubbed 'unplanned sea encounters' and gave the navies a chance to practice 'basic' operations.