US Market Open: Tentative trade across markets with DXY flat & modest gains in US equity futures; NY Fed SCE due

13 May 2024, 11:10 by Newsquawk Desk

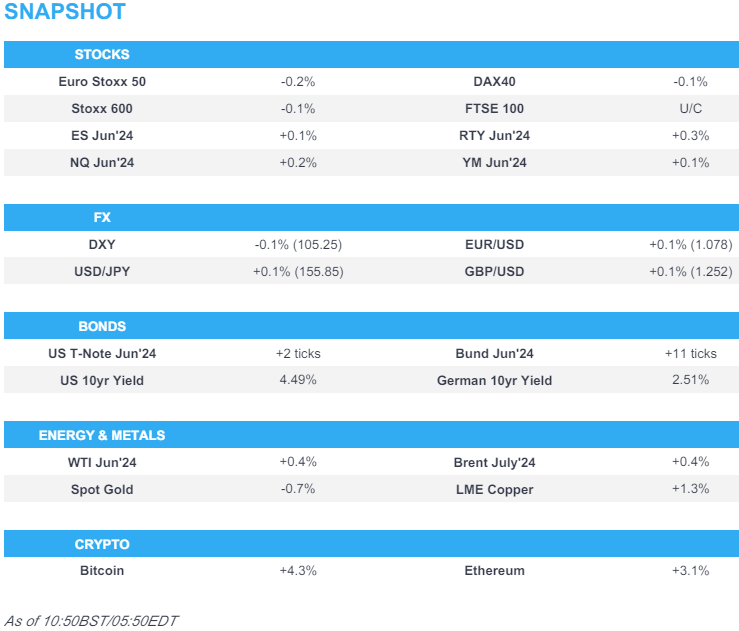

- European bourses are mixed and trade around the unchanged mark; US futures are modestly firmer

- Dollar is slightly softer weighed on by recent EUR strength, NZD lags

- Bonds are incrementally firmer, though within contained ranges

- Crude benchmarks are on the front foot, XAU is softer and base metals are mixed

- Overnight focus on mixed Chinese data and then upcoming ultra-long issuance, latter development providing support

- Looking ahead, NY Fed Survey of Consumer Expectations Survey, Comments from Fed’s Mester & Jefferson, SNB’s Jordan

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (U/C) are mixed and trading on either side of the unchanged mark, in what has been a very quiet European morning.

- European sectors are mixed; Autos tops the pile, with optimism potentially deriving from Chinese CPI as well as new long-dated bond sales, which will help to provide liquidity for the Chinese markets.

- US Equity Futures (ES +0.1%, NQ +0.1%, RTY +0.3%) are very modestly in the green, following the tentative price action also seen in Europe.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- Dollar is modestly softer, having spent much of the European morning flat, with recent EUR strength pushing the index lower, albeit marginally so. Currently, the DXY is towards the bottom end of today's 105.36-20 range.

- EUR is incrementally firmer vs the USD, catching a slight bid in recent trade though with specifics light. Currently holding around its 50DMA at 1.0786.

- GBP is flat vs USD, with very modest early morning weakness petering out. Focus this week will be March’s job data, as well as potential commentary from BoE Chief Economist Pill.

- USD/JPY is incrementally firmer, having wobbled very briefly after the BoJ said it reduced its purchases of 5yr-10yr JGBs. The announcement led USD/JPY to as low as 155.57, before quickly paring the move. As it stands, the pair holds above its 20DMA, with the high for today at 155.95.

- Mixed trade for the Antipodeans, initially softened by the cautious risk tone in APAC trade and after the PBoC set a weaker reference rate setting. Weakness in the Kiwi, after inflation expectations, has led NZD/USD as low as 0.60.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.2284 (prev. 7.1011).

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are a touch firmer but near unchanged overall as the benchmark takes a slight breather from Friday's marked bearish action but remain within a couple of ticks of the 108-21+ trough from Friday with last week's 108-19+ base below.

- Bund price action has been very contained and largely directionless. Drivers thus far have been exceptionally limited and the European docket ahead is very light.

- Gilts in-fitting with the UK docket thin today with the narrative much the same as for EGBs above. Gilts themselves in a thin 20 tick range after a very contained open. Currently around the 97.75 mark above the 97.66 low.

- Click here for more details.

COMMODITIES

- Crude benchmarks are on the front-foot, however action is modest and we remain within around a USD 1/bbl of Friday's base. Focus today has been on commentary from the Iraqi Oil Minister and awaiting updates out of Rafah. Brent July current holding at USD 83/bbl.

- Precious metals are slipping a touch but with the action more of a gentle decline than a pronounced fall thus far. Specifics light and impetus from broader assets limited as overall market action is fairly contained; XAU near session lows around USD 2,240.

- Base metals largely followed the fortunes of China overnight with initial action bearish on the overall soft tone and weak financing data from the region.

- Iraqi Oil Minister said on Saturday that Iraq has made enough voluntary production cuts and will not agree to any future reduction taken by OPEC. However, it was reported on Sunday that the Oil Minister said the voluntary oil output cut is subject to agreement between OPEC countries and any negotiable proposals may be presented at the time, while he added they are part of OPEC and it is necessary to comply with any decisions made by the organisation. The state news agency also reported the Oil Minister said Iraq is committed to voluntary output cuts made by OPEC members and is keen on cooperating with members to achieve more stability in global oil markets.

- Iraqi Oil Ministry launched 29 oil and gas projects within the fifth and sixth licensing rounds.

- Qatar set June marine crude OSP at Oman/Dubai plus USD 1.75/bbl and land crude OSP was set at Oman/Dubai plus USD 0.85/bbl, according to a pricing document.

- QatarEnergy is to acquire two new exploration blocks offshore Egypt in which it signed a farm-in agreement with ExxonMobil (XOM) to acquire a 40% participating interest in the exploration blocks.

- Russian Deputy PM Novak said Russia will be able to increase fuel output in the future, according to TASS.

- Click here for more details.

DATA RECAP

- Czech CPI YY (Apr) 2.9% vs. Exp. 2.4% (Prev. 2.0%); CPI MM (Apr) 0.7% vs. Exp. 0.3% (Prev. 0.1%) Sparked immediate strength in the CZK

NOTABLE EUROPEAN HEADLINES

- UK PM Sunak is set to declare the UK stands 'at a crossroads' as he readies the Tories ahead of an election, according to FT.

- Socialists were ahead in the Catalan regional election with 41 seats out of the 135-seat chamber and separatists Junts were second with 36 seats after 91% of votes were counted, according to Reuters.

- S&P affirmed Poland at A-; Outlook Stable.

NOTABLE US HEADLINES

- Apple (AAPL) reportedly closes in on a deal with OpenAI to put ChatGPT on the iPhone, according to Bloomberg. It was also reported that an Apple store in New Jersey voted against unionising, while an Apple store in Maryland voted to hold a strike with the date to be determined.

- Nvidia (NVDA) says 'Grace Hopper' will ignite a new era of supercomputing. Nvidia announced it will accelerate quantum computing efforts at national supercomputing centres around the world with the open-source Nvidia CUDA-Q platform. Sites in Germany, Japan and Poland will use the platform to power the quantum processing units inside Nvidia-accelerated computing systems. Nvidia also announced that nine new supercomputers worldwide are using its Grace Hopper Superchips.

- Microsoft (MSFT) reportedly to face EU competition charges regarding Teams software, via FT.

- European Commission designates Booking (BNKG) as gatekeeper under digital markets act; now has 6 months to comply with relevant obligations under DMA

GEOPOLITICS

MIDDLE EAST

- Israel’s IDF said it ordered residents of additional east Rafah areas to evacuate and head to the humanitarian zone in Al-Mawasi, according to Reuters.

- Israeli military spokesperson said Hamas has been trying to re-establish military capabilities in Gaza’s Jabalia and Israel is trying to prevent that, while it announced that Israeli forces in Gaza’s Zeitun killed 30 Palestinian militants. It was separately reported that Israel's military opened a new crossing into the Gaza Strip in coordination with the US government for humanitarian aid, according to Reuters.

- US State Department said Secretary of State Blinken stressed to Israeli Defence Minister Gallant the urgent need to protect civilians and aid workers in Gaza and urged to ensure humanitarian access to Gaza, while Blinken reaffirmed to Gallant US opposition to a major ground military operation in Rafah, according to Al Jazeera and Sky News Arabia.

OTHER

- Ukrainian President Zelensky said battles are ongoing at seven border villages in Kharkiv and the Donetsk situation is particularly tense, while Ukraine’s military chief said fighting is ongoing and warned of a difficult situation in the Kharkiv region, according to Reuters.

- Ukrainian shelling killed at least 9 people and injured more than a dozen in an apartment block collapse in Russia’s Belgorod, according to Reuters.

- Russian President Putin conducted a surprise reshuffle of top security officials whereby he removed Patrushev as head of the Security Council who will be moved to a new job and proposed that Defence Minister Shoigu become the new head of the Security Council, while he proposed economic adviser Belousov to become the new Defence Minister, according to FT.

- Russian Defence Ministry said its forces have taken five settlements in Ukraine’s Kharkiv region.

- Ukrainian drone attack has damaged an oil depot/power substation in Belgorod and Lipestk regions of Russia, via Reuters citing Ukrainian intelligence.

CRYPTO

- Strong session for Bitcoin, climbing past USD 63k, whilst Ethereum looks to reclaim USD 3k.

APAC TRADE

- APAC stocks were mostly cautious after mixed inflation and soft financing data from China over the weekend, although Chinese markets found some solace from China's plans to issue ultra-long treasury bonds.

- ASX 200 was led lower by underperformance in the energy sector and amid a tepid NAB Business survey.

- Nikkei 225 lacked firm direction with price action choppy amid a slew of earnings releases.

- Hang Seng & Shanghai Comp were initially pressured after mixed inflation data and disappointing financing data which showed a rare contraction in Aggregate Financing, while expectations of increased US tariffs on Chinese EVs also provided early headwinds. However, the Hong Kong benchmark then recovered and climbed above the 19,000 level amid tech strength, while the mainland pared the majority of its losses as the attention turned to China's plans to issue ultra-long treasury bonds on May 17th.

NOTABLE ASIA-PAC HEADLINES

- Chinese authorities kicked off plans to sell USD 140bln of long-dated bonds, according to the FT. It was later reported that China's Finance Ministry is to issue ultra-long treasury bonds on May 17th in which it plans to issue 20yr, 30-year and 50-year treasuries worth CNY 300bln, CNY 600bln and CNY 100bln, respectively, while it plans to complete the issuance of long-term treasury bonds by end-November.

- Country Garden (2007 HK) said it repaid onshore coupons within the grace period, according to Reuters.

- BoJ offered to buy JPY 375bln in 1-3yr JGBs, JPY 425bln in 5-10yr JGBs and JPY 150bln in 10-25yr JGBs (reduced 5yr-10yr purchases from a previous JPY 475bln).

- Australia’s government cut its 2024/2025 real GDP growth forecast to 2% from 2.25% and cut its 2025/2026 growth forecast to 2.25% from 2.50%, while it said inflation could slow to the RBA’s 2%-3% target range by year-end which is sooner than previously expected, according to Reuters.

- Tencent Music Entertainment Group (TME) Q1 2024 (USD): EPS 0.13 (exp. 0.14), Revenue 0.94bln (exp. .91bln).

DATA RECAP

- Chinese CPI MM (Apr) 0.1% vs. Exp. -0.1% (Prev. -1.0%); YY 0.3% vs. Exp. 0.2% (Prev. 0.1%)

- Chinese PPI YY (Apr) -2.5% vs. Exp. -2.3% (Prev. -2.8%)

- Chinese New Yuan Loans (CNY)(Apr) 730B vs Exp. 800B (Prev. 3090B)

- Chinese Aggregate Financing (CNY)(Apr) -200B vs Exp. 1000B (Prev. 4870B)

- Chinese Money Supply M2 YY (Apr) 7.2% vs Exp. 8.3% (Prev. 8.3%)

- Australian NAB Business Confidence (Apr) 1.0 (Prev. 1.0); Conditions (Apr) 7.0 (Prev. 9.0)

- New Zealand 2-year Inflation Forecast (Q2) Q1 2.33% (Prev. 2.5%); 1-year Inflation Forecast (Q2) Q1 2.73% (Prev. 3.22%)